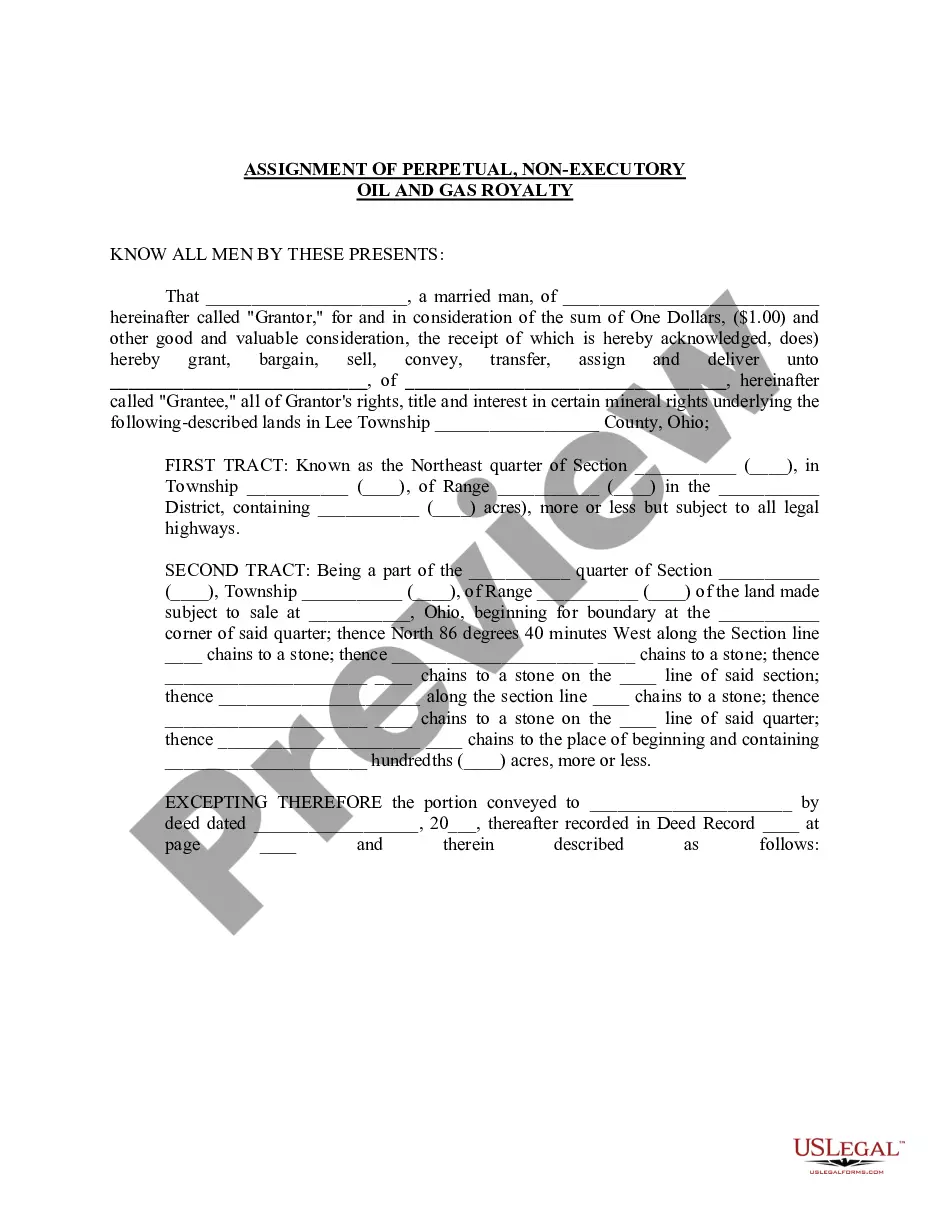

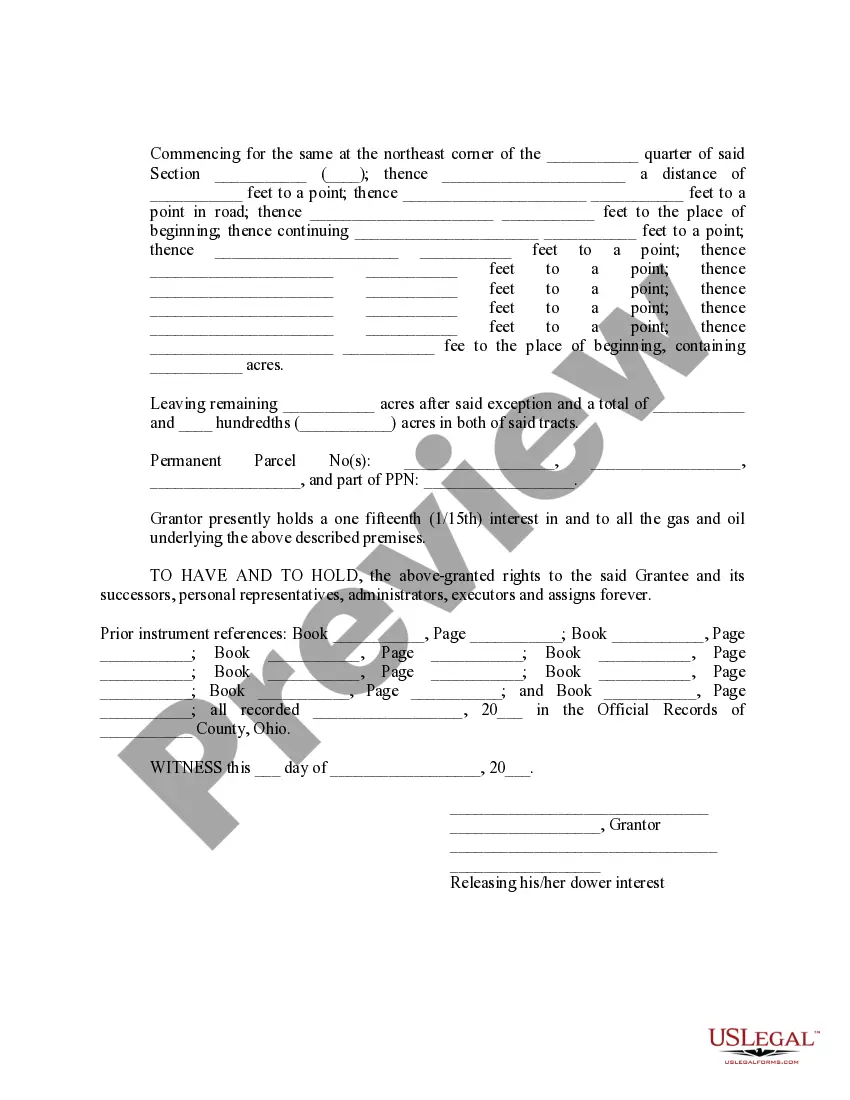

Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty refers to a legally binding agreement that involves the transfer of ownership rights to oil and gas royalty interests in the Cuyahoga County, Ohio area. This type of assignment grants the assignee the perpetual right to receive a share of the proceeds from oil and gas production on a specific property. The assignment is perpetual, which means that it remains in effect for an indefinite amount of time unless otherwise specified in the agreement. This gives the assignee the opportunity to profit from the production of oil and gas as long as it continues on the property. Moreover, the assignment is non-executory, meaning that the assignee does not have the responsibility or authority to actively manage or operate the oil and gas operations on the designated property. Instead, their role is limited to receiving a portion of the royalties generated by the production. It's worth noting that there may be different types of Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalties, which can vary based on specific terms and conditions established in each agreement. These variances may include the percentage of royalty interests assigned, the specific property or properties covered by the assignment, and any additional rights or obligations that both parties agree upon. Some common variations of Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalties may include: 1. Fractional Interest Assignments: This type of assignment involves the transfer of a specific fraction or percentage of the royalty interests. For example, a party may assign a 50% interest in the oil and gas royalties, entitling them to receive half of the proceeds. 2. Specific Property Assignments: In this case, the assignment is limited to a particular property or set of properties. The assignee's royalty rights are restricted only to the production from those specific locations. 3. Non-Participating Royalty Assignments: A non-participating royalty interest assignment grants the assignee the right to receive a portion of the royalties but does not allow them to participate in decisions related to the operation or development of the oil and gas resources. 4. Gross or Net Royalty Assignments: Assignments can also differ based on the method used to calculate royalties. Gross royalty assigns a percentage of the total production value, while net royalty assigns a percentage of the production after deducting expenses such as transportation or processing costs. In summary, the Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty is a legally binding agreement that allows for the transfer of ownership rights to oil and gas royalty interests in Cuyahoga County. With various types and terms available, this assignment offers opportunities for investors to benefit from the long-term production of oil and gas in the designated properties.

Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty

Description

How to fill out Cuyahoga Ohio Assignment Of Perpetual, Non-Executory Oil And Gas Royalty?

Are you looking for a trustworthy and affordable legal forms provider to get the Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty? US Legal Forms is your go-to solution.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Restart the search in case the form isn’t good for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Cuyahoga Ohio Assignment of Perpetual, Non-Executory Oil and Gas Royalty in any available format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online for good.