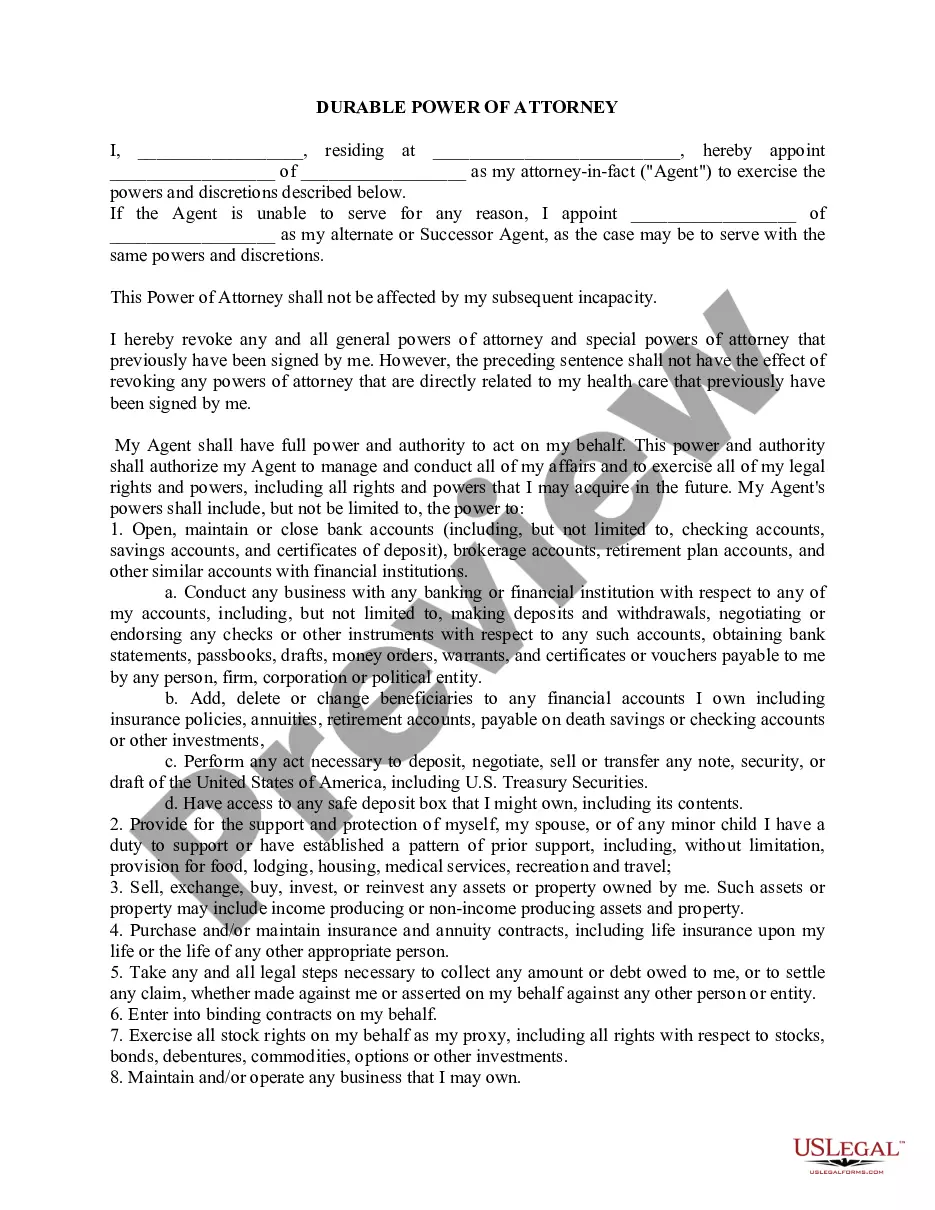

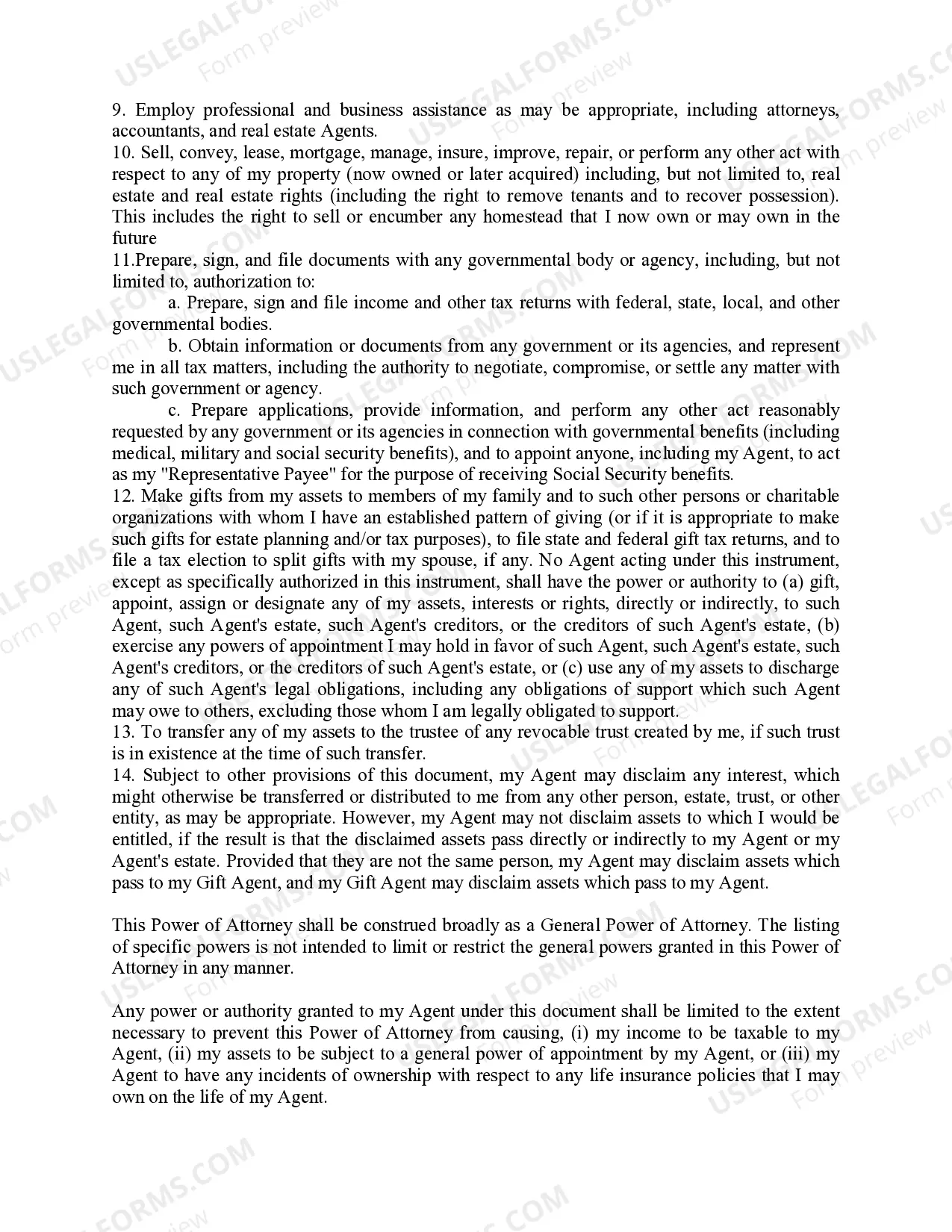

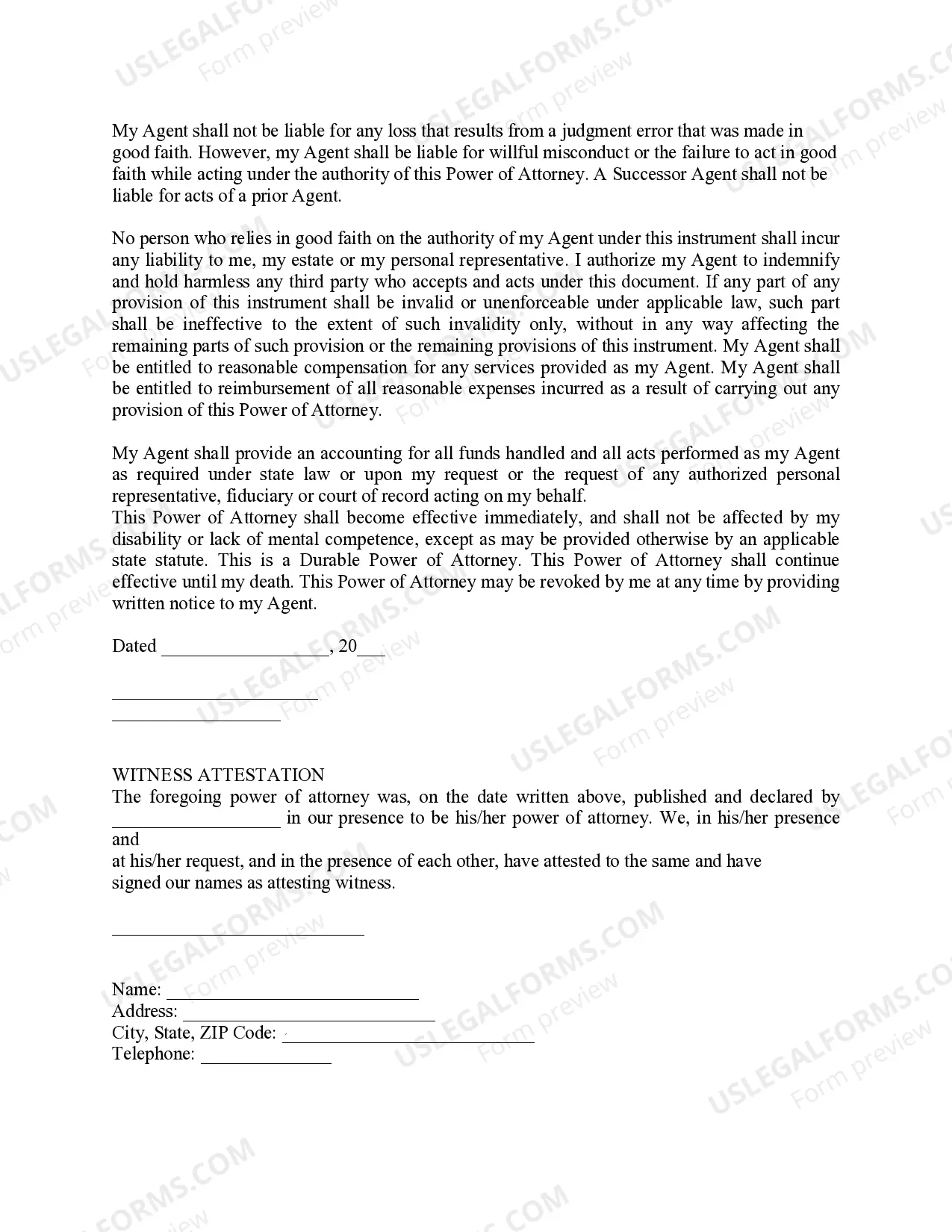

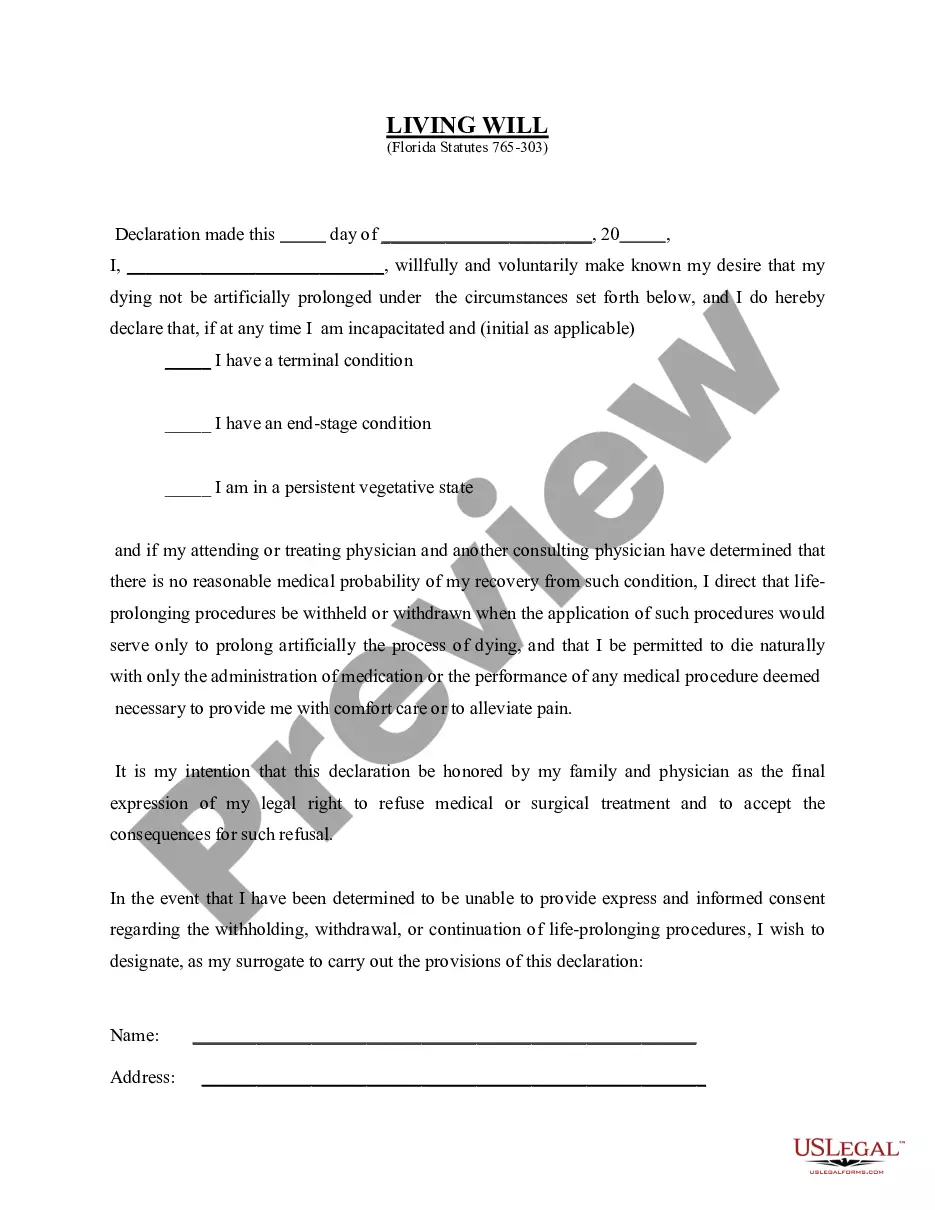

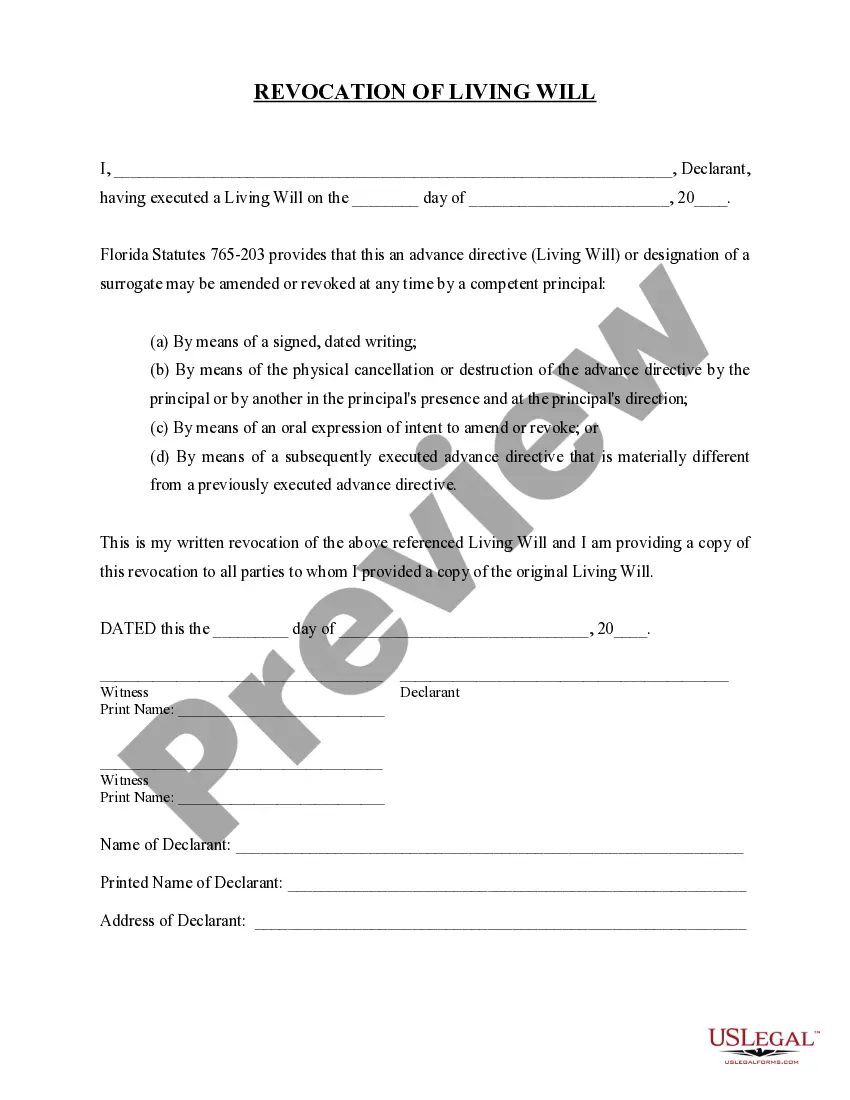

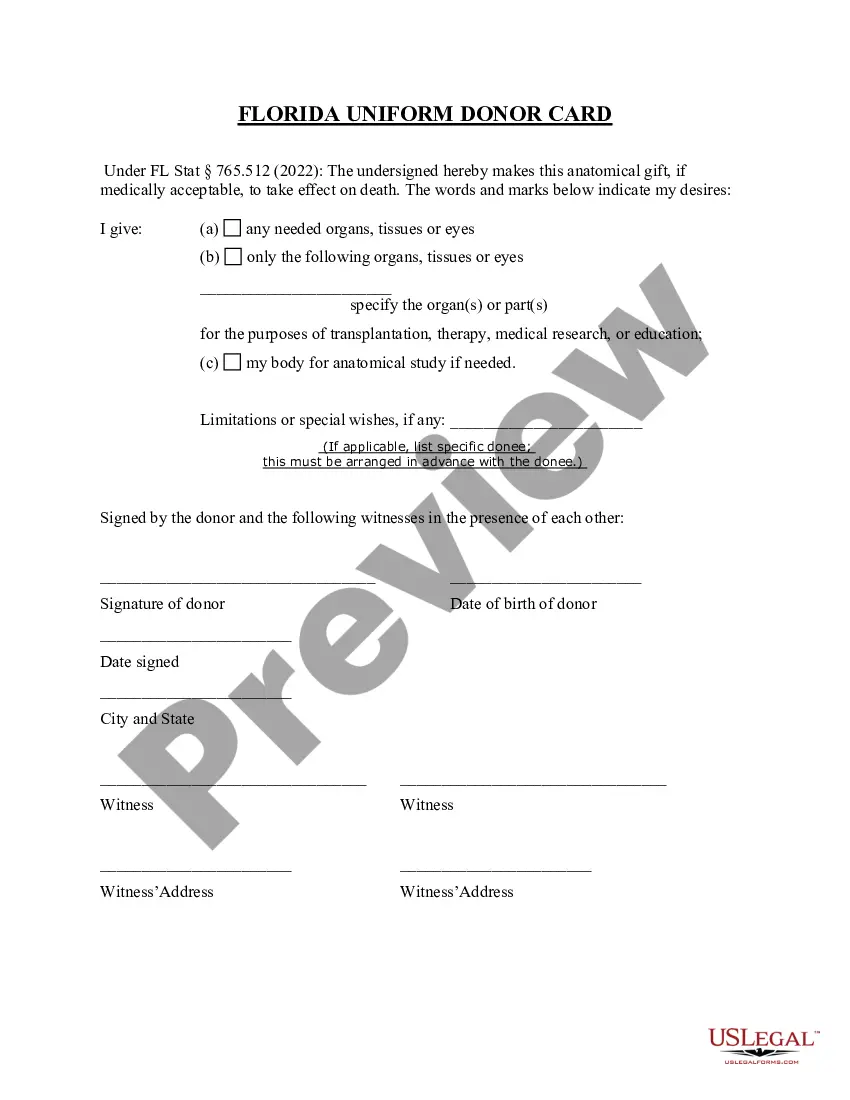

A Columbus Ohio Durable Power of Attorney refers to a legal document granting a trusted individual, known as the agent or attorney-in-fact, the authority to make important decisions on behalf of another person, the principal, in the event the principal becomes incapacitated or unable to handle their affairs. This authority remains effective even if the principal becomes mentally or physically disabled. A durable power of attorney in Columbus, Ohio, is specifically designed to ensure that the designated agent can continue to act on the principal's behalf regardless of their incapacitation. This means the agent's authority to make decisions and manage the principal's affairs remains intact and valid until the principal either revokes the power of attorney or passes away. There are different types of Columbus Ohio Durable Power of Attorney, each serving specific purposes based on the scope of authority granted: 1. Financial Power of Attorney: This type of durable power of attorney authorizes the agent to make financial decisions and manage the principal's assets, including banking, investments, real estate, and other financial transactions. 2. Medical Power of Attorney: Also known as a healthcare power of attorney, this document grants the agent the authority to make medical decisions on behalf of the principal if they are unable to do so. The agent may communicate with healthcare providers, make treatment decisions, and ensure the principal's wishes are followed. 3. Limited Power of Attorney: This type restricts the agent's authority to specific areas or tasks specified in the power of attorney document. For example, the principal may grant limited power of attorney to handle a particular real estate transaction or deal with a specific financial matter. 4. General Power of Attorney: Unlike a limited power of attorney, a general power of attorney provides the agent with broad authority to handle various aspects of the principal's affairs. This includes managing financial matters, making legal decisions, signing contracts, and more. However, it is important to note that a general power of attorney becomes void upon the principal's incapacitation. 5. Springing Power of Attorney: This type of durable power of attorney only becomes effective when a specific event or condition occurs, typically the principal's incapacitation. It outlines the conditions under which the agent can assume decision-making authority, ensuring that the agent's power is only activated when necessary. Creating a Columbus Ohio Durable Power of Attorney is crucial for individuals who want to ensure that their financial and healthcare decisions are handled according to their wishes, especially in cases of incapacitation. It is recommended to consult with a qualified attorney who specializes in estate planning and elder law to draft a durable power of attorney that accurately reflects the principal's intentions and addresses their specific needs.

Columbus Ohio Durable Power of Attorney

Description

How to fill out Columbus Ohio Durable Power Of Attorney?

Make use of the US Legal Forms and have immediate access to any form you need. Our helpful website with thousands of document templates makes it easy to find and obtain almost any document sample you want. You can export, complete, and sign the Columbus Ohio Durable Power of Attorney in just a couple of minutes instead of surfing the Net for many hours trying to find the right template.

Utilizing our catalog is an excellent strategy to improve the safety of your record submissions. Our experienced attorneys on a regular basis check all the documents to make certain that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you get the Columbus Ohio Durable Power of Attorney? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Find the form you need. Make certain that it is the template you were looking for: check its title and description, and use the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Pick the format to get the Columbus Ohio Durable Power of Attorney and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the Columbus Ohio Durable Power of Attorney.

Feel free to benefit from our platform and make your document experience as efficient as possible!