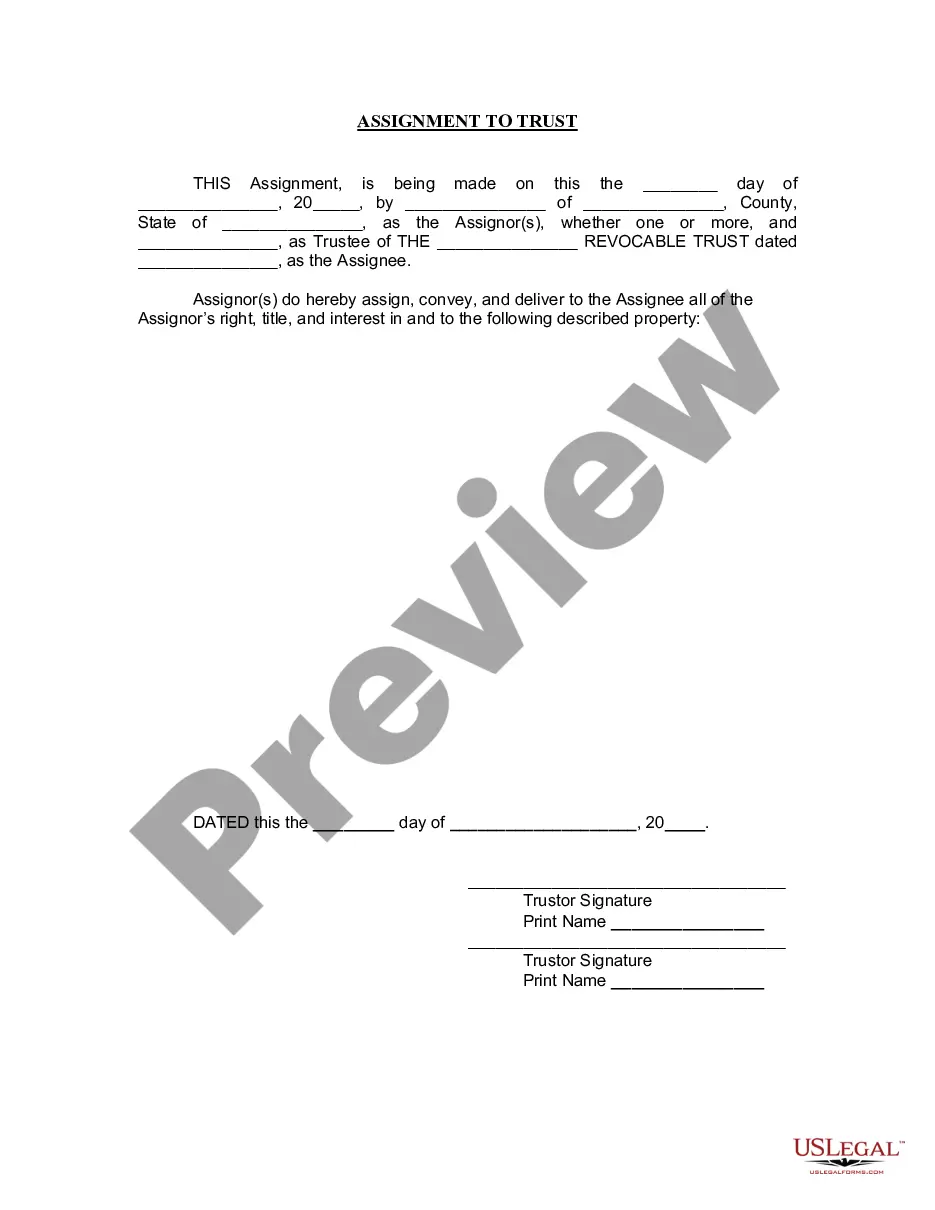

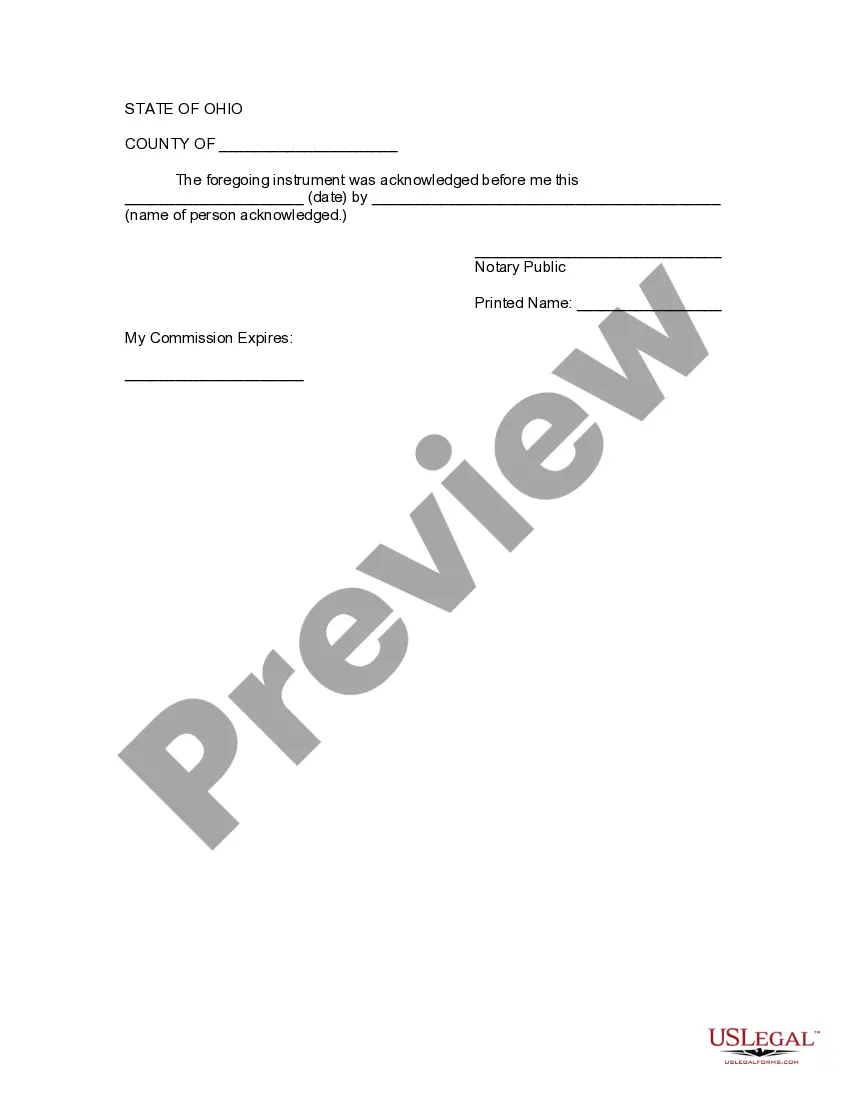

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Cincinnati Ohio Assignment to Living Trust: A Comprehensive Guide What is a Living Trust? A living trust, also known as a revocable trust, is a legal document that allows you to transfer your assets and properties into a trust during your lifetime. By establishing this trust, you can dictate how your assets will be managed and distributed while avoiding the often lengthy and costly probate process. In Cincinnati, Ohio, individuals often choose to create living trusts as part of their estate planning strategy. Types of Cincinnati Ohio Assignment to Living Trust: 1. Revocable Living Trusts: The most common type of living trust, it allows the creator, also known as the granter, to make changes, amendments, or revoke the trust entirely during their lifetime. 2. Irrevocable Living Trusts: Unlike a revocable trust, an irrevocable living trust cannot be altered or terminated by the granter once it has been established. This type of trust provides certain tax benefits and serves as an excellent asset protection tool, ensuring your assets are shielded from potential creditors and allowing for potential Medicaid planning. 3. Testamentary Trusts: While not technically a living trust, a testamentary trust is created within a will and becomes effective only upon the granter's death. It allows you to specify how your assets will be distributed, offering more control and flexibility in the process. 4. Special Needs Trusts: These trusts are designed to benefit individuals with disabilities or special needs. The funds within the trust are carefully managed to ensure that the beneficiary can maintain eligibility for government aid programs while still receiving additional financial support. 5. Charitable Remainder Trusts: For those interested in philanthropy, a charitable remainder trust allows the granter to donate assets to a charitable organization while retaining an income stream for themselves or their beneficiaries. Creating an Assignment to Living Trust in Cincinnati, Ohio: To create a Cincinnati Ohio Assignment to Living Trust, it is advisable to consult with an experienced estate planning attorney. They will guide you through the process, ensuring that all legal requirements are met, and that the trust is tailored to your unique circumstances and objectives. This includes drafting the trust document, identifying assets to be assigned to the trust, and choosing potential beneficiaries and trustees. Benefits of an Assignment to Living Trust: 1. Avoiding Probate: Assets assigned to a living trust can pass to beneficiaries without going through probate, saving time and money. 2. Privacy: Unlike a will, which becomes a public record after probate, a living trust allows for confidential asset distribution. 3. Incapacity Planning: A revocable living trust can provide for the event of your incapacity, ensuring your chosen trustee can seamlessly take over the management of your assets. 4. Potential Tax Savings: Certain types of trusts, such as irrevocable trusts, can offer tax advantages by reducing estate taxes or protecting assets from creditors. By understanding the different types of Cincinnati Ohio Assignment to Living Trusts and their benefits, you can make informed decisions when it comes to drafting your estate plan and protecting your assets for future generations.Cincinnati Ohio Assignment to Living Trust: A Comprehensive Guide What is a Living Trust? A living trust, also known as a revocable trust, is a legal document that allows you to transfer your assets and properties into a trust during your lifetime. By establishing this trust, you can dictate how your assets will be managed and distributed while avoiding the often lengthy and costly probate process. In Cincinnati, Ohio, individuals often choose to create living trusts as part of their estate planning strategy. Types of Cincinnati Ohio Assignment to Living Trust: 1. Revocable Living Trusts: The most common type of living trust, it allows the creator, also known as the granter, to make changes, amendments, or revoke the trust entirely during their lifetime. 2. Irrevocable Living Trusts: Unlike a revocable trust, an irrevocable living trust cannot be altered or terminated by the granter once it has been established. This type of trust provides certain tax benefits and serves as an excellent asset protection tool, ensuring your assets are shielded from potential creditors and allowing for potential Medicaid planning. 3. Testamentary Trusts: While not technically a living trust, a testamentary trust is created within a will and becomes effective only upon the granter's death. It allows you to specify how your assets will be distributed, offering more control and flexibility in the process. 4. Special Needs Trusts: These trusts are designed to benefit individuals with disabilities or special needs. The funds within the trust are carefully managed to ensure that the beneficiary can maintain eligibility for government aid programs while still receiving additional financial support. 5. Charitable Remainder Trusts: For those interested in philanthropy, a charitable remainder trust allows the granter to donate assets to a charitable organization while retaining an income stream for themselves or their beneficiaries. Creating an Assignment to Living Trust in Cincinnati, Ohio: To create a Cincinnati Ohio Assignment to Living Trust, it is advisable to consult with an experienced estate planning attorney. They will guide you through the process, ensuring that all legal requirements are met, and that the trust is tailored to your unique circumstances and objectives. This includes drafting the trust document, identifying assets to be assigned to the trust, and choosing potential beneficiaries and trustees. Benefits of an Assignment to Living Trust: 1. Avoiding Probate: Assets assigned to a living trust can pass to beneficiaries without going through probate, saving time and money. 2. Privacy: Unlike a will, which becomes a public record after probate, a living trust allows for confidential asset distribution. 3. Incapacity Planning: A revocable living trust can provide for the event of your incapacity, ensuring your chosen trustee can seamlessly take over the management of your assets. 4. Potential Tax Savings: Certain types of trusts, such as irrevocable trusts, can offer tax advantages by reducing estate taxes or protecting assets from creditors. By understanding the different types of Cincinnati Ohio Assignment to Living Trusts and their benefits, you can make informed decisions when it comes to drafting your estate plan and protecting your assets for future generations.