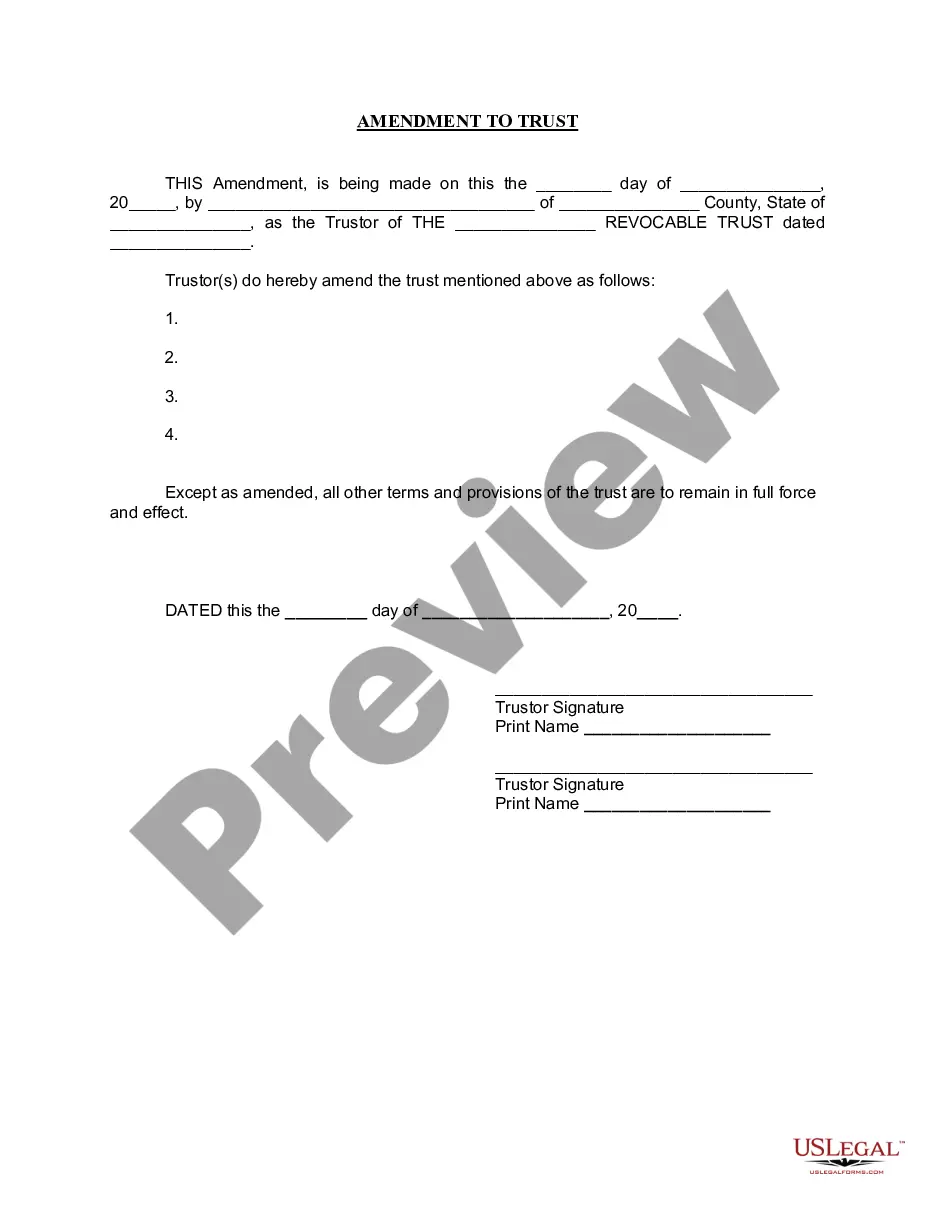

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

The Franklin Ohio Amendment to Living Trust is a legal document that allows individuals residing in Ohio to make changes or modifications to their existing living trust. It provides an opportunity for trust creators to update their trust according to their current needs and circumstances. The purpose of the Franklin Ohio Amendment to Living Trust is to ensure that the trust accurately reflects the trust creator's wishes and intentions. Through this legal instrument, various aspects of the trust can be amended, such as the named beneficiaries, succession plans, distribution of assets, or even the appointment of trustees. Several types of Franklin Ohio Amendments to Living Trust may be made, depending on the specific changes required. Some common types include: 1. Beneficiary Amendment: This amendment allows the trust creator to modify or update the named beneficiaries of the trust. It can be used to include additional beneficiaries, remove existing ones, or change the proportional distribution of assets among beneficiaries. 2. Successor Trustee Amendment: With this type of amendment, the trust creator can alter the appointment of the successor trustee. This is particularly useful when the initially appointed trustee becomes unavailable or unfit to fulfill their responsibilities. 3. Asset Distribution Amendment: Trust creators can utilize this amendment to adjust the distribution plan of the trust's assets. It enables individuals to specify new proportions or instructions regarding the allocation of assets to beneficiaries. 4. Trust Termination Amendment: In certain cases, individuals may desire to terminate their living trust entirely. This amendment allows trust creators to revoke the trust and outline the process for distributing the remaining assets. 5. Administrative Amendment: This type of amendment involves changes in administrative matters, such as updating contact information, addresses, or other administrative details related to the trust. When making a Franklin Ohio Amendment to Living Trust, it is crucial to adhere to the legal requirements and procedures specified under Ohio law. It is recommended to consult with an experienced estate planning attorney to ensure compliance and to accurately draft the amendment document. Remember, a Franklin Ohio Amendment to Living Trust provides a convenient avenue for trust creators to adapt their trusts to reflect their evolving circumstances, protecting their assets and ensuring their intentions are accurately carried out.The Franklin Ohio Amendment to Living Trust is a legal document that allows individuals residing in Ohio to make changes or modifications to their existing living trust. It provides an opportunity for trust creators to update their trust according to their current needs and circumstances. The purpose of the Franklin Ohio Amendment to Living Trust is to ensure that the trust accurately reflects the trust creator's wishes and intentions. Through this legal instrument, various aspects of the trust can be amended, such as the named beneficiaries, succession plans, distribution of assets, or even the appointment of trustees. Several types of Franklin Ohio Amendments to Living Trust may be made, depending on the specific changes required. Some common types include: 1. Beneficiary Amendment: This amendment allows the trust creator to modify or update the named beneficiaries of the trust. It can be used to include additional beneficiaries, remove existing ones, or change the proportional distribution of assets among beneficiaries. 2. Successor Trustee Amendment: With this type of amendment, the trust creator can alter the appointment of the successor trustee. This is particularly useful when the initially appointed trustee becomes unavailable or unfit to fulfill their responsibilities. 3. Asset Distribution Amendment: Trust creators can utilize this amendment to adjust the distribution plan of the trust's assets. It enables individuals to specify new proportions or instructions regarding the allocation of assets to beneficiaries. 4. Trust Termination Amendment: In certain cases, individuals may desire to terminate their living trust entirely. This amendment allows trust creators to revoke the trust and outline the process for distributing the remaining assets. 5. Administrative Amendment: This type of amendment involves changes in administrative matters, such as updating contact information, addresses, or other administrative details related to the trust. When making a Franklin Ohio Amendment to Living Trust, it is crucial to adhere to the legal requirements and procedures specified under Ohio law. It is recommended to consult with an experienced estate planning attorney to ensure compliance and to accurately draft the amendment document. Remember, a Franklin Ohio Amendment to Living Trust provides a convenient avenue for trust creators to adapt their trusts to reflect their evolving circumstances, protecting their assets and ensuring their intentions are accurately carried out.