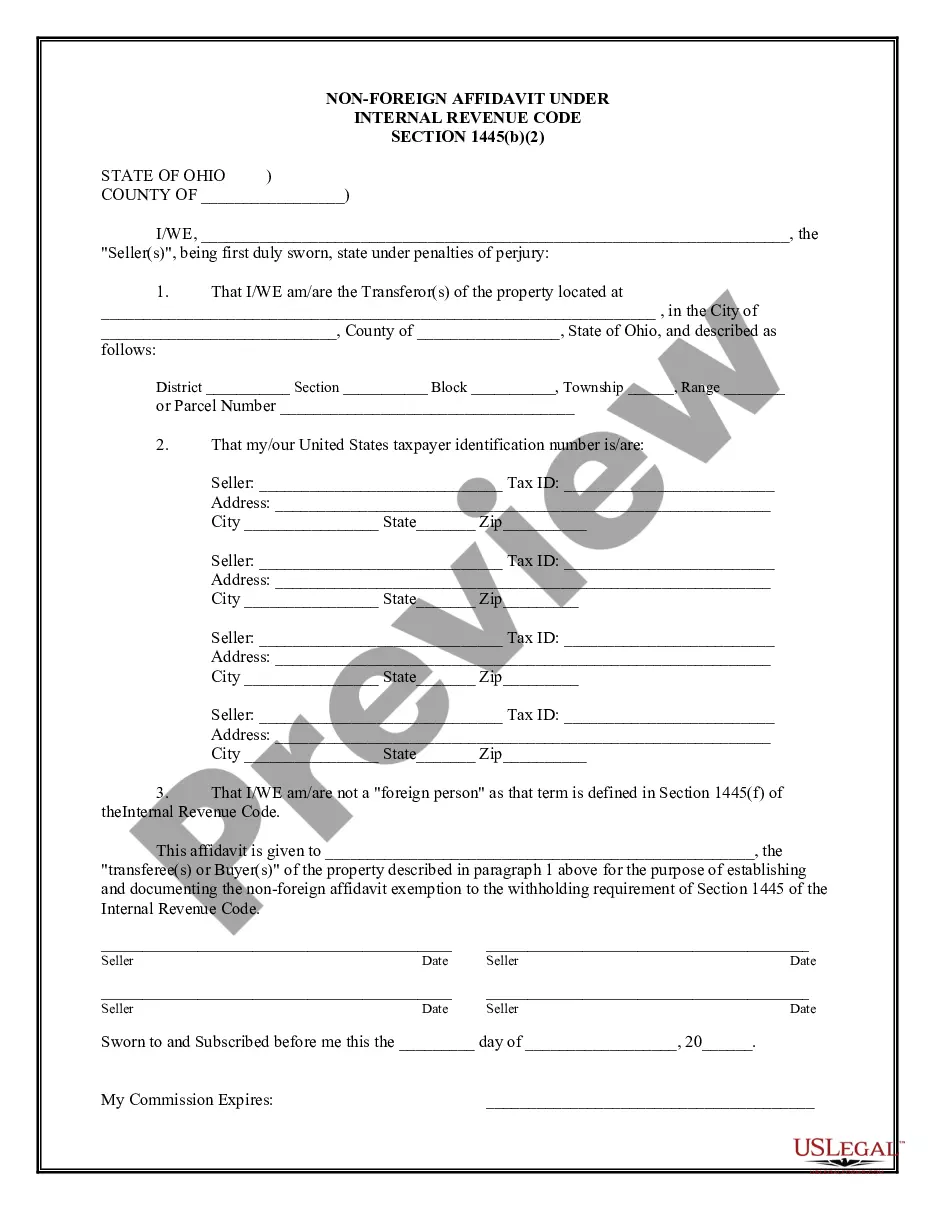

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Franklin Ohio Non-Foreign Affidavit Under IRC 1445 is a legal document that must be completed by non-foreign individuals or entities when selling or transferring certain types of real property in Franklin, Ohio. This affidavit is required under the Internal Revenue Code (IRC) Section 1445, which deals with withholding tax obligations for non-resident aliens, foreign corporations, and foreign partnerships involved in U.S. real property transactions. The purpose of the Franklin Ohio Non-Foreign Affidavit Under IRC 1445 is to establish the seller's status as a non-foreign person. This helps in determining whether the buyer must withhold a certain percentage of the amount realized from the sale or transfer to comply with federal income tax laws. The affidavit typically includes the following information: 1. Seller's Identification: The seller's full legal name, address, and tax identification number (usually a Social Security number or an Employer Identification Number) are specified. This information helps ensure accurate identification of the seller. 2. Property Details: The affidavit also includes a detailed description of the real property being sold or transferred. This may include the property address, legal description, parcel number, and any other relevant identifying information to avoid any confusion. 3. Certification of Non-Foreign Status: The seller certifies, under penalty of perjury, that they are not a foreign person within the meaning of the IRC Section 1445. This declaration affirms that the seller is either a U.S. citizen, a resident alien, a non-resident alien with a U.S. tax identification number, or a qualified foreign person exempt from withholding. 4. Acknowledgement: The affidavit may require the seller's signature, the date signed, and a notary seal. These elements validate the authenticity and legality of the document. It is important to note that there is typically only one type of Franklin Ohio Non-Foreign Affidavit Under IRC 1445. However, variations in specific requirements and format may exist depending on local jurisdiction or individual circumstances. Working with a qualified real estate attorney or tax professional is advisable to ensure compliance with all relevant laws and regulations during a property sale or transfer process in Franklin, Ohio. Keywords: Franklin Ohio, non-foreign affidavit, IRC 1445, real property, withholding tax, Internal Revenue Code, non-resident alien, foreign person, non-foreign status, U.S. citizen, resident alien, non-resident alien, qualified foreign person, tax identification number, perjury, notary seal, real estate attorney, property saleFranklin Ohio Non-Foreign Affidavit Under IRC 1445 is a legal document that must be completed by non-foreign individuals or entities when selling or transferring certain types of real property in Franklin, Ohio. This affidavit is required under the Internal Revenue Code (IRC) Section 1445, which deals with withholding tax obligations for non-resident aliens, foreign corporations, and foreign partnerships involved in U.S. real property transactions. The purpose of the Franklin Ohio Non-Foreign Affidavit Under IRC 1445 is to establish the seller's status as a non-foreign person. This helps in determining whether the buyer must withhold a certain percentage of the amount realized from the sale or transfer to comply with federal income tax laws. The affidavit typically includes the following information: 1. Seller's Identification: The seller's full legal name, address, and tax identification number (usually a Social Security number or an Employer Identification Number) are specified. This information helps ensure accurate identification of the seller. 2. Property Details: The affidavit also includes a detailed description of the real property being sold or transferred. This may include the property address, legal description, parcel number, and any other relevant identifying information to avoid any confusion. 3. Certification of Non-Foreign Status: The seller certifies, under penalty of perjury, that they are not a foreign person within the meaning of the IRC Section 1445. This declaration affirms that the seller is either a U.S. citizen, a resident alien, a non-resident alien with a U.S. tax identification number, or a qualified foreign person exempt from withholding. 4. Acknowledgement: The affidavit may require the seller's signature, the date signed, and a notary seal. These elements validate the authenticity and legality of the document. It is important to note that there is typically only one type of Franklin Ohio Non-Foreign Affidavit Under IRC 1445. However, variations in specific requirements and format may exist depending on local jurisdiction or individual circumstances. Working with a qualified real estate attorney or tax professional is advisable to ensure compliance with all relevant laws and regulations during a property sale or transfer process in Franklin, Ohio. Keywords: Franklin Ohio, non-foreign affidavit, IRC 1445, real property, withholding tax, Internal Revenue Code, non-resident alien, foreign person, non-foreign status, U.S. citizen, resident alien, non-resident alien, qualified foreign person, tax identification number, perjury, notary seal, real estate attorney, property sale