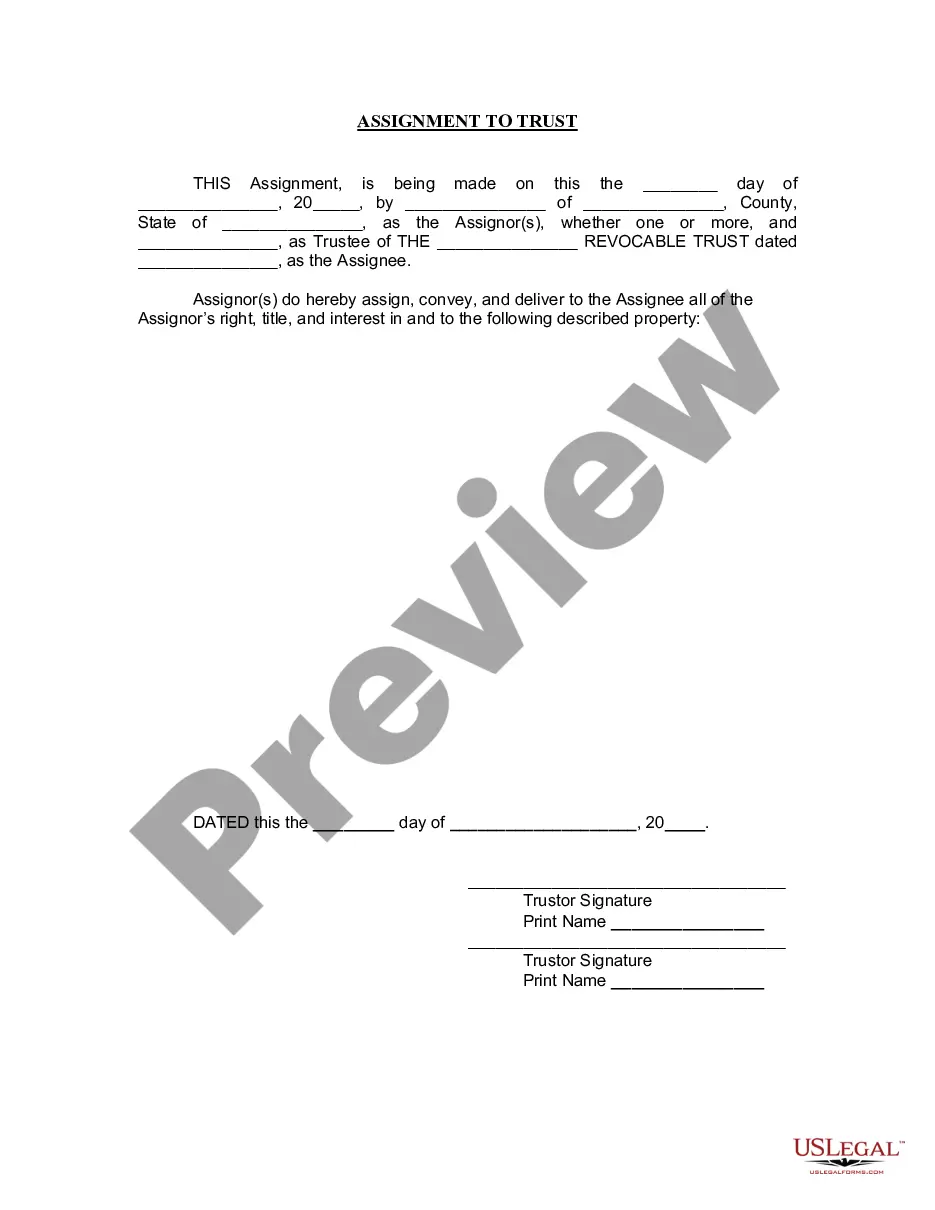

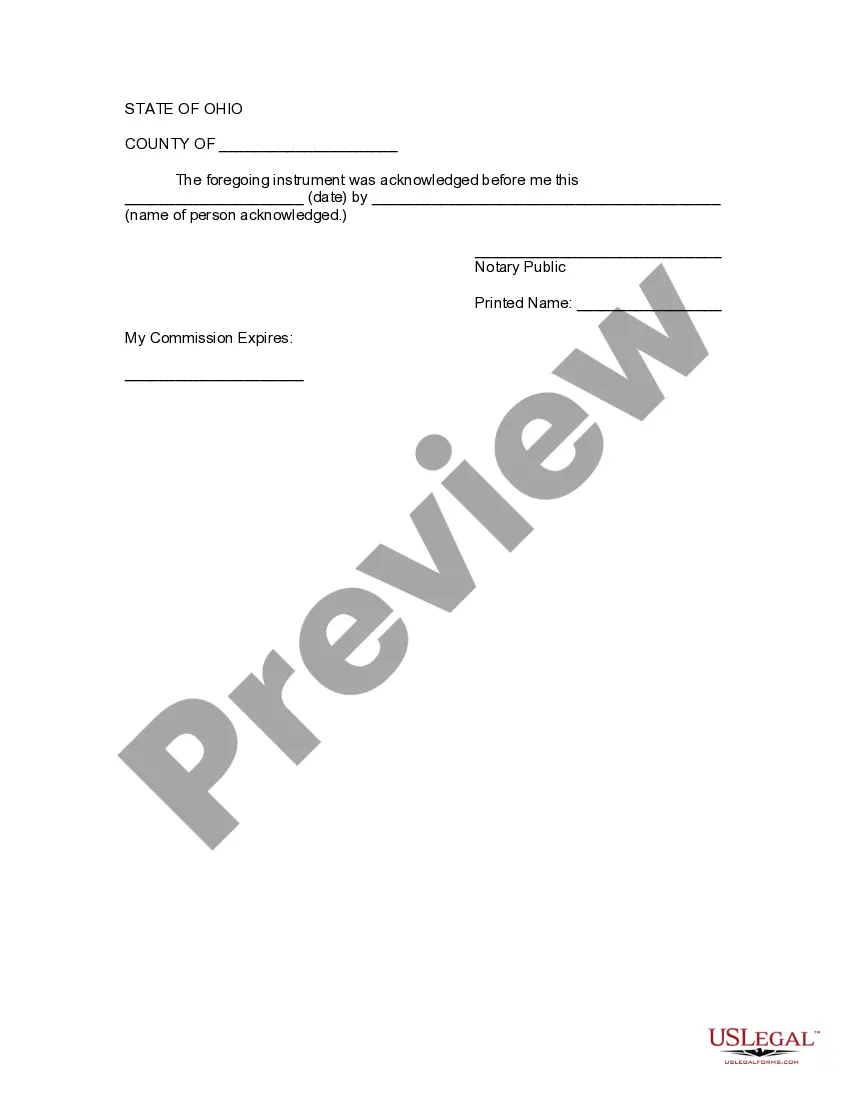

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Columbus Ohio Assignment to Living Trust is a legal document that refers to the process of transferring property or assets in Columbus, Ohio, into a living trust. A living trust is a legal arrangement where a person, referred to as the granter or settler, places their assets into a trust during their lifetime. The granter can then appoint themselves as the trustee or designate someone else to manage the assets. The primary purpose of creating a living trust in Columbus, Ohio is to ensure that the granter's assets are managed and distributed according to their wishes, both during their lifetime and after their passing. By assigning property to a living trust, the granter can avoid probate, which is the legal process of settling an individual's estate after their death. This can result in faster distribution of assets and potentially reduce expenses associated with probate. There are different types of Columbus Ohio Assignment to Living Trust that individuals can establish, depending on their specific needs and circumstances. These can include: 1. Revocable Living Trust: This type of trust allows the granter to retain control over the assets placed in the trust during their lifetime. They can modify or revoke the trust at any time, as long as they are of sound mind. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked without the consent of the beneficiaries named in the trust. Once assets are placed into an irrevocable trust, they are considered permanently transferred, providing potential tax advantages and creditor protection. 3. Testamentary Trust: This type of trust is created through a will and only takes effect upon the granter's death. Assets are transferred into the trust after probate, and usually involve minor or special needs beneficiaries. 4. Special Needs Trust: A special needs trust is designed to provide for the financial needs of individuals with disabilities while preserving their eligibility for government assistance programs. It ensures that the disabled person receives necessary care and support while safeguarding their Medicaid or other benefits. Creating a Columbus Ohio Assignment to Living Trust requires careful consideration and the assistance of an experienced attorney well-versed in estate planning laws. The attorney guides the granter through the process, ensuring that the trust document is properly drafted, assets are appropriately transferred, and all legal requirements are met. It is crucial to consult with a professional to choose the appropriate trust type and ensure that the granter's desires are legally protected.Columbus Ohio Assignment to Living Trust is a legal document that refers to the process of transferring property or assets in Columbus, Ohio, into a living trust. A living trust is a legal arrangement where a person, referred to as the granter or settler, places their assets into a trust during their lifetime. The granter can then appoint themselves as the trustee or designate someone else to manage the assets. The primary purpose of creating a living trust in Columbus, Ohio is to ensure that the granter's assets are managed and distributed according to their wishes, both during their lifetime and after their passing. By assigning property to a living trust, the granter can avoid probate, which is the legal process of settling an individual's estate after their death. This can result in faster distribution of assets and potentially reduce expenses associated with probate. There are different types of Columbus Ohio Assignment to Living Trust that individuals can establish, depending on their specific needs and circumstances. These can include: 1. Revocable Living Trust: This type of trust allows the granter to retain control over the assets placed in the trust during their lifetime. They can modify or revoke the trust at any time, as long as they are of sound mind. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked without the consent of the beneficiaries named in the trust. Once assets are placed into an irrevocable trust, they are considered permanently transferred, providing potential tax advantages and creditor protection. 3. Testamentary Trust: This type of trust is created through a will and only takes effect upon the granter's death. Assets are transferred into the trust after probate, and usually involve minor or special needs beneficiaries. 4. Special Needs Trust: A special needs trust is designed to provide for the financial needs of individuals with disabilities while preserving their eligibility for government assistance programs. It ensures that the disabled person receives necessary care and support while safeguarding their Medicaid or other benefits. Creating a Columbus Ohio Assignment to Living Trust requires careful consideration and the assistance of an experienced attorney well-versed in estate planning laws. The attorney guides the granter through the process, ensuring that the trust document is properly drafted, assets are appropriately transferred, and all legal requirements are met. It is crucial to consult with a professional to choose the appropriate trust type and ensure that the granter's desires are legally protected.