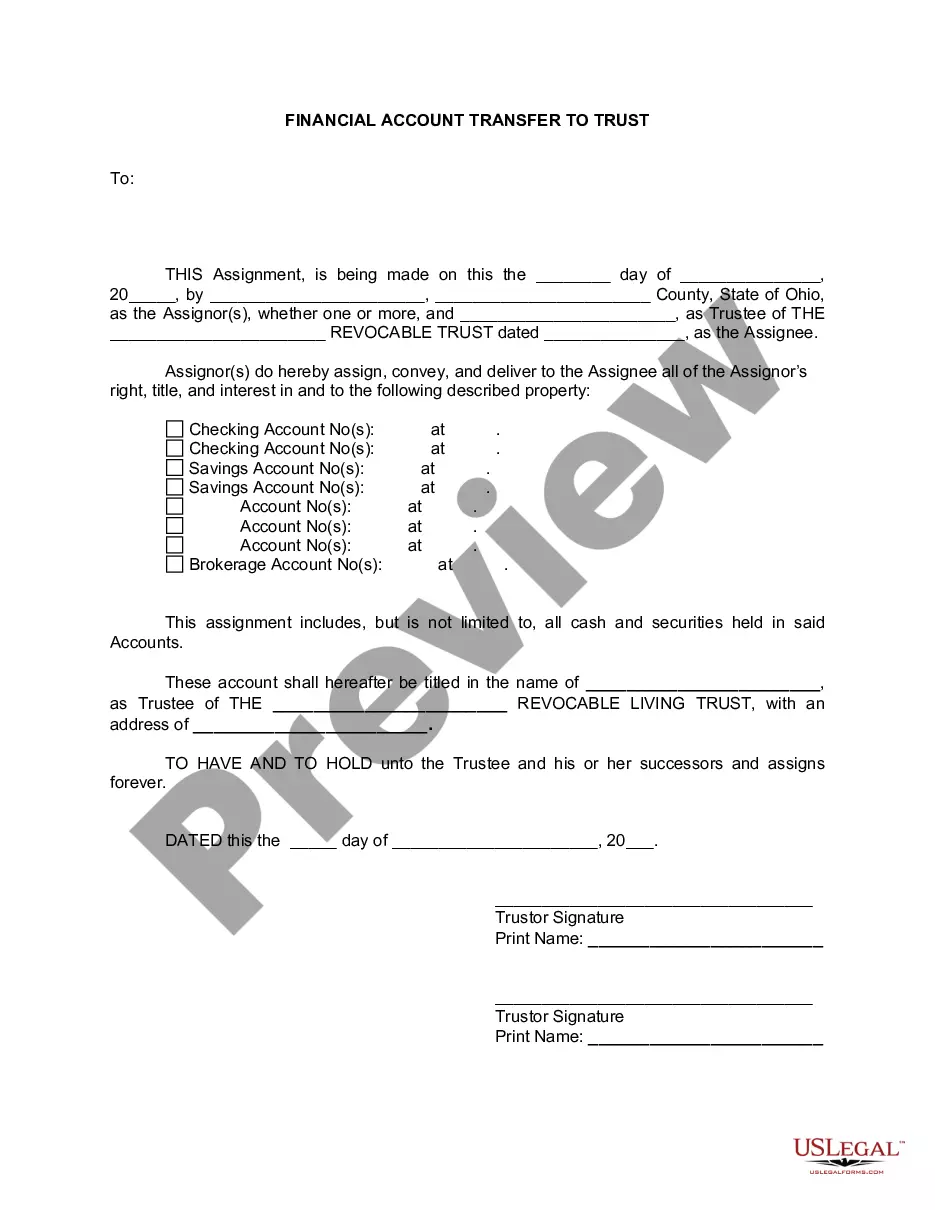

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Cuyahoga Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide In Cuyahoga County, Ohio, individuals have the option to transfer their financial accounts into a living trust as part of their estate planning strategy. This process of transferring ownership of financial assets to a trust offers various advantages and can provide greater control over the distribution of assets upon the account owner's incapacity or passing. Types of Cuyahoga Ohio Financial Account Transfer to Living Trust: 1. Bank Account Transfer: This type of account transfer involves transferring ownership and control of bank accounts, such as checking and savings accounts, to a living trust. By doing so, the account owner ensures that their designated trustee can manage the funds in the account, paying bills, or making necessary transactions on their behalf. 2. Investment Account Transfer: Individuals in Cuyahoga County may also choose to transfer their investment accounts, which include stocks, bonds, mutual funds, and other securities, into a living trust. This transfer enables the appointed trustee to manage the investment portfolio according to the account owner's predetermined instructions, ensuring seamless transition and continuous management upon the owner's incapacity or death. 3. Retirement Account Transfer: Certain retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, can also be transferred to a living trust in Cuyahoga County. This transfer allows the trustee to administer the retirement funds and distribute them in accordance with the owner's wishes, potentially reducing tax liabilities and providing beneficiaries with a smooth transition of inherited retirement assets. 4. Insurance Policy Transfer: In some cases, individuals may wish to transfer the ownership of life insurance policies into a living trust. This transfer ensures that the proceeds from the policy are efficiently managed and distributed according to the trust's terms, providing a reliable financial resource for beneficiaries. To initiate a Cuyahoga Ohio Financial Account Transfer to Living Trust, individuals must follow a series of steps. Firstly, consult with an experienced estate planning attorney familiar with Ohio laws to understand the specifics of the process. Prepare the necessary legal documents, including a trust agreement and a transfer document, which outlines the assets being transferred. Next, contact the financial institutions holding the accounts within Cuyahoga County and request their specific requirements and necessary paperwork for transferring the ownership to a living trust. This may involve completing account transfer forms, providing a copy of the trust agreement, or obtaining a medallion signature guarantee. Once the accounts are successfully transferred, it is crucial to ensure that all relevant financial institutions reflect the new ownership details. Regularly review and update the trust and its provisions as financial circumstances or preferences change over time. In conclusion, Cuyahoga Ohio Financial Account Transfer to Living Trust offers a valuable estate planning tool for individuals to maintain control of their financial assets and ensure desired distribution upon their incapacity or demise. By transferring different types of financial accounts, including bank accounts, investment accounts, retirement accounts, and insurance policies, individuals in Cuyahoga County can create a comprehensive plan for the future management and distribution of their wealth.Cuyahoga Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide In Cuyahoga County, Ohio, individuals have the option to transfer their financial accounts into a living trust as part of their estate planning strategy. This process of transferring ownership of financial assets to a trust offers various advantages and can provide greater control over the distribution of assets upon the account owner's incapacity or passing. Types of Cuyahoga Ohio Financial Account Transfer to Living Trust: 1. Bank Account Transfer: This type of account transfer involves transferring ownership and control of bank accounts, such as checking and savings accounts, to a living trust. By doing so, the account owner ensures that their designated trustee can manage the funds in the account, paying bills, or making necessary transactions on their behalf. 2. Investment Account Transfer: Individuals in Cuyahoga County may also choose to transfer their investment accounts, which include stocks, bonds, mutual funds, and other securities, into a living trust. This transfer enables the appointed trustee to manage the investment portfolio according to the account owner's predetermined instructions, ensuring seamless transition and continuous management upon the owner's incapacity or death. 3. Retirement Account Transfer: Certain retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, can also be transferred to a living trust in Cuyahoga County. This transfer allows the trustee to administer the retirement funds and distribute them in accordance with the owner's wishes, potentially reducing tax liabilities and providing beneficiaries with a smooth transition of inherited retirement assets. 4. Insurance Policy Transfer: In some cases, individuals may wish to transfer the ownership of life insurance policies into a living trust. This transfer ensures that the proceeds from the policy are efficiently managed and distributed according to the trust's terms, providing a reliable financial resource for beneficiaries. To initiate a Cuyahoga Ohio Financial Account Transfer to Living Trust, individuals must follow a series of steps. Firstly, consult with an experienced estate planning attorney familiar with Ohio laws to understand the specifics of the process. Prepare the necessary legal documents, including a trust agreement and a transfer document, which outlines the assets being transferred. Next, contact the financial institutions holding the accounts within Cuyahoga County and request their specific requirements and necessary paperwork for transferring the ownership to a living trust. This may involve completing account transfer forms, providing a copy of the trust agreement, or obtaining a medallion signature guarantee. Once the accounts are successfully transferred, it is crucial to ensure that all relevant financial institutions reflect the new ownership details. Regularly review and update the trust and its provisions as financial circumstances or preferences change over time. In conclusion, Cuyahoga Ohio Financial Account Transfer to Living Trust offers a valuable estate planning tool for individuals to maintain control of their financial assets and ensure desired distribution upon their incapacity or demise. By transferring different types of financial accounts, including bank accounts, investment accounts, retirement accounts, and insurance policies, individuals in Cuyahoga County can create a comprehensive plan for the future management and distribution of their wealth.