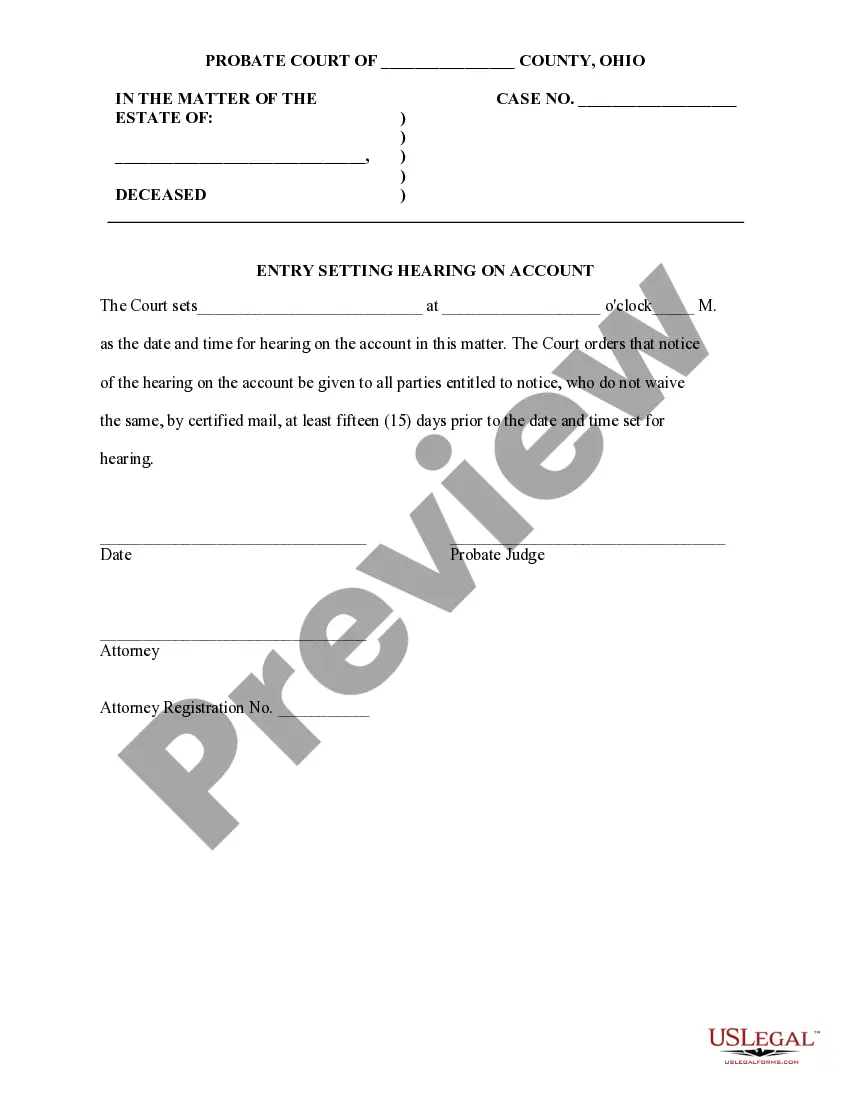

This sample form is an Entry Setting Hearing on Account document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Cuyahoga Ohio Entry Setting Hearing on Account is a legal proceeding that takes place in the Cuyahoga County Court system. It involves the establishment and scheduling of a hearing regarding an account-related matter. Additionally, there are various types of Cuyahoga Ohio Entry Setting Hearings on Account, each addressing specific financial or legal issues. One important type of Cuyahoga Ohio Entry Setting Hearing on Account is the Debt Collection Hearing. This particular hearing is organized to address disputes related to outstanding debts, including unpaid loans, credit card debts, or unpaid bills. During this hearing, both the debtor and the creditor present their arguments regarding the debt, its validity, and any potential settlement agreements. Another type of Cuyahoga Ohio Entry Setting Hearing on Account is the Asset Disposition Hearing. This hearing is specifically designed to determine the appropriate distribution or sale of assets in cases such as bankruptcy, foreclosure, or divorce. It provides a platform for individuals involved in these proceedings to present evidence, provide valuations, and propose the division of assets. Additionally, the Probate Accounting Hearing is a common type of Cuyahoga Ohio Entry Setting Hearing on Account. This hearing focuses on the financial administration and management of an estate after someone's passing. Executors or administrators of the estate provide a detailed financial report, including assets, debts, and expenses, to the court. Beneficiaries and other interested parties can then review the report and raise any concerns or objections during the hearing. Lastly, a Receivership Accounting Hearing may also fall under the category of Cuyahoga Ohio Entry Setting Hearing on Account. This type of hearing occurs when a court appoints a receiver to manage and oversee the financial affairs of a business, organization, or individual to protect the interests of creditors or other parties. In summary, the Cuyahoga Ohio Entry Setting Hearing on Account deals with a range of account-related matters, such as debt collection, asset disposition, probate accounting, and receivership accounting. These hearings provide a platform for individuals to present their cases, resolve disputes, and ensure fair and just financial outcomes.Cuyahoga Ohio Entry Setting Hearing on Account is a legal proceeding that takes place in the Cuyahoga County Court system. It involves the establishment and scheduling of a hearing regarding an account-related matter. Additionally, there are various types of Cuyahoga Ohio Entry Setting Hearings on Account, each addressing specific financial or legal issues. One important type of Cuyahoga Ohio Entry Setting Hearing on Account is the Debt Collection Hearing. This particular hearing is organized to address disputes related to outstanding debts, including unpaid loans, credit card debts, or unpaid bills. During this hearing, both the debtor and the creditor present their arguments regarding the debt, its validity, and any potential settlement agreements. Another type of Cuyahoga Ohio Entry Setting Hearing on Account is the Asset Disposition Hearing. This hearing is specifically designed to determine the appropriate distribution or sale of assets in cases such as bankruptcy, foreclosure, or divorce. It provides a platform for individuals involved in these proceedings to present evidence, provide valuations, and propose the division of assets. Additionally, the Probate Accounting Hearing is a common type of Cuyahoga Ohio Entry Setting Hearing on Account. This hearing focuses on the financial administration and management of an estate after someone's passing. Executors or administrators of the estate provide a detailed financial report, including assets, debts, and expenses, to the court. Beneficiaries and other interested parties can then review the report and raise any concerns or objections during the hearing. Lastly, a Receivership Accounting Hearing may also fall under the category of Cuyahoga Ohio Entry Setting Hearing on Account. This type of hearing occurs when a court appoints a receiver to manage and oversee the financial affairs of a business, organization, or individual to protect the interests of creditors or other parties. In summary, the Cuyahoga Ohio Entry Setting Hearing on Account deals with a range of account-related matters, such as debt collection, asset disposition, probate accounting, and receivership accounting. These hearings provide a platform for individuals to present their cases, resolve disputes, and ensure fair and just financial outcomes.