This dissolution package contains forms, instructions, information and helpful links needed to dissolve a Limited Liabilty Company in Ohio.

Columbus Ohio Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Ohio Dissolution Package To Dissolve Limited Liability Company LLC?

If you have previously utilized our service, Log In to your account and retrieve the Columbus Ohio Dissolution Package to dissolve Limited Liability Company LLC on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it per your payment agreement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifetime access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to retrieve it. Utilize the US Legal Forms service to efficiently locate and save any template for your personal or professional requirements!

- Confirm you have located the correct document. Review the description and utilize the Preview feature, if available, to verify if it suits your requirements. If it does not, employ the Search tab above to find the suitable one.

- Buy the template. Select the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Columbus Ohio Dissolution Package to dissolve Limited Liability Company LLC. Choose the document format and save it on your device.

- Fill out your form. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

In order to dissolve a corporation all business tax accounts must be current on all filings and payments and closed. Corporate taxpayers are required to file form D5 ?Notification of Dissolution or Surrender? with the Ohio Department of Taxation once a final return and payment are made.

Once a member withdraws (or dissociates) from the LLC, the LLC remains in business and does not dissolve. A dissociated member continues to hold an economic interest in the LLC for the same ownership interest percentage as their former membership interest.

To close your business at the state-level of government, you may need to file a dissolution with the Secretary of State as well as close any business accounts you have with the state. There may be more to do at federal and local levels.

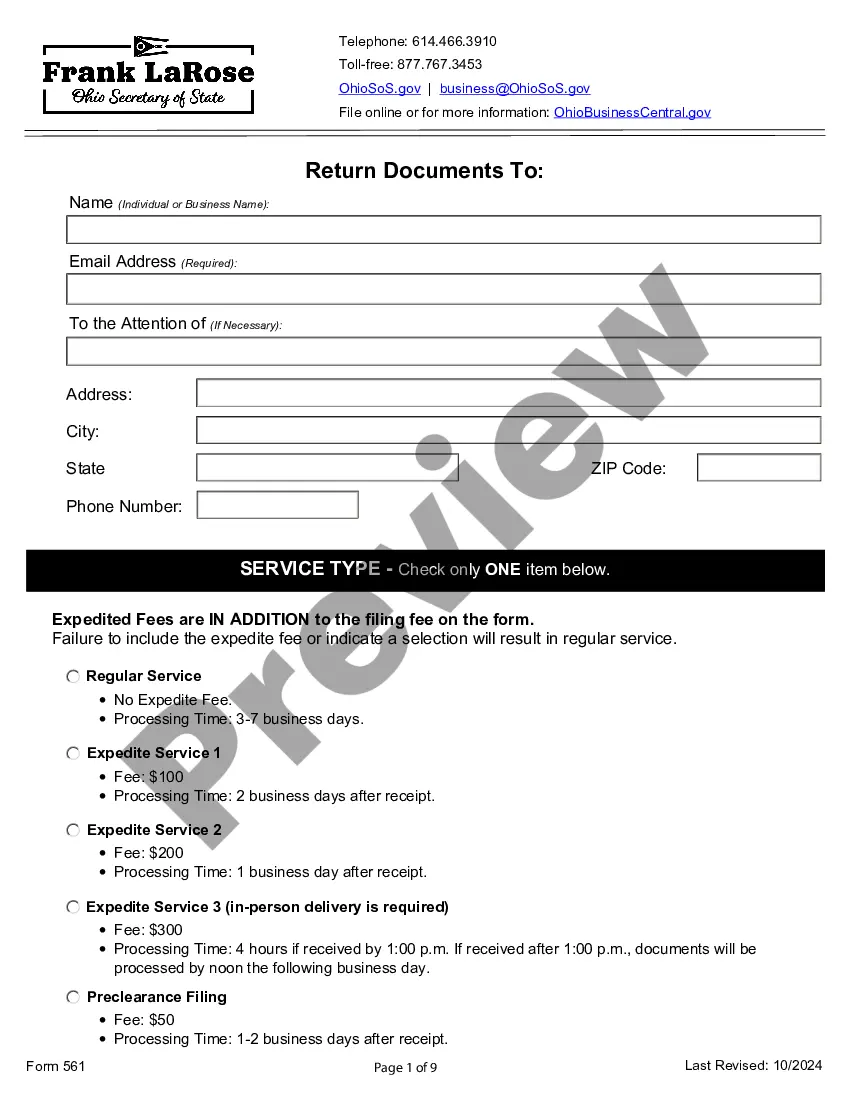

To dissolve your LLC in Ohio, you must provide the completed Certificate of Dissolution of Limited Liability Company / Cancellation of Foreign LLC form to the Secretary of State by mail, in person, or online. Ohio's SOS does not require original signatures.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

Obtain and Submit Appropriate Documents Entity TypeGoverning Ohio Revised Code SectionFiling FeeLimited Liability Company1706.471$50.00General Partnership1776.65$50.00Limited Partnership1782.10$50.00Limited Liability Partnership1776.65$50.008 more rows

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

The Process of Dissolving a NJ LLC Dissolution is a process in which the LLC begins its legal termination. It is the death of the LLC. It takes place when one or more of its members cease their association with the LLC or an event takes place which so affects the company it is forced to legally dissolve.