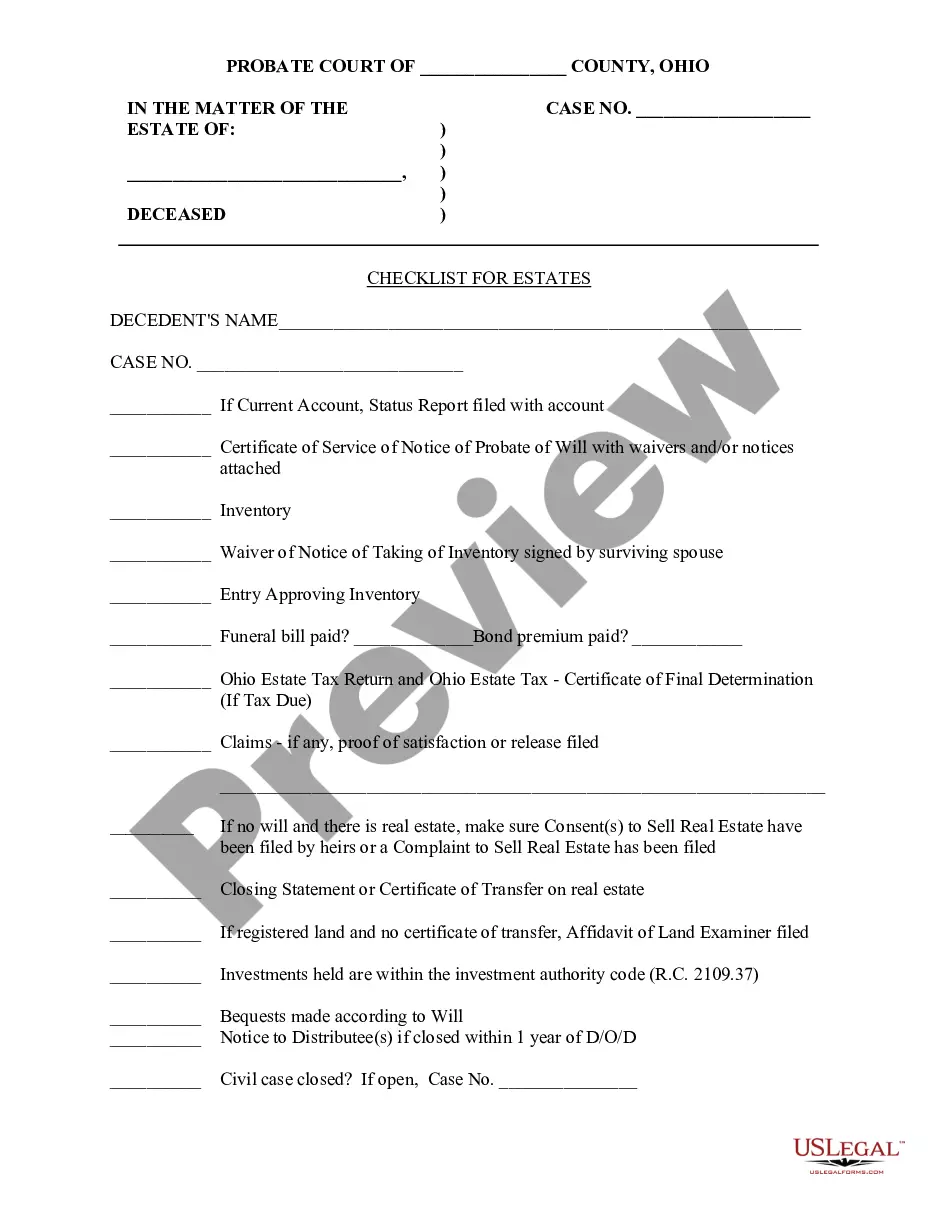

This sample form is a Checklist for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

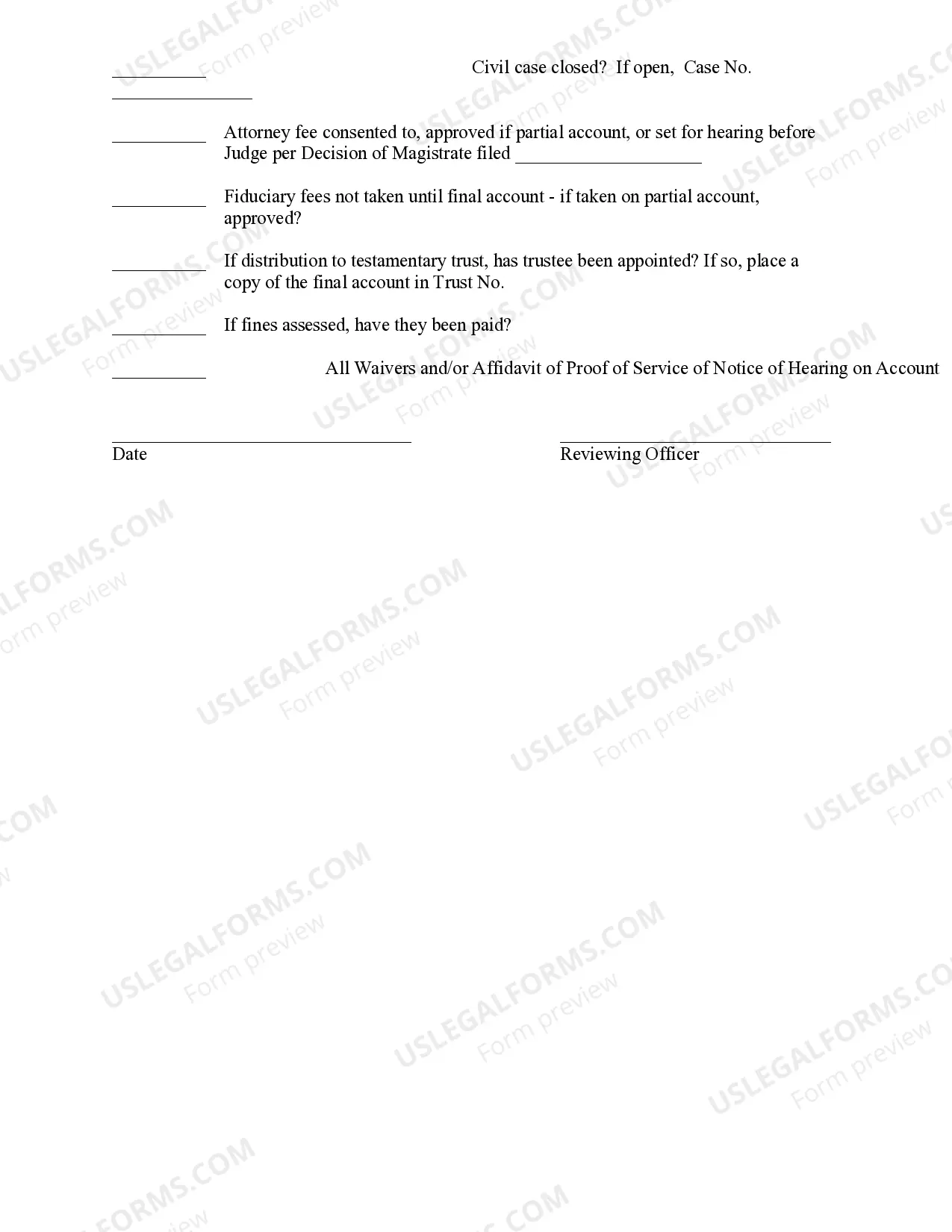

Columbus Ohio Checklist for Estates is a comprehensive list of tasks and requirements that need to be considered when administering an estate in Columbus, Ohio. It assists individuals responsible for managing an estate in ensuring that all necessary steps are taken and obligations fulfilled following the passing of a loved one. The checklist typically includes various categories and tasks, including legal and administrative matters, financial obligations, documentation, property management, and distribution of assets. Each category is further divided into specific tasks that need to be completed. Relevant keywords that may be included in the checklist are: 1. Legal and administrative matters: This category includes tasks such as notifying relevant authorities, obtaining death certificates, initiating probate proceedings if applicable, and appointing an executor or administrator. 2. Financial obligations: This segment involves tasks like notifying banks and financial institutions, locating and inventorying assets, securing valuables, paying off debts, filing tax returns, and settling outstanding liabilities. 3. Documentation: Here, essential documents such as wills, trusts, insurance policies, and investment statements are gathered, reviewed, and updated as required. It may also involve obtaining necessary permissions and certifications. 4. Property management: Tasks within this category revolve around managing and maintaining real estate properties, rental assets, or personal property, which might include appraisal, insurance coverage, maintenance, and utility transfers. 5. Asset distribution: This segment deals with the identification and distribution of the deceased person's assets in accordance with their will or the applicable laws of intestacy. It may involve working with attorneys, financial advisors, and other professionals to allocate assets among beneficiaries. It is worth noting that there might be different types of Columbus Ohio Checklist for Estates tailored to specific situations or legal frameworks. For example, there might be a separate checklist for estates where a valid will exists, as opposed to estates without a will, also known as intestate estates. Additionally, if the estate is subject to complex tax situations, such as federal estate tax, a specialized checklist may be required to address those specific obligations. These checklists are designed to guide individuals through the estate administration process, ensuring they do not overlook any crucial tasks, adhere to legal requirements, and ultimately successfully carry out their responsibilities as estate managers in Columbus, Ohio.