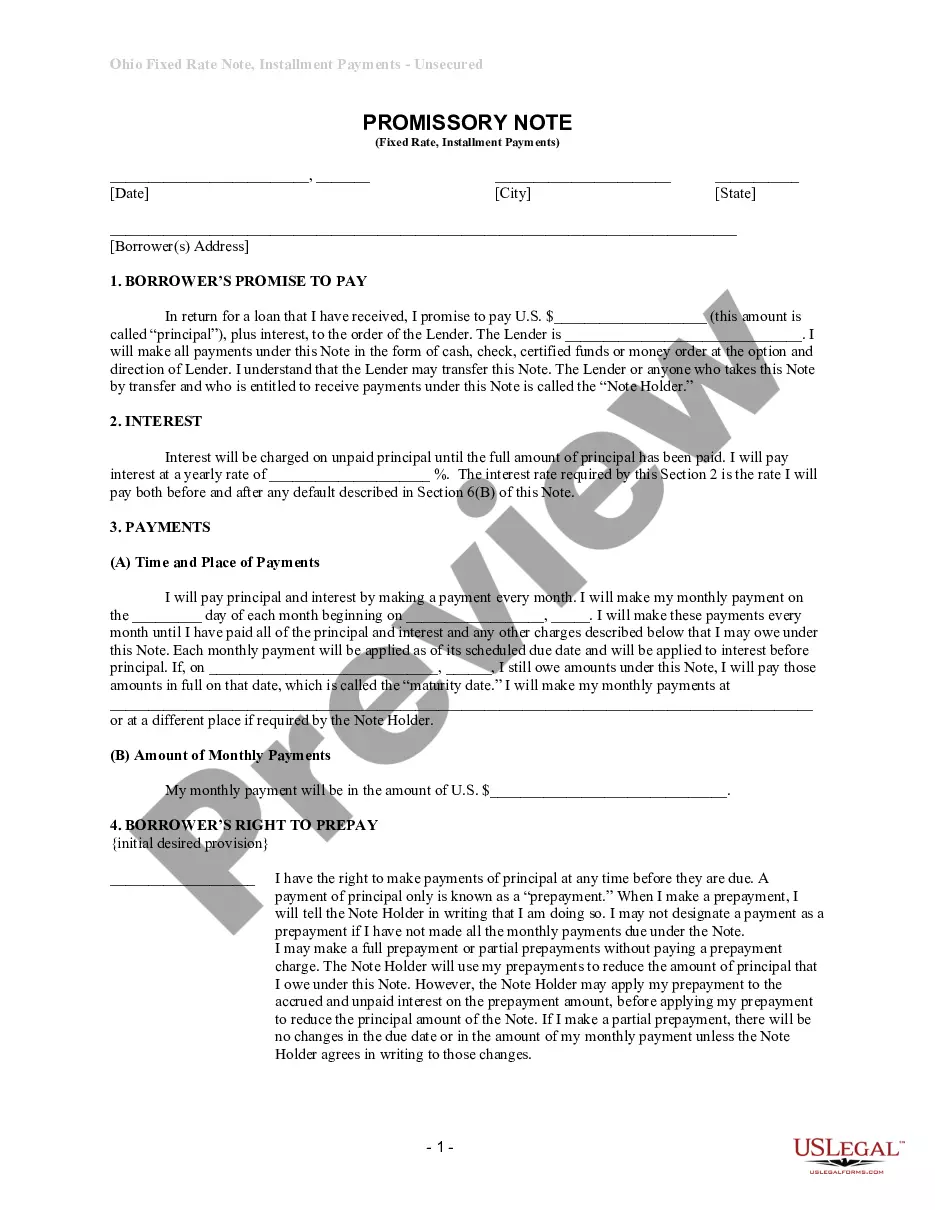

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

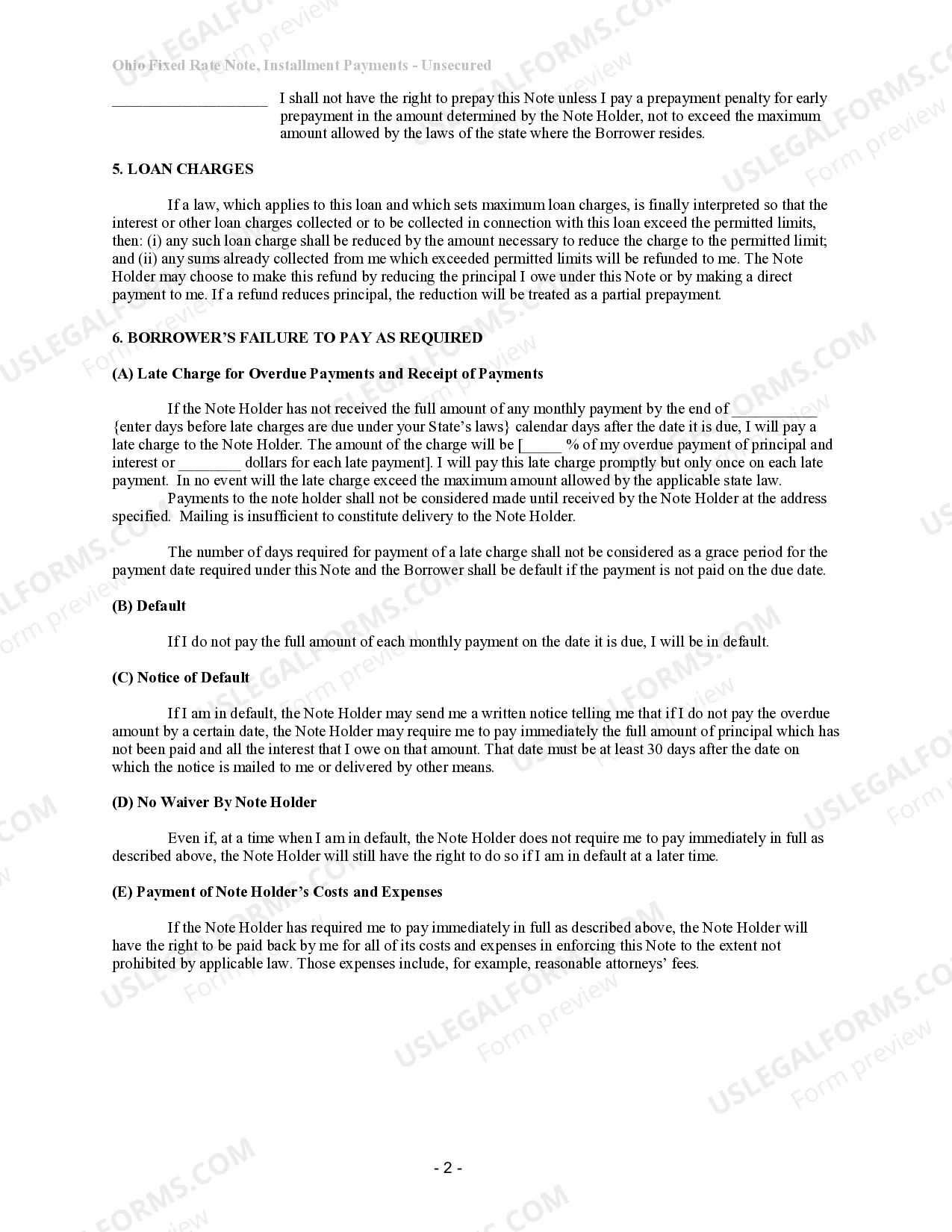

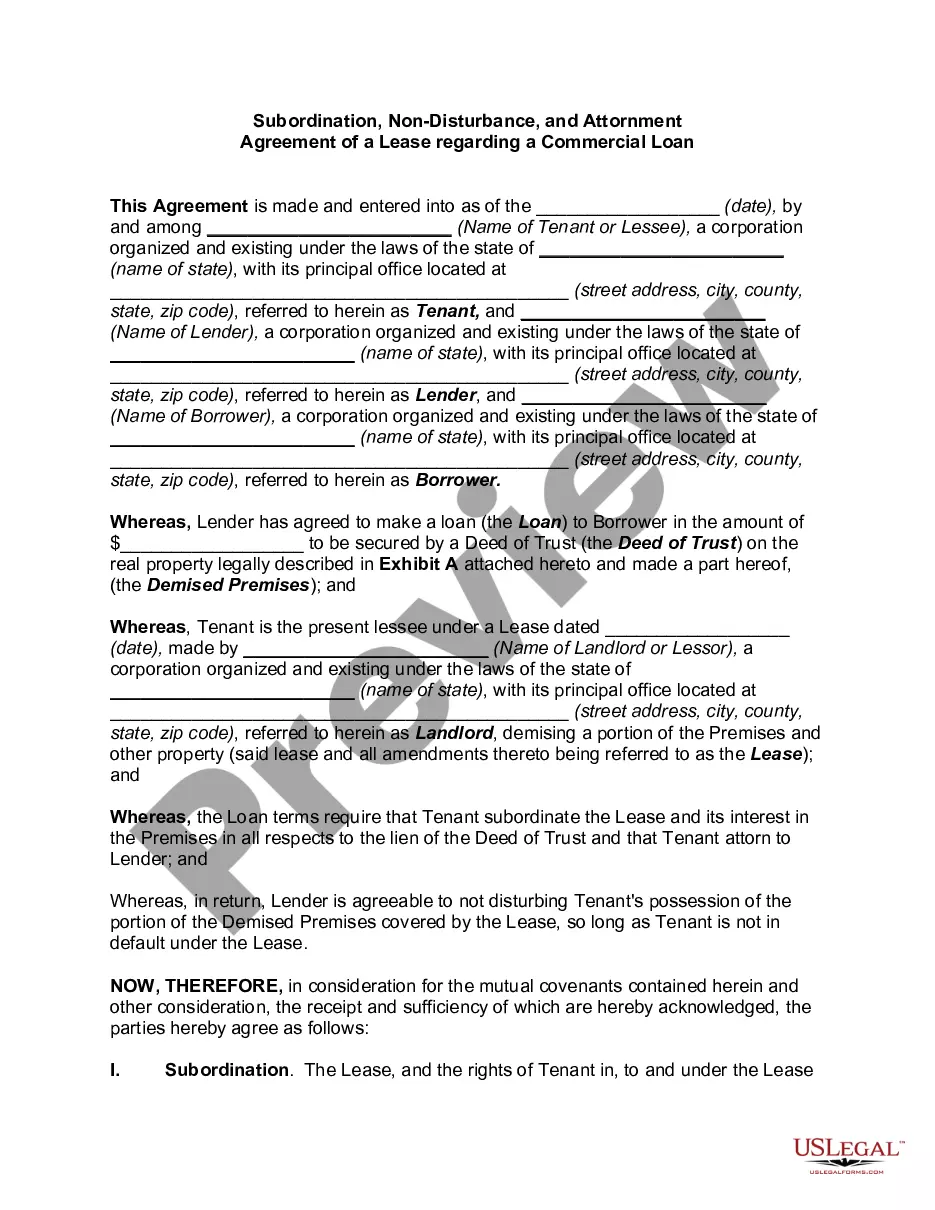

Title: Dayton Ohio Unsecured Installment Payment Promissory Note for Fixed Rate: An In-depth Explanation Introduction: The Dayton Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms, conditions, and repayment details of a loan. This note is specifically designed for borrowers residing in Dayton, Ohio, who are seeking unsecured installment loans with fixed interest rates. Key Features: 1. Unsecured Loan: The promissory note represents an unsecured loan, meaning it does not require collateral from the borrower. This feature makes it accessible to individuals without valuable assets to secure the loan against. 2. Installment Payments: The loan is repayable through a series of predetermined equal installment payments, usually monthly, spread over a fixed term. With this structure, borrowers can conveniently plan their finances and manage repayment without significant financial strain. 3. Fixed Interest Rate: The promissory note specifies a fixed interest rate, meaning the interest percentage remains constant throughout the loan term. This characteristic provides borrowers with predictability and stability in terms of repayment amounts, ensuring there are no surprises. 4. Principal Amount: The promissory note defines the principal amount, which is the initial loan sum issued to the borrower. This amount reflects the total borrowed funds and serves as the basis for calculating interest and determining installment payments. 5. Terms and Conditions: This note highlights several important terms and conditions, including the repayment schedule, late payment penalties, default consequences, prepayment options, and any additional fees or charges. Types of Dayton Ohio Unsecured Installment Payment Promissory Notes for Fixed Rate: 1. Personal Loan Promissory Note: This type of promissory note is used when an individual borrows funds for personal reasons, such as debt consolidation, education, medical expenses, or home improvements. 2. Small Business Loan Promissory Note: This promissory note caters to small business owners in Dayton, Ohio, who require funds for business-related expenses, such as working capital, equipment purchase, or expansion. 3. Student Loan Promissory Note: This note is designed exclusively for students seeking financial assistance for their higher education expenses, such as tuition fees, books, accommodation, or other related costs. Conclusion: The Dayton Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a valuable financial tool for borrowers residing in Dayton, Ohio. It provides a transparent and legally binding agreement between the lender and borrower, ensuring both parties understand their rights and obligations. Whether it's a personal loan, small business loan, or student loan, this promissory note helps borrowers secure necessary funds while maintaining financial stability through consistent installment payments and fixed interest rates.Title: Dayton Ohio Unsecured Installment Payment Promissory Note for Fixed Rate: An In-depth Explanation Introduction: The Dayton Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms, conditions, and repayment details of a loan. This note is specifically designed for borrowers residing in Dayton, Ohio, who are seeking unsecured installment loans with fixed interest rates. Key Features: 1. Unsecured Loan: The promissory note represents an unsecured loan, meaning it does not require collateral from the borrower. This feature makes it accessible to individuals without valuable assets to secure the loan against. 2. Installment Payments: The loan is repayable through a series of predetermined equal installment payments, usually monthly, spread over a fixed term. With this structure, borrowers can conveniently plan their finances and manage repayment without significant financial strain. 3. Fixed Interest Rate: The promissory note specifies a fixed interest rate, meaning the interest percentage remains constant throughout the loan term. This characteristic provides borrowers with predictability and stability in terms of repayment amounts, ensuring there are no surprises. 4. Principal Amount: The promissory note defines the principal amount, which is the initial loan sum issued to the borrower. This amount reflects the total borrowed funds and serves as the basis for calculating interest and determining installment payments. 5. Terms and Conditions: This note highlights several important terms and conditions, including the repayment schedule, late payment penalties, default consequences, prepayment options, and any additional fees or charges. Types of Dayton Ohio Unsecured Installment Payment Promissory Notes for Fixed Rate: 1. Personal Loan Promissory Note: This type of promissory note is used when an individual borrows funds for personal reasons, such as debt consolidation, education, medical expenses, or home improvements. 2. Small Business Loan Promissory Note: This promissory note caters to small business owners in Dayton, Ohio, who require funds for business-related expenses, such as working capital, equipment purchase, or expansion. 3. Student Loan Promissory Note: This note is designed exclusively for students seeking financial assistance for their higher education expenses, such as tuition fees, books, accommodation, or other related costs. Conclusion: The Dayton Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a valuable financial tool for borrowers residing in Dayton, Ohio. It provides a transparent and legally binding agreement between the lender and borrower, ensuring both parties understand their rights and obligations. Whether it's a personal loan, small business loan, or student loan, this promissory note helps borrowers secure necessary funds while maintaining financial stability through consistent installment payments and fixed interest rates.