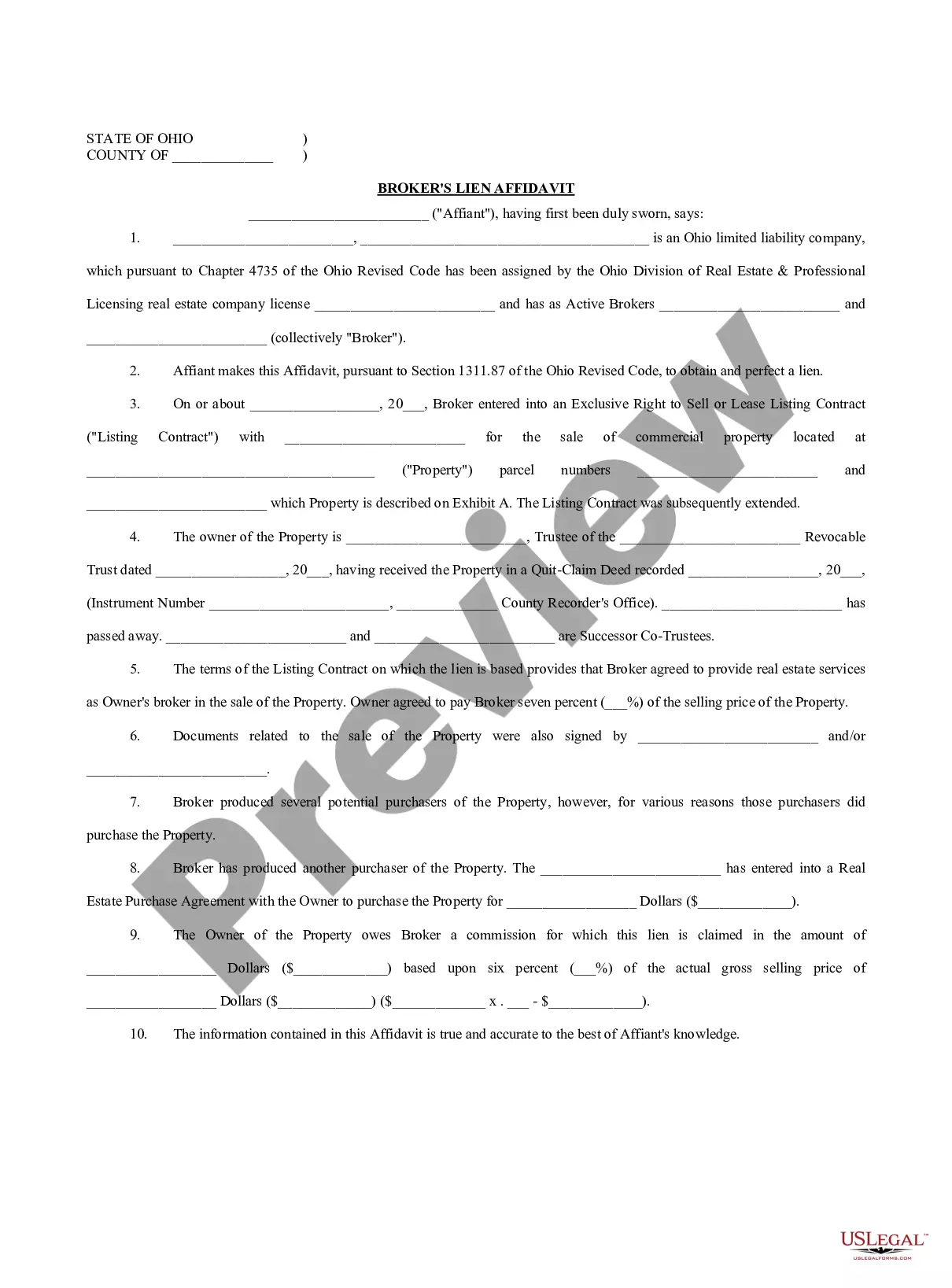

A Dayton Ohio Broker's Lien Affidavit is a legal document used in the real estate industry to assert a broker's claim for compensation for services rendered in a property transaction. It serves as a written statement, providing a detailed description of the services performed by the broker and the specific amount of commission or fees owed. When a broker assists in the sale, lease, or exchange of real estate in Dayton, Ohio, they may be eligible to file a Broker's Lien Affidavit to secure their right to payment. This affidavit acts as a notice to all parties involved, including the property owner, buyer, or lessee, that the broker has a valid claim for commission or fees. It ensures that the broker has a legal right to seek compensation if their services were instrumental in closing the deal. Different types of Dayton Ohio Broker's Lien Affidavits may be applicable depending on the nature of the brokerage services provided. Some common variations include: 1. Residential Broker's Lien Affidavit: This is used when a broker assists in the sale or lease of residential properties, such as houses or apartments. 2. Commercial Broker's Lien Affidavit: This type is applicable when a broker is involved in the sale, lease, or exchange of commercial properties, such as office buildings, retail spaces, or industrial facilities. 3. Rental Broker's Lien Affidavit: Used when a broker assists in securing a rental property, either residential or commercial, for a tenant. It establishes the right to claim a commission or fee for the successful matchmaking process. 4. Vacant Land Broker's Lien Affidavit: When a broker facilitates the sale, purchase, or lease of vacant land, this affidavit becomes relevant. It secures the broker's right to compensation for their efforts in the transaction. In all cases, filing a Dayton Ohio Broker's Lien Affidavit within the specified timeframe, usually within a set number of days from the closing of the transaction, is crucial to protect the broker's financial interests.

Dayton Ohio Broker's Lien Affidavit

Description

How to fill out Dayton Ohio Broker's Lien Affidavit?

If you are searching for a relevant form, it’s difficult to choose a better platform than the US Legal Forms website – one of the most comprehensive online libraries. Here you can find thousands of document samples for business and personal purposes by categories and regions, or key phrases. With the advanced search function, getting the newest Dayton Ohio Broker's Lien Affidavit is as elementary as 1-2-3. In addition, the relevance of every record is confirmed by a team of skilled lawyers that regularly check the templates on our website and revise them according to the latest state and county laws.

If you already know about our platform and have a registered account, all you should do to get the Dayton Ohio Broker's Lien Affidavit is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have opened the sample you want. Check its explanation and use the Preview function (if available) to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to get the appropriate record.

- Confirm your choice. Select the Buy now option. After that, select your preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Indicate the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the acquired Dayton Ohio Broker's Lien Affidavit.

Every single template you add to your account has no expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to get an additional duplicate for editing or printing, feel free to return and download it once more at any moment.

Take advantage of the US Legal Forms extensive catalogue to get access to the Dayton Ohio Broker's Lien Affidavit you were looking for and thousands of other professional and state-specific templates on one platform!