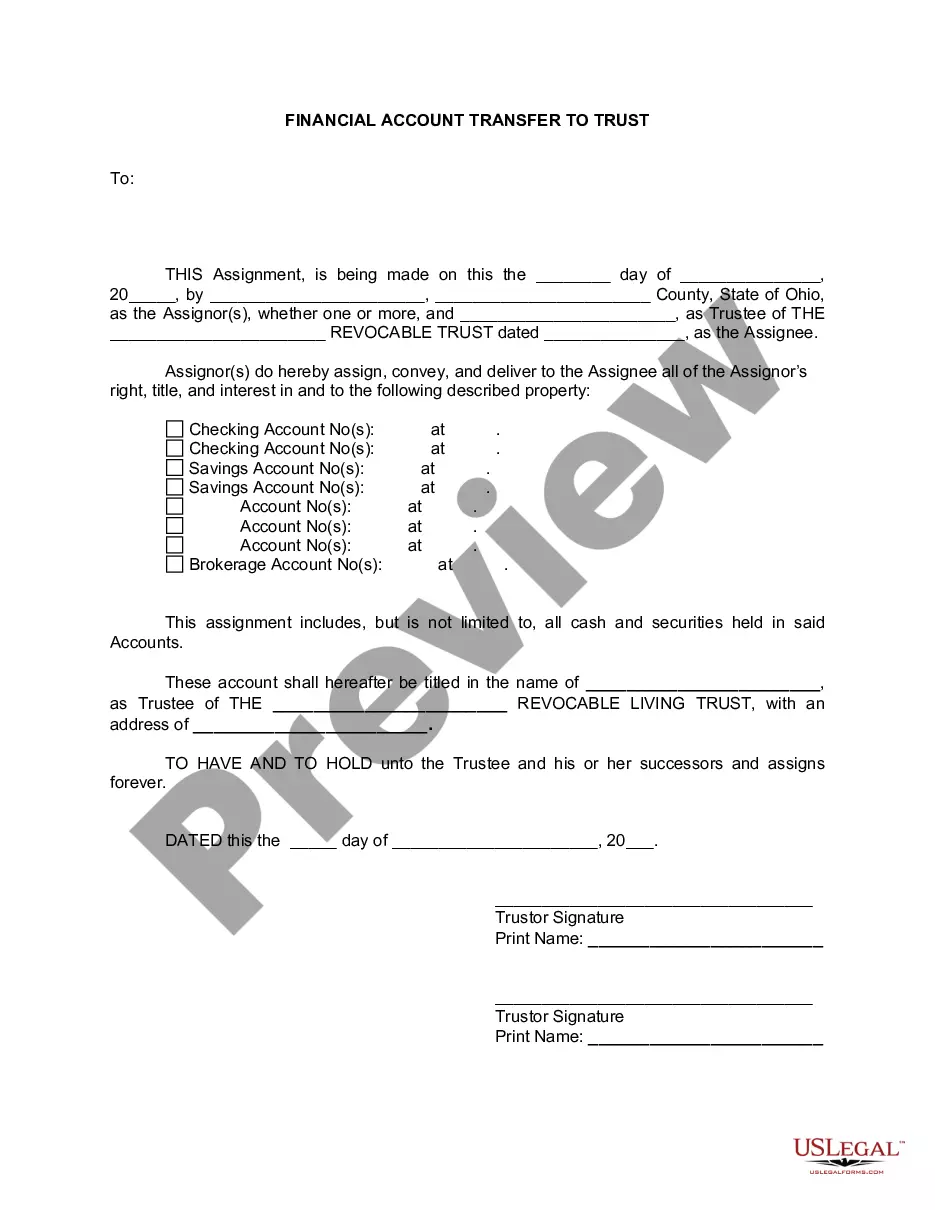

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Dayton Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: When it comes to estate planning, many individuals in Dayton, Ohio, choose to transfer their financial accounts to a living trust. This smart and practical solution ensures the smooth transition of assets to designated beneficiaries while avoiding probate. In this article, we will explore everything you need to know about Dayton Ohio Financial Account Transfer to Living Trust, including its benefits, types, process, and important considerations. Benefits of Trust Planning in Dayton, Ohio: Transferring your financial accounts to a living trust in Dayton, Ohio, can yield numerous advantages. Some key benefits include: 1. Avoidance of Probate: By placing your financial accounts in a living trust, they no longer need to pass through the lengthy and costly probate process, saving your beneficiaries time and unnecessary expenses. 2. Privacy of Your Estate: Unlike wills, which are part of the public record, living trusts maintain the confidentiality of your financial details, ensuring your estate and beneficiaries' privacy. 3. Incapacity Protection: Living trusts offer provisions for managing your financial affairs in case of incapacity, ensuring your assets remain protected and accessible to fulfill your needs. Types of Dayton Ohio Financial Account Transfers to Living Trust: 1. Bank Account Transfer: This type of transfer involves moving your bank accounts, such as savings, checking, and money market accounts, into your living trust. 2. Investment Account Transfer: If you hold investment accounts like stocks, bonds, mutual funds, or other securities, you can transfer ownership through a living trust for seamless management and distribution. 3. Retirement Account Transfer: While retirement accounts such as IRAs and 401(k)s cannot be transferred directly into a living trust, you can name your trust as a beneficiary, enabling a smooth transition upon your passing. Process of Dayton Ohio Financial Account Transfer to Living Trust: To transfer your financial accounts to a living trust in Dayton, Ohio, follow these general steps: 1. Establish a Living Trust: Consult an attorney specializing in estate planning to establish a living trust tailored to your specific needs and goals. 2. Identify Accounts for Transfer: Compile a comprehensive list of financial accounts you wish to transfer, such as bank, investment, and retirement accounts. 3. Obtain Transfer Forms: Contact the financial institutions holding your accounts and request the necessary forms for transferring ownership to a living trust. 4. Complete Transfer Documentation: Fill out the required transfer forms, providing accurate information about your trust and its designated trustee(s). 5. Notify Financial Institutions: Once the forms are completed, submit them to the respective financial institutions, adhering to their specific procedures and requirements. It is advisable to keep copies of all transfer-related documents for your records. Important Considerations for Dayton Ohio Financial Account Transfer to Living Trust: — Consult with an experienced attorney: Seek professional legal advice to ensure compliance with Ohio state laws and the ideal structuring of your living trust. — Update beneficiary designations: Remember to update the beneficiary designations on your transferred accounts to reflect your living trust as the rightful recipient. — Seek professional guidance for complex assets: If you possess complex financial holdings like real estate, businesses, or intellectual property, consult with experts to strategize their transfer to your living trust. Conclusion: Transferring your financial accounts to a living trust in Dayton, Ohio, offers significant advantages, enabling a seamless wealth transition and safeguarding your assets for the benefit of your beneficiaries. Ensure to consult an experienced attorney specializing in estate planning to tailor a living trust that aligns with your unique circumstances and objectives. By following the necessary steps and considerations, you can establish a comprehensive financial account transfer to your living trust.Dayton Ohio Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: When it comes to estate planning, many individuals in Dayton, Ohio, choose to transfer their financial accounts to a living trust. This smart and practical solution ensures the smooth transition of assets to designated beneficiaries while avoiding probate. In this article, we will explore everything you need to know about Dayton Ohio Financial Account Transfer to Living Trust, including its benefits, types, process, and important considerations. Benefits of Trust Planning in Dayton, Ohio: Transferring your financial accounts to a living trust in Dayton, Ohio, can yield numerous advantages. Some key benefits include: 1. Avoidance of Probate: By placing your financial accounts in a living trust, they no longer need to pass through the lengthy and costly probate process, saving your beneficiaries time and unnecessary expenses. 2. Privacy of Your Estate: Unlike wills, which are part of the public record, living trusts maintain the confidentiality of your financial details, ensuring your estate and beneficiaries' privacy. 3. Incapacity Protection: Living trusts offer provisions for managing your financial affairs in case of incapacity, ensuring your assets remain protected and accessible to fulfill your needs. Types of Dayton Ohio Financial Account Transfers to Living Trust: 1. Bank Account Transfer: This type of transfer involves moving your bank accounts, such as savings, checking, and money market accounts, into your living trust. 2. Investment Account Transfer: If you hold investment accounts like stocks, bonds, mutual funds, or other securities, you can transfer ownership through a living trust for seamless management and distribution. 3. Retirement Account Transfer: While retirement accounts such as IRAs and 401(k)s cannot be transferred directly into a living trust, you can name your trust as a beneficiary, enabling a smooth transition upon your passing. Process of Dayton Ohio Financial Account Transfer to Living Trust: To transfer your financial accounts to a living trust in Dayton, Ohio, follow these general steps: 1. Establish a Living Trust: Consult an attorney specializing in estate planning to establish a living trust tailored to your specific needs and goals. 2. Identify Accounts for Transfer: Compile a comprehensive list of financial accounts you wish to transfer, such as bank, investment, and retirement accounts. 3. Obtain Transfer Forms: Contact the financial institutions holding your accounts and request the necessary forms for transferring ownership to a living trust. 4. Complete Transfer Documentation: Fill out the required transfer forms, providing accurate information about your trust and its designated trustee(s). 5. Notify Financial Institutions: Once the forms are completed, submit them to the respective financial institutions, adhering to their specific procedures and requirements. It is advisable to keep copies of all transfer-related documents for your records. Important Considerations for Dayton Ohio Financial Account Transfer to Living Trust: — Consult with an experienced attorney: Seek professional legal advice to ensure compliance with Ohio state laws and the ideal structuring of your living trust. — Update beneficiary designations: Remember to update the beneficiary designations on your transferred accounts to reflect your living trust as the rightful recipient. — Seek professional guidance for complex assets: If you possess complex financial holdings like real estate, businesses, or intellectual property, consult with experts to strategize their transfer to your living trust. Conclusion: Transferring your financial accounts to a living trust in Dayton, Ohio, offers significant advantages, enabling a seamless wealth transition and safeguarding your assets for the benefit of your beneficiaries. Ensure to consult an experienced attorney specializing in estate planning to tailor a living trust that aligns with your unique circumstances and objectives. By following the necessary steps and considerations, you can establish a comprehensive financial account transfer to your living trust.