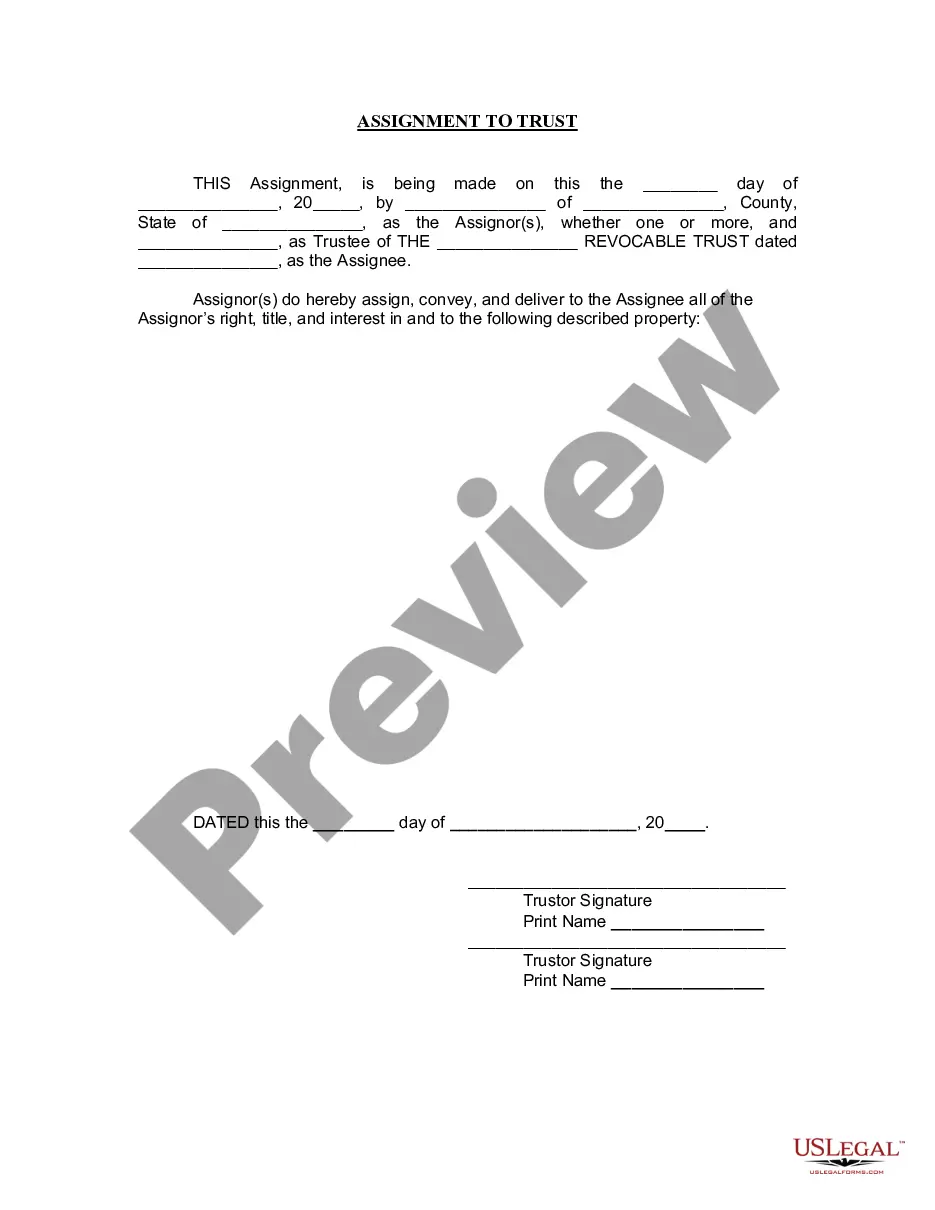

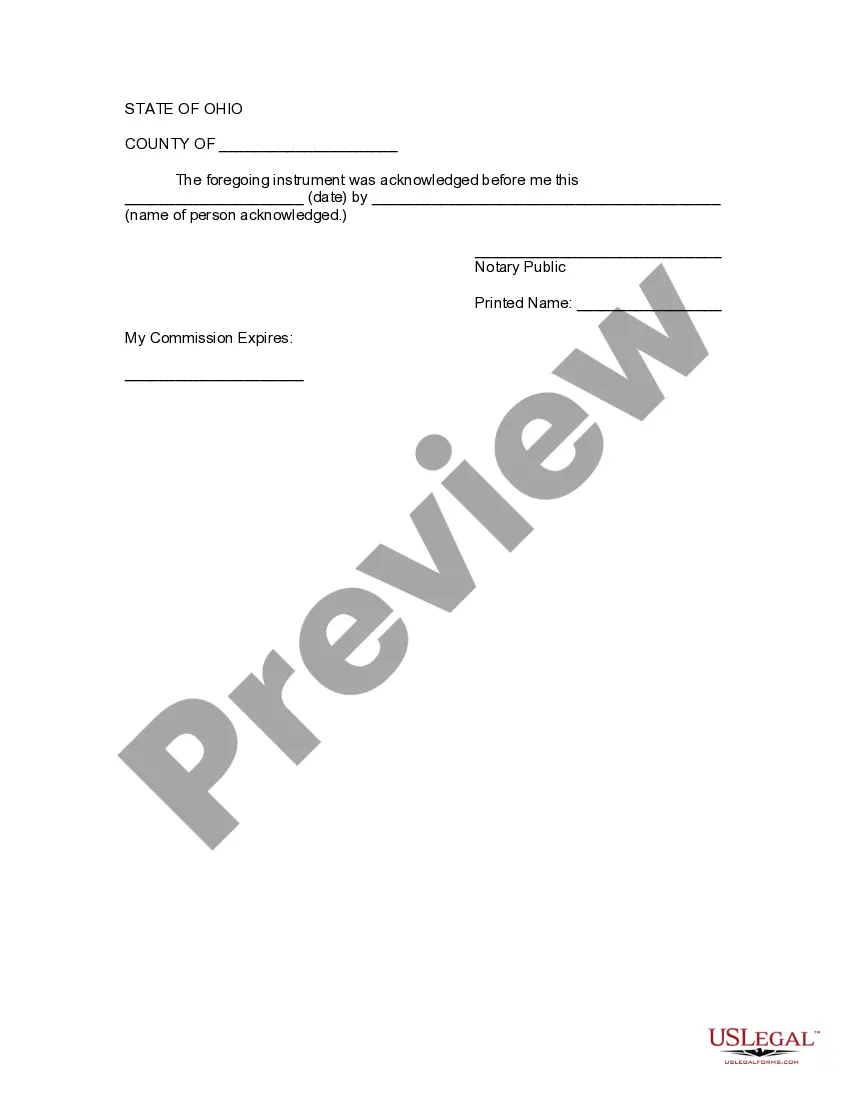

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Dayton Ohio Assignment to Living Trust: A living trust is a legal arrangement where an individual (known as the granter) transfers ownership of their assets into a trust entity during their lifetime. The assets placed in the trust are managed by a chosen trustee and are intended to benefit the beneficiaries named in the trust document. In the case of Dayton, Ohio, residents, the process of assigning assets to a living trust in the area falls under the Dayton Ohio Assignment to Living Trust. There are two primary types of living trusts commonly used in Dayton, Ohio: 1. Revocable Living Trust: A revocable living trust is the most common type and offers flexibility to the granter. They can make changes, modify the trust terms, add or remove assets, or even revoke the trust entirely if needed. The assets transferred to this trust remain available for the granter's use during their lifetime. Upon their death, the assets are transferred smoothly to the beneficiaries, thus bypassing probate, which is an expensive and time-consuming legal process. 2. Irrevocable Living Trust: An irrevocable living trust is a more permanent arrangement, as it involves permanently transferring ownership of assets to the trust, and the granter typically gives up control over those assets. This type of trust provides distinct advantages, such as potential estate tax benefits, asset protection, and Medicaid planning. Once assets are assigned to an irrevocable living trust, they are usually shielded from creditors and estate taxes, benefiting future generations. Assigning assets to a living trust in Dayton, Ohio, involves several steps. First, the granter needs to consult with an experienced estate planning attorney who specializes in living trusts. The attorney will guide them through the entire process, ensuring compliance with Ohio's specific trust laws. Next, the granter must identify and list their assets, which may include real estate, bank accounts, investments, vehicles, and personal belongings. These assets require proper legal documentation to be transferred into the trust's name. For instance, real estate would require a new deed reflecting the transfer to the living trust. Once all assets are identified, the granter, along with their attorney, will draft a comprehensive trust document. This document specifies the granter's wishes regarding asset distribution, appointment of successor trustees, and provisions for managing the trust in case of the granter's incapacity. Finally, the granter will sign the trust document and take the necessary steps to transfer each asset into the living trust's ownership. This could involve retitling accounts, updating beneficiary designations, or filing appropriate documents with the local registrar of deeds for real estate. Overall, Dayton Ohio Assignment to Living Trust allows individuals to protect their assets, potentially reduce estate taxes, and ensure a seamless transfer of property to their beneficiaries. It is crucial to consult a qualified attorney to understand the specific legal requirements and implications associated with assigning assets to a living trust in Dayton, Ohio.Dayton Ohio Assignment to Living Trust: A living trust is a legal arrangement where an individual (known as the granter) transfers ownership of their assets into a trust entity during their lifetime. The assets placed in the trust are managed by a chosen trustee and are intended to benefit the beneficiaries named in the trust document. In the case of Dayton, Ohio, residents, the process of assigning assets to a living trust in the area falls under the Dayton Ohio Assignment to Living Trust. There are two primary types of living trusts commonly used in Dayton, Ohio: 1. Revocable Living Trust: A revocable living trust is the most common type and offers flexibility to the granter. They can make changes, modify the trust terms, add or remove assets, or even revoke the trust entirely if needed. The assets transferred to this trust remain available for the granter's use during their lifetime. Upon their death, the assets are transferred smoothly to the beneficiaries, thus bypassing probate, which is an expensive and time-consuming legal process. 2. Irrevocable Living Trust: An irrevocable living trust is a more permanent arrangement, as it involves permanently transferring ownership of assets to the trust, and the granter typically gives up control over those assets. This type of trust provides distinct advantages, such as potential estate tax benefits, asset protection, and Medicaid planning. Once assets are assigned to an irrevocable living trust, they are usually shielded from creditors and estate taxes, benefiting future generations. Assigning assets to a living trust in Dayton, Ohio, involves several steps. First, the granter needs to consult with an experienced estate planning attorney who specializes in living trusts. The attorney will guide them through the entire process, ensuring compliance with Ohio's specific trust laws. Next, the granter must identify and list their assets, which may include real estate, bank accounts, investments, vehicles, and personal belongings. These assets require proper legal documentation to be transferred into the trust's name. For instance, real estate would require a new deed reflecting the transfer to the living trust. Once all assets are identified, the granter, along with their attorney, will draft a comprehensive trust document. This document specifies the granter's wishes regarding asset distribution, appointment of successor trustees, and provisions for managing the trust in case of the granter's incapacity. Finally, the granter will sign the trust document and take the necessary steps to transfer each asset into the living trust's ownership. This could involve retitling accounts, updating beneficiary designations, or filing appropriate documents with the local registrar of deeds for real estate. Overall, Dayton Ohio Assignment to Living Trust allows individuals to protect their assets, potentially reduce estate taxes, and ensure a seamless transfer of property to their beneficiaries. It is crucial to consult a qualified attorney to understand the specific legal requirements and implications associated with assigning assets to a living trust in Dayton, Ohio.