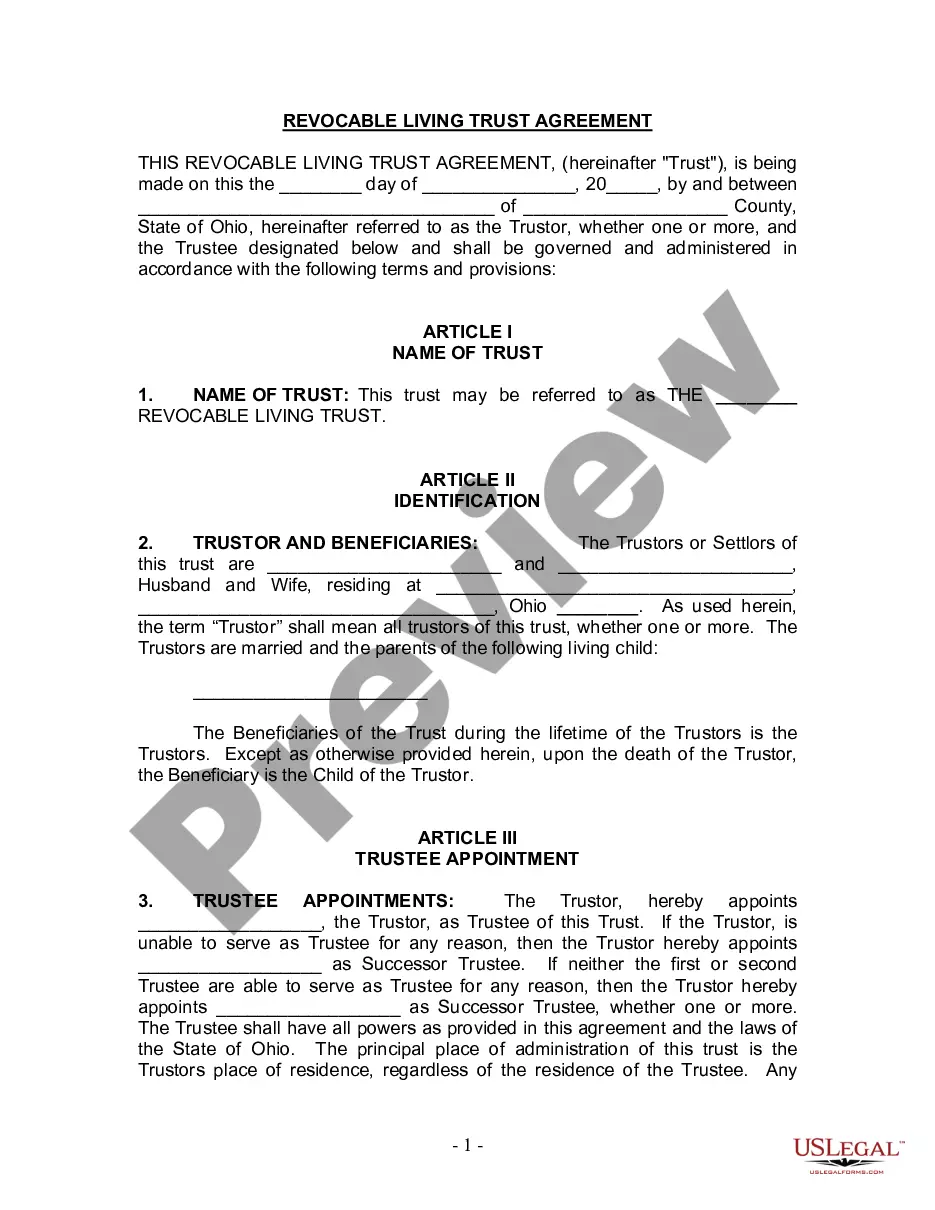

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Franklin Ohio Living Trust for Husband and Wife with One Child is a legal document specifically designed to protect assets and manage the distribution of those assets after the death of the both spouses. This form of living trust ensures that the surviving spouse and their child are the primary beneficiaries and beneficiaries maintain control over their assets during their lifetime. The main purpose of creating a living trust for a couple with one child in Franklin, Ohio is to avoid probate, a time-consuming and expensive legal process. By establishing a living trust, individuals can ensure a smooth transfer of assets to their loved ones and minimize the burden on their family during their already difficult time. There are two common types of Franklin Ohio Living Trust for Husband and Wife with One Child: 1. Revocable Living Trust: This type of trust allows flexibility, as it can be altered or revoked during the lifetime of the granters (the spouses). With a revocable living trust, the spouses can serve as trustees and manage their assets as desired. In the event of incapacity or death, a successor trustee takes over the management and distribution of assets according to the trust's provisions. 2. Irrevocable Living Trust: Unlike the revocable trust, an irrevocable living trust cannot be modified once established without court approval. When assets are transferred into this type of trust, they are no longer considered part of the granters' estates. This can offer potential tax benefits and protection against creditors. However, it is essential to consider the irreversibility of this type of trust before making the decision. When establishing a Franklin Ohio Living Trust for Husband and Wife with One Child, the trust must be carefully drafted, considering the specific needs and goals of the spouses. It should clearly identify the beneficiaries, trustees, successor trustees, and the distribution of assets. Additionally, it is crucial to consider any potential estate tax implications and consult with a qualified attorney who specializes in estate planning. In summary, a Franklin Ohio Living Trust for Husband and Wife with One Child is a legal tool designed to protect assets, streamline the distribution of assets, and minimize the probate process after the death of the spouses. The revocable and irrevocable living trust are the two common types available, each with its own advantages and considerations. Professional legal advice should be sought to ensure compliance with Ohio laws and to tailor the trust document to the specific needs of the family.Franklin Ohio Living Trust for Husband and Wife with One Child is a legal document specifically designed to protect assets and manage the distribution of those assets after the death of the both spouses. This form of living trust ensures that the surviving spouse and their child are the primary beneficiaries and beneficiaries maintain control over their assets during their lifetime. The main purpose of creating a living trust for a couple with one child in Franklin, Ohio is to avoid probate, a time-consuming and expensive legal process. By establishing a living trust, individuals can ensure a smooth transfer of assets to their loved ones and minimize the burden on their family during their already difficult time. There are two common types of Franklin Ohio Living Trust for Husband and Wife with One Child: 1. Revocable Living Trust: This type of trust allows flexibility, as it can be altered or revoked during the lifetime of the granters (the spouses). With a revocable living trust, the spouses can serve as trustees and manage their assets as desired. In the event of incapacity or death, a successor trustee takes over the management and distribution of assets according to the trust's provisions. 2. Irrevocable Living Trust: Unlike the revocable trust, an irrevocable living trust cannot be modified once established without court approval. When assets are transferred into this type of trust, they are no longer considered part of the granters' estates. This can offer potential tax benefits and protection against creditors. However, it is essential to consider the irreversibility of this type of trust before making the decision. When establishing a Franklin Ohio Living Trust for Husband and Wife with One Child, the trust must be carefully drafted, considering the specific needs and goals of the spouses. It should clearly identify the beneficiaries, trustees, successor trustees, and the distribution of assets. Additionally, it is crucial to consider any potential estate tax implications and consult with a qualified attorney who specializes in estate planning. In summary, a Franklin Ohio Living Trust for Husband and Wife with One Child is a legal tool designed to protect assets, streamline the distribution of assets, and minimize the probate process after the death of the spouses. The revocable and irrevocable living trust are the two common types available, each with its own advantages and considerations. Professional legal advice should be sought to ensure compliance with Ohio laws and to tailor the trust document to the specific needs of the family.