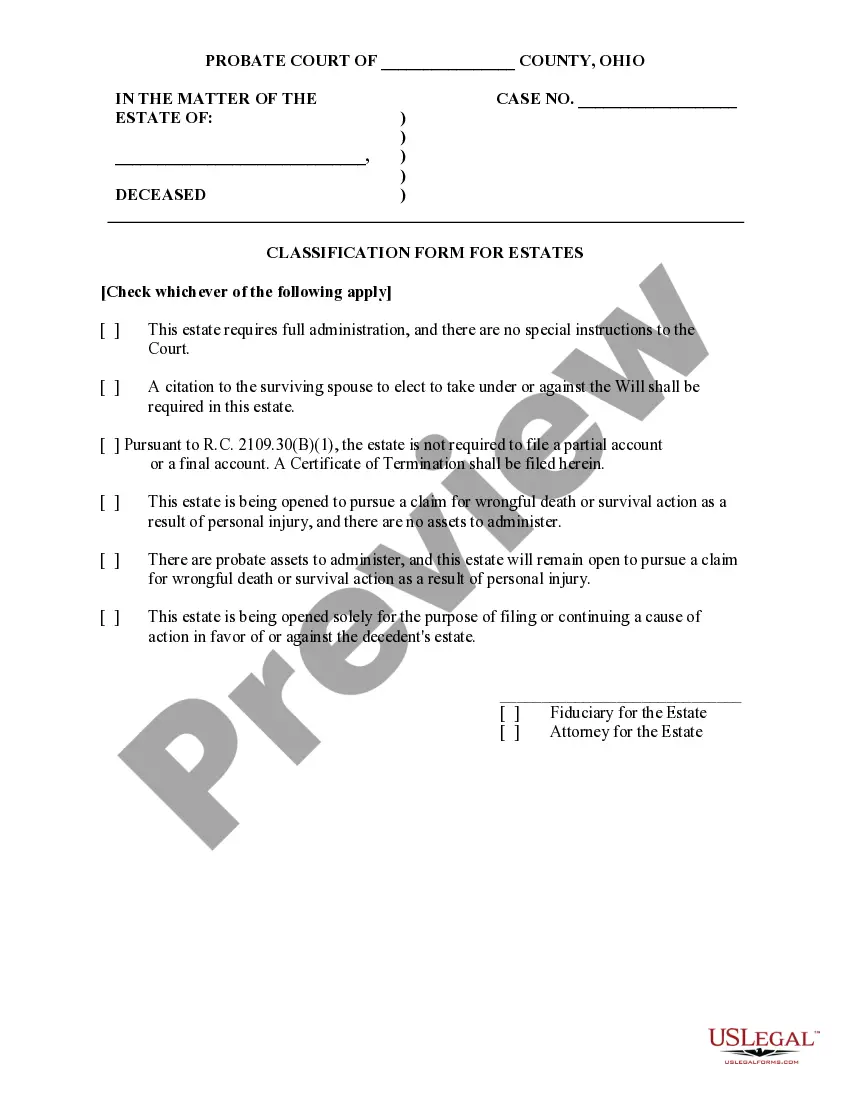

This sample form is a Classification Form for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

The Dayton Ohio Classification Form for Estates is a legal document used in the state of Ohio for the purpose of classifying and categorizing estates. This comprehensive form gathers essential information to accurately ascertain the classification of an estate based on its specific characteristics and attributes. The form serves as a guide for estate administrators, attorneys, and the court system to determine the appropriate actions and procedures to be followed in the administration and distribution of an estate. By completing this form, individuals involved in the estate administration process can ensure that all legal requirements and regulations are properly addressed. Relevant keywords for the Dayton Ohio Classification Form for Estates could include: 1. Estate classification: The form aims to establish the classification of the estate, such as whether it is a small estate, large estate, or a trust estate, based on various factors such as the total value of the assets and the existence of a valid will. 2. Asset valuation: The form requires comprehensive information regarding the value of assets held within the estate, including real estate properties, financial investments, personal belongings, and any other valuable assets. 3. Debts and liabilities: It is crucial to provide details about any outstanding debts or liabilities associated with the estate, such as mortgages, loans, credit card debts, or any pending claims. 4. Beneficiary information: The form requests essential data regarding the beneficiaries of the estate, including their names, addresses, contact information, and their relationship to the deceased individual. 5. Executor or administrator details: Individuals responsible for the administration of the estate need to provide their personal information, contact details, and qualifications to ensure proper communication and legal compliance. 6. Probate court involvement: The form includes sections to indicate whether the estate is being processed through probate court or if it is exempt from probate, based on the details provided, such as the presence of a valid will. 7. Trust establishment: If the estate involves the creation of a trust, the form enables the individual to provide information on the type of trust and its specific terms. 8. Tax considerations: The form requires information regarding potential tax obligations, including federal and state estate taxes, inheritance taxes, and any related tax filings. Different types of Dayton Ohio Classification Forms for Estates can include variations specific to the classification being sought, such as: 1. Small Estate Classification Form: This form is used for estates with a relatively low total asset value, usually under a certain threshold determined by state laws. It streamlines the administration process by providing a simplified version of the classification form tailored to small estates. 2. Large Estate Classification Form: Designed for estates with substantial assets, this form includes additional sections and requirements to address the complexities associated with high-value estates. 3. Trust Estate Classification Form: When an estate involves the creation of a trust, this form addresses the specific details of the trust structure, terms, and beneficiaries, while still capturing essential information for classification purposes. It is important to consult with a qualified legal professional to ensure accurate completion of the Dayton Ohio Classification Form for Estates, as laws and requirements may vary and change over time.The Dayton Ohio Classification Form for Estates is a legal document used in the state of Ohio for the purpose of classifying and categorizing estates. This comprehensive form gathers essential information to accurately ascertain the classification of an estate based on its specific characteristics and attributes. The form serves as a guide for estate administrators, attorneys, and the court system to determine the appropriate actions and procedures to be followed in the administration and distribution of an estate. By completing this form, individuals involved in the estate administration process can ensure that all legal requirements and regulations are properly addressed. Relevant keywords for the Dayton Ohio Classification Form for Estates could include: 1. Estate classification: The form aims to establish the classification of the estate, such as whether it is a small estate, large estate, or a trust estate, based on various factors such as the total value of the assets and the existence of a valid will. 2. Asset valuation: The form requires comprehensive information regarding the value of assets held within the estate, including real estate properties, financial investments, personal belongings, and any other valuable assets. 3. Debts and liabilities: It is crucial to provide details about any outstanding debts or liabilities associated with the estate, such as mortgages, loans, credit card debts, or any pending claims. 4. Beneficiary information: The form requests essential data regarding the beneficiaries of the estate, including their names, addresses, contact information, and their relationship to the deceased individual. 5. Executor or administrator details: Individuals responsible for the administration of the estate need to provide their personal information, contact details, and qualifications to ensure proper communication and legal compliance. 6. Probate court involvement: The form includes sections to indicate whether the estate is being processed through probate court or if it is exempt from probate, based on the details provided, such as the presence of a valid will. 7. Trust establishment: If the estate involves the creation of a trust, the form enables the individual to provide information on the type of trust and its specific terms. 8. Tax considerations: The form requires information regarding potential tax obligations, including federal and state estate taxes, inheritance taxes, and any related tax filings. Different types of Dayton Ohio Classification Forms for Estates can include variations specific to the classification being sought, such as: 1. Small Estate Classification Form: This form is used for estates with a relatively low total asset value, usually under a certain threshold determined by state laws. It streamlines the administration process by providing a simplified version of the classification form tailored to small estates. 2. Large Estate Classification Form: Designed for estates with substantial assets, this form includes additional sections and requirements to address the complexities associated with high-value estates. 3. Trust Estate Classification Form: When an estate involves the creation of a trust, this form addresses the specific details of the trust structure, terms, and beneficiaries, while still capturing essential information for classification purposes. It is important to consult with a qualified legal professional to ensure accurate completion of the Dayton Ohio Classification Form for Estates, as laws and requirements may vary and change over time.