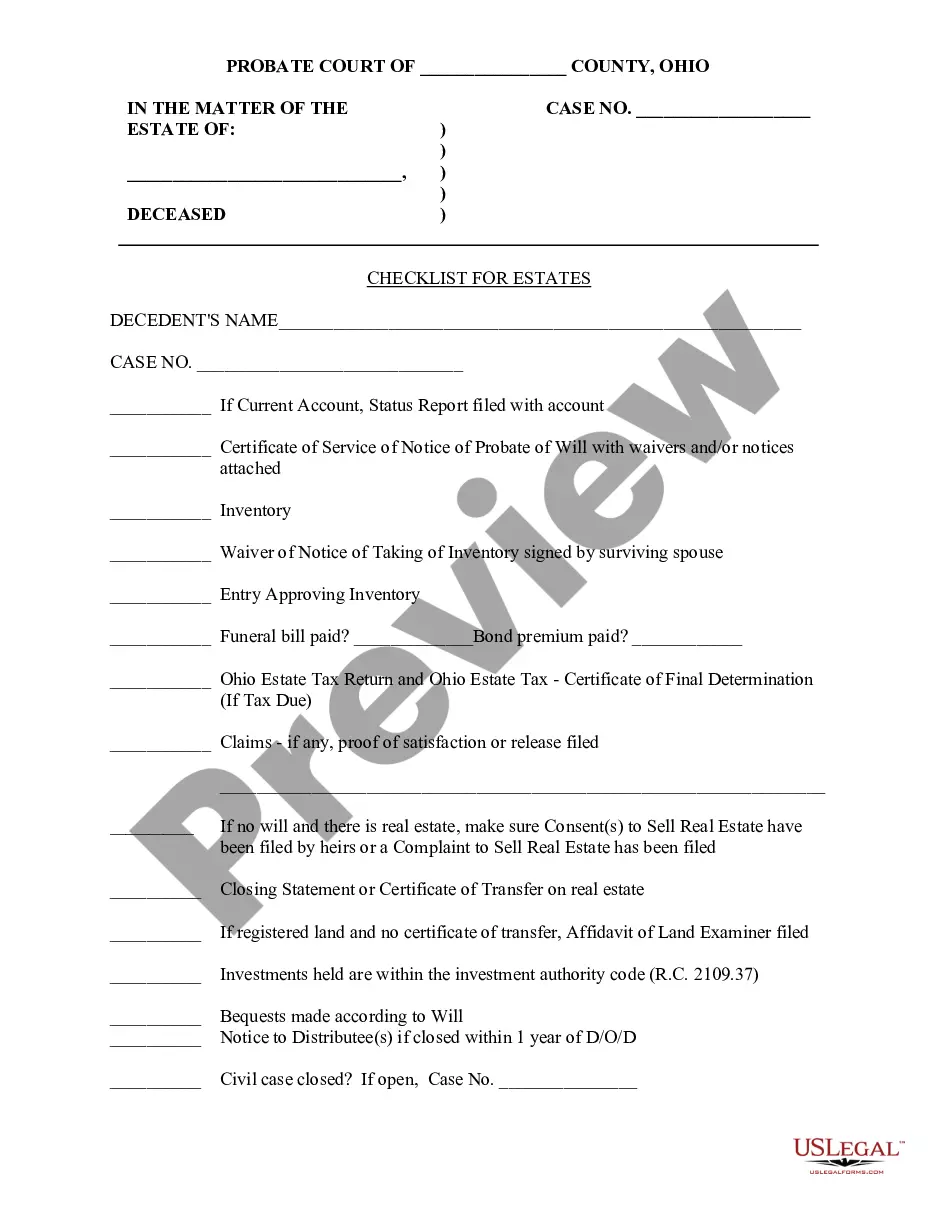

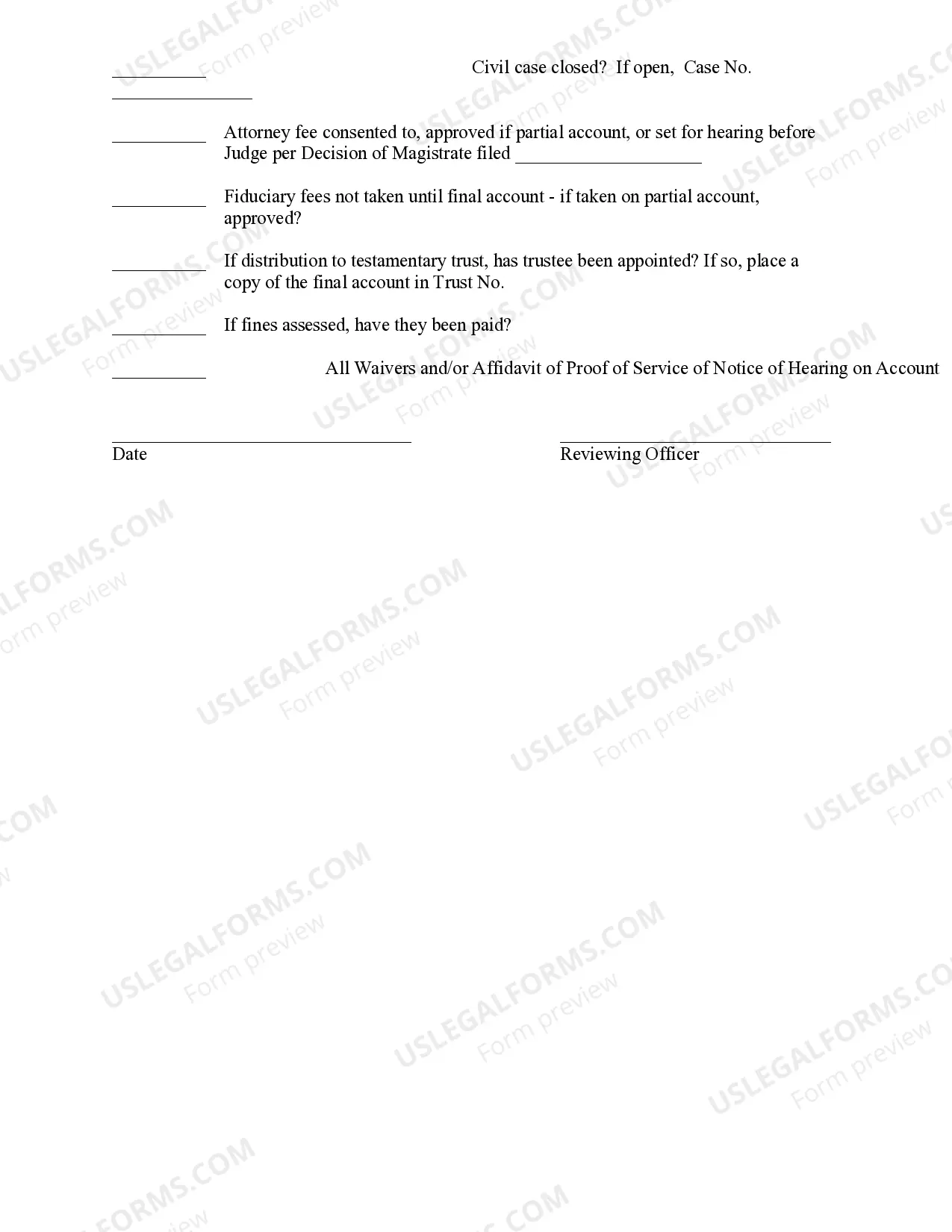

This sample form is a Checklist for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Dayton Ohio Checklist for Estates is a comprehensive guide that helps individuals navigate the process of settling estates and ensuring a smooth transition of assets after a loved one's passing. This checklist acts as a valuable resource for executors, administrators, or beneficiaries tasked with managing an estate in Dayton, Ohio. 1. Probate Process: — Understanding the probate process in Dayton, Ohio — Gathering essential documents required for probate — Initiating the probate process with the court — Appointing an executor or administrator for the estate 2. Notify Relevant Parties: — Notifying family members, close friends, and beneficiaries about the death — Informing employers, banks, insurance companies, and creditors about the passing — Cancelling subscriptions, services, and memberships of the deceased — Forwarding mail to the executor's address 3. Asset Identification: — Identifying all assets owned by the deceased, such as real estate, bank accounts, investments, and vehicles — Gathering necessary documentation to support ownership claims — Conducting appraisals for valuable assets like jewelry, art, or collectibles 4. Debts and Liabilities: — Compiling a list of debts, loans, and outstanding payments owed by the deceased — Communicating with creditors to negotiate payment or resolve outstanding issues — Paying off debts using available estate funds 5. Estate Tax Obligations: — Understanding and fulfilling any estate tax obligations in Dayton, Ohio — Filing necessary tax forms and meeting deadlines — Seeking professional assistance when needed to accurately calculate and settle estate taxes 6. Estate Distribution: — Preparing a comprehensive inventory of all assets and their values — Following the instructions outlined in the deceased's will — Distributing assets to beneficiaries in accordance with the probate court's approval — Settling any disputes that may arise among beneficiaries or other interested parties 7. Finalizing Estate Affairs: — Closing bank accounts and investment portfolios — Canceling credit cards and closing any outstanding loans — Transferring ownership of property or assets to new owners — Preparing a final accounting of the estate's financial transactions Different types of Dayton Ohio Checklists for Estates could include variations based on the complexity of the estate, the presence or absence of a will, or if there are multiple beneficiaries involved. These checklists may also be tailored for specific scenarios, such as an estate with significant real estate holdings or one that involves business interests.Dayton Ohio Checklist for Estates is a comprehensive guide that helps individuals navigate the process of settling estates and ensuring a smooth transition of assets after a loved one's passing. This checklist acts as a valuable resource for executors, administrators, or beneficiaries tasked with managing an estate in Dayton, Ohio. 1. Probate Process: — Understanding the probate process in Dayton, Ohio — Gathering essential documents required for probate — Initiating the probate process with the court — Appointing an executor or administrator for the estate 2. Notify Relevant Parties: — Notifying family members, close friends, and beneficiaries about the death — Informing employers, banks, insurance companies, and creditors about the passing — Cancelling subscriptions, services, and memberships of the deceased — Forwarding mail to the executor's address 3. Asset Identification: — Identifying all assets owned by the deceased, such as real estate, bank accounts, investments, and vehicles — Gathering necessary documentation to support ownership claims — Conducting appraisals for valuable assets like jewelry, art, or collectibles 4. Debts and Liabilities: — Compiling a list of debts, loans, and outstanding payments owed by the deceased — Communicating with creditors to negotiate payment or resolve outstanding issues — Paying off debts using available estate funds 5. Estate Tax Obligations: — Understanding and fulfilling any estate tax obligations in Dayton, Ohio — Filing necessary tax forms and meeting deadlines — Seeking professional assistance when needed to accurately calculate and settle estate taxes 6. Estate Distribution: — Preparing a comprehensive inventory of all assets and their values — Following the instructions outlined in the deceased's will — Distributing assets to beneficiaries in accordance with the probate court's approval — Settling any disputes that may arise among beneficiaries or other interested parties 7. Finalizing Estate Affairs: — Closing bank accounts and investment portfolios — Canceling credit cards and closing any outstanding loans — Transferring ownership of property or assets to new owners — Preparing a final accounting of the estate's financial transactions Different types of Dayton Ohio Checklists for Estates could include variations based on the complexity of the estate, the presence or absence of a will, or if there are multiple beneficiaries involved. These checklists may also be tailored for specific scenarios, such as an estate with significant real estate holdings or one that involves business interests.