Toledo Ohio Notice of Lien Renewal: Understanding its Purpose and Types The Toledo Ohio Notice of Lien Renewal is a crucial legal document used to extend the validity of a previously filed lien on a property. When a creditor places a lien on a debtor's property, it serves as a legal claim ensuring they receive payment for any debts owed. However, liens have an expiration date, and if not renewed, their validity can lapse. To prevent this, creditors can file a Toledo Ohio Notice of Lien Renewal, allowing them to maintain a valid claim on the property for an extended period. Keywords: Toledo Ohio, Notice of Lien Renewal, legal document, property, validity, creditor, debtor, debts owed, expiration date, claim, filed, extension. Types of Toledo Ohio Notice of Lien Renewal: 1. Real Estate Lien Renewal: This type of renewal notice is filed by a creditor who has obtained a lien on a property. It allows the creditor to continue their legal claim on the property until the debt is settled or the lien is released. 2. Mechanics Lien Renewal: Contractors and suppliers who provided labor, materials, or services for construction projects can file a mechanics lien. When the initial lien expires, these parties can use the Notice of Lien Renewal to extend their claim on the property until full payment is received. 3. Tax Lien Renewal: Government bodies, such as the Internal Revenue Service (IRS) or Ohio Department of Taxation, can file a tax lien against a property for unpaid taxes. The Notice of Lien Renewal enables them to prolong their claim until the taxpayer satisfies their tax obligation. 4. Judgment Lien Renewal: If a creditor successfully obtains a judgment against a debtor in court, they may enforce that judgment by placing a lien on the debtor's property. The Notice of Lien Renewal allows the creditor to extend the duration of the lien, ensuring they have the legal right to collect the outstanding amount. 5. Municipal Lien Renewal: Municipalities may place liens on properties for unpaid fees, such as water bills, code violations, or property taxes. With the Notice of Lien Renewal, they can maintain their claim until the debt is cleared or a payment arrangement is established. In summary, the Toledo Ohio Notice of Lien Renewal serves to extend the validity of various types of liens placed on properties in the Toledo area. By keying in on important keywords and understanding the different types of liens, individuals can navigate the legal process effectively while protecting their rights or seeking to satisfy owed debts.

Toledo Ohio Notice of Lien Renewal

Description

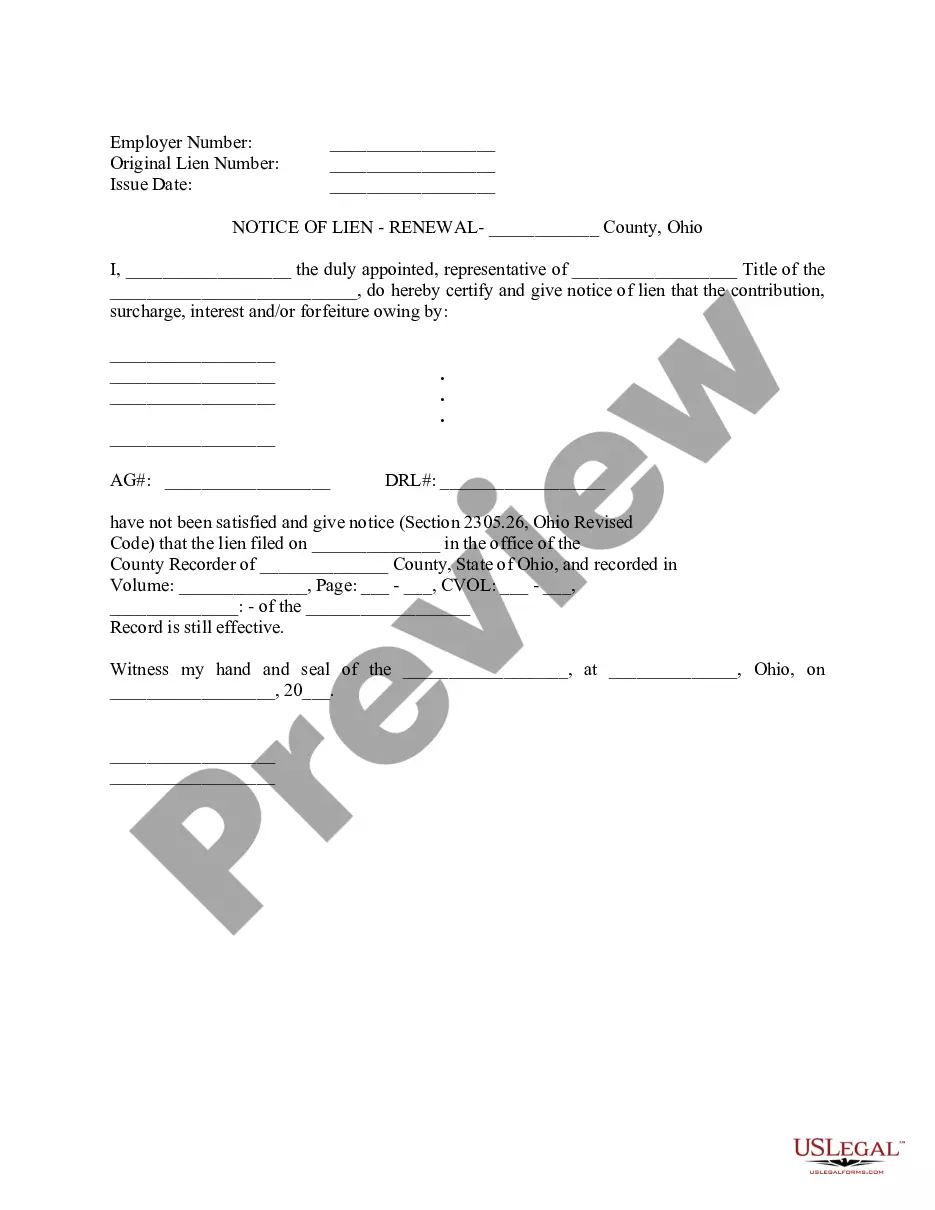

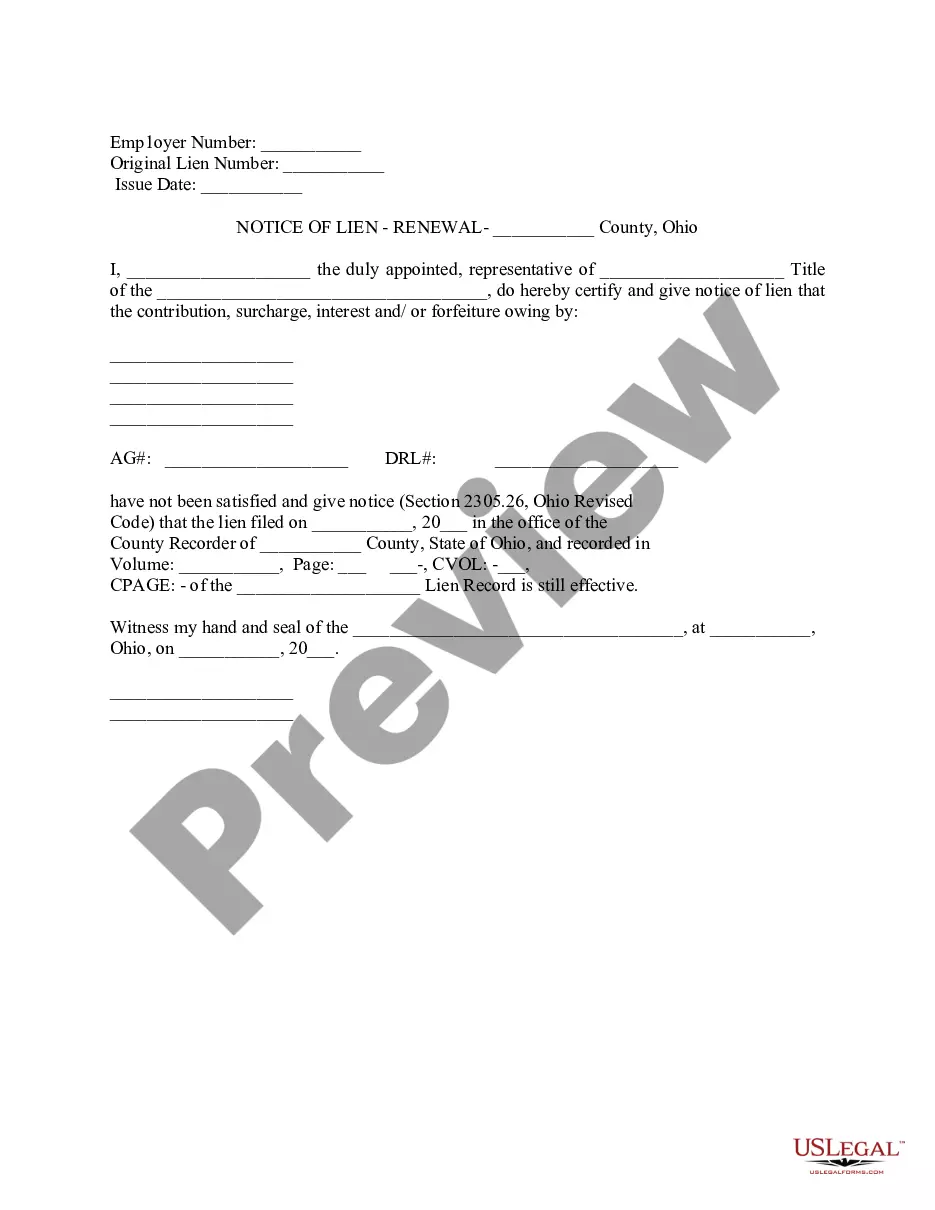

How to fill out Ohio Notice Of Lien Renewal?

Irrespective of societal or occupational position, finalizing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it becomes nearly impossible for an individual without a legal background to formulate such documents from the ground up, primarily due to the intricate terminology and legal nuances they encompass.

This is where US Legal Forms steps in to assist.

Confirm that the template you have located is appropriate for your locality as the laws of one state or county do not apply to another.

Preview the document and read a brief overview (if available) of situations the form can be utilized for.

- Our service offers a vast assortment of over 85,000 ready-to-use state-specific forms that cater to nearly any legal matter.

- US Legal Forms also acts as a valuable tool for associates or legal advisors looking to conserve time by utilizing our DIY forms.

- Whether you need the Toledo Ohio Notice of Lien Renewal or any other documentation that is applicable in your region or jurisdiction, with US Legal Forms, everything is readily accessible.

- Here’s the process to obtain the Toledo Ohio Notice of Lien Renewal in moments using our reliable service.

- If you are already a returning user, you can proceed to Log In to your account to retrieve the relevant form.

- Conversely, if you are new to our platform, ensure that you adhere to these steps before securing the Toledo Ohio Notice of Lien Renewal.

Form popularity

FAQ

Yes, you can place a lien against your own property under certain conditions. This process often involves using a Toledo Ohio Notice of Lien Renewal to formalize the additional claim on your assets. Keep in mind that while it is legally permissible, you should consult with a legal expert to ensure you fully understand the implications. Such guidance can help you navigate the complexities of lien management effectively.

In Oklahoma, a lien generally lasts for five years. However, if you have a Toledo Ohio Notice of Lien Renewal, you can extend this period by renewing the lien before it expires. This renewal is vital to maintaining your legal rights over the property. Therefore, it's essential to stay informed and take necessary actions to protect your interests.

Requesting a lien release letter involves writing to the entity that placed the lien on your property. You need to include specific details regarding the property and the lien, as well as any supporting documentation. For those seeking help with this process, the USLegalForms platform offers a wealth of resources, including templates and instructions, to help you successfully manage your Toledo Ohio Notice of Lien Renewal.

The time it takes to receive a lien release can vary based on several factors, including the issuer's responsiveness. Typically, if you file the correct paperwork and meet all requirements, you may expect a lien release within a few weeks. In urgent situations, submitting your request through the USLegalForms service might expedite your Toledo Ohio Notice of Lien Renewal process, as they provide guidance and necessary templates.

To obtain a copy of a lien release from the IRS, you should first verify that the lien has been released. You can then request a copy by contacting the IRS directly. Be prepared to provide your personal information and details about the original lien. Using the USLegalForms platform can simplify the process, offering you the necessary forms to ensure you receive your Toledo Ohio Notice of Lien Renewal efficiently.

A lien release cannot serve as a title for your property or vehicle. While it confirms that you have cleared your debts, it does not provide ownership proof. To navigate this effectively, especially related to a Toledo Ohio Notice of Lien Renewal, obtaining the official title is crucial. This protects your investment and streamlines any future sales or transfers.

Selling a car with just a lien release letter can present challenges, especially without the title. The lien release letter indicates the debt related to the car has been settled, but it does not substitute for the title. If you are working under a Toledo Ohio Notice of Lien Renewal, it's advisable to obtain a clear title first. This ensures a smooth transaction and provides assurance to the buyer.

When a lien is released, it signifies that the legal claim the creditor had against your property is removed. This process often occurs once you have satisfied the debt associated with the lien. In the context of a Toledo Ohio Notice of Lien Renewal, understanding lien release is essential to clear obligations. You can confidently move forward with your property transactions once the lien is officially released.

Filing a lien in Ohio involves a series of steps, starting with the preparation of your lien documents. You will need to specify the debt owed and include any evidence supporting your claim. After that, submit your completed forms to the proper authority, typically the county recorder or the local court. If you're navigating the Toledo Ohio Notice of Lien Renewal, utilizing platforms like US Legal Forms can streamline the entire process and provide valuable resources.

To file a lien in Ohio, you need to complete the appropriate lien forms, gather supporting documentation, and submit them to the county recorder's office or relevant court. Depending on the type of lien, there may be specific fees or requirements to meet. For those interested in the Toledo Ohio Notice of Lien Renewal, it’s essential to keep track of the filing timeline. Accurate filing ensures your lien remains enforceable and protects your interests.