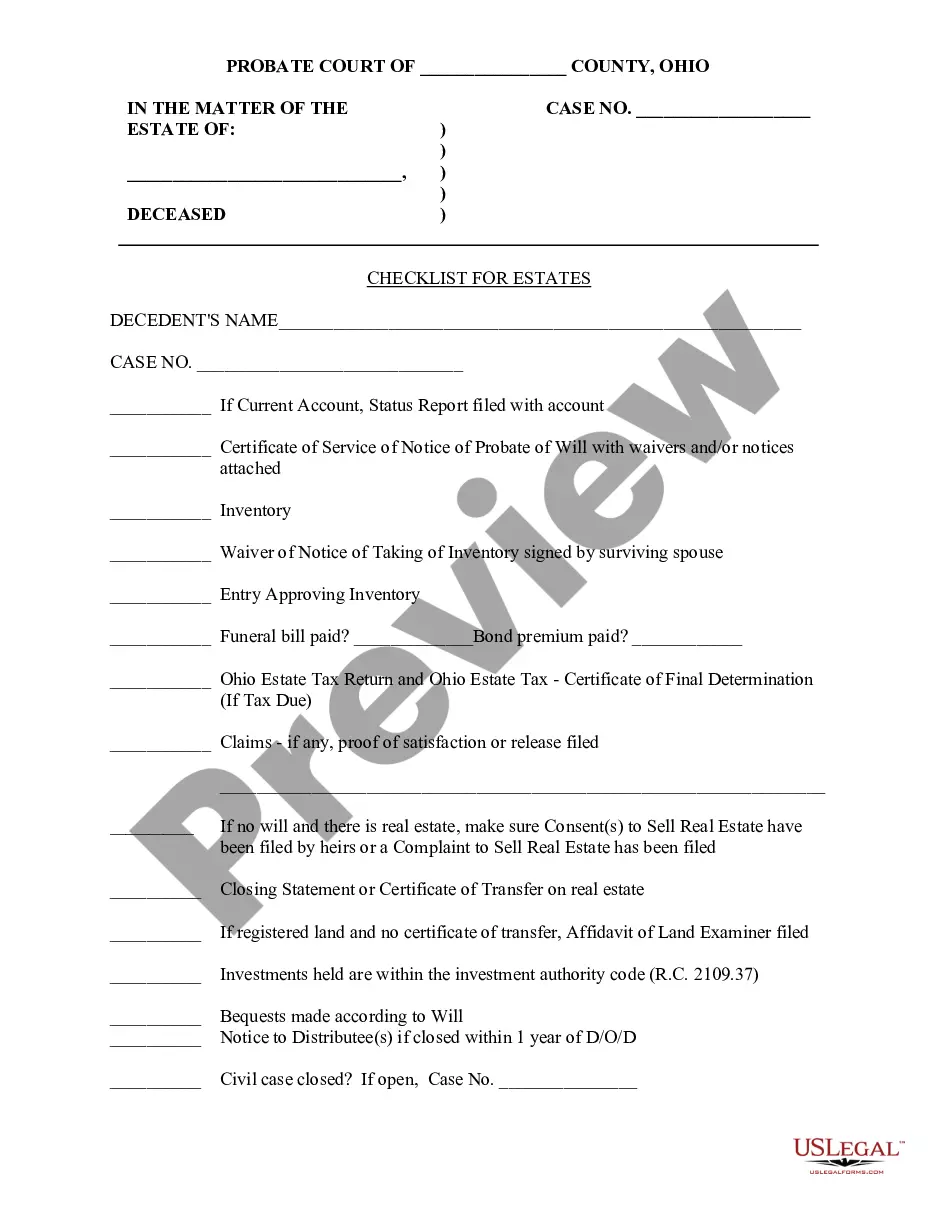

This sample form is a Checklist for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

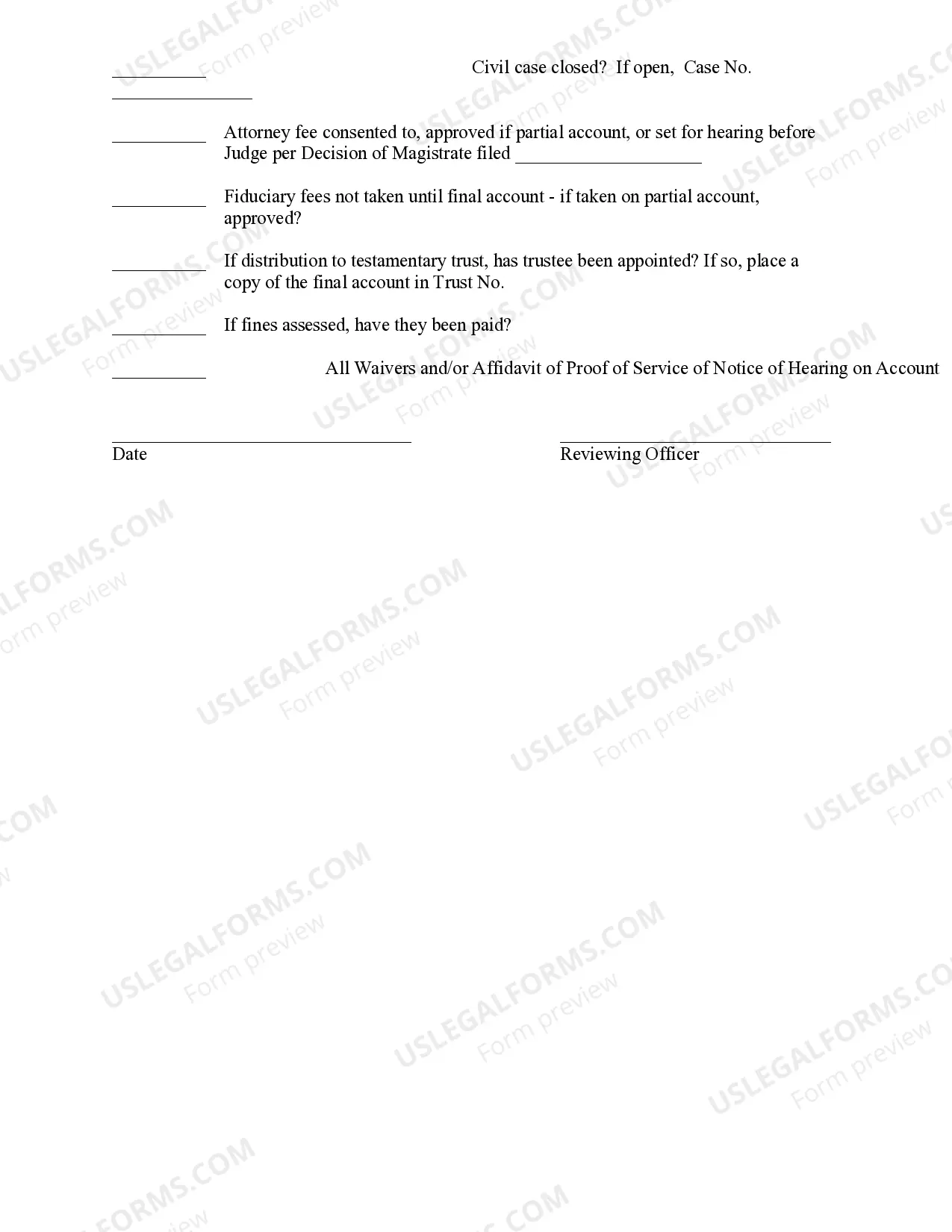

Franklin Ohio Checklist for Estates is a comprehensive guide that outlines the necessary steps and tasks to be completed when settling an estate in Franklin, Ohio. Whether you are an executor, administrator, or a family member, this checklist will help ensure that all important aspects of the estate settlement process are handled properly. Here is an extensive overview of the Franklin Ohio Checklist for Estates: 1. Obtain Probate: Initiate the probate process by filing the necessary documents with the Franklin County Probate Court. This includes filing the will (if any) and the application for appointment of executor or administrator. 2. Notify Interested Parties: Notify all interested parties, including beneficiaries, heirs, and creditors, about the current estate administration. 3. Appraise Assets: Take inventory of all the assets of the estate, including real estate, bank accounts, investments, personal property, and any businesses. Hire a professional appraiser if required. 4. Obtain Death Certificates: Request multiple certified copies of the decedent's death certificate from the Ohio Department of Health or the funeral home. 5. Open an Estate Bank Account: Establish a separate bank account in the name of the estate to handle financial transactions and pay any outstanding bills or debts. 6. Contact Creditors: Identify and notify all creditors of the estate, providing them with the necessary documentation, such as the creditor’s claim forms, to file their claims within the specified time frame. 7. File Tax Returns: Prepare and file the decedent's final income tax return, federal estate tax return (if applicable), and Ohio estate tax return (if applicable). Seek assistance from a qualified tax professional for accurate filing. 8. Inventory and Appraise Personal Property: Create a detailed list of the decedent's personal belongings, determine their value, and appropriately distribute them as per the will or Ohio intestate laws. 9. Pay Outstanding Debts: Use available estate funds to settle any outstanding debts, such as funeral expenses, medical bills, and credit card debts. 10. Mediate Disputes: Address any conflicts or disputes that may arise during the estate settlement process, ensuring that they are resolved amicably and in compliance with Ohio probate laws. 11. Distribute Assets: Following the probate court's approval, distribute the remaining estate assets to the beneficiaries and heirs according to the decedent's wishes or Ohio intestacy laws. Variations of the Franklin Ohio Checklist for Estates may include: 1. Franklin Ohio Probate Checklist: A detailed list specifically focusing on the necessary steps to be taken during the probate process in Franklin, Ohio. 2. Franklin Ohio Estate Inventory Checklist: A comprehensive checklist specifically designed for creating an inventory of assets and their valuation. 3. Franklin Ohio Estate Tax Filing Checklist: A specialized checklist guiding the executor or administrator through the process of filing federal and state estate tax returns to the state of Ohio. In conclusion, the Franklin Ohio Checklist for Estates serves as a valuable tool to ensure that the estate settlement process in Franklin, Ohio is carried out diligently and in compliance with legal requirements.