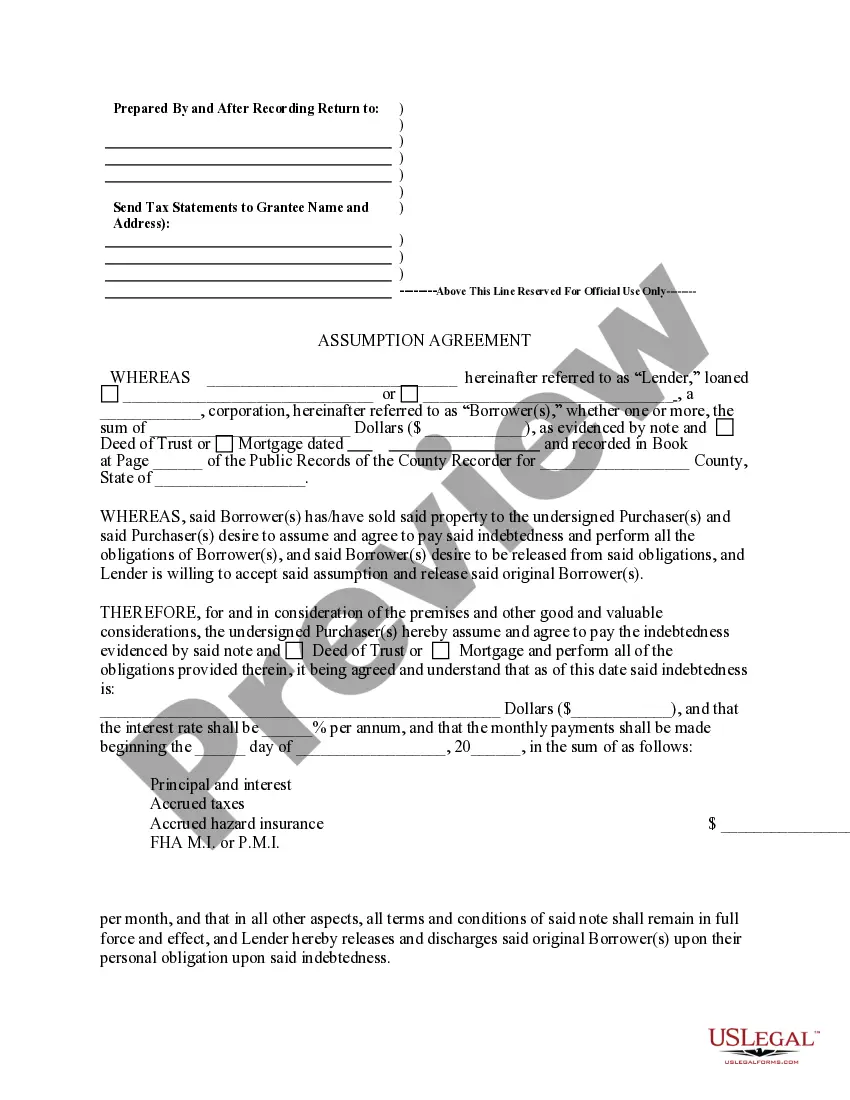

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Dayton Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document used in the real estate industry. It outlines the process by which a mortgage is transferred from the original mortgagor to a new party, known as the assumption. This agreement allows the assumption to take responsibility for the original mortgage, including the remaining balance and terms established by the lender. The Dayton Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors serves as a binding contract between the original mortgagor, the assumption, and the lender. It protects the lender's interests by ensuring that the assumption is capable of fulfilling the obligations set forth in the original mortgage. Moreover, this document legally releases the original mortgagor from any further liability or responsibility pertaining to the mortgage once the assumption is completed. There are different types of Dayton Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors, each catering to specific scenarios. Some common variations may include: 1. Simple Assumption Agreement: This type of assumption occurs when the original mortgagor transfers the mortgage to a new party without any additional changes to the terms or conditions of the original mortgage. The assumption takes over the responsibility of repaying the remaining mortgage balance and adhering to the original mortgage terms. 2. Novation Assumption Agreement: In this type of assumption, the original mortgage is completely replaced by a new contract between the lender, the original mortgagor, and the assumption. The assumption assumes all rights and obligations of the original mortgage, essentially replacing the original mortgagor. 3. Subject-to Assumption Agreement: This type of assumption involves the assumption taking over the mortgage payments and responsibilities, but with the understanding that they are not becoming personally liable for the mortgage. The original mortgagor remains on the mortgage note, and in case of default, the lender can pursue the original mortgagor for payment. When executing a Dayton Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors, it is crucial for all parties involved to consult legal professionals to ensure compliance with local laws and regulations. Properly drafted assumption agreements protect the rights of all parties and provide clarity regarding the transfer of ownership and responsibilities associated with the mortgage.