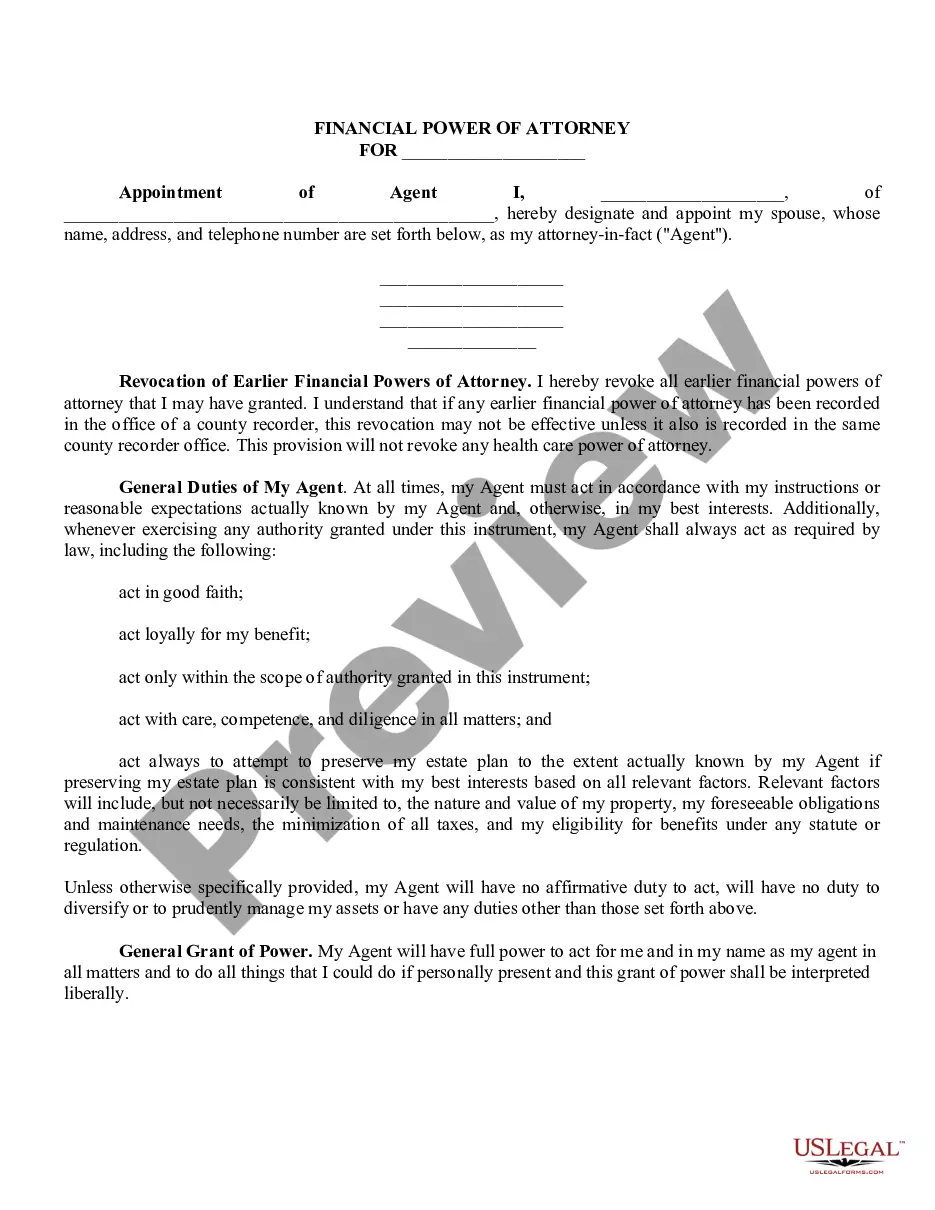

Akron Ohio Financial Power of Attorney is a legal document that grants an individual the authority to make financial decisions on behalf of another person. This power of attorney is commonly used when an individual becomes unable to handle their financial matters due to illness, disability, or absence. Having a financial power of attorney in place ensures that someone trustworthy can step in and manage the individual's financial affairs, including paying bills, managing investments, signing contracts, and dealing with banks or other financial institutions. In Akron, Ohio, there are different types of Financial Power of Attorney that individuals can choose from, depending on their specific requirements and preferences. These include: 1. General Financial Power of Attorney: This type grants broad and comprehensive powers to the chosen attorney-in-fact, allowing them to handle virtually all financial matters on the principal's behalf. It is often used by individuals who want to ensure a smooth transition of financial responsibilities or anticipate future incapacitation. 2. Limited or Special Financial Power of Attorney: This type limits the attorney-in-fact's powers to specific financial matters or for a specific period. It is commonly used when the principal needs assistance with a particular transaction or during a temporary absence. 3. Springing Financial Power of Attorney: This type becomes effective only when a specified event or condition occurs, typically when the principal becomes incapacitated or unable to make financial decisions. It provides a safeguard for individuals who may not require assistance immediately but want to ensure someone is authorized if the need arises. When creating an Akron Ohio Financial Power of Attorney, it is essential to consult with an attorney experienced in estate planning and elder law to ensure that the document meets all legal requirements and serves the individual's best interests. Additionally, it is crucial to select a trustworthy and competent attorney-in-fact who will act in the principal's best interests, as they will have significant control over the individual's financial matters.

Akron Ohio Financial Power of Attorney

Description

How to fill out Akron Ohio Financial Power Of Attorney?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law education to create this sort of paperwork cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with over 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the Akron Ohio Financial Power of Attorney or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Akron Ohio Financial Power of Attorney quickly using our reliable platform. If you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

However, if you are a novice to our platform, make sure to follow these steps prior to downloading the Akron Ohio Financial Power of Attorney:

- Be sure the template you have chosen is suitable for your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a short outline (if provided) of cases the document can be used for.

- If the form you picked doesn’t suit your needs, you can start over and look for the suitable document.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your login information or create one from scratch.

- Select the payment method and proceed to download the Akron Ohio Financial Power of Attorney once the payment is done.

You’re good to go! Now you can proceed to print the form or fill it out online. In case you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.