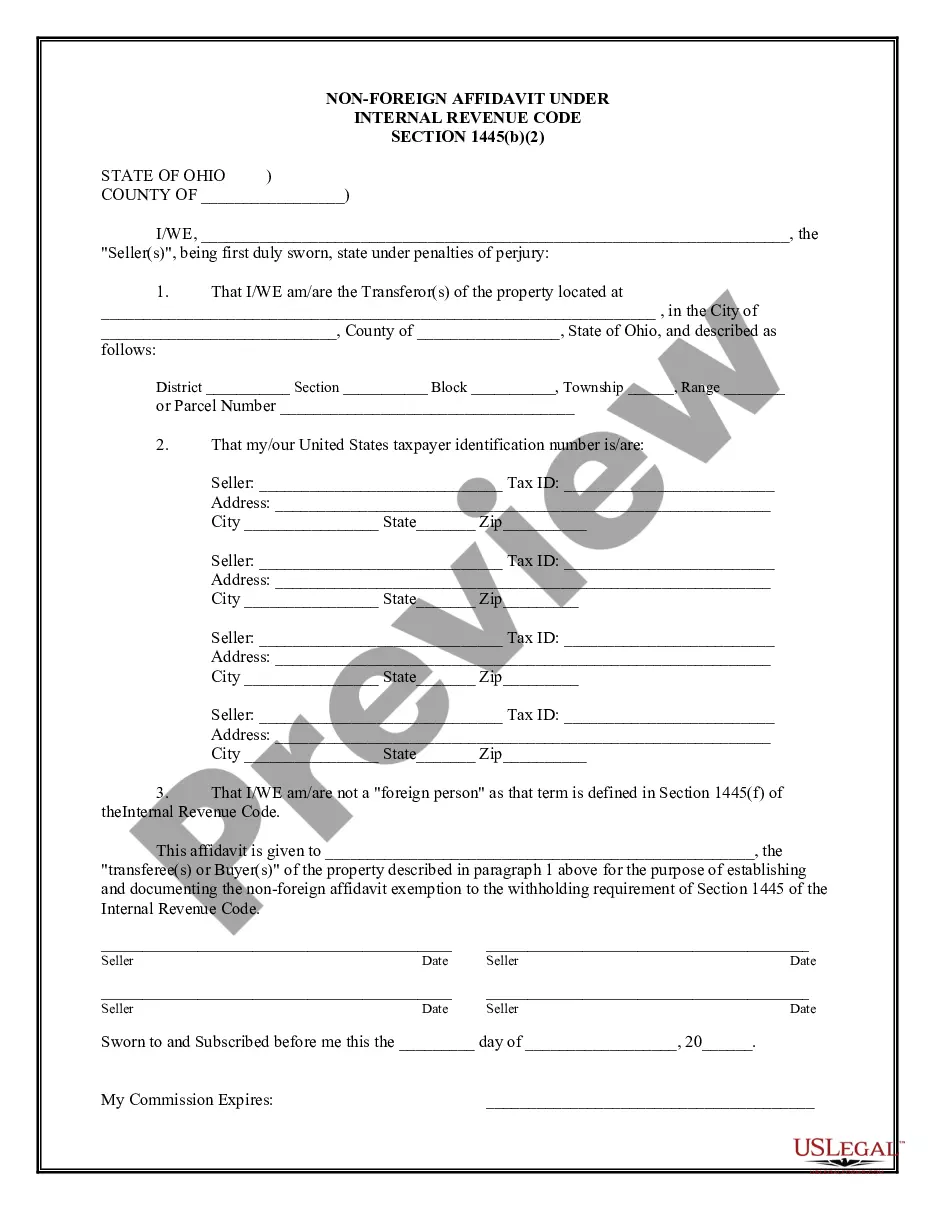

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 is a legal document that is necessary under certain circumstances to comply with the Internal Revenue Code (IRC) section 1445 requirements. This affidavit aims to confirm the non-foreign status of sellers or transferors involved in real estate transactions within Cuyahoga County, Ohio. In cases where a foreign person sells or transfers real property located within the United States, the buyer or transferee is required by the IRC to withhold 15% of the gross proceeds from the sale. However, if the seller or transferor can provide a valid Non-Foreign Affidavit, the withholding can be waived. The Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 serves as a declaration made by the seller or transferor, affirming that they are a non-foreign person who is exempt from the withholding tax requirement. It is essential to complete this affidavit accurately and honestly to avoid any legal complications and ensure compliance with the applicable laws. There are several types of Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 that may be required depending on the specific circumstances of the transaction. Some of these variations include: 1. Individual Non-Foreign Affidavit: This affidavit is utilized when the seller or transferor is an individual person, either a U.S. citizen or a resident alien, and meets the non-foreign criteria outlined in IRC 1445. 2. Corporate Non-Foreign Affidavit: This type of affidavit is necessary when the seller or transferor is a domestic corporation, meaning it is incorporated under the laws of the United States or any of its states. 3. Partnership Non-Foreign Affidavit: If the seller or transferor is a domestic partnership, this affidavit needs to be provided, confirming that the partnership is not a foreign entity. 4. Trust Non-Foreign Affidavit: When the seller or transferor is a trust, this affidavit should be completed, helping establish its non-foreign status under IRC 1445. Please note that these are general categories, and specific variations of the Cuyahoga Ohio Non-Foreign Affidavit may exist depending on the unique circumstances of the transaction. In conclusion, the Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 is a vital legal document used to confirm the non-foreign status of sellers or transferors involved in real estate transactions within Cuyahoga County, Ohio. By providing this affidavit, individuals and entities can potentially avoid the 15% withholding tax requirement as mandated by the IRC. It is crucial to ensure accurate completion of the affidavit based on the specific type applicable to the seller or transferor's legal status.The Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 is a legal document that is necessary under certain circumstances to comply with the Internal Revenue Code (IRC) section 1445 requirements. This affidavit aims to confirm the non-foreign status of sellers or transferors involved in real estate transactions within Cuyahoga County, Ohio. In cases where a foreign person sells or transfers real property located within the United States, the buyer or transferee is required by the IRC to withhold 15% of the gross proceeds from the sale. However, if the seller or transferor can provide a valid Non-Foreign Affidavit, the withholding can be waived. The Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 serves as a declaration made by the seller or transferor, affirming that they are a non-foreign person who is exempt from the withholding tax requirement. It is essential to complete this affidavit accurately and honestly to avoid any legal complications and ensure compliance with the applicable laws. There are several types of Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 that may be required depending on the specific circumstances of the transaction. Some of these variations include: 1. Individual Non-Foreign Affidavit: This affidavit is utilized when the seller or transferor is an individual person, either a U.S. citizen or a resident alien, and meets the non-foreign criteria outlined in IRC 1445. 2. Corporate Non-Foreign Affidavit: This type of affidavit is necessary when the seller or transferor is a domestic corporation, meaning it is incorporated under the laws of the United States or any of its states. 3. Partnership Non-Foreign Affidavit: If the seller or transferor is a domestic partnership, this affidavit needs to be provided, confirming that the partnership is not a foreign entity. 4. Trust Non-Foreign Affidavit: When the seller or transferor is a trust, this affidavit should be completed, helping establish its non-foreign status under IRC 1445. Please note that these are general categories, and specific variations of the Cuyahoga Ohio Non-Foreign Affidavit may exist depending on the unique circumstances of the transaction. In conclusion, the Cuyahoga Ohio Non-Foreign Affidavit Under IRC 1445 is a vital legal document used to confirm the non-foreign status of sellers or transferors involved in real estate transactions within Cuyahoga County, Ohio. By providing this affidavit, individuals and entities can potentially avoid the 15% withholding tax requirement as mandated by the IRC. It is crucial to ensure accurate completion of the affidavit based on the specific type applicable to the seller or transferor's legal status.