A Cuyahoga Ohio Financial Power of Attorney is a legal document that grants someone the authority to handle financial matters on behalf of another person, known as the principal. This power of attorney enables the appointed agent, also called an attorney-in-fact, to make financial decisions, manage assets, and perform financial transactions if the principal becomes incapacitated, unavailable, or unable to make these decisions themselves. Having a valid Cuyahoga Ohio Financial Power of Attorney in place ensures that a trusted individual can step in and manage the principal's financial affairs smoothly and without disruptions. This document is particularly useful for elderly individuals or those facing health issues, as it safeguards their financial well-being and prevents any mismanagement or exploitation. In Cuyahoga County, Ohio, there are different types of Financial Power of Attorney documents available to cater to various needs and situations: 1. General Financial Power of Attorney: This is the most common type, granting broad authority to the agent over all financial matters, including banking, real estate, investments, tax filings, and debt management. 2. Limited or Special Financial Power of Attorney: This document grants the agent specific powers for a limited duration or particular financial transactions. For instance, it could authorize the agent to sell a specific property on behalf of the principal. 3. Springing Financial Power of Attorney: This type only becomes effective if a specific event or condition occurs, such as the principal's incapacity or unavailability. It can be helpful for those who wish to retain control until they are incapacitated. When creating a Cuyahoga Ohio Financial Power of Attorney, certain guidelines must be followed to ensure its validity. The principal must be of sound mind and understand the powers delegated to the agent. It is advisable to consult an attorney experienced in Ohio estate planning laws to ensure compliance and to address specific concerns. In summary, a Cuyahoga Ohio Financial Power of Attorney is a crucial legal document that allows a trusted individual to manage an individual's finances when incapacitated or unavailable. With different types available, including the General, Limited, and Springing powers of attorney, individuals can tailor the document to suit their particular needs and circumstances. Consulting an attorney can ensure compliance with Ohio laws and guarantee the protection of one's financial interests.

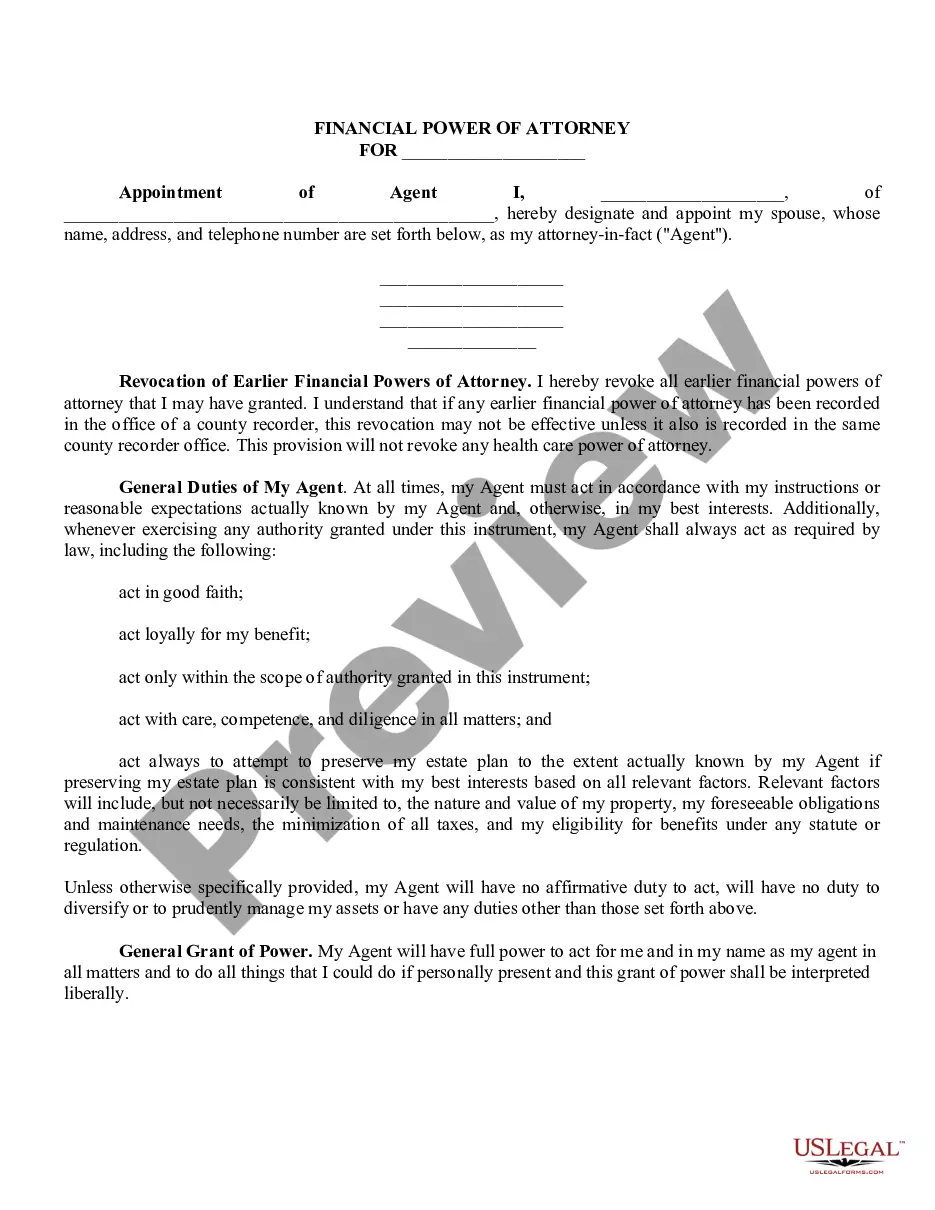

Cuyahoga Ohio Financial Power of Attorney

Description

How to fill out Cuyahoga Ohio Financial Power Of Attorney?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Cuyahoga Ohio Financial Power of Attorney or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Cuyahoga Ohio Financial Power of Attorney adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Cuyahoga Ohio Financial Power of Attorney is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!