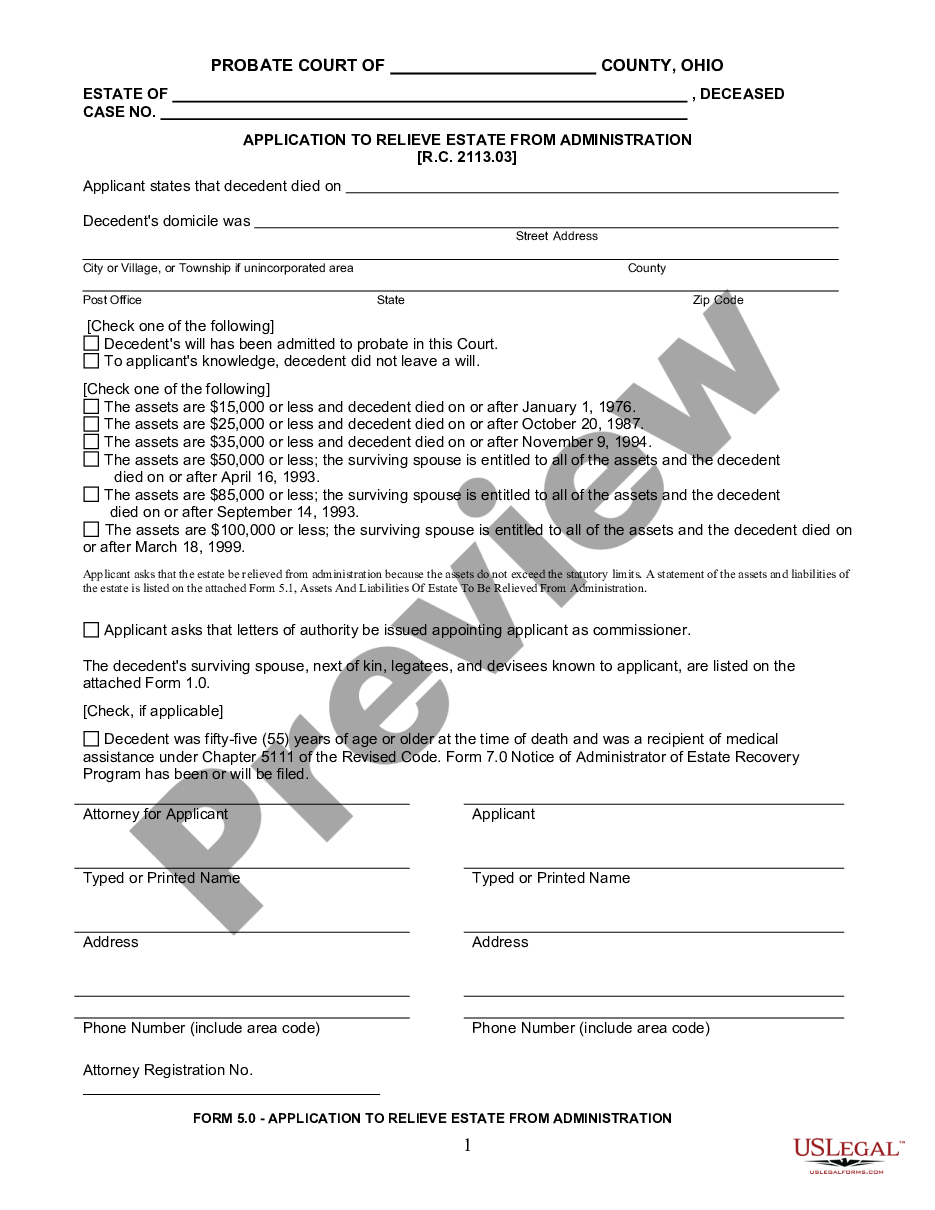

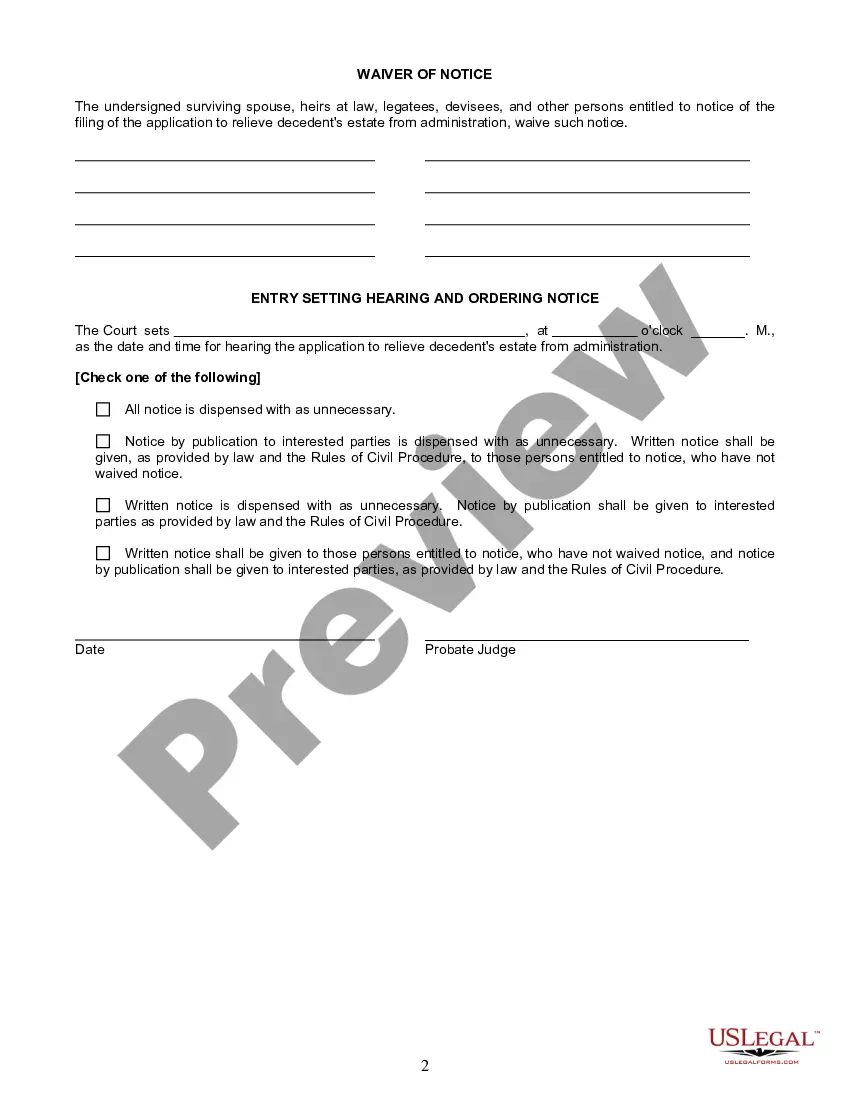

The Columbus Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse is a legal document that allows a surviving spouse to claim the assets of a deceased spouse's estate without having to go through the probate process. This affidavit is specifically tailored for small estates valued at either $35,000 or less, or under $100,000 if the assets are inherited solely by the spouse. It provides a simplified and expedited method for the surviving spouse to transfer the deceased's assets to their name. The affidavit requires the surviving spouse to provide certain information, including their name and address, the deceased spouse's name and date of death, and a detailed list of the assets to be transferred. It is crucial to provide accurate and complete information in this affidavit. To qualify for this affidavit, the estate must meet a few criteria. Firstly, the total value of the estate (assets owned solely by the deceased at the time of death) must not exceed the specified limits. Secondly, the assets should solely be inherited by the surviving spouse, meaning there are no other beneficiaries or heirs entitled to these assets. There are two types of Columbus Ohio Small Estate Affidavits, depending on the value of the estate as mentioned earlier. If the value is $35,000 or less, the surviving spouse can file the Small Estate Affidavit for Estates Not More Than $35,000. If the value is under $100,000 and inherited fully by the spouse, the Small Estate Affidavit for Estates Not More Than $100,000 and Inherited Fully by Spouse should be used. These affidavits are meant to provide a quick and efficient method for transferring small estates to the deserving spouse, eliminating the need for a lengthy probate process.

Columbus Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse

Description

How to fill out Columbus Ohio Small Estate Affidavit For Estates Not More Than $35,00, Or $100,000 And Inherited Fully By Spouse?

If you have previously engaged our service, Log In to your profile and store the Columbus Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Entirely Inherited by Spouse on your gadget by clicking the Download button. Ensure your subscription is current. If not, renew it as per your billing plan.

In case this is your initial usage of our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

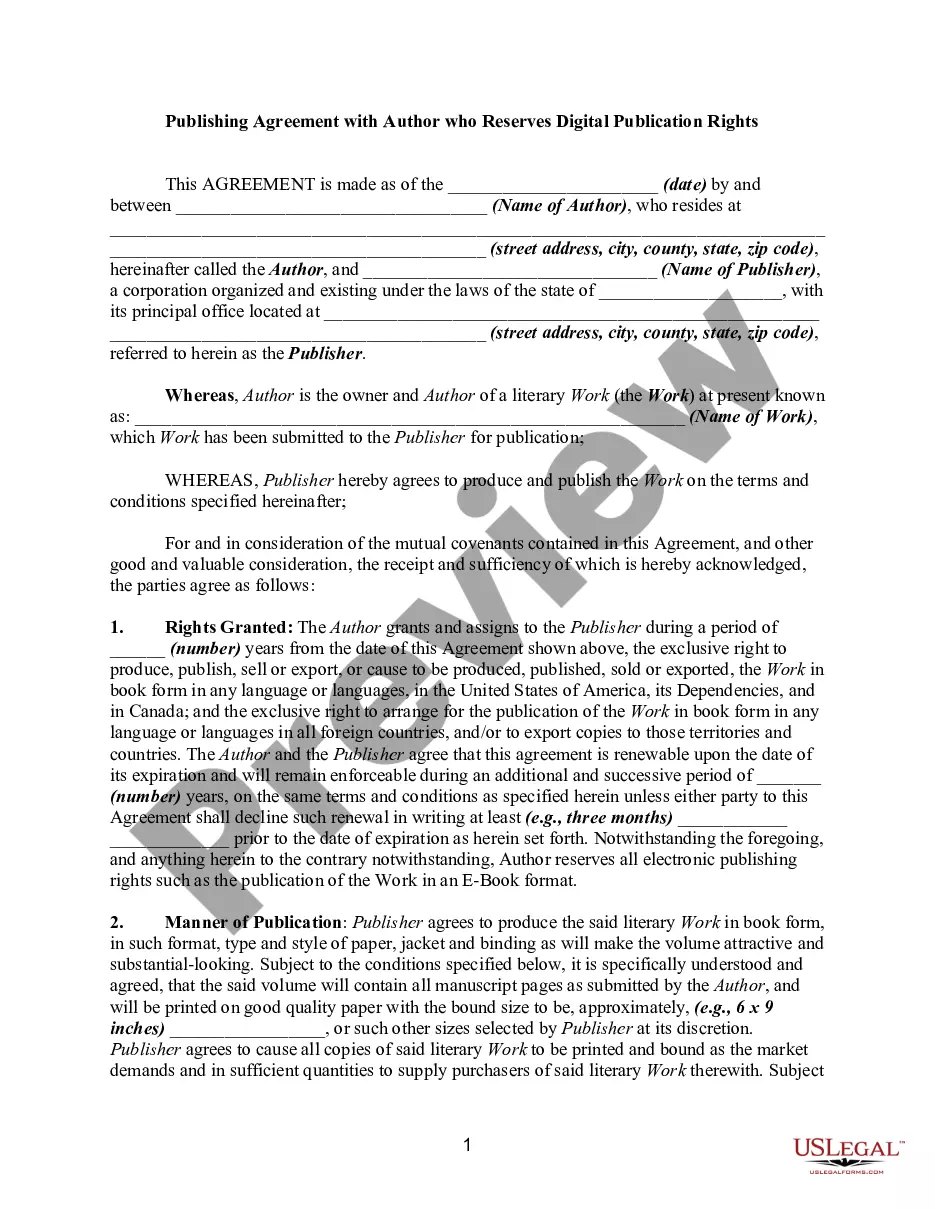

- Ensure you’ve identified the correct document. Review the details and utilize the Preview option, if available, to confirm it fulfills your requirements. If it’s not suitable, use the Search tab above to discover the suitable one.

- Buy the template. Press the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the purchase.

- Retrieve your Columbus Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Entirely Inherited by Spouse. Choose the file format for your document and store it on your gadget.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Is Ohio Probate a Requirement? In most cases, probate is required in Ohio. While there are a few exceptions, most estates will go through the probate process. It can be a simple process or a more complicated situation, which can take more time and require the assistance of an attorney.

The necessary form may be found here. Step 1 ? Appraisal. Before completing paperwork for filing, any person who wants to petition an estate with this affidavit is responsible for first having the estate appraised by an appraiser.Step 2 ? Complete Paperwork.Step 3 ? File With the Court.Step 4 ? Notify.

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses, whichever is less. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.

Ohio probate law requires any property owned by the decedent alone at the time of death to go through probate if it is not jointly owned with survivorship rights, titled to a trust, or have a beneficiary designated.

The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate. You can use the simplified small estate process in Ohio if: The estate is worth less than $5,000 or someone paid funeral and burial expenses (up to $5,000) and asks the court for reimbursement.

One of the most common ways to avoid probate is by using a trust. A trust creates a separate legal entity that owns your assets and is managed by a trustee. By naming yourself as the trustee of a living trust, you can still manage the assets that have been placed in the trust.

What Qualifies As A Small Estate In Ohio? An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.

A question we often hear from executors or administrators of estates is, ?Do I need to hire a probate lawyer?? The short answer to that question is that no, you are not required to have an attorney to probate an Ohio estate.

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses, whichever is less. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.

What Qualifies As A Small Estate In Ohio? An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.