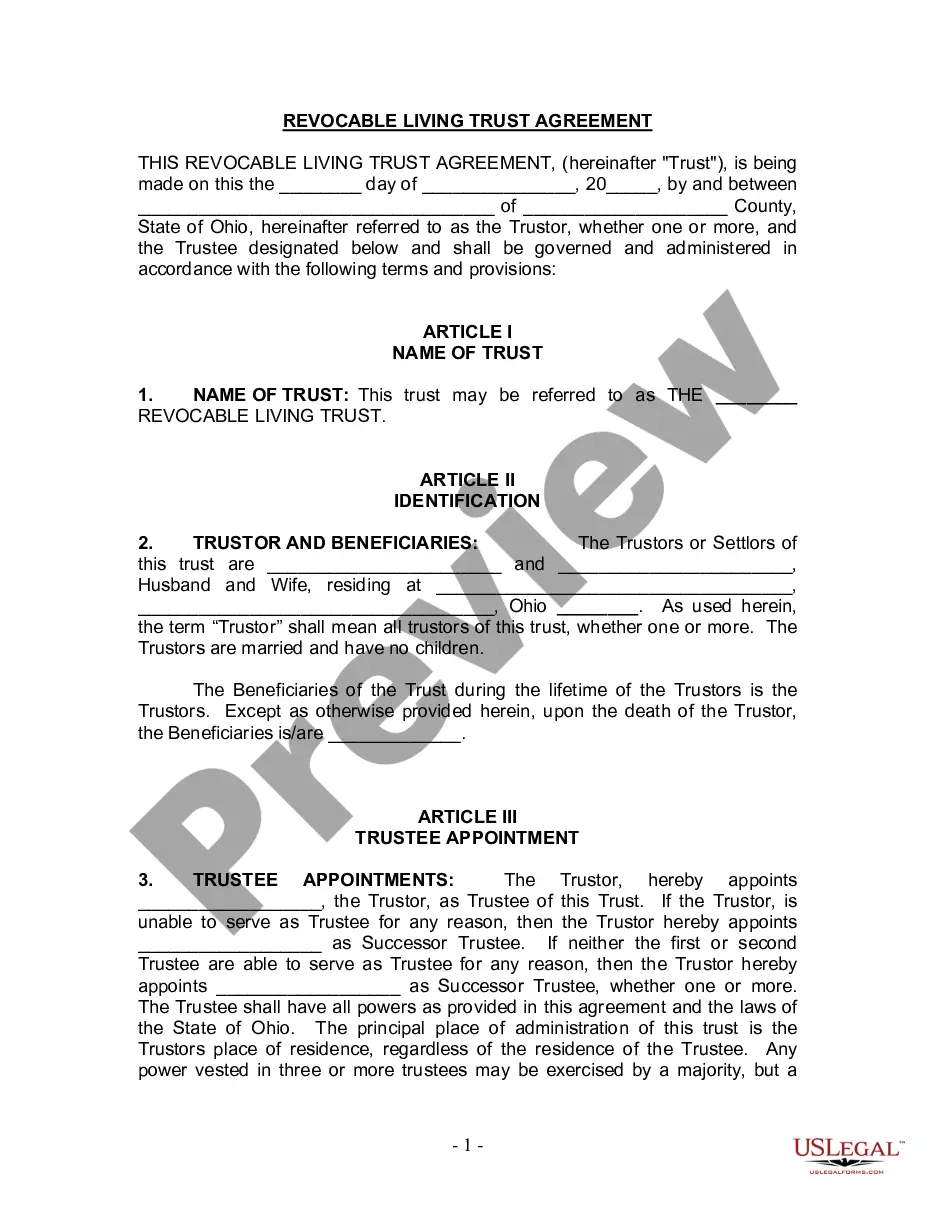

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Columbus Ohio Living Trust for Husband and Wife with No Children

Description

How to fill out Ohio Living Trust For Husband And Wife With No Children?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It's a digital collection of over 85,000 legal documents for both personal and professional requirements and various real-world scenarios.

All the forms are correctly categorized by usage area and jurisdiction, allowing you to search for the Columbus Ohio Living Trust for Husband and Wife with No Children swiftly and effortlessly.

Maintain your paperwork organized and compliant with the legal standards is of utmost importance. Take advantage of the US Legal Forms library to consistently have essential document templates readily available for any requirements!

- Examine the Preview mode and form description.

- Ensure you’ve chosen the accurate one that fulfills your requirements and fully aligns with your local jurisdiction specifications.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the correct one. If it meets your expectations, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

The Rights of a Surviving Spouse in Ohio If a person dies leaving a surviving spouse without any minor children, a surviving spouse and minor children, or minor children and no surviving spouse, these parties are entitled to receive $40,000 as an allowance for support.

If your spouse named you as the beneficiary on life insurance policies or pensions, transfer of the assets will not require probate. Even if others?such as your children?are named as beneficiaries, there is no need to probate the assets. They will simply go to the designated beneficiary. Joint bank accounts.

A trust will cost about $1,200 for individuals and $2,500 for married couples on average. However, costs may differ based on an individual's needs and circumstances. Those who have a living trust are urged to review it no more than every five years. Living trusts may be ideal for those looking to avoid probate.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

Spouses in Ohio Inheritance Law The surviving spouse is afforded 100% of the decedent's estate if neither had children or all of their collective children were with each other, according to Ohio inheritance laws.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

If there are no children of the decedent or the descendants of the children, then the entire estate goes to the surviving spouse. If there isn't a surviving spouse, no children, or descendants of children, then the estate goes to the surviving parents or the surviving parent.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Married partners or civil partners inherit under the rules of intestacy only if they are actually married or in a civil partnership at the time of death. So if you are divorced or if your civil partnership has been legally ended, you can't inherit under the rules of intestacy.

According to Ohio's intestate laws, property is distributed as follows: If there is a surviving spouse, the entire estate will go to him or her. If there is no spouse, but there are children, the estate will be divided equally among them. If there is no spouse and no children, the deceased's parents will inherit.