The dissolution of a corporation package contains all forms to dissolve a corporation in Ohio, step by step instructions, addresses, transmittal letters, and other information.

Columbus Ohio Dissolution Package to Dissolve Corporation

Description

How to fill out Ohio Dissolution Package To Dissolve Corporation?

If you are seeking a legitimate form template, it’s exceptionally challenging to find a more suitable location than the US Legal Forms site – one of the largest online repositories.

With this repository, you can access thousands of document examples for business and personal use categorized by types and regions, or keywords.

With the excellent search function, locating the latest Columbus Ohio Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Retrieve the form. Specify the format and download it to your device. Edit. Complete, amend, print, and sign the acquired Columbus Ohio Dissolution Package to Dissolve Corporation.

- Moreover, the relevance of every document is validated by a group of professional attorneys who routinely evaluate the templates on our site and refresh them according to the latest state and county legislation.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Columbus Ohio Dissolution Package to Dissolve Corporation is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the form you need. Review its description and use the Preview feature (if available) to view its content. If it does not fit your needs, utilize the Search option at the top of the screen to find the correct document.

- Confirm your selection. Click the Buy now option. Then, choose your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

To dissolve an LLC in Ohio you need to file the Certificate of Dissolution with the Ohio Secretary of State through mail or online by paying a filing fee of $20. Dissolving an LLC in Ohio is a straightforward process. The filing fee is $50. This process is applicable for both domestic and foreign entities.

The business entity must: File the appropriate dissolution, surrender, or cancellation form(s) with the SOS within 12 months of filing the final tax return....Requirements for SOS File all delinquent tax returns. Pay all delinquent tax balances, including penalties, fees, and interest. File a revivor request form.

In order to dissolve a corporation all business tax accounts must be current on all filings and payments and closed. Corporate taxpayers are required to file form D5 ?Notification of Dissolution or Surrender? with the Ohio Department of Taxation once a final return and payment are made.

In order to dissolve a corporation all business tax accounts must be current on all filings and payments and closed. Corporate taxpayers are required to file form D5 ?Notification of Dissolution or Surrender? with the Ohio Department of Taxation once a final return and payment are made.

Obtain and Submit Appropriate Documents Entity TypeGoverning Ohio Revised Code SectionFiling FeeLimited Liability Company1706.471$50.00General Partnership1776.65$50.00Limited Partnership1782.10$50.00Limited Liability Partnership1776.65$50.008 more rows

It can take the SOS at least eight weeks to process your filings, but processing times can vary. Various forms of expedited processing are available for additional fees. Be aware that your business name will become available for use by others after dissolution.

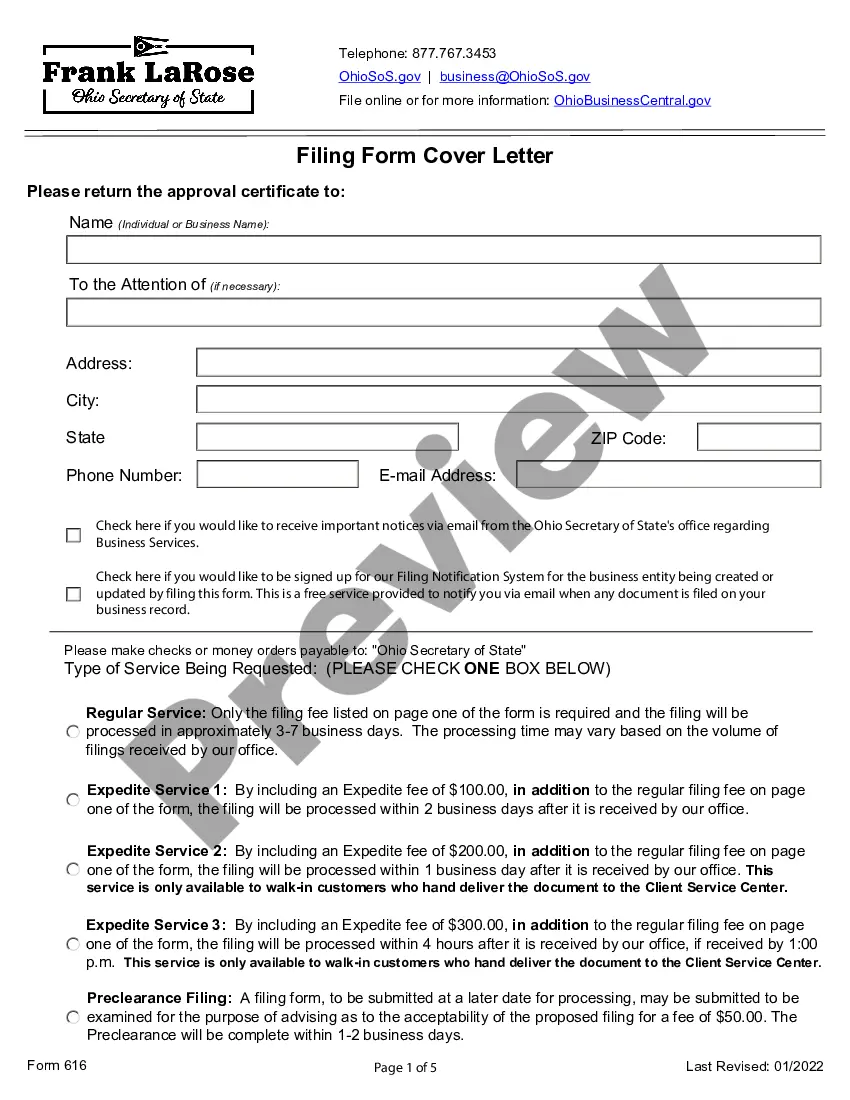

To dissolve your corporation in Ohio, you must provide the completed Certificate of Dissolution by Shareholders, Directors, or Incorporators form (561) to Ohio's Secretary of State (SOS) by mail or in person. The certificate itself is not too complicated and instructions are included at the end of Form 561.

How to dissolve a business in 7 steps Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.Step 6: Settle creditors' claims.

To close your business at the state-level of government, you may need to file a dissolution with the Secretary of State as well as close any business accounts you have with the state. There may be more to do at federal and local levels.