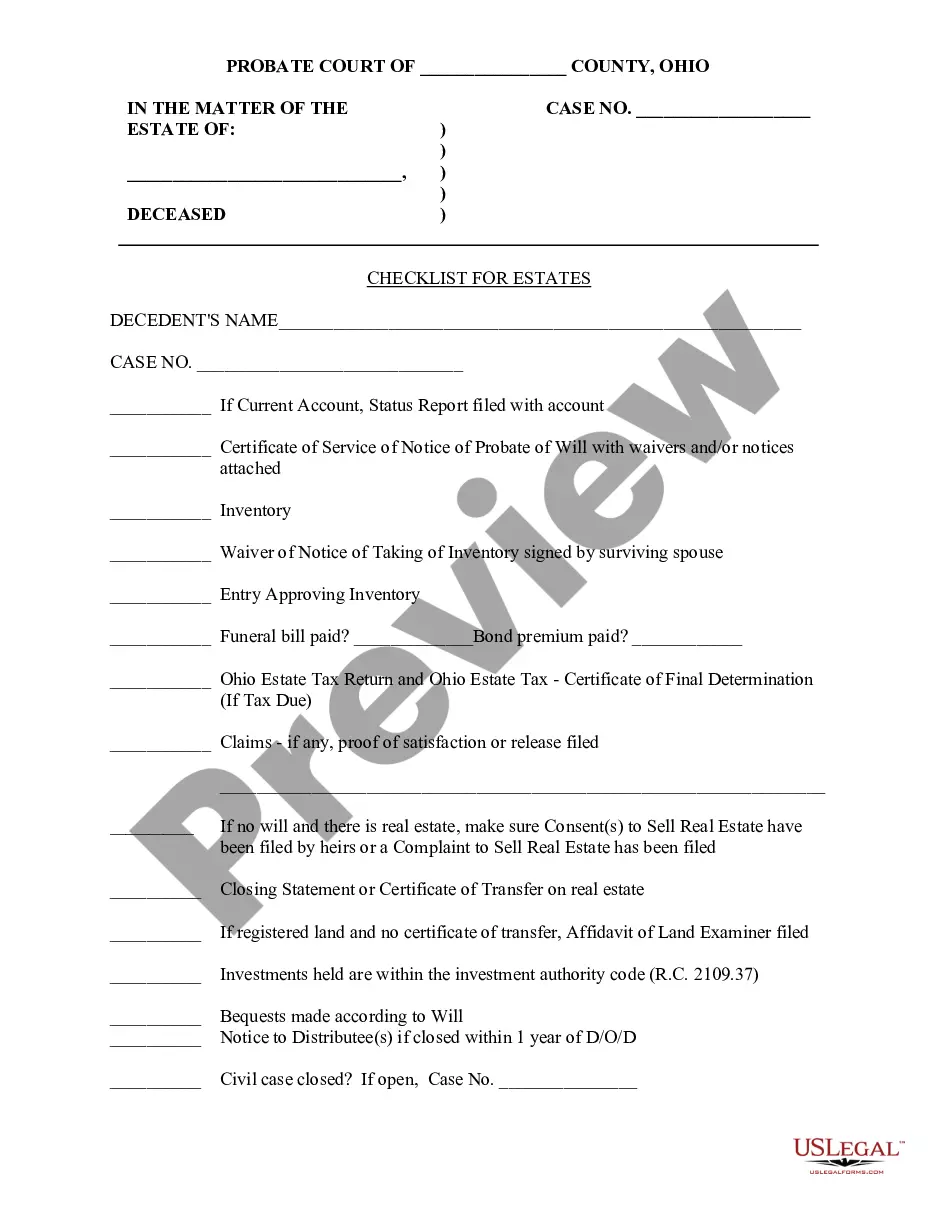

This sample form is a Schedule of Assets document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Franklin Ohio Schedule of Assets

Description

How to fill out Ohio Schedule Of Assets?

Acquiring verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms repository.

It is an online assortment of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life situations.

All the documents are properly classified by usage area and jurisdiction, making the search for the Franklin Ohio Schedule of Assets as swift and straightforward as ABC.

Click on the Buy Now button and choose your preferred subscription plan. You will need to create an account to gain access to the library’s resources.

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your needs and fully aligns with your local jurisdiction requirements.

- Search for an alternative template, if necessary.

- Should you encounter any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In Ohio, assets that typically go through probate include solely-owned real estate, bank accounts without a beneficiary, and personal belongings owned solely by the deceased. This process helps ensure that these assets are distributed according to the will or state law. Including these assets in your Franklin Ohio Schedule of Assets is essential for a comprehensive estate plan. You can simplify the documentation process with resources from USLegalForms.

Certain assets do not go through probate, including life insurance proceeds, retirement accounts with named beneficiaries, and jointly owned property. These items can pass directly to the designated heirs swiftly. Understanding this distinction can save time and make estate management easier. Consider including these insights in your Franklin Ohio Schedule of Assets for clarity.

Filling out an estate inventory involves listing all assets owned by the deceased as of the date of death. Begin by identifying real estate, bank accounts, investments, and personal property, then assign a value to each asset. The Franklin Ohio Schedule of Assets can assist you in organizing this information effectively. Utilize tools like USLegalForms to ensure you capture every necessary detail.

In Ohio, an estate must be worth at least $35,000 for the probate process to be necessary. This threshold does not include the value of the property that passes outside of probate. Knowing this amount helps you determine whether you need to create a Franklin Ohio Schedule of Assets for your estate planning. If your estate value is below this limit, you may be eligible for a simpler process.

In Franklin County, Ohio, wills are filed with the Probate Court located at the county courthouse. After a person passes away, the executor must present the will to the court to initiate probate proceedings. Keeping your Franklin Ohio Schedule of Assets organized enables the executor to provide necessary documents efficiently. For those needing assistance, US Legal Forms offers resources that guide you through the filing process and help manage your estate effectively.

In Ohio, certain assets are exempt from probate, which can simplify the estate settlement process. Properties held in joint ownership, life insurance policies, and assets placed in a trust typically bypass probate. Understanding your Franklin Ohio Schedule of Assets is essential, as it can reveal which items might qualify for exemption. This approach not only speeds up distribution but also reduces the overall costs associated with estate settlement.

In Ohio, certain assets must go through probate, including real estate, bank accounts, investments, and personal property owned solely by the deceased. However, assets that are jointly owned or have named beneficiaries generally do not require probate. Understanding which assets fall under the Franklin Ohio Schedule of Assets can simplify the probate process. Consulting with resources like USLegalForms can guide you through these requirements.

The schedule of assets is a detailed list that outlines all assets owned by an individual or entity. This is an essential component during estate planning and probate proceedings, especially in Franklin, Ohio. By accurately documenting these assets, you can ensure a smoother process for distribution and minimize estate taxes. Utilizing services like USLegalForms can help you create your Franklin Ohio Schedule of Assets effectively.

Not all estates in Ohio must go through probate. For example, if an estate's assets are held in a living trust, they can bypass the probate process. Additionally, certain small estates, typically those valued under $35,000, may also avoid probate. Consulting the Franklin Ohio Schedule of Assets can help you understand your specific situation, and uslegalforms offers resources to navigate these legal requirements effectively.

In Ohio, if an estate is valued at more than $35,000, it typically must go through probate. This process involves proving the validity of the will and administering the estate according to state law. When dealing with the Franklin Ohio Schedule of Assets, it is important to accurately assess the total value of the estate to determine if probate is necessary. Utilizing uslegalforms can simplify this process by providing you with the necessary documents and guidance.