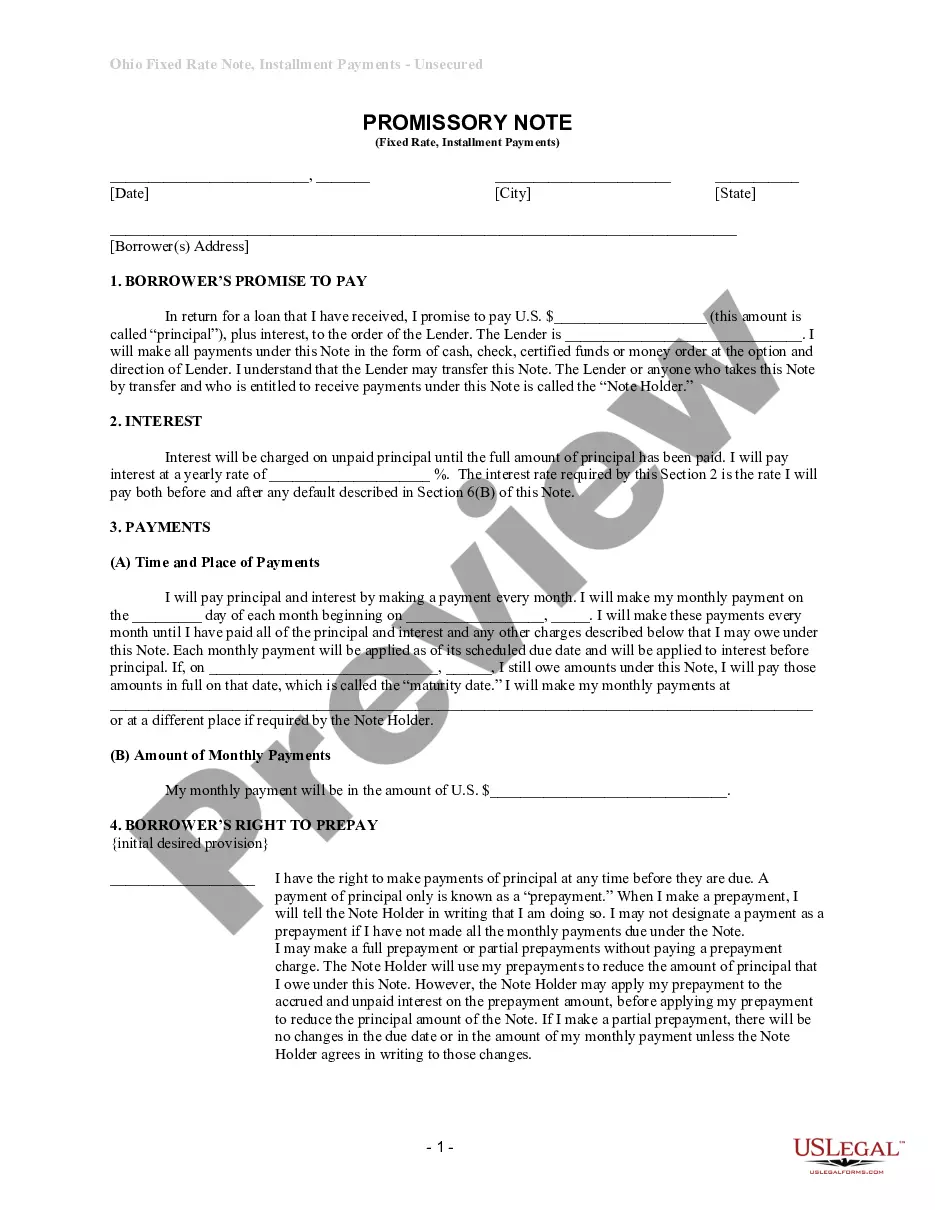

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

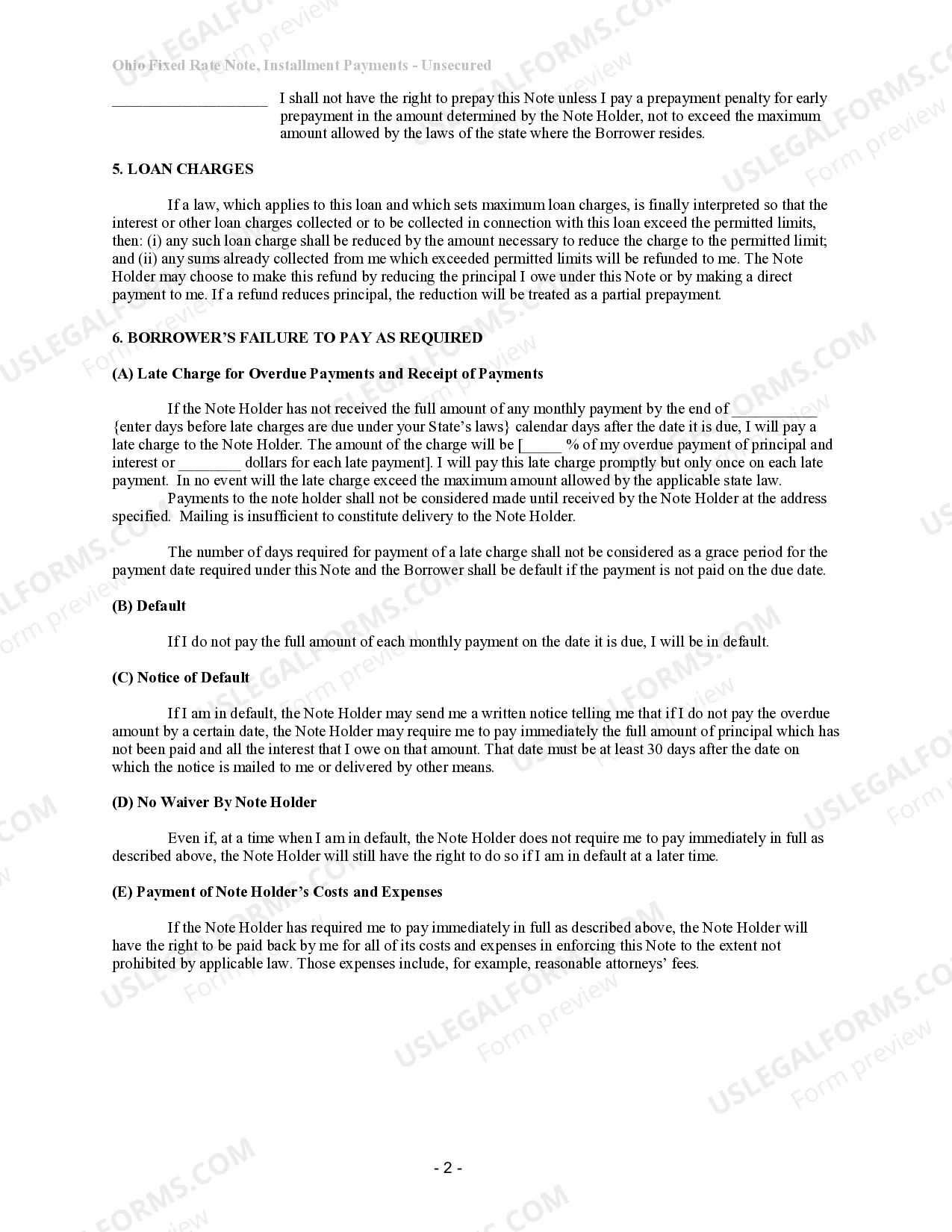

The Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document designed to outline the terms and conditions of a loan agreement between a lender and a borrower. This specific promissory note is suitable for transactions conducted in Franklin, Ohio, and involves a fixed interest rate. The Unsecured Installment Payment Promissory Note provides a framework for repayment of a loan amount borrowed by the borrower. Unlike a secured promissory note, this agreement does not require any collateral to back up the loan. This means that the lender relies solely on the borrower's promise to repay the loan on schedule. Key elements covered in the Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate include: 1. Loan Amount: The specific amount of money borrowed by the borrower, clearly stated in the promissory note. 2. Interest Rate and Payment Schedule: The agreed-upon fixed interest rate applied to the loan amount, and the schedule of installment payments, which can be monthly, quarterly, or annually, depending on the agreement. 3. Due Dates: The specific dates on which each installment payment is due. It is important to indicate the number of installment payments required to fully repay the loan. 4. Late Payment Penalties: Any penalties or charges that may apply if the borrower fails to make payments on time. This helps ensure timely repayment and helps protect the lender's interests. 5. Prepayment Options: This section outlines whether the borrower is allowed to make early payments or pay off the loan in full before the scheduled due date. If prepayment is permitted, any applicable penalties or fees should be included. 6. Governing Law: Specifying that the promissory note is subject to the laws of Franklin, Ohio, ensures that any legal disputes arising from the agreement are to be resolved under the jurisdiction of the state's courts. Different types or variations of the Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with a Balloon Payment: This variation involves smaller monthly installments during the term of the loan, with a larger balloon payment due at the end. 2. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with Adjustable Rate: In this type, the interest rate is not fixed but variable and fluctuates based on certain financial indices. 3. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with Guarantor: This includes a third party who agrees to take on the borrower's obligations in the event of default. 4. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with Acceleration Clause: This variation allows the lender to demand immediate repayment of the outstanding loan amount if the borrower fails to comply with specific terms stated in the promissory note. It is important to consult with legal professionals when drafting or entering into any type of promissory note to ensure compliance with local laws and establish a fair and transparent agreement between the lender and the borrower.The Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document designed to outline the terms and conditions of a loan agreement between a lender and a borrower. This specific promissory note is suitable for transactions conducted in Franklin, Ohio, and involves a fixed interest rate. The Unsecured Installment Payment Promissory Note provides a framework for repayment of a loan amount borrowed by the borrower. Unlike a secured promissory note, this agreement does not require any collateral to back up the loan. This means that the lender relies solely on the borrower's promise to repay the loan on schedule. Key elements covered in the Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate include: 1. Loan Amount: The specific amount of money borrowed by the borrower, clearly stated in the promissory note. 2. Interest Rate and Payment Schedule: The agreed-upon fixed interest rate applied to the loan amount, and the schedule of installment payments, which can be monthly, quarterly, or annually, depending on the agreement. 3. Due Dates: The specific dates on which each installment payment is due. It is important to indicate the number of installment payments required to fully repay the loan. 4. Late Payment Penalties: Any penalties or charges that may apply if the borrower fails to make payments on time. This helps ensure timely repayment and helps protect the lender's interests. 5. Prepayment Options: This section outlines whether the borrower is allowed to make early payments or pay off the loan in full before the scheduled due date. If prepayment is permitted, any applicable penalties or fees should be included. 6. Governing Law: Specifying that the promissory note is subject to the laws of Franklin, Ohio, ensures that any legal disputes arising from the agreement are to be resolved under the jurisdiction of the state's courts. Different types or variations of the Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with a Balloon Payment: This variation involves smaller monthly installments during the term of the loan, with a larger balloon payment due at the end. 2. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with Adjustable Rate: In this type, the interest rate is not fixed but variable and fluctuates based on certain financial indices. 3. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with Guarantor: This includes a third party who agrees to take on the borrower's obligations in the event of default. 4. Franklin Ohio Unsecured Installment Payment Promissory Note for Fixed Rate with Acceleration Clause: This variation allows the lender to demand immediate repayment of the outstanding loan amount if the borrower fails to comply with specific terms stated in the promissory note. It is important to consult with legal professionals when drafting or entering into any type of promissory note to ensure compliance with local laws and establish a fair and transparent agreement between the lender and the borrower.