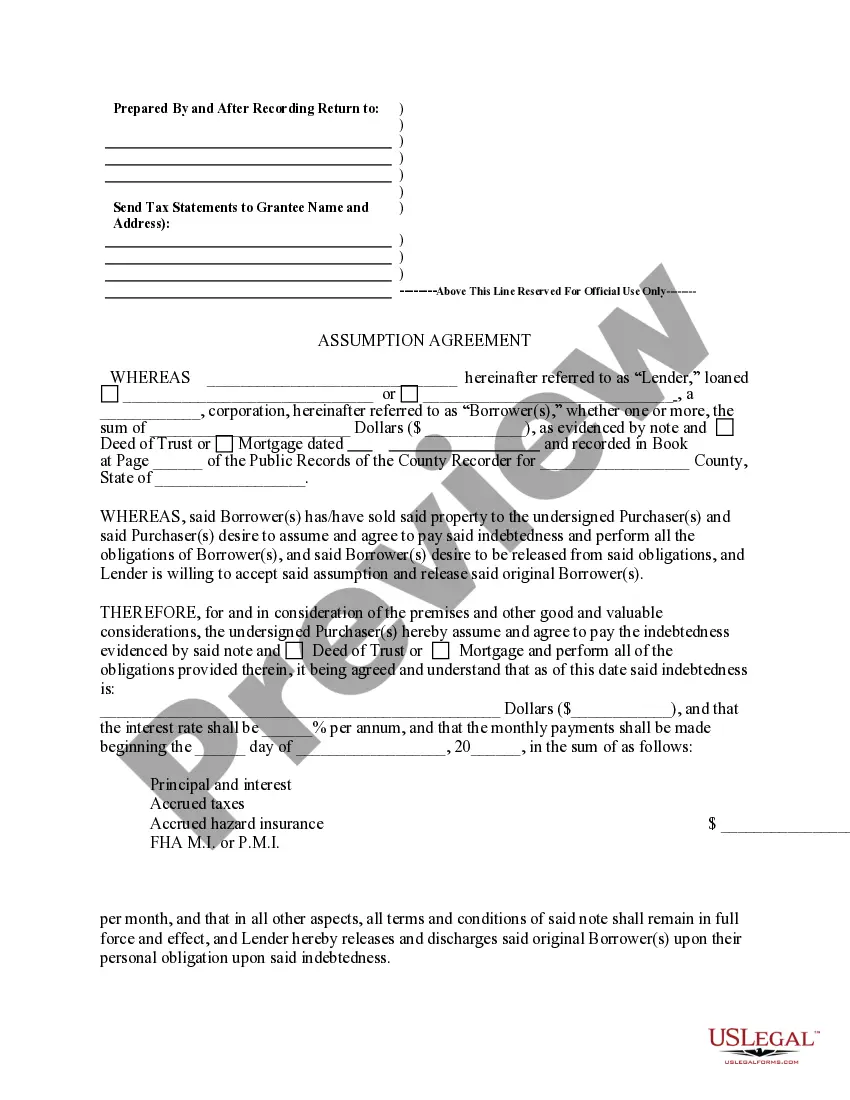

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Toledo Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the process of transferring the responsibility of an existing mortgage from the original mortgagor(s) to a new party, known as the assumption. This agreement allows the assumption to step into the shoes of the original mortgagors, becoming responsible for the remaining mortgage payments, while releasing the original mortgagor(s) from any further liability. There are two main types of Toledo Ohio Assumption Agreements of Mortgage and Release of Original Mortgagors, namely: 1. Complete Assumption Agreement: This type of agreement occurs when the assumption assumes both the legal and financial responsibilities of the existing mortgage without changing any of the terms. In this case, the assumption becomes solely liable for the remaining mortgage balance, monthly payments, and other obligations associated with the loan. 2. Subject to Assumption Agreement: This type of agreement differs from the complete assumption as the assumption agrees to take over the mortgage payments, but without assuming full responsibility for the debt. In this scenario, the original mortgagor(s) remain legally obligated to repay the loan and are still considered primary borrowers. However, the assumption agrees to make the payments on behalf of the original mortgagor(s). It is crucial to note that in this type of assumption, the original mortgagor(s) ultimately remain responsible for any defaults or breaches of the loan terms. Both types of assumption agreements typically require the consent of the lender, as mortgage loans often contain due-on-sale clauses. These clauses stipulate that if a property is sold or transferred to a new owner, the entire loan balance becomes due immediately. Obtaining the lender's approval ensures that the assumption process is legally valid and prevents potential acceleration of the loan. To execute a Toledo Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors, it is important to consult with a qualified real estate attorney or a mortgage professional who can guide the parties involved through the necessary steps, ensuring that all legal requirements are met. Additionally, it is advisable to conduct a thorough review of the existing mortgage terms, assessing the financial implications and potential risks before entering into this agreement.The Toledo Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the process of transferring the responsibility of an existing mortgage from the original mortgagor(s) to a new party, known as the assumption. This agreement allows the assumption to step into the shoes of the original mortgagors, becoming responsible for the remaining mortgage payments, while releasing the original mortgagor(s) from any further liability. There are two main types of Toledo Ohio Assumption Agreements of Mortgage and Release of Original Mortgagors, namely: 1. Complete Assumption Agreement: This type of agreement occurs when the assumption assumes both the legal and financial responsibilities of the existing mortgage without changing any of the terms. In this case, the assumption becomes solely liable for the remaining mortgage balance, monthly payments, and other obligations associated with the loan. 2. Subject to Assumption Agreement: This type of agreement differs from the complete assumption as the assumption agrees to take over the mortgage payments, but without assuming full responsibility for the debt. In this scenario, the original mortgagor(s) remain legally obligated to repay the loan and are still considered primary borrowers. However, the assumption agrees to make the payments on behalf of the original mortgagor(s). It is crucial to note that in this type of assumption, the original mortgagor(s) ultimately remain responsible for any defaults or breaches of the loan terms. Both types of assumption agreements typically require the consent of the lender, as mortgage loans often contain due-on-sale clauses. These clauses stipulate that if a property is sold or transferred to a new owner, the entire loan balance becomes due immediately. Obtaining the lender's approval ensures that the assumption process is legally valid and prevents potential acceleration of the loan. To execute a Toledo Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors, it is important to consult with a qualified real estate attorney or a mortgage professional who can guide the parties involved through the necessary steps, ensuring that all legal requirements are met. Additionally, it is advisable to conduct a thorough review of the existing mortgage terms, assessing the financial implications and potential risks before entering into this agreement.