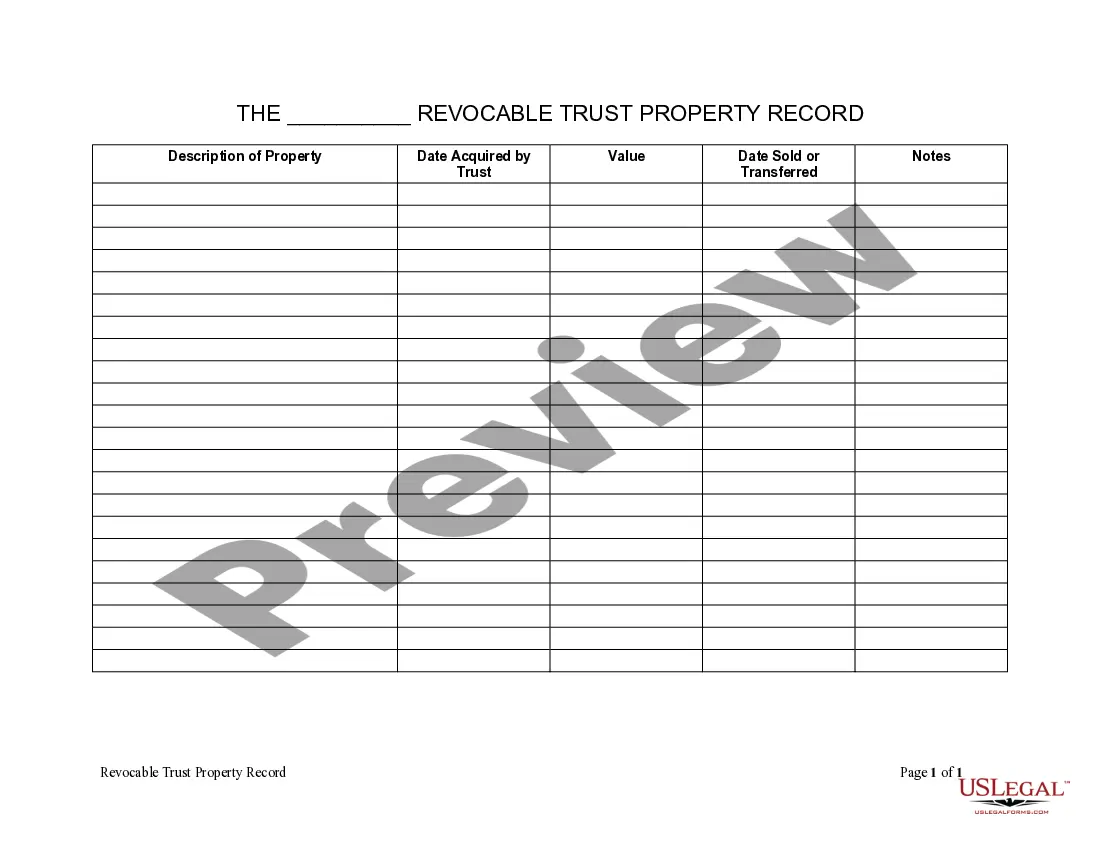

A Cuyahoga Ohio Living Trust Property Record is a comprehensive document that serves as an official record of the property owned by a living trust in Cuyahoga County, Ohio. It includes detailed information about the trust, the property, and the individuals involved. Properly maintaining this record is vital for effective estate planning and management. Keywords: Cuyahoga Ohio, living trust, property record, estate planning, property ownership, trust document, Cuyahoga County, Ohio, trust management. There are different types of Cuyahoga Ohio Living Trust Property Record, including: 1. Trust Agreement: This document outlines the terms and conditions of the living trust, specifying who the beneficiaries are, the trustee's responsibilities, and how the property should be managed. 2. Deed: The property deed is an essential part of the record as it confirms the ownership of the property by the living trust. It includes detailed legal descriptions of the property and is recorded with the county clerk's office. 3. Mortgage or Lien Documentation: If the property within the living trust has any mortgages or liens against it, all relevant documentation must be included in the record. This ensures that all outstanding debts are accounted for and can be properly managed. 4. Title Insurance: Including the title insurance policy and related documentation in the property record helps protect the living trust from any potential legal issues related to the property's title. 5. Property Appraisal: It is crucial to include a recent property appraisal to determine the property's fair market value, which can be used for tax purposes, insurance coverage, and evaluating potential asset growth. 6. Tax Assessment Records: Documentation related to property tax assessments, payment receipts, and any tax exemptions should be included in the record to demonstrate compliance with tax laws and regulations. 7. Maintenance and Repair Records: Keeping track of regular maintenance, repairs, and improvements made to the property is important. This information helps in assessing the property's condition and potential value appreciation. 8. Insurance Policies: All insurance policies covering the property and its assets should be included in the record. This includes homeowner's insurance, flood insurance, and any other relevant coverage. 9. Rental Agreements or Leases: If the trust property is being rented out, including the rental agreements or leases in the record is crucial. These documents outline the terms and conditions of the rental arrangement and the responsibilities of both the tenant and the trust. 10. Correspondence and Communication: Any significant correspondence related to the property, such as communication with tenants, property managers, or contractors, should be documented and included in the property record. By maintaining a comprehensive Cuyahoga Ohio Living Trust Property Record, trustees and beneficiaries can effectively manage the trust property, ensure legal compliance, and make informed decisions regarding the property's ownership and management.

Cuyahoga Ohio Living Trust Property Record

Description

How to fill out Cuyahoga Ohio Living Trust Property Record?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone without any legal education to create such paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a huge library with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Cuyahoga Ohio Living Trust Property Record or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Cuyahoga Ohio Living Trust Property Record in minutes employing our trustworthy platform. In case you are already a subscriber, you can go on and log in to your account to get the needed form.

Nevertheless, if you are a novice to our platform, make sure to follow these steps prior to obtaining the Cuyahoga Ohio Living Trust Property Record:

- Ensure the template you have chosen is specific to your location considering that the regulations of one state or area do not work for another state or area.

- Preview the document and read a short outline (if provided) of cases the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or create one from scratch.

- Select the payment method and proceed to download the Cuyahoga Ohio Living Trust Property Record as soon as the payment is completed.

You’re good to go! Now you can go on and print out the document or complete it online. Should you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.