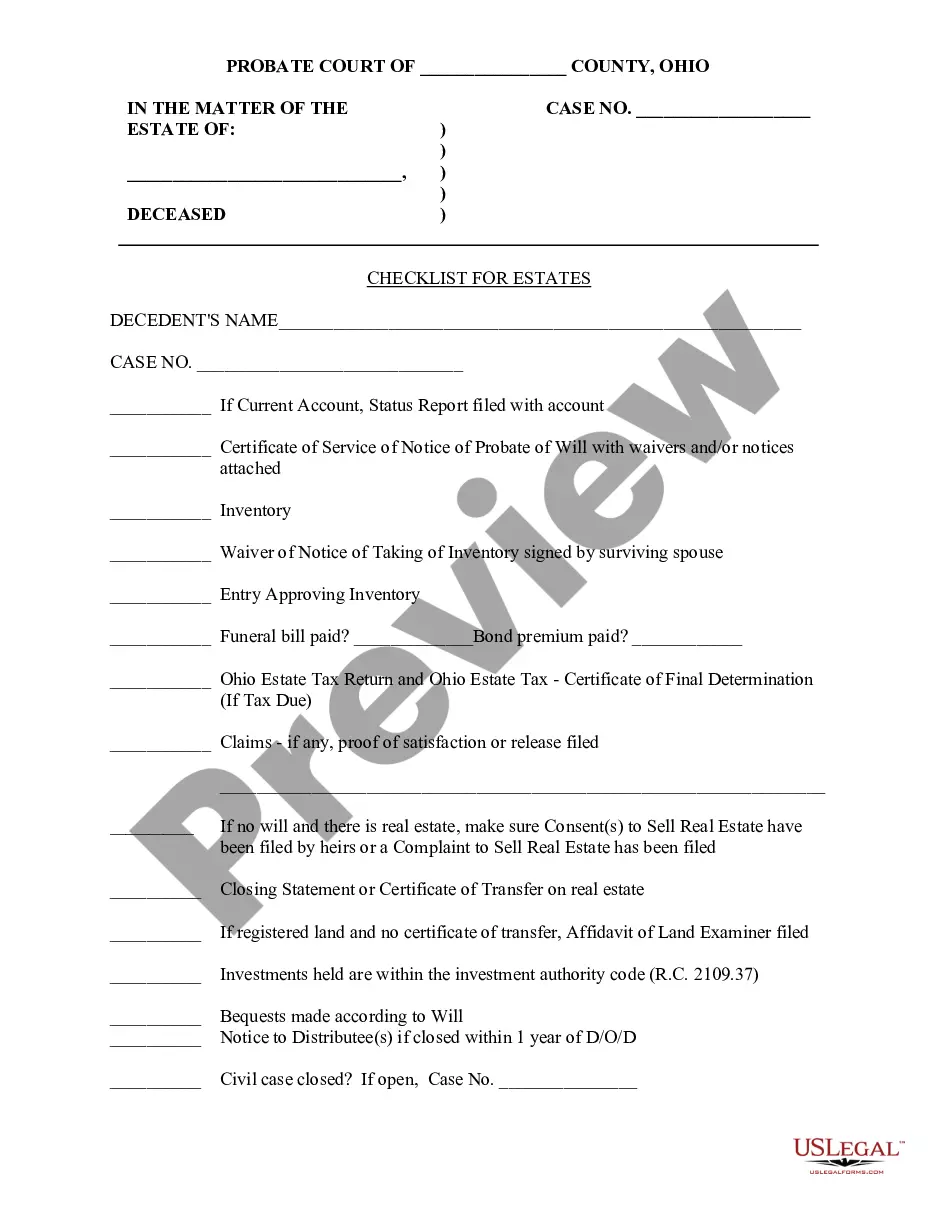

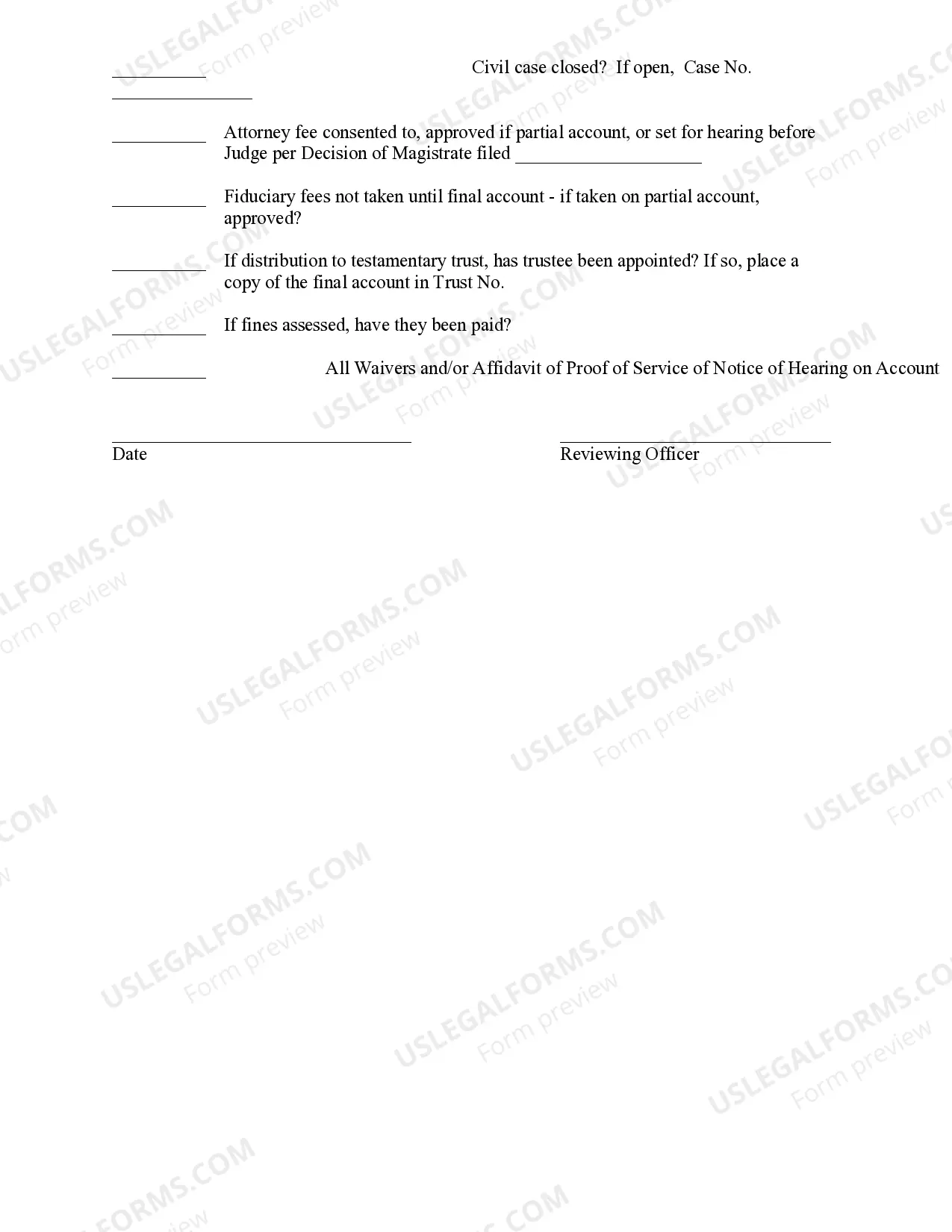

This sample form is a Checklist for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Title: Cincinnati Ohio Checklist for Estates: A Comprehensive Guideline for Executors Introduction: When it comes to managing an estate in Cincinnati, Ohio, executors face numerous tasks that require thorough planning and organization. This detailed checklist provides an overview of the essential steps involved in estate management, ensuring a smooth and efficient process for executors. Types of Cincinnati Ohio Checklists for Estates: 1. Probate Checklist: — Assets: Compile an inventory of the decedent's assets, including real estate, bank accounts, investments, vehicles, and personal possessions. — Liabilities: Identify any outstanding debts such as mortgages, loans, credit card bills, and taxes. — Estate Administration: Determine if probate is necessary, appoint an executor, and initiate probate proceedings if required. — Notification: Notify appropriate parties, including beneficiaries, creditors, and government agencies, as per legal requirements. — Valuation and Appraisal: Obtain professional appraisals for real estate, valuable items, and collectibles. — Financial Management: Open an estate bank account and manage finances, including income, expenses, and settlements. — Distribution: Determine the distribution plan according to the will or intestate laws, ensuring compliance with legal requirements. — Estate Tax: Determine estate tax obligations and file appropriate tax returns. 2. Estate Planning Checklist: — Create a Will: Ensure that the decedent's last will and testament is properly drafted, signed, and witnessed to reflect their wishes. — Trusts: Review and manage any existing trusts, ensuring proper administration and potential distribution to beneficiaries. — Beneficiaries: Identify and record the beneficiaries of the estate, considering any necessary updates or changes. — Power of Attorney: Determine if the decedent had assigned a power of attorney and ensure proper documentation and authority for decision-making. — Healthcare Directive: Verify the existence and validity of any healthcare directives, such as living wills or medical power of attorney documents. — Guardianship: If applicable, identify and appoint guardians for minor children or dependents. — Digital Assets: Record and manage digital assets, including online accounts, websites, social media, and email accounts. — Philanthropy: If desired, outline any charitable contributions or donations the decedent wished to make. — Executor Selection: Choose a reliable and qualified executor who will act in accordance with the estate plan. 3. Estate Administration Checklist: — Notify Relevant Parties: Inform beneficiaries, creditors, financial institutions, and government agencies about the decedent's passing. — Gather Documentation: Collect all necessary documents such as death certificates, wills, trusts, deeds, titles, insurance policies, and financial statements. — Property Management: Safeguard properties and assets, ensure appropriate insurance coverage, and maintain property during the administration process. — Debts and Claims: Address outstanding debts, settle claims, negotiate or contest debts if necessary. Accountinggs and Inventories: Prepare thorough and accurate inventories of assets, as well as accounting of income, expenses, and distributions. — Tax Filings: Manage all tax-related responsibilities, including filing income tax returns and estate tax returns. — Distribution and Closing: Distribute assets as per the estate plan, obtain receipts and releases from beneficiaries, close the estate, and file necessary documentation with the court. Conclusion: This comprehensive Cincinnati Ohio Checklist for Estates serves as an invaluable tool for executors, providing a detailed roadmap for successfully administering and managing estates. By following this checklist, executors can ensure that all legal requirements are met, beneficiaries are properly informed and included, and the estate is settled efficiently and fairly.