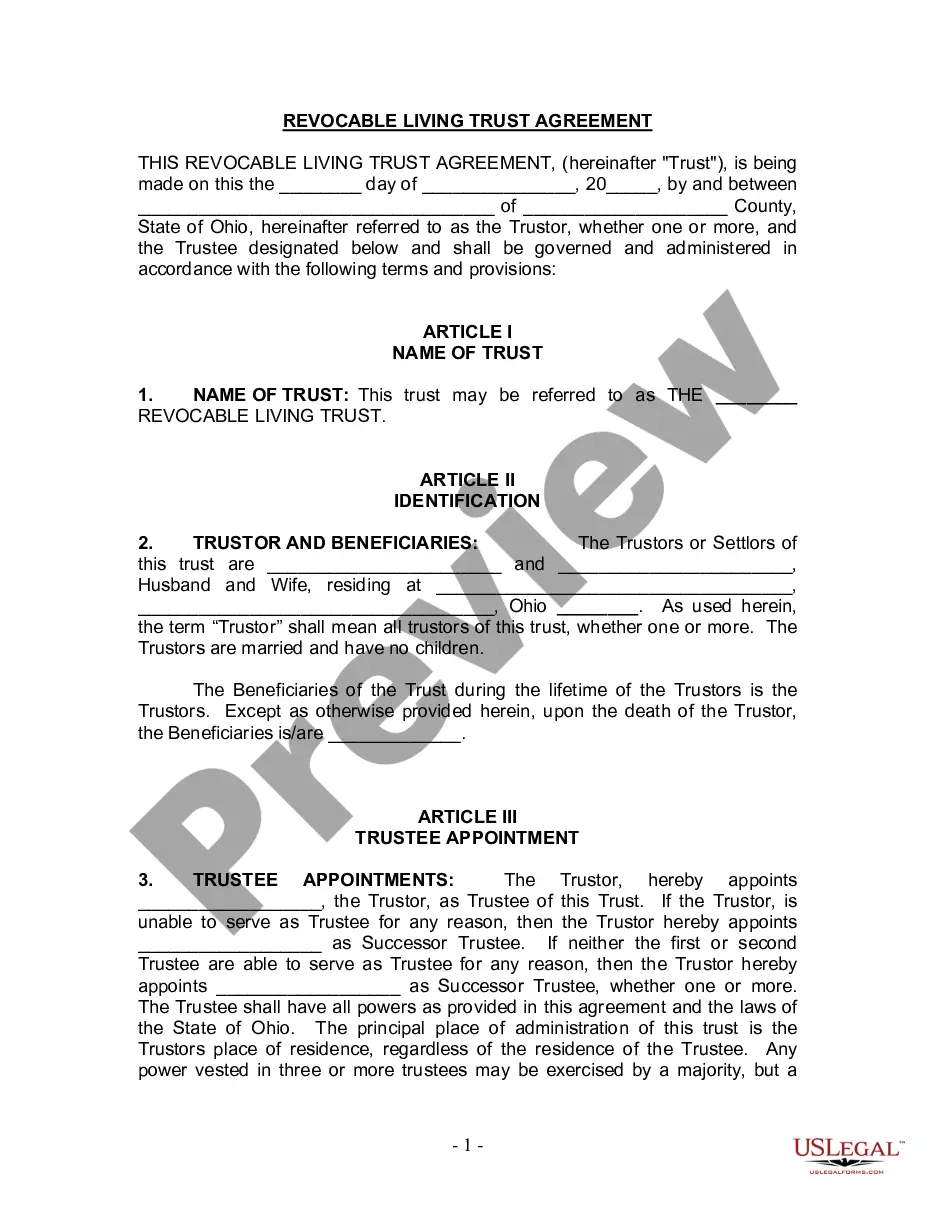

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Cuyahoga Ohio Living Trust for Husband and Wife with No Children is a legal document that allows a married couple without children to protect and manage their assets during their lifetime and ensure a smooth transfer of their property upon their death. This type of living trust provides specific instructions on how the couple's assets should be handled and distributed. Keywords: Cuyahoga Ohio Living Trust, Husband and Wife, No Children, assets, property, lifetime, death, instructions, distributed. There are different types of Cuyahoga Ohio Living Trusts for Husband and Wife with No Children, including: 1. Revocable Living Trust: This type of trust allows the couple to retain control over their assets during their lifetime. They can make changes or terminate the trust if needed. Upon the death of one spouse, the assets are transferred to the surviving spouse. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be changed or revoked once it is established. This type of trust protects assets from estate taxes and creditors. It allows the couple to maintain control over their property and specify how it should be distributed upon their death. 3. Survivor's Trust: A survivor's trust, also known as a bypass or marital trust, is commonly used by married couples without children. It ensures that the surviving spouse has access to the deceased spouse's assets while still protecting the interests of both parties. Upon the death of the surviving spouse, the remaining assets are distributed according to the instructions laid out in the trust. 4. Testamentary Trust: Unlike the aforementioned living trusts, a testamentary trust is established through a will. It becomes effective upon the death of the second spouse and is used to manage and distribute assets according to the couple's wishes. Cuyahoga Ohio Living Trust for Husband and Wife with No Children provides the couple with flexibility, control, and peace of mind regarding the management and distribution of their assets. It is crucial to consult with an experienced estate planning attorney to determine which type of living trust best fits the couple's specific needs and goals.A Cuyahoga Ohio Living Trust for Husband and Wife with No Children is a legal document that allows a married couple without children to protect and manage their assets during their lifetime and ensure a smooth transfer of their property upon their death. This type of living trust provides specific instructions on how the couple's assets should be handled and distributed. Keywords: Cuyahoga Ohio Living Trust, Husband and Wife, No Children, assets, property, lifetime, death, instructions, distributed. There are different types of Cuyahoga Ohio Living Trusts for Husband and Wife with No Children, including: 1. Revocable Living Trust: This type of trust allows the couple to retain control over their assets during their lifetime. They can make changes or terminate the trust if needed. Upon the death of one spouse, the assets are transferred to the surviving spouse. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be changed or revoked once it is established. This type of trust protects assets from estate taxes and creditors. It allows the couple to maintain control over their property and specify how it should be distributed upon their death. 3. Survivor's Trust: A survivor's trust, also known as a bypass or marital trust, is commonly used by married couples without children. It ensures that the surviving spouse has access to the deceased spouse's assets while still protecting the interests of both parties. Upon the death of the surviving spouse, the remaining assets are distributed according to the instructions laid out in the trust. 4. Testamentary Trust: Unlike the aforementioned living trusts, a testamentary trust is established through a will. It becomes effective upon the death of the second spouse and is used to manage and distribute assets according to the couple's wishes. Cuyahoga Ohio Living Trust for Husband and Wife with No Children provides the couple with flexibility, control, and peace of mind regarding the management and distribution of their assets. It is crucial to consult with an experienced estate planning attorney to determine which type of living trust best fits the couple's specific needs and goals.