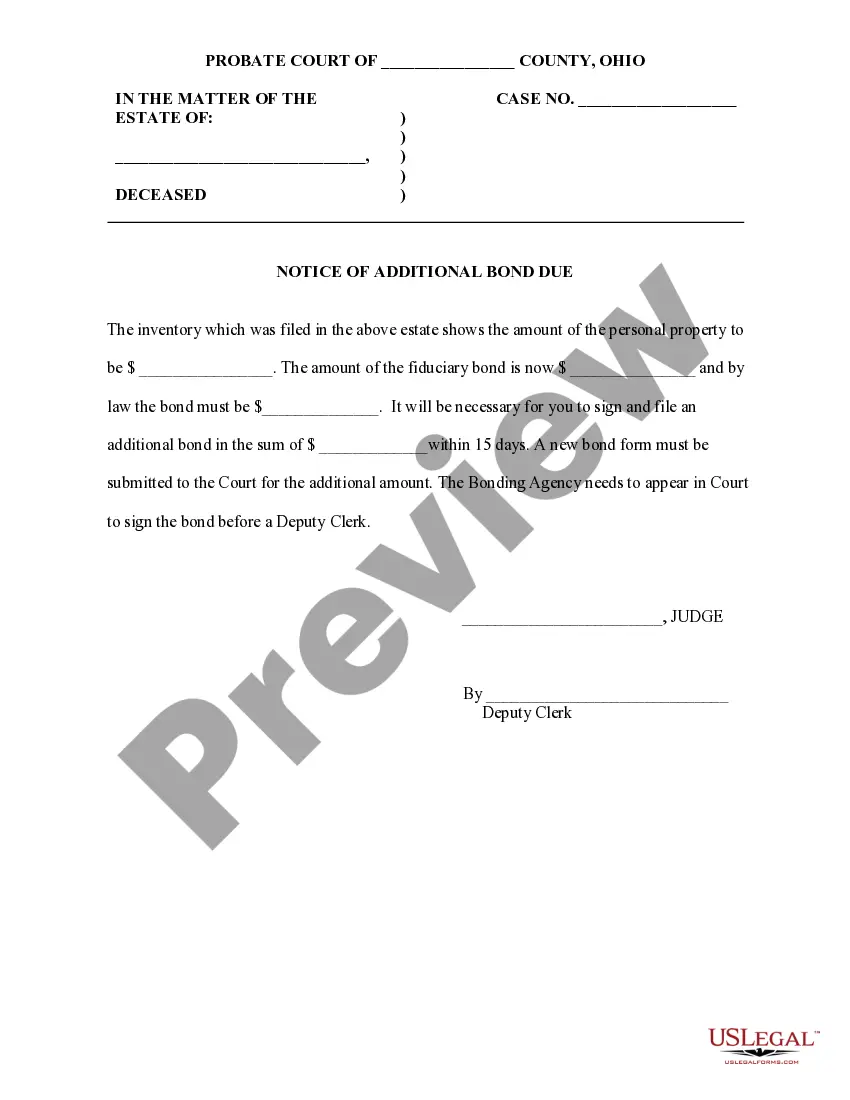

This sample form is a Notice of Additional Bond Due document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Columbus Ohio Notice of Additional Bond Due refers to an official document issued by the city of Columbus, Ohio, to notify individuals or entities regarding an additional bond payment that is owed. This notice serves as a reminder and request for payment, ensuring that the bond obligations are met on time. It is essential to understand the potential consequences of failing to pay the additional bond due, as it may result in penalties, legal actions, or other adverse effects. The notice typically includes the following key elements: 1. Identification: The Columbus Ohio Notice of Additional Bond Due will clearly identify the issuing department or agency responsible for administering the bond obligation. It may mention specific divisions or individuals to contact for any inquiries or assistance. 2. Recipient Information: The notice will contain the details of the recipient, such as their name, address, and contact information. This ensures that the document is delivered to the correct person or entity responsible for fulfilling the bond payment. 3. Bond Details: The notice will specify the pertinent information related to the bond in question. This may include the bond identification number, issue date, maturity date, and the purpose or project financed by the bond. 4. Amount Due: The notice will clearly state the additional bond payment amount that is required. It will specify the due date and provide instructions on accepted payment methods and where to make the payment. It is crucial to pay close attention to the specified deadline to avoid any penalties or consequences. 5. Penalties and Consequences: The document will outline the potential penalties or consequences resulting from non-payment or late payment of the additional bond amount. This may include interest charges, fees, or even the possibility of defaulting on the bond, leading to legal action or credit implications. It is important to note that there may be different types of Columbus Ohio Notice of Additional Bond Due based on the specific bond or project it pertains to. Some possible types or variations could include: 1. Municipal Bonds: Notices related to bonds issued by the city of Columbus for financing municipal projects, such as infrastructure improvements, schools, or public facilities. 2. Special Assessment Bonds: Notices concerning bonds issued to fund specific local improvement projects benefiting certain properties within the city, such as road repairs, sidewalk construction, or sewer system upgrades. 3. Revenue Bonds: Notices related to bonds issued based on the revenue generated from a specific project or enterprise, such as a toll road or a utility system. These bonds are typically repaid using the revenue generated by the project itself. 4. General Obligation Bonds: Notices pertaining to bonds backed by the full faith and credit of the city of Columbus, meaning they are secured by the city's taxing power. These bonds usually finance long-term capital investments such as schools, parks, or public buildings. These are just a few examples of the potential types of Columbus Ohio Notice of Additional Bond Due, and the specific terms and conditions may vary depending on the nature of the bond and the associated project. It is important for the recipients of such notices to carefully review the document, understand their obligations, and promptly fulfill the additional bond payment to avoid any negative consequences.Columbus Ohio Notice of Additional Bond Due refers to an official document issued by the city of Columbus, Ohio, to notify individuals or entities regarding an additional bond payment that is owed. This notice serves as a reminder and request for payment, ensuring that the bond obligations are met on time. It is essential to understand the potential consequences of failing to pay the additional bond due, as it may result in penalties, legal actions, or other adverse effects. The notice typically includes the following key elements: 1. Identification: The Columbus Ohio Notice of Additional Bond Due will clearly identify the issuing department or agency responsible for administering the bond obligation. It may mention specific divisions or individuals to contact for any inquiries or assistance. 2. Recipient Information: The notice will contain the details of the recipient, such as their name, address, and contact information. This ensures that the document is delivered to the correct person or entity responsible for fulfilling the bond payment. 3. Bond Details: The notice will specify the pertinent information related to the bond in question. This may include the bond identification number, issue date, maturity date, and the purpose or project financed by the bond. 4. Amount Due: The notice will clearly state the additional bond payment amount that is required. It will specify the due date and provide instructions on accepted payment methods and where to make the payment. It is crucial to pay close attention to the specified deadline to avoid any penalties or consequences. 5. Penalties and Consequences: The document will outline the potential penalties or consequences resulting from non-payment or late payment of the additional bond amount. This may include interest charges, fees, or even the possibility of defaulting on the bond, leading to legal action or credit implications. It is important to note that there may be different types of Columbus Ohio Notice of Additional Bond Due based on the specific bond or project it pertains to. Some possible types or variations could include: 1. Municipal Bonds: Notices related to bonds issued by the city of Columbus for financing municipal projects, such as infrastructure improvements, schools, or public facilities. 2. Special Assessment Bonds: Notices concerning bonds issued to fund specific local improvement projects benefiting certain properties within the city, such as road repairs, sidewalk construction, or sewer system upgrades. 3. Revenue Bonds: Notices related to bonds issued based on the revenue generated from a specific project or enterprise, such as a toll road or a utility system. These bonds are typically repaid using the revenue generated by the project itself. 4. General Obligation Bonds: Notices pertaining to bonds backed by the full faith and credit of the city of Columbus, meaning they are secured by the city's taxing power. These bonds usually finance long-term capital investments such as schools, parks, or public buildings. These are just a few examples of the potential types of Columbus Ohio Notice of Additional Bond Due, and the specific terms and conditions may vary depending on the nature of the bond and the associated project. It is important for the recipients of such notices to carefully review the document, understand their obligations, and promptly fulfill the additional bond payment to avoid any negative consequences.