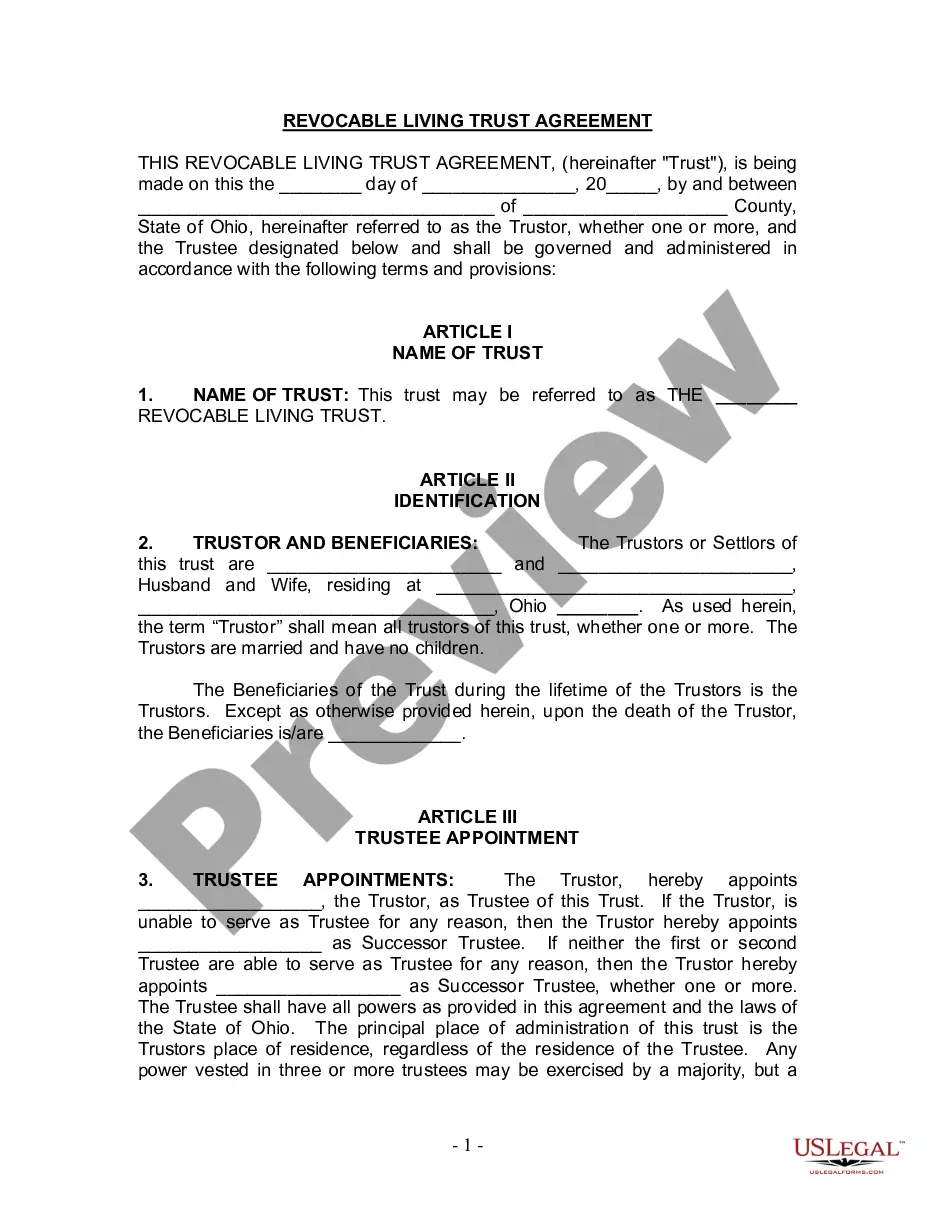

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Dayton Ohio Living Trust for Husband and Wife with No Children

Description

How to fill out Ohio Living Trust For Husband And Wife With No Children?

Are you seeking a reliable and economical supplier of legal forms to purchase the Dayton Ohio Living Trust for Married Couples with No Offspring? US Legal Forms is your prime choice.

Whether you need a simple agreement to establish guidelines for living together with your spouse or a collection of documents to facilitate your separation or divorce through the judicial system, we've got you covered.

Our website features over 85,000 current legal document templates for individual and commercial use. All templates we provide access to are not generic and are tailored based on the needs of different states and regions.

To acquire the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can re-download your previously purchased document templates at any time from the My documents section.

Now you can register your account. Next, choose the subscription plan and move forward to payment. After completing the payment, you can download the Dayton Ohio Living Trust for Married Couples with No Offspring in any available file format.

You can return to the site anytime and redownload the document at no additional cost. Accessing up-to-date legal forms has never been simpler. Try US Legal Forms today, and say goodbye to spending hours searching for legal documents online.

- Is this your first visit to our site? No problem.

- You can create an account with great ease, but before you do that, please ensure to.

- Verify that the Dayton Ohio Living Trust for Married Couples with No Offspring complies with your state and local regulations.

- Review the details of the form (if available) to understand the intended purpose and audience of the document.

- Restart the search if the form is unsuitable for your particular circumstances.

Form popularity

FAQ

Yes, a single person with no children can benefit from having a trust. Even without dependents, a Dayton Ohio Living Trust for Husband and Wife with No Children can help you manage your assets and outline your wishes clearly. It allows you to designate how your property should be distributed, reducing potential delays and disputes. Setting up a trust helps ensure your wishes are honored, regardless of your family situation.

Writing your own trust in Ohio is entirely possible, and many individuals choose this route. Your Dayton Ohio Living Trust for Husband and Wife with No Children can be custom-tailored to suit your specific needs and wishes. However, ensure that you follow the legal requirements outlined in Ohio law. Consider using tools or templates from uslegalforms to help streamline the process and ensure nothing is overlooked.

Yes, a person can set up a trust for themselves, known as a self-settled trust. This can be an effective strategy within your Dayton Ohio Living Trust for Husband and Wife with No Children to manage assets during your lifetime and facilitate their distribution after passing. By doing this, you retain control over your assets while planning for future needs. It's important to comply with Ohio laws to ensure your trust is valid.

Yes, you can write your own trust in Ohio, although it is crucial to ensure that it meets all legal requirements. When creating your Dayton Ohio Living Trust for Husband and Wife with No Children, you should include specific clauses that reflect your intentions clearly. Using resources from platforms like uslegalforms can guide you through the process and help you avoid common mistakes. Always consider seeking legal advice to ensure everything is set up properly.

In Ohio, a trust does not necessarily need to be notarized to be valid. However, having your Dayton Ohio Living Trust for Husband and Wife with No Children notarized can help in proving its authenticity and can simplify the execution process. It provides an additional layer of protection against potential disputes. Notarization may also be beneficial if you intend to present the trust to banks or other institutions.

Husbands and wives may opt for separate trusts to manage their assets independently or protect them from creditors. For a Dayton Ohio Living Trust for Husband and Wife with No Children, this decision could ensure that personal preferences are honored when distributing assets. Furthermore, separate trusts allow couples to tailor their estate planning, catering to specific financial needs and goals.

Deciding between separate or joint living trusts hinges on the couple’s individual circumstances. While a Dayton Ohio Living Trust for Husband and Wife with No Children may suit many couples, separate trusts can address unique asset ownership or personal financial goals. If one spouse has significantly more assets or liabilities, separate trusts might offer protection and give each person more control.

The best living trust for a married couple often depends on their specific needs, but a joint living trust is generally recommended. For those considering a Dayton Ohio Living Trust for Husband and Wife with No Children, this option simplifies asset management and provides clear instructions for asset distribution. It allows both partners to make decisions together, which can provide peace of mind and clarity.

Suze Orman emphasizes the importance of establishing a living trust to ensure your assets are managed according to your wishes. She highlights that a Dayton Ohio Living Trust for Husband and Wife with No Children can simplify the transfer of property after death, avoiding costly probate. Orman encourages couples to consider their unique situations, especially when children are not involved, to ensure their financial legacy is preserved.

A significant mistake parents make when setting up a trust fund is failing to regularly review and update the trust as circumstances change. This can lead to confusion and conflicts over asset distribution. For couples with no children, a Dayton Ohio Living Trust for Husband and Wife with No Children should reflect your current desires, incorporating changes in laws, finances, or family dynamics. Staying proactive helps ensure your trust fulfills its intended purpose.