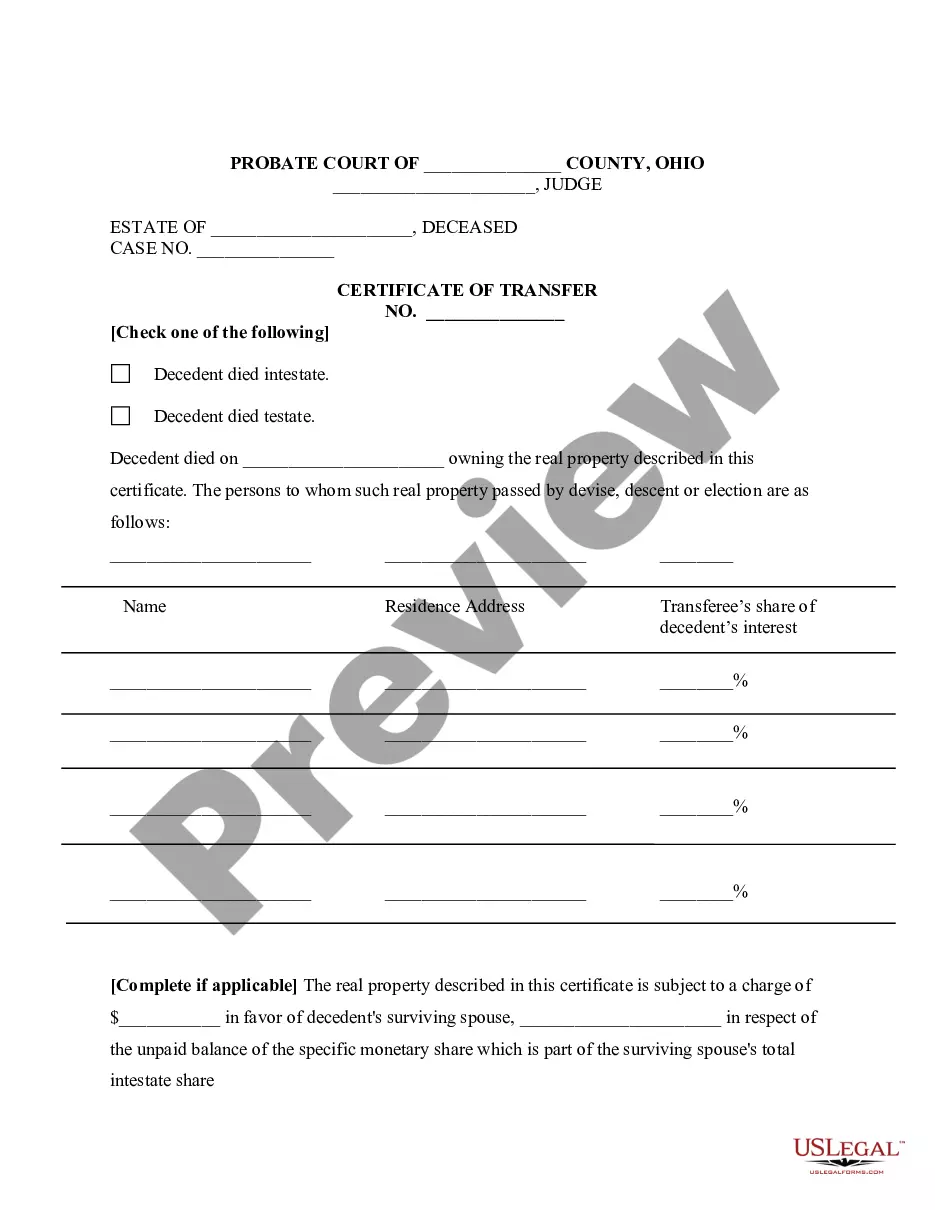

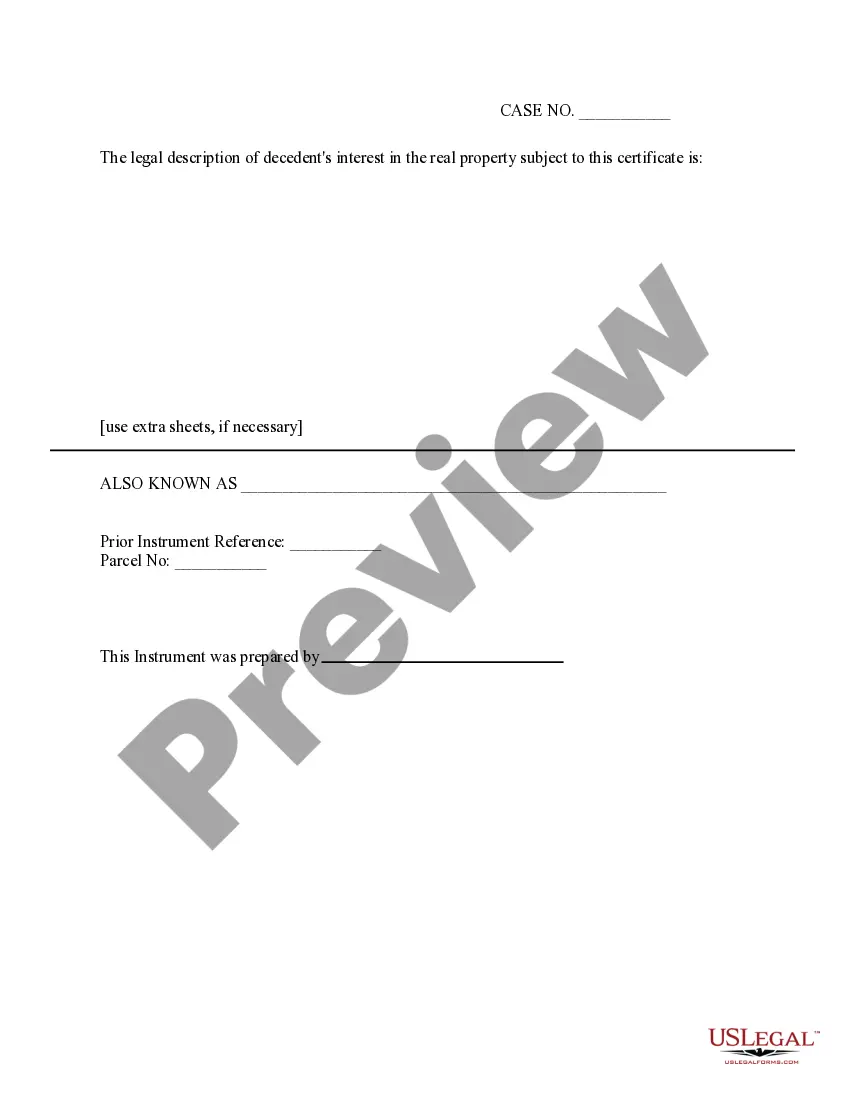

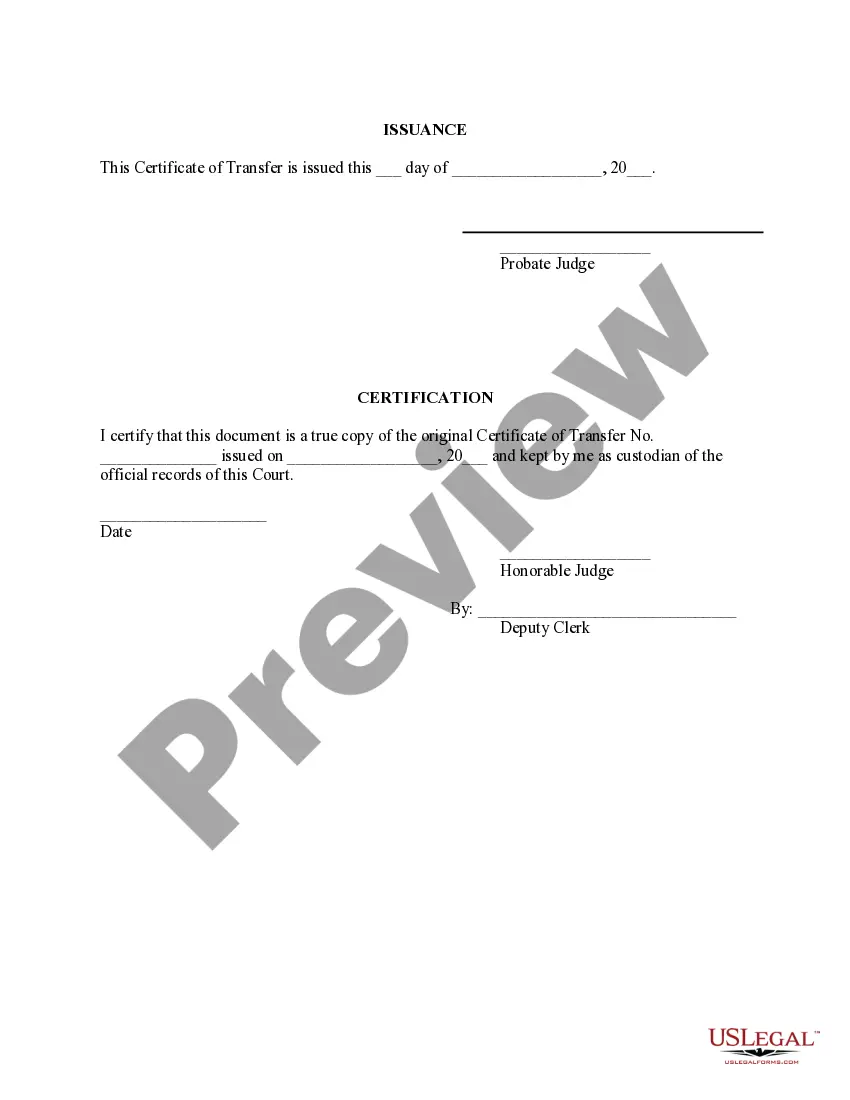

Cuyahoga Ohio Certificate of Transfer

Description

How to fill out Ohio Certificate Of Transfer?

If you are looking for an authentic document, it’s challenging to select a superior service than the US Legal Forms website – likely the most extensive online collections.

Here you can obtain thousands of templates for commercial and personal use categorized by types and states, or keywords.

Utilizing our enhanced search feature, locating the latest Cuyahoga Ohio Certificate of Transfer is as straightforward as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Select the format and store it on your device. Edit. Fill out, modify, print, and sign the obtained Cuyahoga Ohio Certificate of Transfer.

Every document you add to your account has no expiration and belongs to you indefinitely. You always have the option to access them through the My documents section, so if you need to retrieve an additional copy for editing or for hardcopy creation, you can return and download it again anytime.

Leverage the US Legal Forms professional library to obtain the Cuyahoga Ohio Certificate of Transfer you were looking for and thousands of other professional and state-specific templates all in one place!

- Moreover, the validity of each document is verified by a team of qualified attorneys who consistently assess the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to acquire the Cuyahoga Ohio Certificate of Transfer is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the directions outlined below.

- Ensure you have located the form you are seeking. Review its details and utilize the Preview feature to view its content. If it doesn’t fulfill your needs, use the Search option at the top of the page to locate the necessary document.

- Confirm your choice. Click the Buy now button. Then, choose the desired subscription plan and submit your information to register for an account.

Form popularity

FAQ

Transferring a house title in Ohio requires several steps to ensure everything is done legally. First, you'll need to prepare a deed, which can be facilitated through the Cuyahoga Ohio Certificate of Transfer. This document serves as proof of ownership change. Once the deed is ready, you must file it with the county recorder's office. Consider using US Legal Forms for easy access to the necessary templates and guidance.

In Ohio, the transfer tax is typically charged on the sale or transfer of real estate and stands at $1 per $1,000 of the property value. Additional local taxes may apply, and they can vary by county. If you plan on transferring property, knowing the implications of the Cuyahoga Ohio Certificate of Transfer, including the associated transfer tax, can help you budget accurately. Utilize resources like uslegalforms to gain insights into tax applications during property transfer.

Cuyahoga County imposes a property tax based on assessed values, which can vary depending on the specifics of the property. The tax rate is determined by a combination of local government needs and school funding requirements. When dealing with property transfers, understanding these taxes is essential for calculating total costs associated with the Cuyahoga Ohio Certificate of Transfer. Consulting local government resources or engaging legal services can provide clarity on these obligations.

To transfer property in Ohio, you must prepare a deed, typically a quitclaim or warranty deed, and ensure it is signed and notarized by the parties involved. Next, you will need to submit the deed to the appropriate county recorder's office for filing. This step is particularly vital when you are handling the Cuyahoga Ohio Certificate of Transfer, as it formalizes the property transfer. Consider using uslegalforms to access templates and detailed instructions for a seamless experience.

A certificate of transfer in Ohio is a legal document that facilitates the transfer of property ownership from one party to another. It is essential for ensuring proper title conveyance, reflecting accurate ownership records. When dealing with real estate transactions, understanding the Cuyahoga Ohio Certificate of Transfer is crucial for smooth transfers. You can find reliable resources and templates on platforms like uslegalforms to help you navigate this process.

In Cuyahoga County, you can file a deed at the County Recorder’s Office located in downtown Cleveland. Make sure to bring your completed Cuyahoga Ohio Certificate of Transfer, along with any necessary identification and payment for filing fees. Filing your deed correctly is crucial to ensure it is recognized by local authorities. The US Legal Forms platform offers resources to help you prepare properly for this important step.

Transferring a property title to a family member in Ohio typically involves completing a new deed and submitting it to your local recorder's office. You would use a Cuyahoga Ohio Certificate of Transfer to ensure the process follows state regulations. It is essential to properly fill out and notarize the deed, which may require some guidance. Consider using the US Legal Forms platform to access templates and resources that simplify this process.