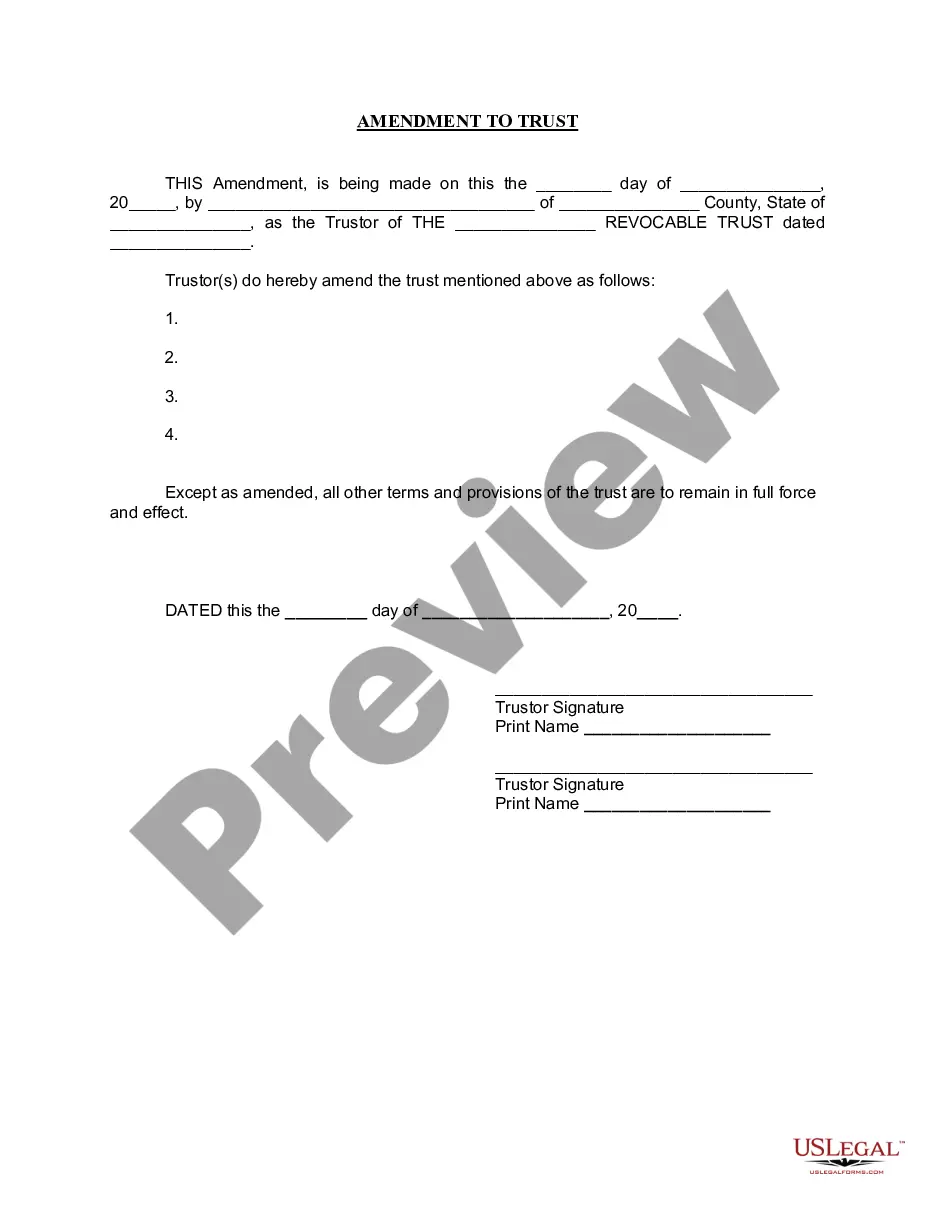

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

The Dayton Ohio Amendment to Living Trust is a legal document that enables individuals in Dayton, Ohio, to make changes or updates to their existing living trust. A living trust is a popular estate planning tool that allows individuals to manage and distribute their assets during their lifetime and after their death, while avoiding probate. Having the ability to amend a living trust ensures flexibility for individuals who may experience significant life changes, such as marriage, divorce, birth of a child, acquisition of new assets, or changes in financial goals. Through the Dayton Ohio Amendment to Living Trust, individuals can modify provisions in their trust to reflect their current wishes and circumstances. There are several types of Dayton Ohio Amendment to Living Trust that individuals may consider depending on their specific needs: 1. General Amendment: This type of amendment is used to make changes to various aspects of the living trust, including modifying beneficiaries, adding or removing assets, or altering distribution instructions. 2. Beneficiary Amendment: If an individual wishes to change the beneficiaries named in their living trust, they can make use of this amendment. It allows them to add or remove beneficiaries or adjust the distribution percentages among the existing beneficiaries. 3. Successor Trustee Amendment: This amendment enables individuals to designate a new successor trustee or modify the existing appointment if the originally appointed trustee becomes incapacitated, passes away, or is no longer willing or able to fulfill their role. 4. Asset Amendment: Individuals may utilize this type of amendment to add or remove specific assets from their living trust. This can be useful when acquiring new assets or deciding to transfer certain assets outside the trust. 5. Specific Instruction Amendment: If there are specific instructions within the living trust that require modification or clarification, individuals can use this amendment to make necessary adjustments. It is important to note that any changes made through the Dayton Ohio Amendment to Living Trust must comply with Ohio state laws and be executed with proper legal formalities. Consulting with a knowledgeable estate planning attorney in Dayton, Ohio, is essential to ensure the validity and legality of any amendments made to a living trust within the state.The Dayton Ohio Amendment to Living Trust is a legal document that enables individuals in Dayton, Ohio, to make changes or updates to their existing living trust. A living trust is a popular estate planning tool that allows individuals to manage and distribute their assets during their lifetime and after their death, while avoiding probate. Having the ability to amend a living trust ensures flexibility for individuals who may experience significant life changes, such as marriage, divorce, birth of a child, acquisition of new assets, or changes in financial goals. Through the Dayton Ohio Amendment to Living Trust, individuals can modify provisions in their trust to reflect their current wishes and circumstances. There are several types of Dayton Ohio Amendment to Living Trust that individuals may consider depending on their specific needs: 1. General Amendment: This type of amendment is used to make changes to various aspects of the living trust, including modifying beneficiaries, adding or removing assets, or altering distribution instructions. 2. Beneficiary Amendment: If an individual wishes to change the beneficiaries named in their living trust, they can make use of this amendment. It allows them to add or remove beneficiaries or adjust the distribution percentages among the existing beneficiaries. 3. Successor Trustee Amendment: This amendment enables individuals to designate a new successor trustee or modify the existing appointment if the originally appointed trustee becomes incapacitated, passes away, or is no longer willing or able to fulfill their role. 4. Asset Amendment: Individuals may utilize this type of amendment to add or remove specific assets from their living trust. This can be useful when acquiring new assets or deciding to transfer certain assets outside the trust. 5. Specific Instruction Amendment: If there are specific instructions within the living trust that require modification or clarification, individuals can use this amendment to make necessary adjustments. It is important to note that any changes made through the Dayton Ohio Amendment to Living Trust must comply with Ohio state laws and be executed with proper legal formalities. Consulting with a knowledgeable estate planning attorney in Dayton, Ohio, is essential to ensure the validity and legality of any amendments made to a living trust within the state.