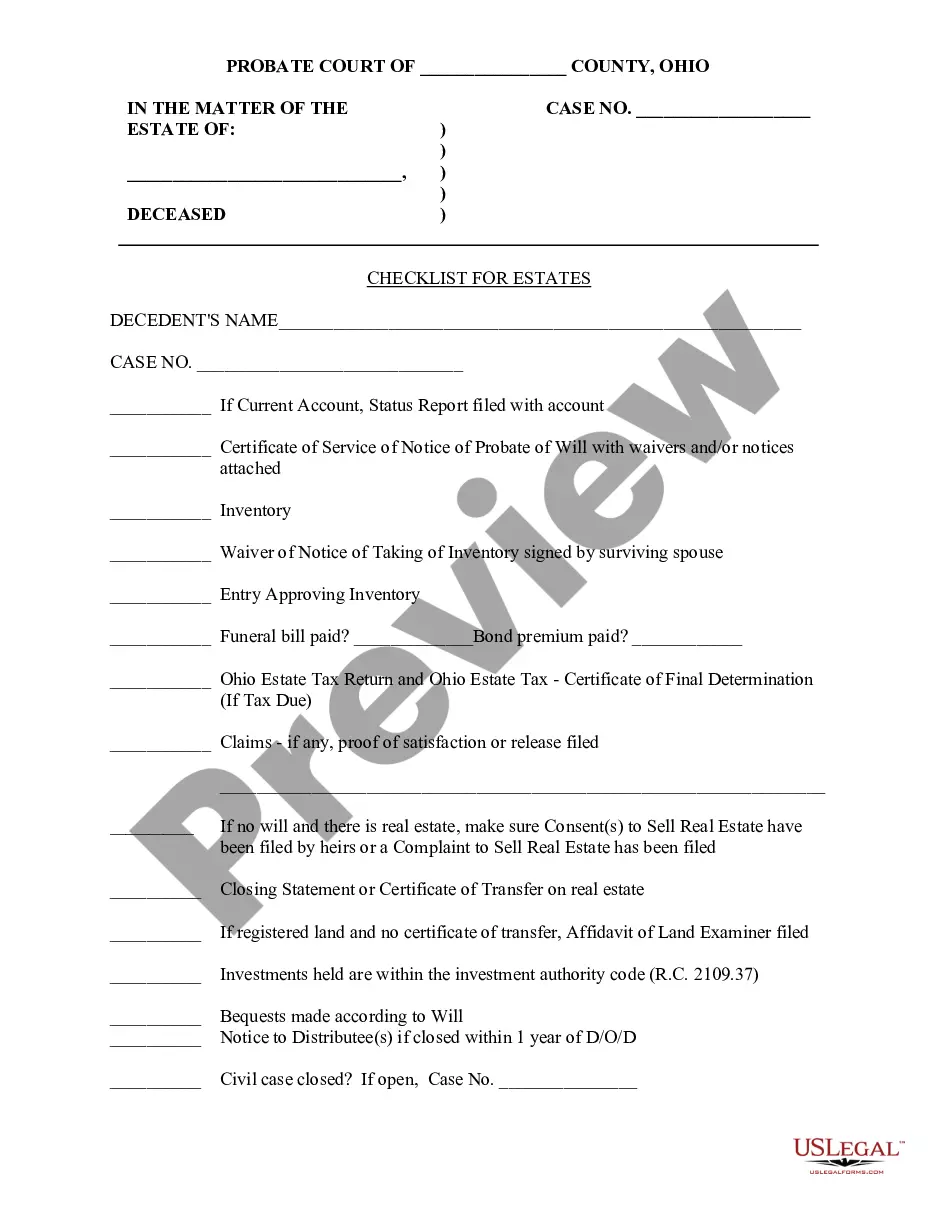

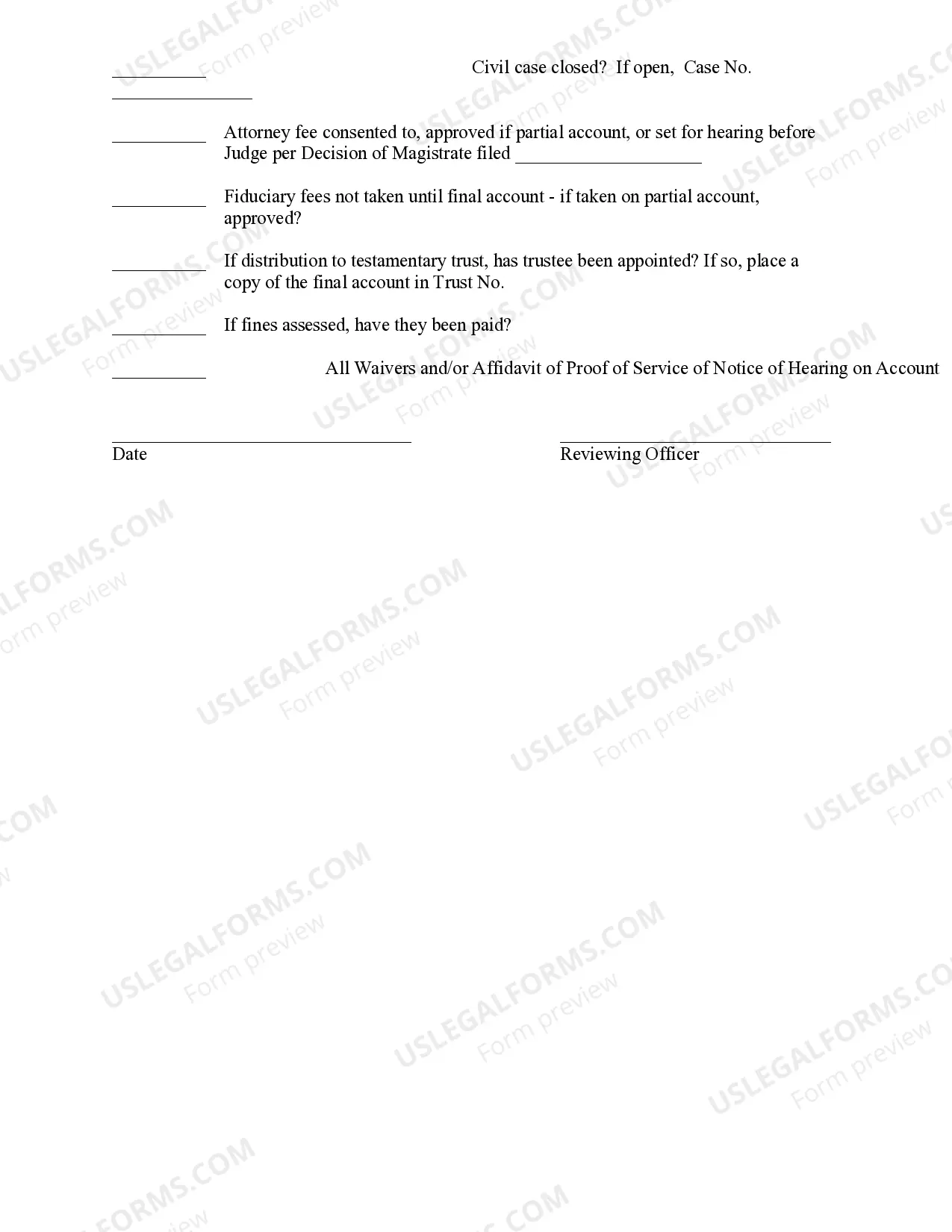

This sample form is a Checklist for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Title: All You Need to Know About Cuyahoga Ohio Checklist for Estates Introduction: An estate in Cuyahoga, Ohio, requires careful management and administration after a person's passing. This article provides a comprehensive guide to the Cuyahoga Ohio Checklist for Estates. We will explore the important steps and key considerations involved in administering an estate, taking into account various types of checklists that are commonly used for different estate scenarios. Key Keywords: Cuyahoga Ohio, Checklist for Estates 1. The Importance of Estate Administration in Cuyahoga Ohio: — Understand the significance of estate administration and the need for meticulous organization. — Overview of the legal framework governing estates in Cuyahoga, Ohio. — The role and responsibilities of an executor or administrator in managing the estate. 2. Probate Process in Cuyahoga Ohio: — Step-by-step guide through the probate process in Cuyahoga County. — Filing necessary court documents and obtaining letters of authority. — Navigating the court system for probate proceedings. 3. Cuyahoga Ohio Checklist for Estates: General Requirements: — Compile an inventory of assets and debts of the deceased. — Notify relevant parties such as banks, creditors, and beneficiaries. — Determine whether the estate qualifies for small estate administration. 4. Type 1: Checklist for Intestate Estates (No Will): — Steps involved in administering an estate when the deceased does not have a valid will. — Overview of the rules for distribution of assets among heirs. 5. Type 2: Checklist for Testate Estates (With Will): — Understanding the importance of a valid will in estate administration. — Outlining the steps required to execute the terms of the will in Cuyahoga County. 6. Type 3: Checklist for Trust Estates: — Exploring the specific requirements for estates with a valid trust. — Overview of trust administration procedures and asset distribution. 7. Tax and Financial Considerations: — Identifying and settling outstanding tax liabilities of the deceased. — Understanding the implications of estate taxes in Cuyahoga County. 8. Additional Considerations and Challenges: — Dealing with unique estate scenarios, such as guardianship of minor children or incapacitated adults. — Addressing potential disputes and contested estates. — Working with professionals such as attorneys, accountants, and appraisers for smooth estate administration. Conclusion: Administering an estate in Cuyahoga, Ohio, can be a complex and time-consuming process. By following the Cuyahoga Ohio Checklist for Estates, individuals can ensure that their responsibilities as executors or administrators are fulfilled effectively and efficiently. Whether dealing with intestate estates, testate estates, or trust estates, it is crucial to be well-informed about the specific requirements and considerations relevant to each case. Seek professional guidance in order to navigate through the estate administration process with confidence and accuracy.Title: All You Need to Know About Cuyahoga Ohio Checklist for Estates Introduction: An estate in Cuyahoga, Ohio, requires careful management and administration after a person's passing. This article provides a comprehensive guide to the Cuyahoga Ohio Checklist for Estates. We will explore the important steps and key considerations involved in administering an estate, taking into account various types of checklists that are commonly used for different estate scenarios. Key Keywords: Cuyahoga Ohio, Checklist for Estates 1. The Importance of Estate Administration in Cuyahoga Ohio: — Understand the significance of estate administration and the need for meticulous organization. — Overview of the legal framework governing estates in Cuyahoga, Ohio. — The role and responsibilities of an executor or administrator in managing the estate. 2. Probate Process in Cuyahoga Ohio: — Step-by-step guide through the probate process in Cuyahoga County. — Filing necessary court documents and obtaining letters of authority. — Navigating the court system for probate proceedings. 3. Cuyahoga Ohio Checklist for Estates: General Requirements: — Compile an inventory of assets and debts of the deceased. — Notify relevant parties such as banks, creditors, and beneficiaries. — Determine whether the estate qualifies for small estate administration. 4. Type 1: Checklist for Intestate Estates (No Will): — Steps involved in administering an estate when the deceased does not have a valid will. — Overview of the rules for distribution of assets among heirs. 5. Type 2: Checklist for Testate Estates (With Will): — Understanding the importance of a valid will in estate administration. — Outlining the steps required to execute the terms of the will in Cuyahoga County. 6. Type 3: Checklist for Trust Estates: — Exploring the specific requirements for estates with a valid trust. — Overview of trust administration procedures and asset distribution. 7. Tax and Financial Considerations: — Identifying and settling outstanding tax liabilities of the deceased. — Understanding the implications of estate taxes in Cuyahoga County. 8. Additional Considerations and Challenges: — Dealing with unique estate scenarios, such as guardianship of minor children or incapacitated adults. — Addressing potential disputes and contested estates. — Working with professionals such as attorneys, accountants, and appraisers for smooth estate administration. Conclusion: Administering an estate in Cuyahoga, Ohio, can be a complex and time-consuming process. By following the Cuyahoga Ohio Checklist for Estates, individuals can ensure that their responsibilities as executors or administrators are fulfilled effectively and efficiently. Whether dealing with intestate estates, testate estates, or trust estates, it is crucial to be well-informed about the specific requirements and considerations relevant to each case. Seek professional guidance in order to navigate through the estate administration process with confidence and accuracy.