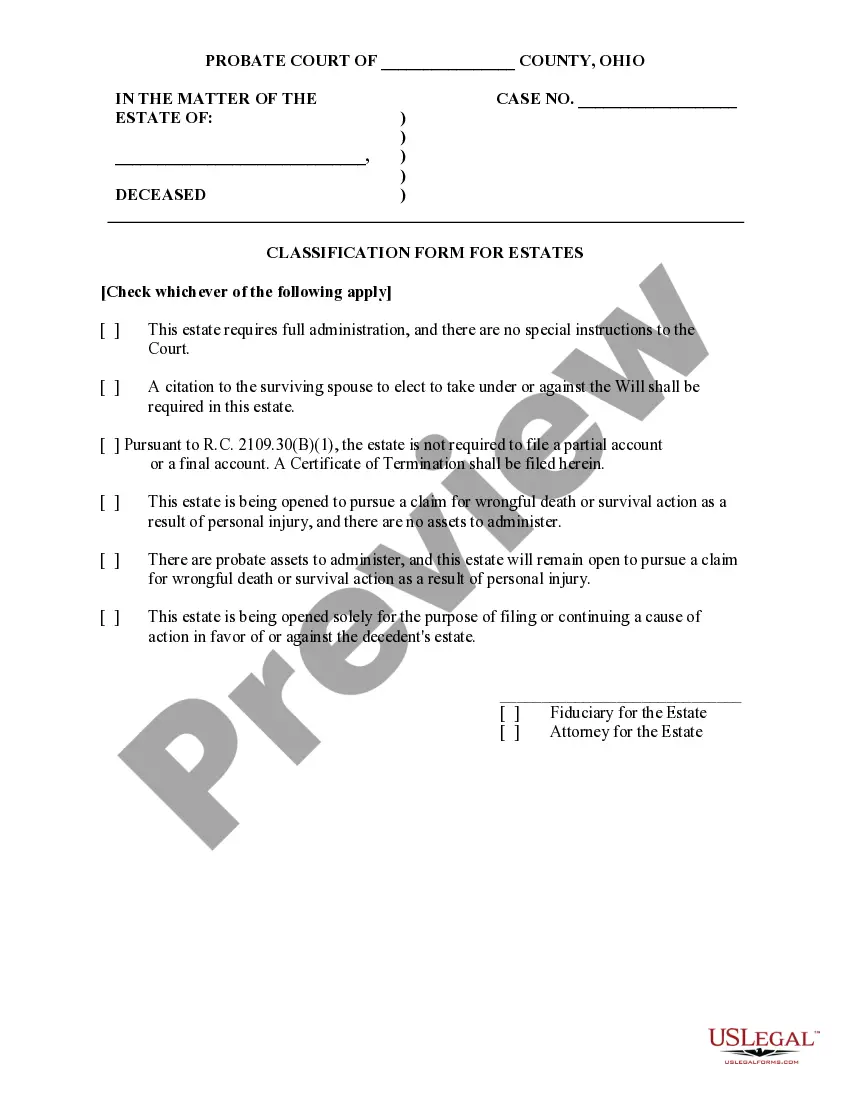

This sample form is a Classification Form for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

The Cuyahoga Ohio Classification Form for Estates is a crucial legal document used in the state of Ohio to categorize and assess different types of estates. This form plays a significant role in the process of estate administration and the determination of assets, debts, and taxes related to the estate. By accurately classifying the estate, the form ensures that the correct procedures are followed and the appropriate taxes are paid. The Cuyahoga Ohio Classification Form for Estates takes into account various factors to determine the estate's classification. These factors include the size and nature of the assets, any outstanding liabilities, and the legal arrangements made by the deceased, such as a will or trust. The form acts as a comprehensive guide for estate administrators, attorneys, and executors to understand the specific requirements for each type of estate. There are different types of Cuyahoga Ohio Classification Forms for Estates, which are tailored to meet the unique circumstances of individual estates. Some common types of classifications include: 1. Small Estate: This classification applies to estates with a lower total value of assets, typically below a specified threshold set by state laws. Small estates may have simplified procedures and reduced tax liabilities. 2. Probate Estate: When an individual passes away without estate planning documents, such as a will or trust, their estate is categorized as a probate estate. The probate process entails the court-supervised administration of the estate, including asset distribution and debt settlement. 3. Trust Estate: If the deceased individual established a trust during their lifetime, their estate may be classified as a trust estate. Trust estates often have different tax implications and distribution guidelines compared to probate estates. 4. Intestate Estate: When someone dies without a valid will or trust, their estate is classified as an intestate estate. In such cases, state laws dictate the distribution of assets among heirs based on legal priorities. 5. Taxable Estate: Taxable estates are subject to federal and state taxes, including estate taxes. This classification requires thorough evaluation of the estate's assets, deductions, and tax thresholds to determine the tax liability. Accuracy and attention to detail are essential when completing the Cuyahoga Ohio Classification Form for Estates. Failing to classify an estate correctly may result in legal complications, delays in the administration process, or even penalties. It is advisable to seek guidance from a qualified estate attorney or tax professional to ensure compliance with Ohio laws and regulations.The Cuyahoga Ohio Classification Form for Estates is a crucial legal document used in the state of Ohio to categorize and assess different types of estates. This form plays a significant role in the process of estate administration and the determination of assets, debts, and taxes related to the estate. By accurately classifying the estate, the form ensures that the correct procedures are followed and the appropriate taxes are paid. The Cuyahoga Ohio Classification Form for Estates takes into account various factors to determine the estate's classification. These factors include the size and nature of the assets, any outstanding liabilities, and the legal arrangements made by the deceased, such as a will or trust. The form acts as a comprehensive guide for estate administrators, attorneys, and executors to understand the specific requirements for each type of estate. There are different types of Cuyahoga Ohio Classification Forms for Estates, which are tailored to meet the unique circumstances of individual estates. Some common types of classifications include: 1. Small Estate: This classification applies to estates with a lower total value of assets, typically below a specified threshold set by state laws. Small estates may have simplified procedures and reduced tax liabilities. 2. Probate Estate: When an individual passes away without estate planning documents, such as a will or trust, their estate is categorized as a probate estate. The probate process entails the court-supervised administration of the estate, including asset distribution and debt settlement. 3. Trust Estate: If the deceased individual established a trust during their lifetime, their estate may be classified as a trust estate. Trust estates often have different tax implications and distribution guidelines compared to probate estates. 4. Intestate Estate: When someone dies without a valid will or trust, their estate is classified as an intestate estate. In such cases, state laws dictate the distribution of assets among heirs based on legal priorities. 5. Taxable Estate: Taxable estates are subject to federal and state taxes, including estate taxes. This classification requires thorough evaluation of the estate's assets, deductions, and tax thresholds to determine the tax liability. Accuracy and attention to detail are essential when completing the Cuyahoga Ohio Classification Form for Estates. Failing to classify an estate correctly may result in legal complications, delays in the administration process, or even penalties. It is advisable to seek guidance from a qualified estate attorney or tax professional to ensure compliance with Ohio laws and regulations.