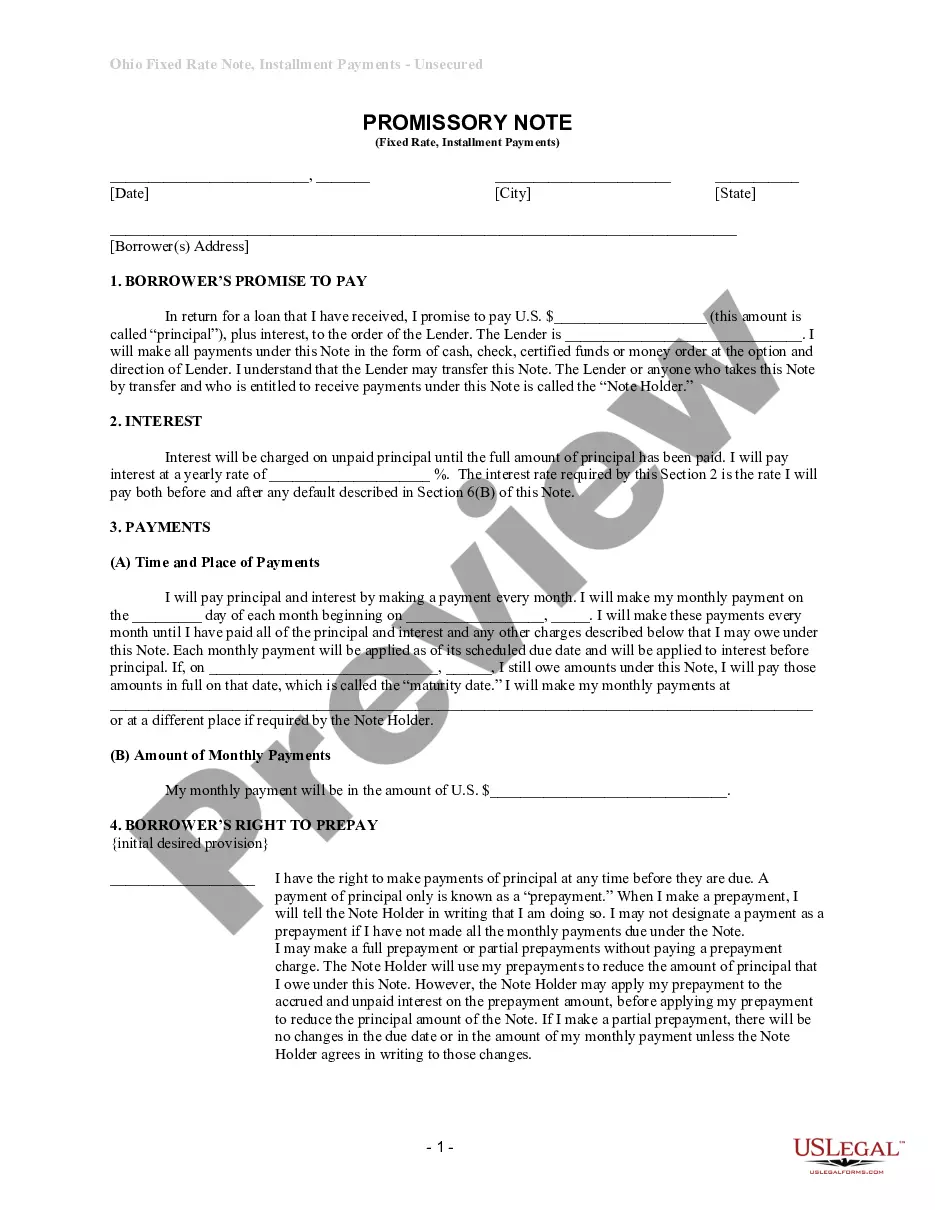

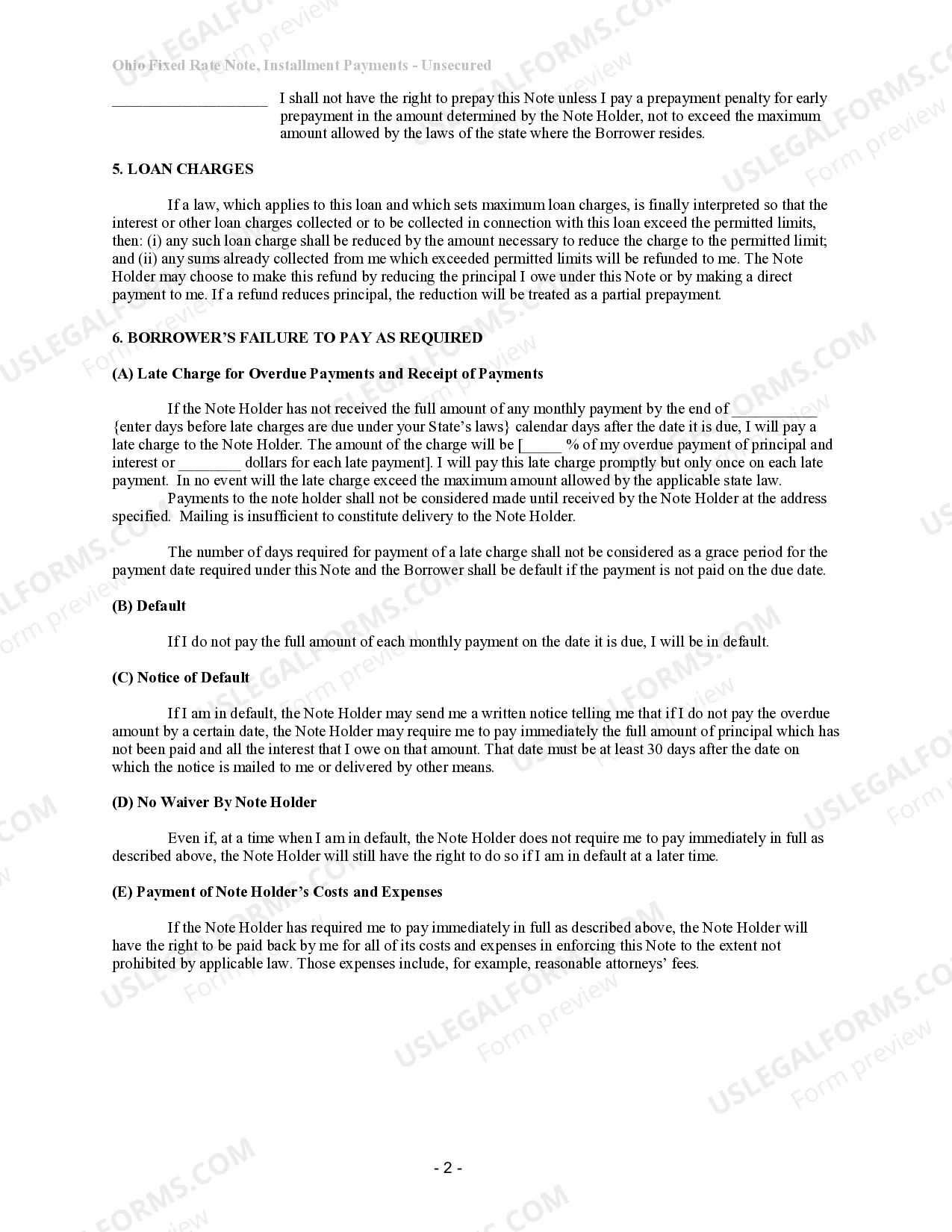

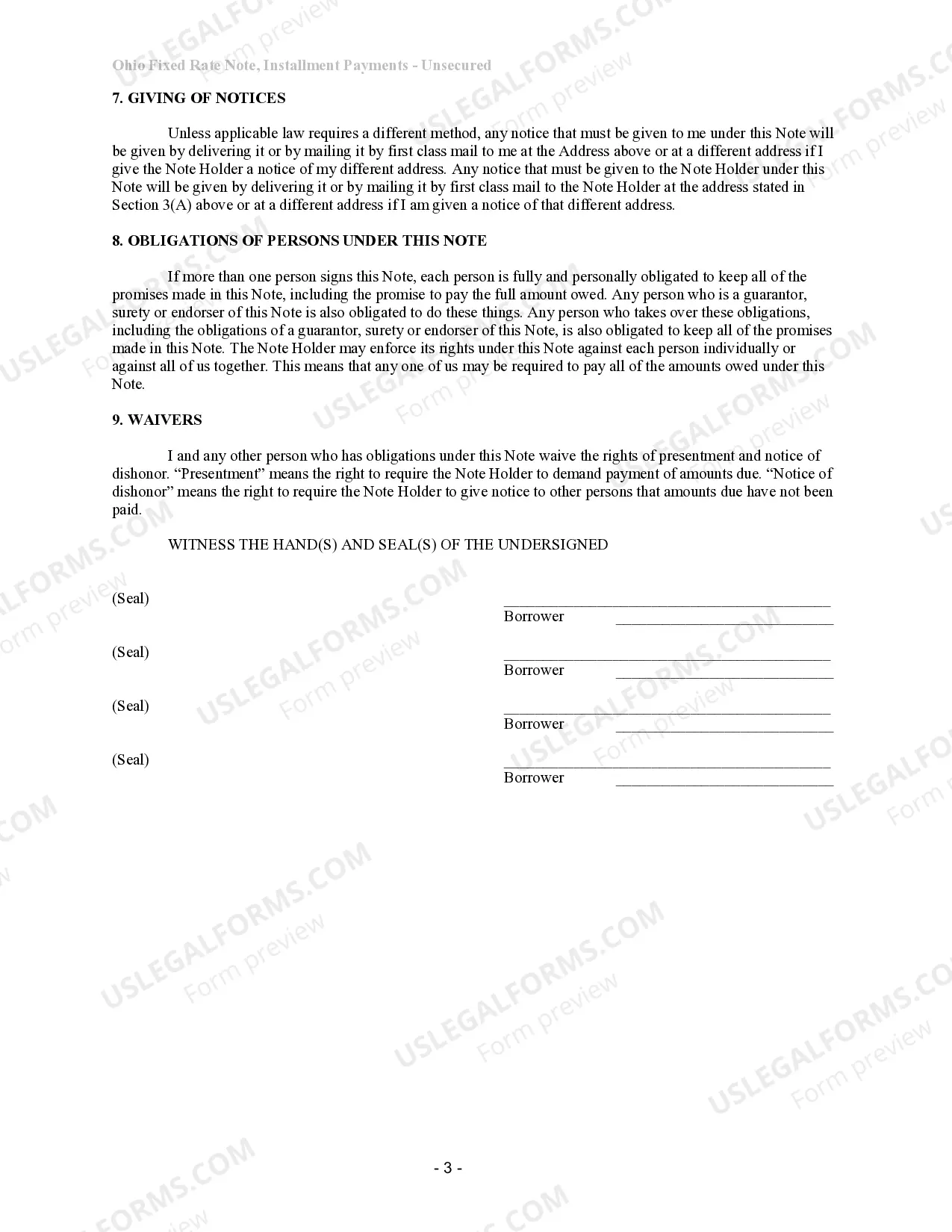

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

The Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Akron, Ohio. This promissory note secures a loan that is unsecured, meaning it does not require collateral, and has a fixed interest rate and repayment plan. The Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is designed to protect both parties involved in the loan transaction. It clearly defines the key details of the loan, such as the principal amount, interest rate, repayment schedule, and any penalties or fees associated with late payments or defaults. By using this promissory note, the lender can ensure that the borrower understands their obligations and responsibilities, while the borrower gains a clear understanding of the repayment terms. There may be different types of Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate, including: 1. Personal Loan Promissory Note: This type of promissory note is used when an individual borrows money for personal reasons, such as debt consolidation, home improvements, or education expenses. The terms and conditions of the loan are agreed upon between the lender and the borrower. 2. Small Business Loan Promissory Note: This promissory note is specifically tailored for small business owners in Akron, Ohio, who require financing to support their business operations or expansion. It outlines the repayment plan and other important loan details that are pertinent to a business loan. 3. Medical Loan Promissory Note: This type of promissory note is used when an individual borrows money for medical expenses, including surgeries, treatments, or specialized care. It ensures that the borrower will repay the loan in fixed installments, taking into consideration the fixed interest rate. 4. Educational Loan Promissory Note: This promissory note is commonly used by students in Akron, Ohio, who borrow money to finance their higher education. It defines the terms of the loan, including the repayment period and interest rate, making it easier for both parties to track and manage the loan. Regardless of the specific type of Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate, it is important for both the borrower and lender to thoroughly read and understand the document before signing it. Consulting with a legal professional can also be beneficial to ensure compliance with local laws and regulations.The Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Akron, Ohio. This promissory note secures a loan that is unsecured, meaning it does not require collateral, and has a fixed interest rate and repayment plan. The Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is designed to protect both parties involved in the loan transaction. It clearly defines the key details of the loan, such as the principal amount, interest rate, repayment schedule, and any penalties or fees associated with late payments or defaults. By using this promissory note, the lender can ensure that the borrower understands their obligations and responsibilities, while the borrower gains a clear understanding of the repayment terms. There may be different types of Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate, including: 1. Personal Loan Promissory Note: This type of promissory note is used when an individual borrows money for personal reasons, such as debt consolidation, home improvements, or education expenses. The terms and conditions of the loan are agreed upon between the lender and the borrower. 2. Small Business Loan Promissory Note: This promissory note is specifically tailored for small business owners in Akron, Ohio, who require financing to support their business operations or expansion. It outlines the repayment plan and other important loan details that are pertinent to a business loan. 3. Medical Loan Promissory Note: This type of promissory note is used when an individual borrows money for medical expenses, including surgeries, treatments, or specialized care. It ensures that the borrower will repay the loan in fixed installments, taking into consideration the fixed interest rate. 4. Educational Loan Promissory Note: This promissory note is commonly used by students in Akron, Ohio, who borrow money to finance their higher education. It defines the terms of the loan, including the repayment period and interest rate, making it easier for both parties to track and manage the loan. Regardless of the specific type of Akron Ohio Unsecured Installment Payment Promissory Note for Fixed Rate, it is important for both the borrower and lender to thoroughly read and understand the document before signing it. Consulting with a legal professional can also be beneficial to ensure compliance with local laws and regulations.