This dissolution package contains forms, instructions, information and helpful links needed to dissolve a Limited Liabilty Company in Ohio.

Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Ohio Dissolution Package To Dissolve Limited Liability Company LLC?

If you have previously utilized our service, sign in to your profile and download the Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC onto your device by clicking the Download button. Ensure that your subscription is active. Otherwise, renew it according to your payment structure.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to each document you have purchased; you can find it in your profile under the My documents section whenever you wish to retrieve it again. Leverage the US Legal Forms service to swiftly locate and download any template for your personal or professional needs!

- Ensure that you have found a suitable document. Review the description and use the Preview feature, if available, to confirm it fulfills your needs. If it doesn't meet your expectations, utilize the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to complete it and sign it digitally.

Form popularity

FAQ

Dissolving a limited liability company in Ohio involves several key steps. First, the members must agree to the dissolution and file the necessary paperwork. Next, you will need to notify any creditors and settle any outstanding debts. Finally, you can complete the official dissolution by submitting the Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC, ensuring that all legal formalities are correctly handled.

Dissolving an LLC involves formally ending the business's existence through a legal process, while terminating an LLC typically refers to ceasing operations without necessarily following legal protocols. With the Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC, you can navigate the dissolution process properly. This approach ensures your business is officially closed, protecting you from potential legal issues in the future.

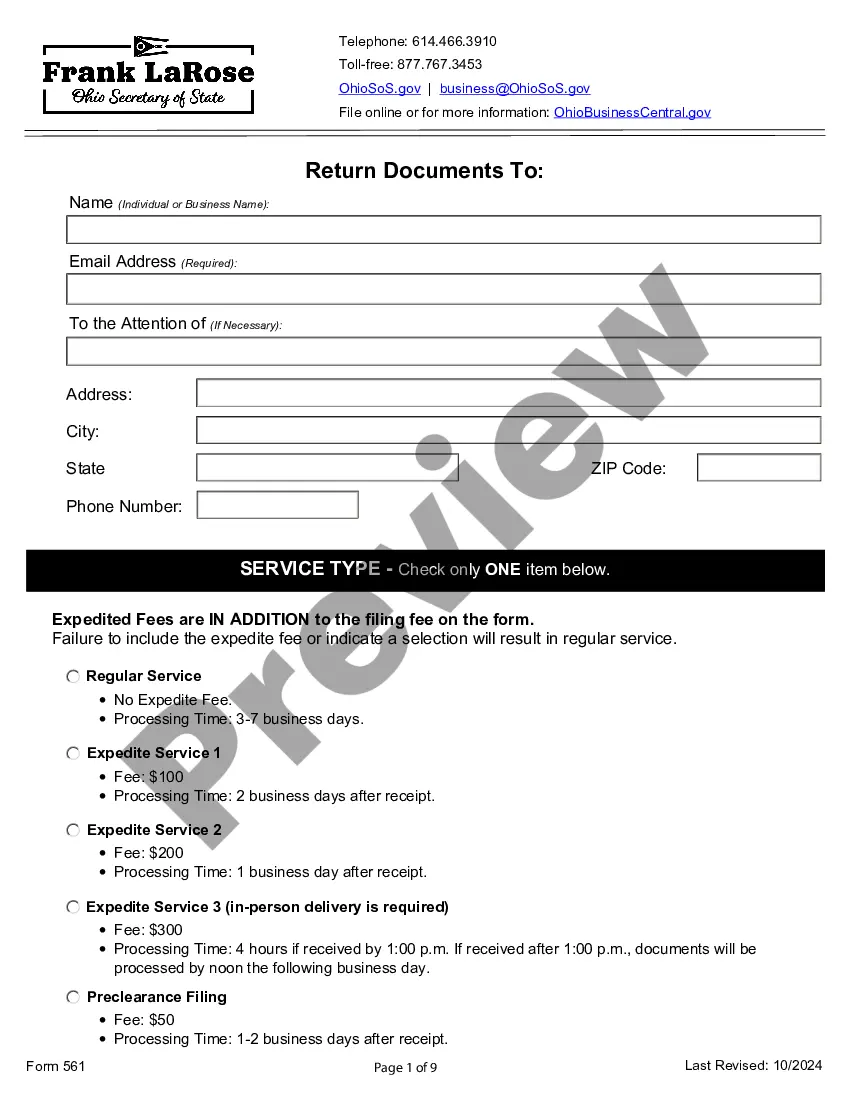

To dissolve an LLC in Ohio, you need to file the Articles of Dissolution. This form formally initiates the process of dissolving your business. By utilizing the Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC, you can ensure that you have all necessary documents and guidance to complete the process smoothly. Be sure to follow all filing requirements to avoid complications.

Yes, you can file for a dissolution without a lawyer in Ohio. Many entrepreneurs successfully use the Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC to handle their own filings. This package provides users with step-by-step instructions and essential documentation needed for the process. By choosing to go this route, you can save costs while still completing the dissolution accurately.

Yes, you can easily get a dissolution online in Ohio. The Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC allows you to complete the process from the comfort of your home. Using this package, you can access the necessary forms and guidance, making your dissolution straightforward and quick. Many users find that taking this online route saves them time and reduces stress.

The requirements for dissolving an LLC in Ohio include having a valid reason for dissolution and settling all financial obligations. You need to complete the Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC, which details your LLC's information and its intended closure. Additionally, you must notify all members and finalize any tax filings before submission. It’s important to follow these steps to ensure a smooth process.

Dissolving your LLC in Ohio involves a few important steps. Start by gathering the Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC, which contains all the required forms. Next, ensure that you settle any debts and liabilities of the business. Once everything is in order, file the completed package with the Ohio Secretary of State.

Yes, you can file a dissolution online in Ohio. The Secretary of State's website offers a streamlined process for submitting your Cincinnati Ohio Dissolution Package to Dissolve Limited Liability Company LLC. This online option saves time and ensures that your documents are submitted correctly. Make sure to have all necessary information ready before you start the process.