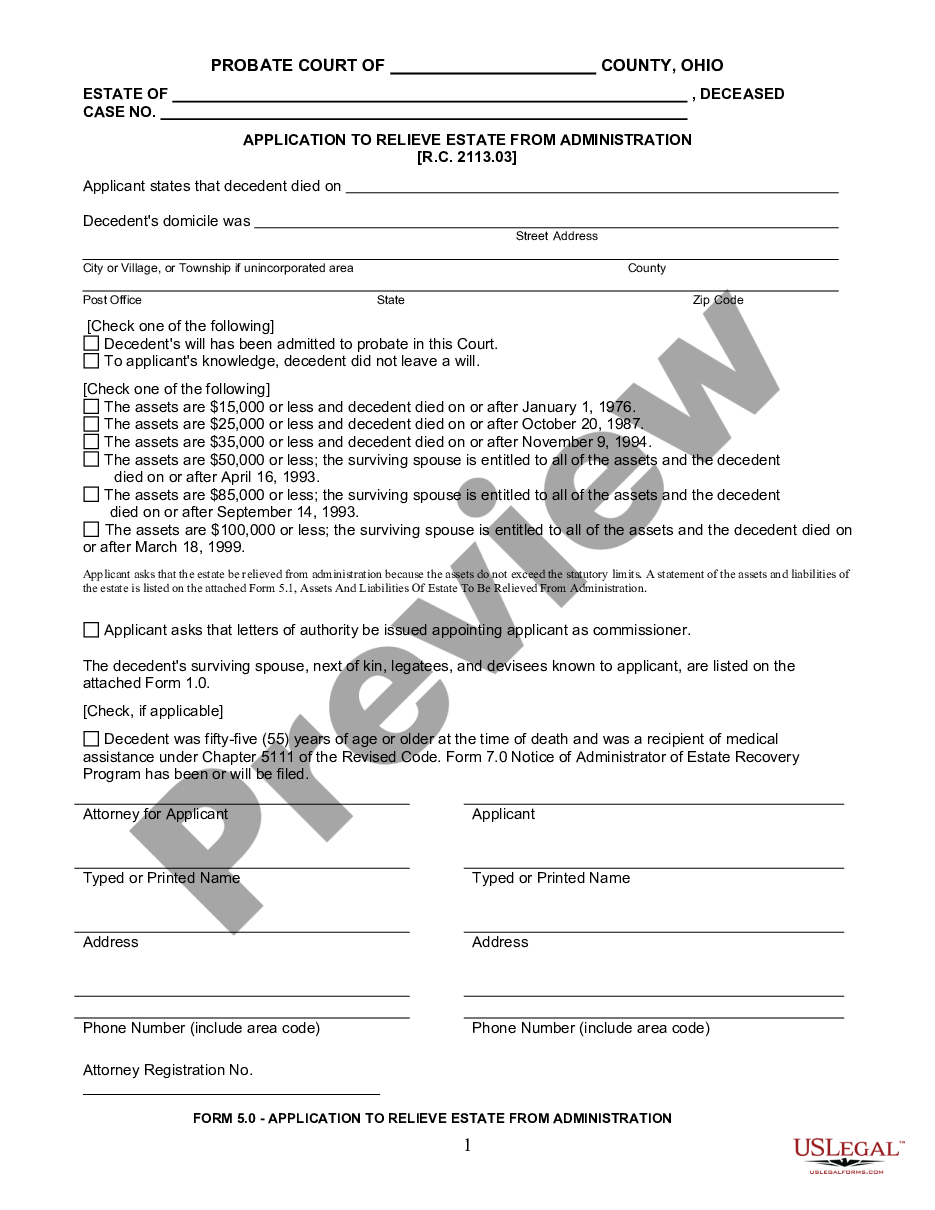

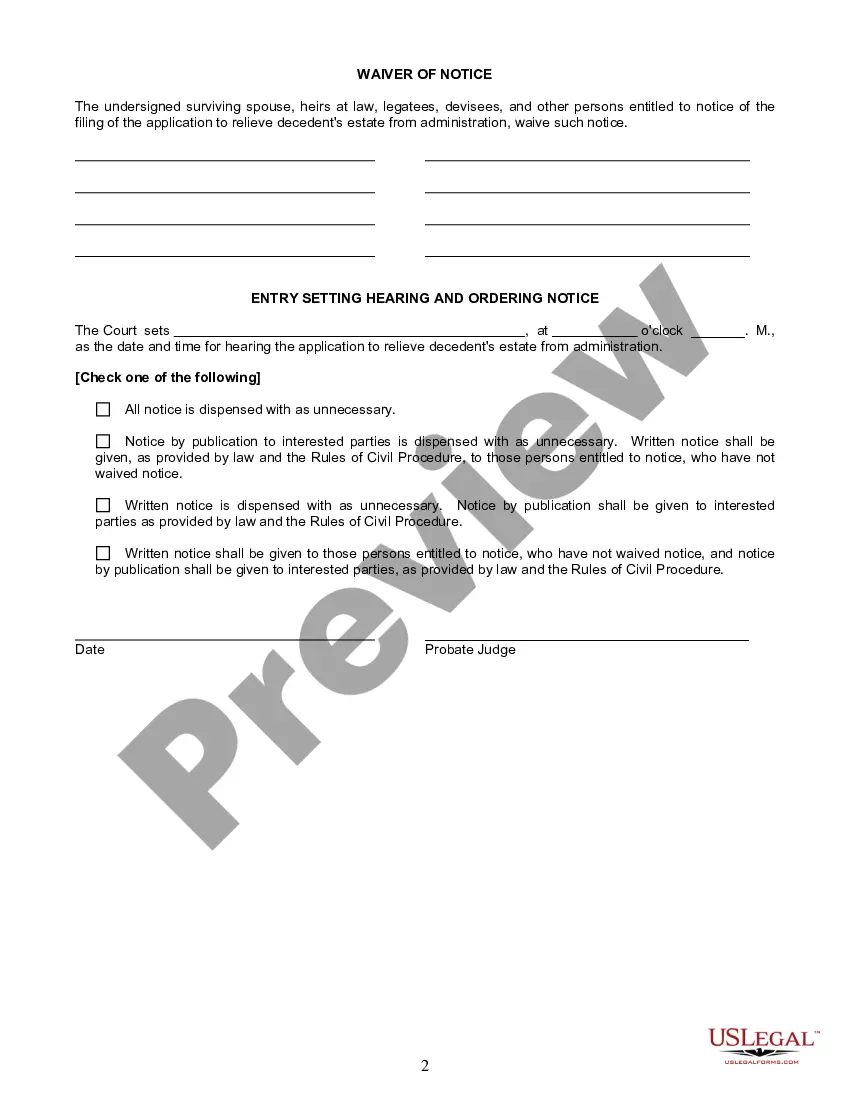

Title: Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse Introduction: The Dayton Ohio Small Estate Affidavit is a legal document designed to simplify the process of transferring assets from an estate valued at $35,000 or $100,000, solely inherited by a surviving spouse. This article aims to provide a detailed description of this affidavit, its purpose, requirements, and benefits. Additionally, we will discuss other potential variations of the Dayton Ohio Small Estate Affidavit based on differing estate values and beneficiaries. 1. Purpose of the Dayton Ohio Small Estate Affidavit: The purpose of the Dayton Ohio Small Estate Affidavit is to enable surviving spouses to efficiently and expediently transfer assets from an estate valued not more than $35,000 or $100,000. By utilizing this affidavit, heirs can avoid the need for lengthy probate proceedings, reducing time, costs, and complexities associated with the traditional estate administration process. 2. Eligibility Criteria: To be eligible for Dayton Ohio Small Estate Affidavit for Estates Not More Than $35.00 or $100,000 and Inherited Fully by Spouse, the following conditions must be met: — The deceased person's estate value should not exceed $35,000 or $100,000. — The estate must be solely inherited by a surviving spouse. — There should be no outstanding debts or real estate involved in the estate. — The affidavit must be filed within a specified time frame (usually within six months of the decedent's passing). 3. Required Documentation: To successfully complete the Dayton Ohio Small Estate Affidavit, the following essential documents and information are typically required: — The original death certificate of the deceased spouse. — A detailed inventory of all assets, including their values. — A copy of the marriage certificate— - Proof confirming the affine as the sole inheriting spouse. — An affidavit affirming no outstanding debts or real estate associated with the estate. 4. Benefits of Dayton Ohio Small Estate Affidavit: Utilizing the Dayton Ohio Small Estate Affidavit offers several advantages, including: — Streamlined process: By eliminating the need for probate, the affidavit allows for a faster transfer of assets. — Cost-effective: The affidavit procedure eliminates the need for expensive legal fees associated with traditional probate proceedings. — Simplicity: The affidavit is relatively straightforward, avoiding complex legal processes typical of estate administration. — Privacy: Since it bypasses probate, the transfer of assets can maintain the family's privacy since probate records are generally public. Variations of Dayton Ohio Small Estate Affidavit: 1. Dayton Ohio Small Estate Affidavit for Estates Not More Than $5,000 and Inherited Fully by Spouse 2. Dayton Ohio Small Estate Affidavit for Estates Not More Than $20,000 and Inherited Fully by Spouse 3. Dayton Ohio Small Estate Affidavit for Estates Not More Than $50,000 and Inherited Fully by Spouse Conclusion: The Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse is an efficient, cost-effective, and simplified method for transferring assets to surviving spouses of smaller estates. By complying with specific requirements and gathering the necessary documentation, eligible individuals can successfully navigate this process and minimize the complexities associated with traditional probate proceedings.

Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse

Description

How to fill out Dayton Ohio Small Estate Affidavit For Estates Not More Than $35,00, Or $100,000 And Inherited Fully By Spouse?

Make use of the US Legal Forms and obtain instant access to any form you require. Our useful website with thousands of document templates makes it easy to find and obtain virtually any document sample you want. You can export, fill, and sign the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse in a couple of minutes instead of surfing the Net for hours searching for a proper template.

Using our catalog is an excellent way to raise the safety of your record filing. Our professional legal professionals regularly check all the documents to make sure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How can you get the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Open the page with the form you need. Ensure that it is the template you were hoping to find: verify its title and description, and make use of the Preview function if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Pick the format to get the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy template libraries on the web. We are always happy to help you in any legal procedure, even if it is just downloading the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse.

Feel free to make the most of our service and make your document experience as straightforward as possible!