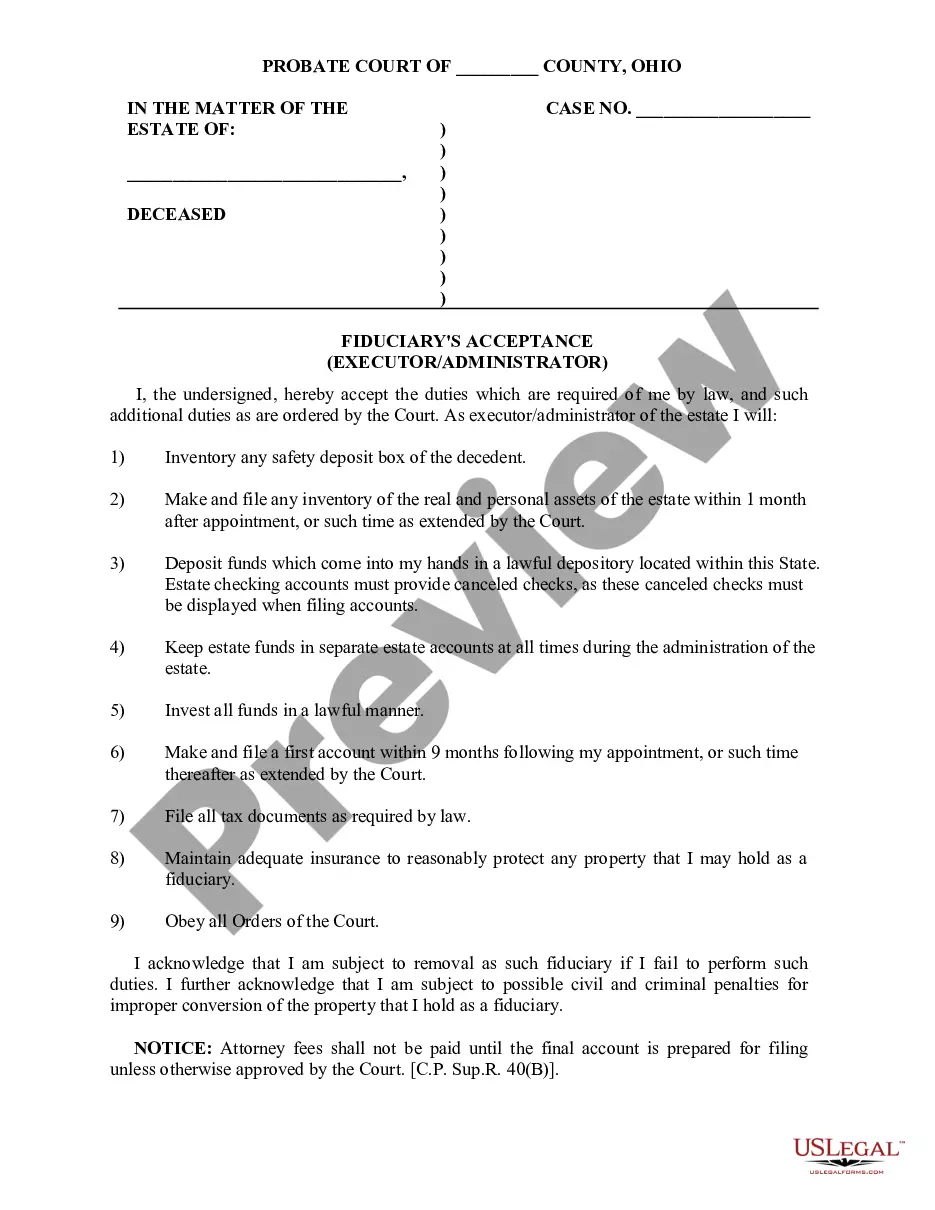

This sample form is a Fiduciary Acceptance - Executor/Administrator document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Toledo Ohio Fiduciary Acceptance Executeto— - Administrator is a legal service that involves accepting the responsibility of managing the affairs of an estate or trust in Toledo, Ohio. A fiduciary is an individual or entity appointed by a court or designated in a will or trust document to act in the best interest of the beneficiaries. As a fiduciary, the Executor or Administrator assumes various responsibilities and tasks in the administration of an estate or trust. These can include: 1. Estate Administration: An Executor is appointed in a will, while an Administrator is appointed by the court when there is no valid will or the will does not name an Executor. Both roles involve managing and distributing assets, paying debts and taxes, resolving disputes, and submitting necessary paperwork to the court. 2. Asset Management: A fiduciary accepts the responsibility of managing and safeguarding the assets of the estate or trust. This can include real estate, investments, bank accounts, and personal property. 3. Accounting and Record-Keeping: Accurate bookkeeping is a crucial aspect of a fiduciary's duties. They must maintain detailed records of all financial transactions, including income, expenses, distributions, and filings with the court. 4. Communication with Beneficiaries: Executors and Administrators are responsible for keeping beneficiaries informed about the status of the estate or trust. They may provide regular updates, answer questions, and address concerns that beneficiaries may have throughout the administration process. 5. Estate Taxes and Final Expenses: Fiduciaries are responsible for filing and paying any applicable estate taxes and ensuring that all final expenses, such as funeral costs or outstanding debts, are properly settled. 6. Dispute Resolution: If disputes arise between beneficiaries, creditors, or other parties involved in the estate or trust, the fiduciary may be required to mediate and resolve these conflicts or seek legal assistance if necessary. Different types of fiduciary acceptance roles may exist within Toledo, Ohio, including: 1. Executor: This position is named in a valid will and is responsible for carrying out the wishes of the deceased as outlined in the document. 2. Administrator: When no valid will exists or when a will does not name an Executor, the court appoints an Administrator to oversee the estate administration process. 3. Corporate Fiduciary: In some cases, a professional trust company or financial institution may act as the Executor or Administrator. They have the expertise and resources to handle complex estates and trusts. In conclusion, Toledo Ohio Fiduciary Acceptance Executeto— - Administrator provides individuals or entities with the legal authority and responsibility to manage the affairs of an estate or trust in Toledo, Ohio. They handle tasks such as asset management, estate administration, accounting, and resolving disputes, aiming to act in the best interest of the beneficiaries.Toledo Ohio Fiduciary Acceptance Executeto— - Administrator is a legal service that involves accepting the responsibility of managing the affairs of an estate or trust in Toledo, Ohio. A fiduciary is an individual or entity appointed by a court or designated in a will or trust document to act in the best interest of the beneficiaries. As a fiduciary, the Executor or Administrator assumes various responsibilities and tasks in the administration of an estate or trust. These can include: 1. Estate Administration: An Executor is appointed in a will, while an Administrator is appointed by the court when there is no valid will or the will does not name an Executor. Both roles involve managing and distributing assets, paying debts and taxes, resolving disputes, and submitting necessary paperwork to the court. 2. Asset Management: A fiduciary accepts the responsibility of managing and safeguarding the assets of the estate or trust. This can include real estate, investments, bank accounts, and personal property. 3. Accounting and Record-Keeping: Accurate bookkeeping is a crucial aspect of a fiduciary's duties. They must maintain detailed records of all financial transactions, including income, expenses, distributions, and filings with the court. 4. Communication with Beneficiaries: Executors and Administrators are responsible for keeping beneficiaries informed about the status of the estate or trust. They may provide regular updates, answer questions, and address concerns that beneficiaries may have throughout the administration process. 5. Estate Taxes and Final Expenses: Fiduciaries are responsible for filing and paying any applicable estate taxes and ensuring that all final expenses, such as funeral costs or outstanding debts, are properly settled. 6. Dispute Resolution: If disputes arise between beneficiaries, creditors, or other parties involved in the estate or trust, the fiduciary may be required to mediate and resolve these conflicts or seek legal assistance if necessary. Different types of fiduciary acceptance roles may exist within Toledo, Ohio, including: 1. Executor: This position is named in a valid will and is responsible for carrying out the wishes of the deceased as outlined in the document. 2. Administrator: When no valid will exists or when a will does not name an Executor, the court appoints an Administrator to oversee the estate administration process. 3. Corporate Fiduciary: In some cases, a professional trust company or financial institution may act as the Executor or Administrator. They have the expertise and resources to handle complex estates and trusts. In conclusion, Toledo Ohio Fiduciary Acceptance Executeto— - Administrator provides individuals or entities with the legal authority and responsibility to manage the affairs of an estate or trust in Toledo, Ohio. They handle tasks such as asset management, estate administration, accounting, and resolving disputes, aiming to act in the best interest of the beneficiaries.