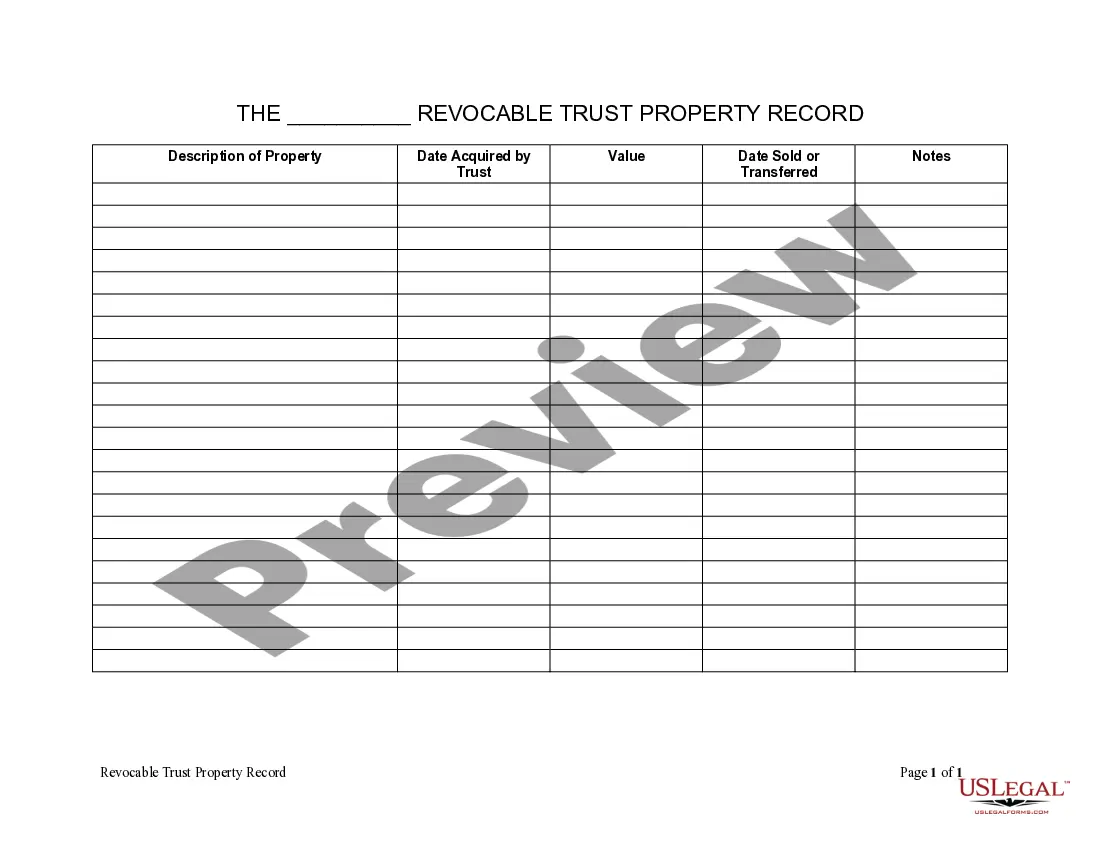

Toledo Ohio Living Trust Property Record

Description

How to fill out Ohio Living Trust Property Record?

Acquiring authenticated templates tailored to your regional legislation can be difficult unless you utilize the US Legal Forms repository.

It’s an online assortment of over 85,000 legal documents catering to both personal and professional requirements and various real-world scenarios.

All the files are neatly categorized by purpose and jurisdiction areas, making the search for the Toledo Ohio Living Trust Property Record as swift and straightforward as ABC.

Maintaining documents organized and compliant with legal standards is critically important. Take advantage of the US Legal Forms library to always have necessary document templates for any requirements just within reach!

- Review the Preview mode and form details.

- Ensure you select the right one that fulfills your needs and is fully compliant with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your requirements, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

One disadvantage of placing property in a trust is the potential for upfront costs associated with creating the trust and transferring assets. Additionally, some people may face ongoing administrative duties, including keeping records and filing taxes for the trust. Moreover, if not structured correctly, you might lose some control over your assets. However, understanding these challenges can help you navigate your Toledo Ohio Living Trust Property Record strategically, ensuring you make the right choices for your estate.

To place your house in a trust in Ohio, first, you need to choose the type of trust that fits your goals. Next, prepare a trust document that outlines how the trust will function and who the beneficiaries are. After that, you will need to transfer the property title to the trust, which also requires filing the necessary documents with the county recorder. Utilizing US Legal Forms can simplify this process, providing you with the right templates to handle your Toledo Ohio Living Trust Property Record efficiently.

If you've lost your deed, don't worry; you can obtain a copy from your county's recorder's office. Start by providing any identifying information about the property, such as the address or parcel number. Additionally, using the Toledo Ohio Living Trust Property Record can ease the process, allowing you to find detailed information about your property and request necessary documents with confidence.

In Ohio, deeds are recorded at the county recorder's office where the property is located. Each county maintains its records, ensuring that the information is accessible to the public. To find specific records, you may want to search the Toledo Ohio Living Trust Property Record, which provides an organized way to access these documents. This resource can be invaluable for anyone needing information on property transactions.

To obtain a copy of your house deed in Ohio, start by contacting your county's recorder's office. You may find the document online through their website or visit in person. If you're looking for detailed information about a specific property, consider searching the Toledo Ohio Living Trust Property Record for comprehensive data. This can help you verify ownership and related details efficiently.

Yes, you can write your own trust in Ohio, but it is highly recommended to use a professional service or consult with an attorney to ensure it meets all legal requirements. A well-drafted trust can prevent complications later, particularly concerning asset management and distribution. Using ulegalforms can guide you through the process of creating your living trust and keeping your Toledo Ohio Living Trust Property Record accurate.

A living trust works by allowing you to transfer ownership of your assets into the trust, which you then control as the trustee. You can manage these assets during your lifetime and dictate how they should be distributed after your passing. Keeping your Toledo Ohio Living Trust Property Record updated will help your successor trustee understand your wishes and manage your assets according to your directions.

A living trust provides several benefits in Ohio, including avoiding probate, protecting your privacy, and enabling easier management of your assets during your lifetime and after your death. By creating a trust, you can ensure that your property is managed according to your wishes, which can make a significant difference for your beneficiaries. Additionally, maintaining your Toledo Ohio Living Trust Property Record will streamline this process.

In Ohio, a living trust typically does not need to be filed with the court. Unlike wills, which require probate, living trusts remain private and do not go through the court process. However, it's still essential to maintain accurate records, such as your Toledo Ohio Living Trust Property Record, to ensure everything is organized.

To put your property in a trust in Ohio, you first need to create a living trust document that outlines how you want to manage your assets. You will then need to re-title your property, which involves updating the property deed to reflect the trust as the new owner. Ensure that you include your Toledo Ohio Living Trust Property Record in this process for proper documentation.