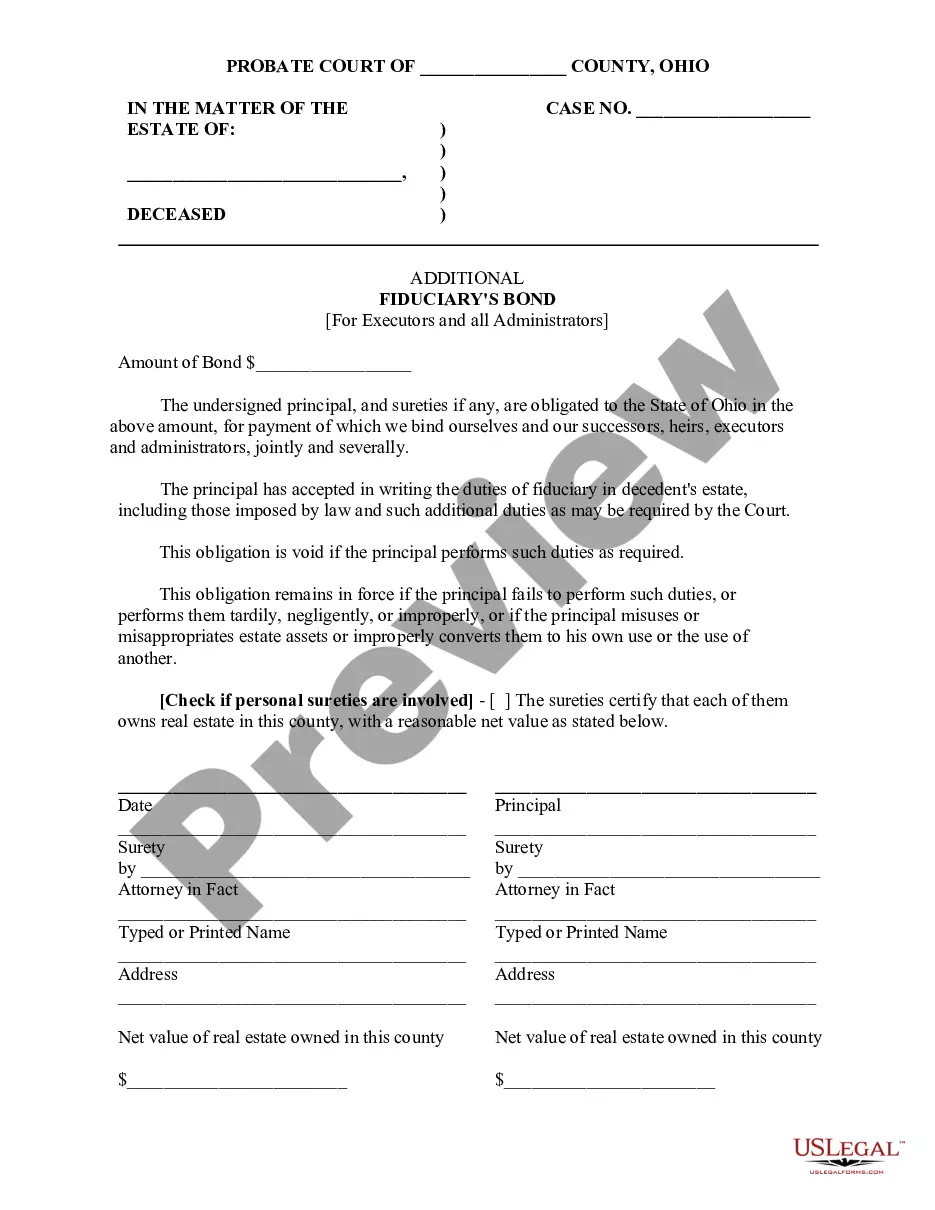

This sample form is an Additional Fiduciary's Bond document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

The Cuyahoga Ohio Additional Fiduciary's Bond is a type of surety bond required by the Cuyahoga County Probate Court in the state of Ohio. It acts as a financial guarantee that protects the interests of the beneficiaries and heirs involved in fiduciary transactions within the county. This bond is mandatory for individuals or entities appointed as fiduciaries, such as executors, administrators, guardians, trustees, or conservators, who are entrusted with managing another person's assets or affairs. By obtaining the Cuyahoga Ohio Additional Fiduciary's Bond, these fiduciaries provide an assurance to the court and all interested parties that they will fulfill their responsibilities faithfully, honestly, and in compliance with the applicable laws and regulations. This bond serves as a safeguard against any potential mismanagement, fraud, or negligence committed by the fiduciary during the discharge of their duties. In case the fiduciary breaches their obligations, resulting in financial losses or harm to beneficiaries, a claim can be filed by the affected parties. If the claim is found valid, the surety company issuing the bond will provide compensation up to the bond's limit. However, the fiduciary is ultimately held accountable for any damages incurred and may be required to reimburse the surety company in such circumstances. It's important to note that there are different types of Cuyahoga Ohio Additional Fiduciary's Bond, each serving a specific purpose: 1. Executor's Bond: Executors, also known as personal representatives, are appointed to administer the estate of a deceased individual according to their will. The executor's bond ensures that they will manage the affairs impartially, distribute assets correctly, and fulfill all legal obligations. 2. Administrator's Bond: When a person passes away without leaving a valid will, an administrator is appointed by the court to oversee the estate's distribution. The administrator's bond is similar to the executor's bond, providing security that the administrator will fulfill their duties lawfully and protect the interests of the rightful heirs. 3. Guardian's Bond: If a minor child or incapacitated person requires a legal guardian to manage their personal and financial affairs, the court may require a guardian's bond. This bond guarantees that the guardian will act in the best interests of the ward, managing their assets prudently and ethically. 4. Trustee's Bond: Trustees are responsible for managing and protecting assets held in a trust for the benefit of designated beneficiaries. The trustee's bond assures that the trustee will act in accordance with the trust document, avoiding any self-dealing or conflicts of interest. By imposing the Cuyahoga Ohio Additional Fiduciary's Bond requirement, the court aims to safeguard the assets and interests of beneficiaries and ensure that fiduciaries fulfill their duties with integrity and competence.The Cuyahoga Ohio Additional Fiduciary's Bond is a type of surety bond required by the Cuyahoga County Probate Court in the state of Ohio. It acts as a financial guarantee that protects the interests of the beneficiaries and heirs involved in fiduciary transactions within the county. This bond is mandatory for individuals or entities appointed as fiduciaries, such as executors, administrators, guardians, trustees, or conservators, who are entrusted with managing another person's assets or affairs. By obtaining the Cuyahoga Ohio Additional Fiduciary's Bond, these fiduciaries provide an assurance to the court and all interested parties that they will fulfill their responsibilities faithfully, honestly, and in compliance with the applicable laws and regulations. This bond serves as a safeguard against any potential mismanagement, fraud, or negligence committed by the fiduciary during the discharge of their duties. In case the fiduciary breaches their obligations, resulting in financial losses or harm to beneficiaries, a claim can be filed by the affected parties. If the claim is found valid, the surety company issuing the bond will provide compensation up to the bond's limit. However, the fiduciary is ultimately held accountable for any damages incurred and may be required to reimburse the surety company in such circumstances. It's important to note that there are different types of Cuyahoga Ohio Additional Fiduciary's Bond, each serving a specific purpose: 1. Executor's Bond: Executors, also known as personal representatives, are appointed to administer the estate of a deceased individual according to their will. The executor's bond ensures that they will manage the affairs impartially, distribute assets correctly, and fulfill all legal obligations. 2. Administrator's Bond: When a person passes away without leaving a valid will, an administrator is appointed by the court to oversee the estate's distribution. The administrator's bond is similar to the executor's bond, providing security that the administrator will fulfill their duties lawfully and protect the interests of the rightful heirs. 3. Guardian's Bond: If a minor child or incapacitated person requires a legal guardian to manage their personal and financial affairs, the court may require a guardian's bond. This bond guarantees that the guardian will act in the best interests of the ward, managing their assets prudently and ethically. 4. Trustee's Bond: Trustees are responsible for managing and protecting assets held in a trust for the benefit of designated beneficiaries. The trustee's bond assures that the trustee will act in accordance with the trust document, avoiding any self-dealing or conflicts of interest. By imposing the Cuyahoga Ohio Additional Fiduciary's Bond requirement, the court aims to safeguard the assets and interests of beneficiaries and ensure that fiduciaries fulfill their duties with integrity and competence.