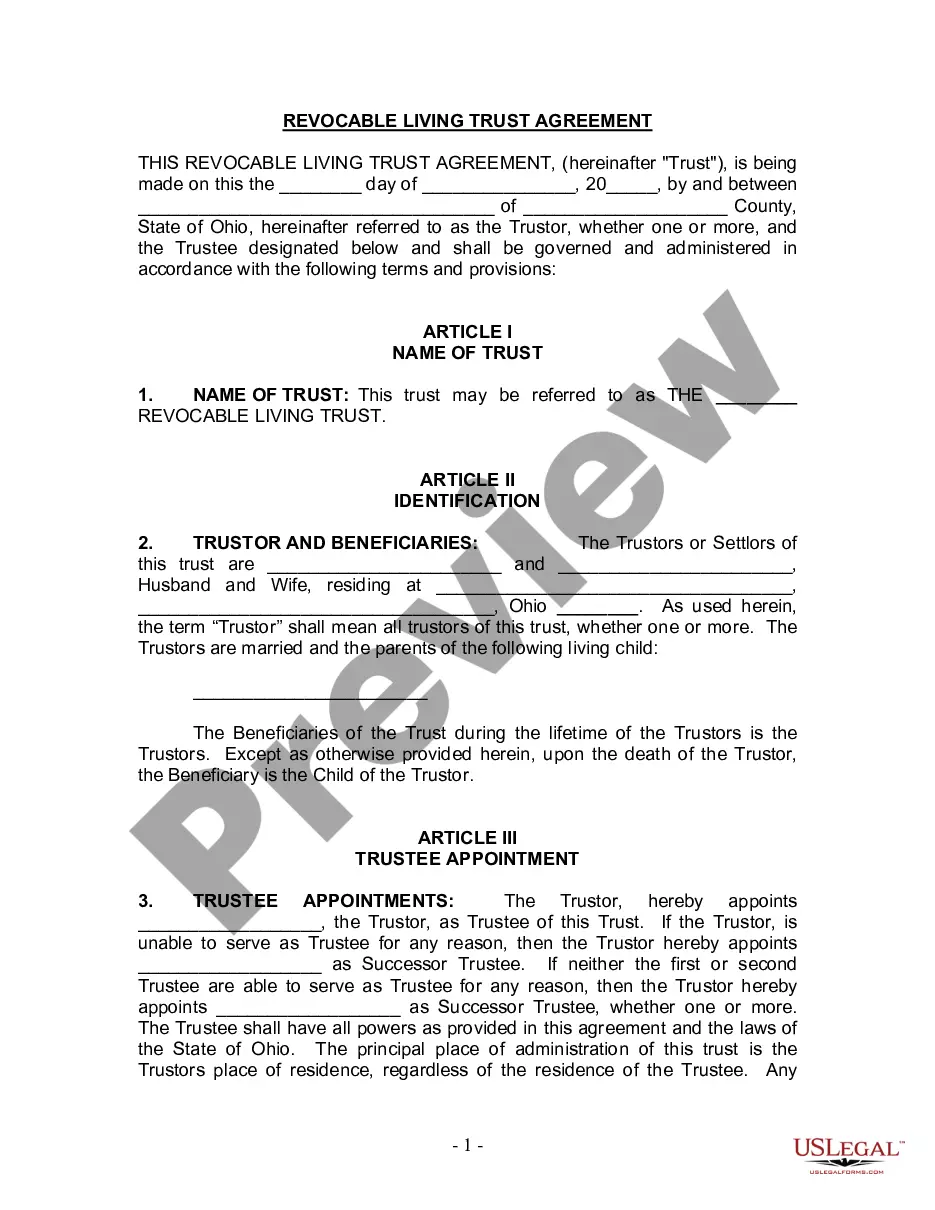

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

The Cuyahoga Ohio Living Trust for Husband and Wife with One Child is a legal instrument designed to protect and manage an individual or a couple's assets during their lifetime and ensure a smooth transfer of those assets to their child upon their passing. This type of living trust is popular among families in Cuyahoga County, Ohio, as it provides numerous benefits, including avoiding the lengthy and costly process of probate. A Cuyahoga Ohio Living Trust for Husband and Wife with One Child, commonly known as a revocable living trust, allows the individual or couple (referred to as the granter(s)) to maintain control over their assets while alive. It enables them to appoint themselves as the trustees, giving them the power to manage, invest, and make changes to the trust as needed. Additionally, they can also name a successor trustee to take over the management of the trust upon their incapacity or death. By creating a living trust, the granter(s) can ensure that their assets are protected and allocated according to their wishes. In this case, with one child, the trust can be designed to provide for the child's needs, such as education, healthcare, and general support. The trust can also include provisions for the management of the assets if the child is a minor or lacks the capability to handle their inheritance. One of the main advantages of a living trust is the avoidance of probate. In Cuyahoga County, Ohio, probate can be a lengthy and costly process. By establishing a living trust, the granter(s) can bypass probate and reduce the administrative burden on their family. This allows for a quicker distribution of assets and privacy, as the trust administration is not a matter of public record. It's important to note that there are various types of Cuyahoga Ohio Living Trusts for Husband and Wife with One Child, each tailored to specific needs or goals of the granter(s). Some common types include: 1. Testamentary Trust: This type of trust is created within a will and becomes effective only upon the death of the granter(s). It can specify how assets are to be distributed and managed for the benefit of the child. 2. Supplemental Needs Trust: This type of trust is designed to provide for a child with special needs without jeopardizing their eligibility for government benefits. It ensures that the child's inheritance is used to enhance their quality of life while not disqualifying them from essential support programs. 3. Educational Trust: This trust focuses on providing for the child's education. It can allocate funds for tuition, books, living expenses, and other educational needs. It's crucial for individuals or couples in Cuyahoga County, Ohio, to consult with an experienced estate planning attorney who can guide them through the process of creating a custom Cuyahoga Ohio Living Trust for Husband and Wife with One Child. This ensures that their goals, wishes, and concerns are addressed, and their assets are protected for the benefit of their child.The Cuyahoga Ohio Living Trust for Husband and Wife with One Child is a legal instrument designed to protect and manage an individual or a couple's assets during their lifetime and ensure a smooth transfer of those assets to their child upon their passing. This type of living trust is popular among families in Cuyahoga County, Ohio, as it provides numerous benefits, including avoiding the lengthy and costly process of probate. A Cuyahoga Ohio Living Trust for Husband and Wife with One Child, commonly known as a revocable living trust, allows the individual or couple (referred to as the granter(s)) to maintain control over their assets while alive. It enables them to appoint themselves as the trustees, giving them the power to manage, invest, and make changes to the trust as needed. Additionally, they can also name a successor trustee to take over the management of the trust upon their incapacity or death. By creating a living trust, the granter(s) can ensure that their assets are protected and allocated according to their wishes. In this case, with one child, the trust can be designed to provide for the child's needs, such as education, healthcare, and general support. The trust can also include provisions for the management of the assets if the child is a minor or lacks the capability to handle their inheritance. One of the main advantages of a living trust is the avoidance of probate. In Cuyahoga County, Ohio, probate can be a lengthy and costly process. By establishing a living trust, the granter(s) can bypass probate and reduce the administrative burden on their family. This allows for a quicker distribution of assets and privacy, as the trust administration is not a matter of public record. It's important to note that there are various types of Cuyahoga Ohio Living Trusts for Husband and Wife with One Child, each tailored to specific needs or goals of the granter(s). Some common types include: 1. Testamentary Trust: This type of trust is created within a will and becomes effective only upon the death of the granter(s). It can specify how assets are to be distributed and managed for the benefit of the child. 2. Supplemental Needs Trust: This type of trust is designed to provide for a child with special needs without jeopardizing their eligibility for government benefits. It ensures that the child's inheritance is used to enhance their quality of life while not disqualifying them from essential support programs. 3. Educational Trust: This trust focuses on providing for the child's education. It can allocate funds for tuition, books, living expenses, and other educational needs. It's crucial for individuals or couples in Cuyahoga County, Ohio, to consult with an experienced estate planning attorney who can guide them through the process of creating a custom Cuyahoga Ohio Living Trust for Husband and Wife with One Child. This ensures that their goals, wishes, and concerns are addressed, and their assets are protected for the benefit of their child.