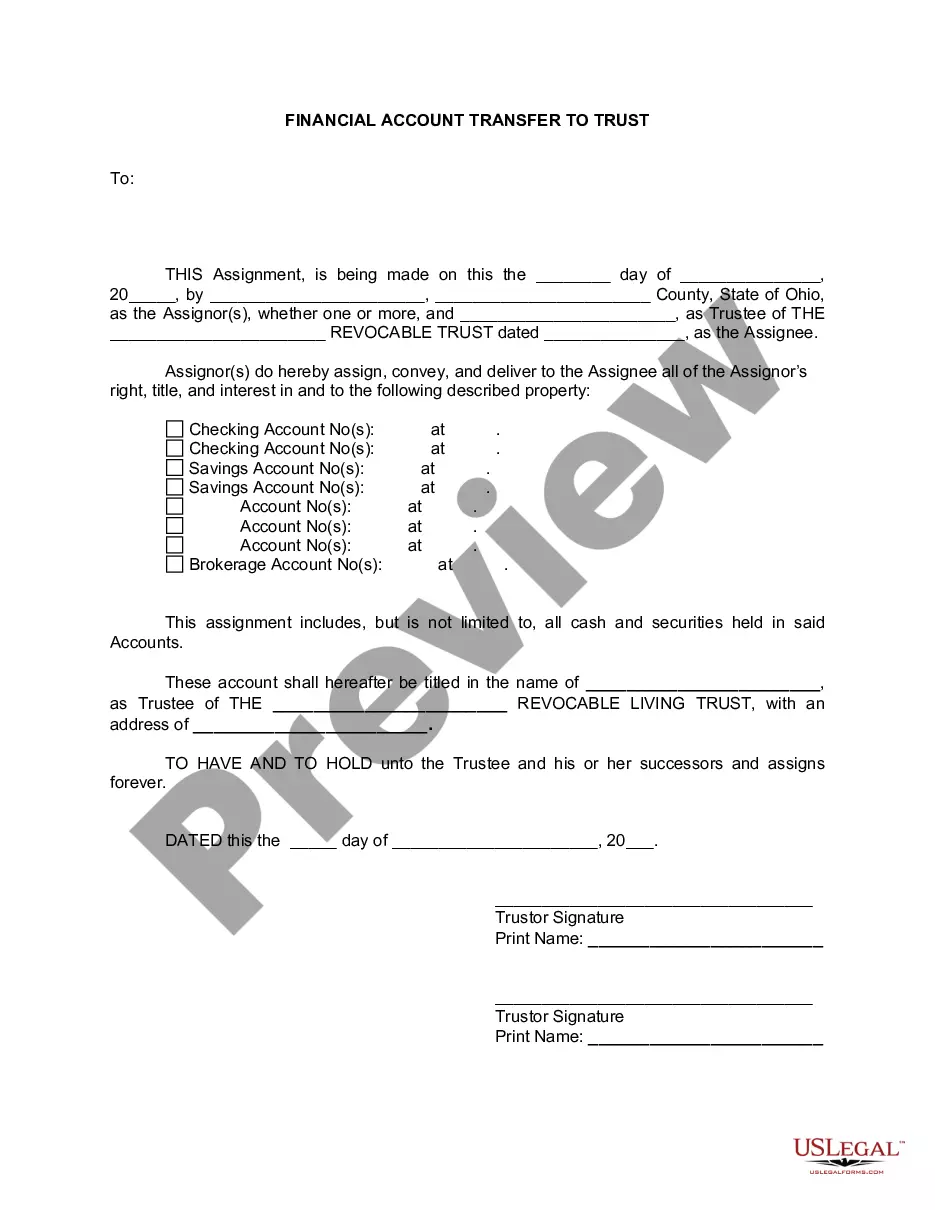

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Columbus Ohio Financial Account Transfer to Living Trust refers to the process of moving one's financial accounts to a living trust established in Columbus, Ohio. This transfer allows individuals to transfer ownership of their accounts from themselves as individuals to the living trust, which serves as a separate legal entity. A living trust is a legal document that outlines a person's wishes regarding the management and distribution of their assets while they are alive and after their passing. Establishing a living trust offers various benefits, including the ability to avoid probate, maintain privacy, and provide for the smooth transfer of assets to beneficiaries. In Columbus, Ohio, there are different types of financial account transfers to a living trust that individuals can consider: 1. Bank Account Transfer: This involves transferring funds from individual bank accounts, such as checking or savings accounts, to the living trust. By transferring ownership to the trust, the designated trustee (often the individual themselves) gains control over the account, managing and distributing the funds according to the trust's instructions. 2. Investment Account Transfer: This type of transfer involves moving investment assets, such as stocks, bonds, mutual funds, and brokerage accounts, into the living trust. By designating the trust as the new owner, the trustee gains control over the investments and ensures they are handled and distributed in line with the trust's provisions. 3. Retirement Account Transfer: In some cases, individuals may opt to transfer their retirement accounts, such as IRAs (Individual Retirement Accounts) or 401(k)s, to their living trust. This process requires adherence to specific rules and regulations imposed by the Internal Revenue Service (IRS) to avoid tax consequences. Consulting with a financial advisor or estate planning attorney is highly recommended for proper guidance. 4. Insurance Policy Transfer: Some individuals choose to transfer ownership of their life insurance policies to their living trust. This ensures that the proceeds from the policies are managed and distributed according to the trust's directives, providing financial security to the intended beneficiaries. To facilitate a Columbus Ohio Financial Account Transfer to Living Trust, individuals must contact the financial institutions where their accounts reside. These institutions will typically require specific documentation, including copies of the living trust, account information, and appropriate transfer forms. It is advisable to consult with an experienced estate planning attorney to help navigate the different requirements and ensure a smooth transfer process. In summary, Columbus Ohio Financial Account Transfer to Living Trust involves transferring various financial accounts, including bank accounts, investment accounts, retirement accounts, and life insurance policies, to a living trust in Columbus, Ohio. Each type of transfer comes with specific considerations and requires compliance with relevant legal and tax regulations. Seeking the guidance of professionals, such as estate planning attorneys and financial advisors, is crucial to successfully execute these transfers and ensure the proper management and distribution of assets according to the individual's wishes.Columbus Ohio Financial Account Transfer to Living Trust refers to the process of moving one's financial accounts to a living trust established in Columbus, Ohio. This transfer allows individuals to transfer ownership of their accounts from themselves as individuals to the living trust, which serves as a separate legal entity. A living trust is a legal document that outlines a person's wishes regarding the management and distribution of their assets while they are alive and after their passing. Establishing a living trust offers various benefits, including the ability to avoid probate, maintain privacy, and provide for the smooth transfer of assets to beneficiaries. In Columbus, Ohio, there are different types of financial account transfers to a living trust that individuals can consider: 1. Bank Account Transfer: This involves transferring funds from individual bank accounts, such as checking or savings accounts, to the living trust. By transferring ownership to the trust, the designated trustee (often the individual themselves) gains control over the account, managing and distributing the funds according to the trust's instructions. 2. Investment Account Transfer: This type of transfer involves moving investment assets, such as stocks, bonds, mutual funds, and brokerage accounts, into the living trust. By designating the trust as the new owner, the trustee gains control over the investments and ensures they are handled and distributed in line with the trust's provisions. 3. Retirement Account Transfer: In some cases, individuals may opt to transfer their retirement accounts, such as IRAs (Individual Retirement Accounts) or 401(k)s, to their living trust. This process requires adherence to specific rules and regulations imposed by the Internal Revenue Service (IRS) to avoid tax consequences. Consulting with a financial advisor or estate planning attorney is highly recommended for proper guidance. 4. Insurance Policy Transfer: Some individuals choose to transfer ownership of their life insurance policies to their living trust. This ensures that the proceeds from the policies are managed and distributed according to the trust's directives, providing financial security to the intended beneficiaries. To facilitate a Columbus Ohio Financial Account Transfer to Living Trust, individuals must contact the financial institutions where their accounts reside. These institutions will typically require specific documentation, including copies of the living trust, account information, and appropriate transfer forms. It is advisable to consult with an experienced estate planning attorney to help navigate the different requirements and ensure a smooth transfer process. In summary, Columbus Ohio Financial Account Transfer to Living Trust involves transferring various financial accounts, including bank accounts, investment accounts, retirement accounts, and life insurance policies, to a living trust in Columbus, Ohio. Each type of transfer comes with specific considerations and requires compliance with relevant legal and tax regulations. Seeking the guidance of professionals, such as estate planning attorneys and financial advisors, is crucial to successfully execute these transfers and ensure the proper management and distribution of assets according to the individual's wishes.