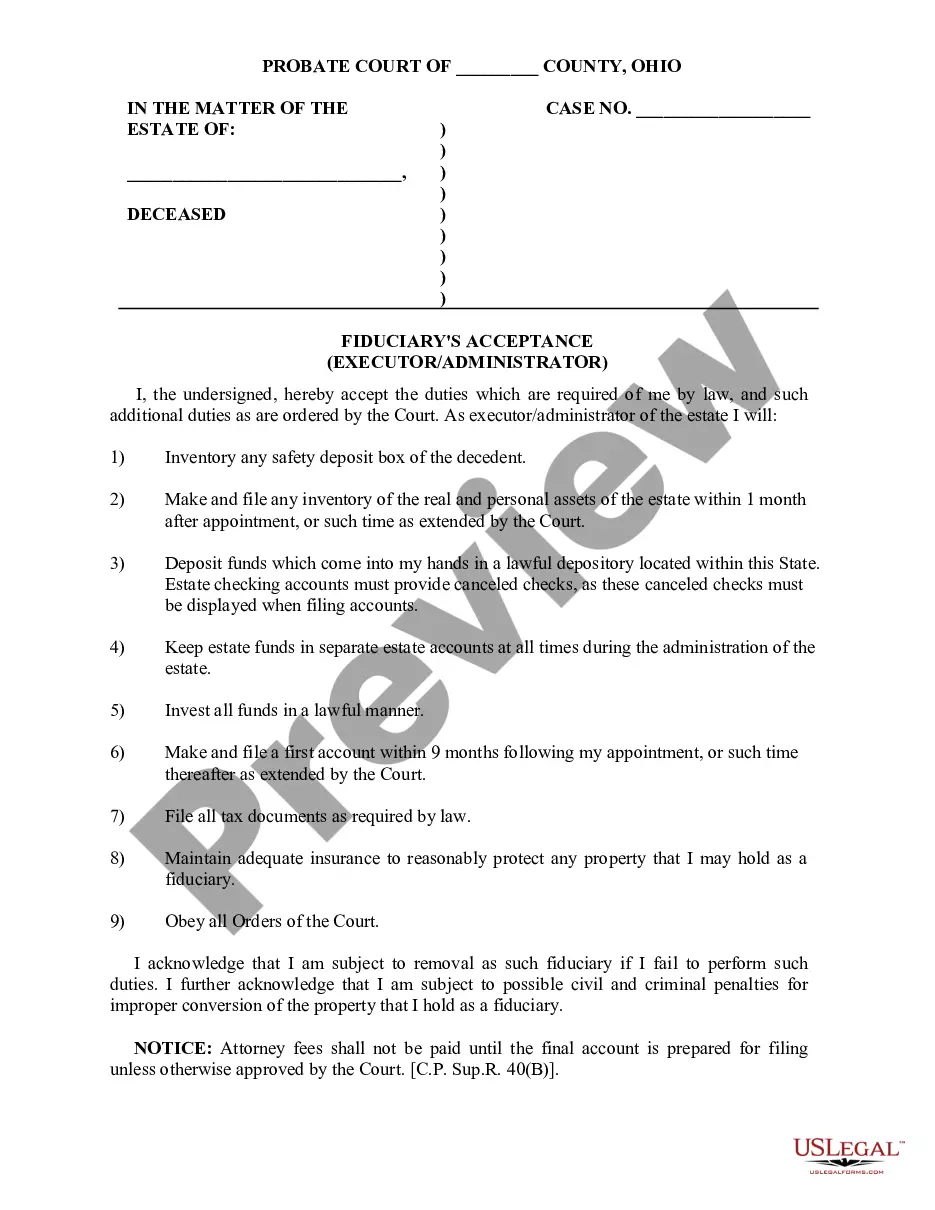

This sample form is a Fiduciary Acceptance - Executor/Administrator document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Franklin Ohio Fiduciary Acceptance Executeto— - Administrator In Franklin, Ohio, Fiduciary Acceptance refers to the legal process where an individual or entity assumes the responsibility of managing the affairs of a deceased person. Specifically, the role of a Fiduciary is divided into various types, including Executor and Administrator, depending on the circumstances and the presence or absence of a will. 1. Executor: An Executor is a person designated in a will who is responsible for overseeing the distribution and management of the estate of a deceased person. They ensure that the deceased's wishes, as outlined in the will, are carried out. This involves gathering and valuing the assets, paying off any debts or taxes owed by the deceased, and distributing the remaining assets to the beneficiaries. 2. Administrator: In cases where there is no valid will or the named Executor is unable or unwilling to fulfill their duties, an Administrator is appointed by the court to handle the estate administration process. They essentially play the same role as an Executor but are guided by state laws regarding inheritance in the absence of a will. The Administrator's responsibilities include identifying and locating heirs, managing the decedent's assets, and distributing them according to the legal requirements. Both Executors and Administrators are legally bound to act in the best interest of the deceased and the beneficiaries. They must adhere to strict laws and regulations that govern the estate administration process in Franklin, Ohio. This includes maintaining accurate records, filing required tax returns, notifying potential heirs and creditors, and seeking court approval for certain actions. It's important to understand that being an Executor or Administrator can be a complex and time-consuming process, requiring knowledge of legal and financial matters. It is common for individuals to seek professional assistance, such as attorneys or estate planning professionals, to fulfill these roles effectively. In summary, Fiduciary Acceptance in Franklin, Ohio, refers to the acceptance of the responsibility to manage the affairs of a deceased person. This role can be fulfilled by either an Executor (named in the will) or an Administrator (appointed by the court). Both roles involve tasks such as asset valuation, debt settlement, and asset distribution, with the ultimate goal of honoring the deceased's wishes and ensuring a smooth transition of their estate.Franklin Ohio Fiduciary Acceptance Executeto— - Administrator In Franklin, Ohio, Fiduciary Acceptance refers to the legal process where an individual or entity assumes the responsibility of managing the affairs of a deceased person. Specifically, the role of a Fiduciary is divided into various types, including Executor and Administrator, depending on the circumstances and the presence or absence of a will. 1. Executor: An Executor is a person designated in a will who is responsible for overseeing the distribution and management of the estate of a deceased person. They ensure that the deceased's wishes, as outlined in the will, are carried out. This involves gathering and valuing the assets, paying off any debts or taxes owed by the deceased, and distributing the remaining assets to the beneficiaries. 2. Administrator: In cases where there is no valid will or the named Executor is unable or unwilling to fulfill their duties, an Administrator is appointed by the court to handle the estate administration process. They essentially play the same role as an Executor but are guided by state laws regarding inheritance in the absence of a will. The Administrator's responsibilities include identifying and locating heirs, managing the decedent's assets, and distributing them according to the legal requirements. Both Executors and Administrators are legally bound to act in the best interest of the deceased and the beneficiaries. They must adhere to strict laws and regulations that govern the estate administration process in Franklin, Ohio. This includes maintaining accurate records, filing required tax returns, notifying potential heirs and creditors, and seeking court approval for certain actions. It's important to understand that being an Executor or Administrator can be a complex and time-consuming process, requiring knowledge of legal and financial matters. It is common for individuals to seek professional assistance, such as attorneys or estate planning professionals, to fulfill these roles effectively. In summary, Fiduciary Acceptance in Franklin, Ohio, refers to the acceptance of the responsibility to manage the affairs of a deceased person. This role can be fulfilled by either an Executor (named in the will) or an Administrator (appointed by the court). Both roles involve tasks such as asset valuation, debt settlement, and asset distribution, with the ultimate goal of honoring the deceased's wishes and ensuring a smooth transition of their estate.