Dayton Ohio Notice of Assignment to Living Trust: A Comprehensive Guide Introduction: Creating a living trust is a crucial aspect of estate planning, enabling individuals in Dayton, Ohio, to secure their assets and ensure their efficient distribution upon incapacitation or death. The Dayton Ohio Notice of Assignment to Living Trust plays a vital role in this process, serving as a formal acknowledgment of assets being transferred into the trust. In this article, we will explore what a Notice of Assignment to Living Trust entails in Dayton, Ohio, its importance, and any potential variations or types in existence. Key Keywords: Dayton Ohio, notice of assignment, living trust, assets, transfer, estate planning, incapacitation, death, formal acknowledgment. 1. Understanding the Dayton Ohio Notice of Assignment to Living Trust: The Dayton Ohio Notice of Assignment to Living Trust is a legal document used to transfer ownership of assets from an individual to their living trust. A living trust, also known as an inter vivos trust, is created during the granter's lifetime, allowing for the seamless management and distribution of assets during their lifetime and after their passing. This notice serves as an official record of asset transfer and offers protection and clarity in asset ownership. 2. The Importance of the Notice of Assignment to Living Trust: a) Asset Protection: By assigning assets to a living trust through this notice, individuals in Dayton, Ohio, can shield their assets from potential creditors or legal disputes while ensuring a smooth transfer of ownership. b) Probate Avoidance: A key advantage of creating a living trust is bypassing the probate process. The Notice of Assignment to Living Trust ensures that assets will not undergo probate, saving time and costs associated with court proceedings and ensuring a private and seamless transfer of ownership. c) Incapacitation Planning: In the event of incapacitation, the living trust allows for a seamless management handover of assets to a designated trustee without involving the court. The Notice of Assignment provides clarity on the granter's intentions and assists in asset management while incapacitated. d) Privacy Protection: Unlike a will, which becomes a public record upon probate, a living trust allows for a confidential distribution of assets. The Notice of Assignment to Living Trust ensures that asset distribution remains private, safeguarding personal information from public scrutiny. 3. Potential Types of Dayton Ohio Notice of Assignment to Living Trust: While the core function of the Notice of Assignment to Living Trust remains consistent, there might be variations based on specific asset details or revocable vs. irrevocable trust distinctions. Some potential types of notices include: a) Real Estate Notice of Assignment: This type of notice focuses primarily on transferring real property assets into the living trust. b) Financial Account Notice of Assignment: To transfer financial accounts such as bank accounts, investment portfolios, or retirement accounts into the living trust, a specific notice might be issued. c) Personal Property Notice of Assignment: This type of notice pertains to the transfer of personal belongings, such as vehicles, artwork, jewelry, or household items, into the living trust. Conclusion: Creating a Dayton Ohio Notice of Assignment to Living Trust forms a crucial part of comprehensive estate planning. By utilizing this legal document, individuals can efficiently transfer ownership of assets into their living trust, ensuring their protection, seamless management, and private distribution. Whether it involves real estate, financial accounts, or personal belongings, the Notice of Assignment to Living Trust allows individuals in Dayton, Ohio, to maintain control over their assets, minimizing legal complexities and maximizing the benefits of a living trust.

Dayton Ohio Notice of Assignment to Living Trust

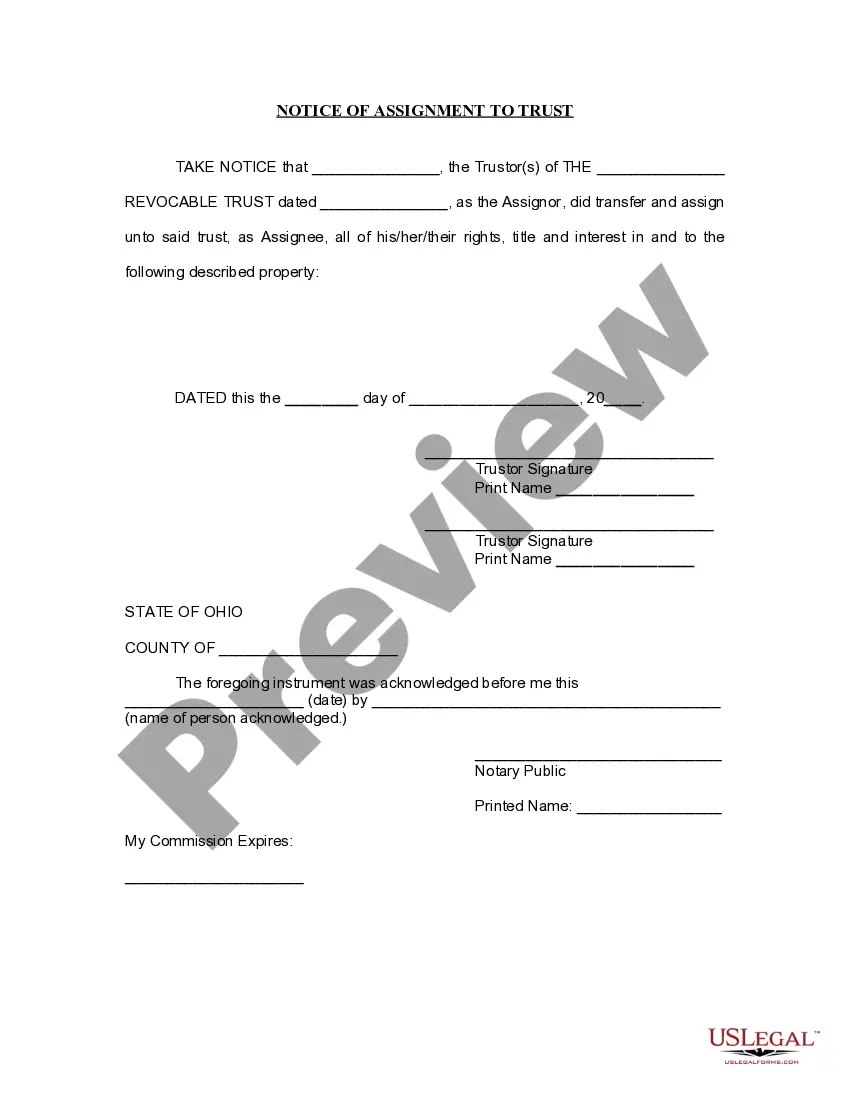

Description

How to fill out Dayton Ohio Notice Of Assignment To Living Trust?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for a person with no law background to create such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform offers a huge library with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Dayton Ohio Notice of Assignment to Living Trust or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Dayton Ohio Notice of Assignment to Living Trust in minutes using our trusted platform. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are unfamiliar with our library, ensure that you follow these steps before downloading the Dayton Ohio Notice of Assignment to Living Trust:

- Ensure the form you have chosen is specific to your location because the regulations of one state or area do not work for another state or area.

- Review the document and go through a brief description (if available) of cases the document can be used for.

- If the one you picked doesn’t suit your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your credentials or create one from scratch.

- Select the payment method and proceed to download the Dayton Ohio Notice of Assignment to Living Trust once the payment is done.

You’re good to go! Now you can proceed to print the document or complete it online. If you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.