The Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement in Franklin, Ohio. It provides details regarding the repayment schedule, interest rate, and the collateral that secures the loan. This type of promissory note is specifically tied to residential real estate properties in Franklin, Ohio. The borrower agrees to make regular installment payments over a predetermined period, ensuring the lender receives the principal amount along with the fixed interest rate. The note emphasizes that the loan is secured by the residential real estate property, which serves as collateral. This means that if the borrower defaults on the loan or fails to make the required payments, the lender has the right to take possession of the property to satisfy the debt. There can be different variations of the Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate, depending on the specific terms agreed upon by the parties involved. Some variations might include: 1. Short-term installment note: This type of promissory note has a shorter repayment period, usually between 1 and 5 years, making it suitable for borrowers who aim to pay off the loan quickly. 2. Long-term installment note: In contrast to the short-term version, this type of promissory note extends the repayment period to over 5 years. Borrowers often opt for this option when they need more time to pay off a larger loan. 3. Variable interest rate note: While the fixed rate promissory note maintains a constant interest rate throughout the loan term, a variable interest rate note allows the interest rate to fluctuate based on market conditions or other predetermined factors. 4. Balloon promissory note: This variation involves lower monthly installment payments throughout the loan term, with a large final payment due at the end, commonly known as a "balloon payment." Borrowers choose this option to minimize their monthly obligations, with the intention of refinancing or selling the property before the balloon payment is due. The Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a binding agreement that provides a clear framework for both the borrower and lender. It ensures that all parties involved understand their obligations and protects the lender's interests by securing the loan with residential real estate collateral.

Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

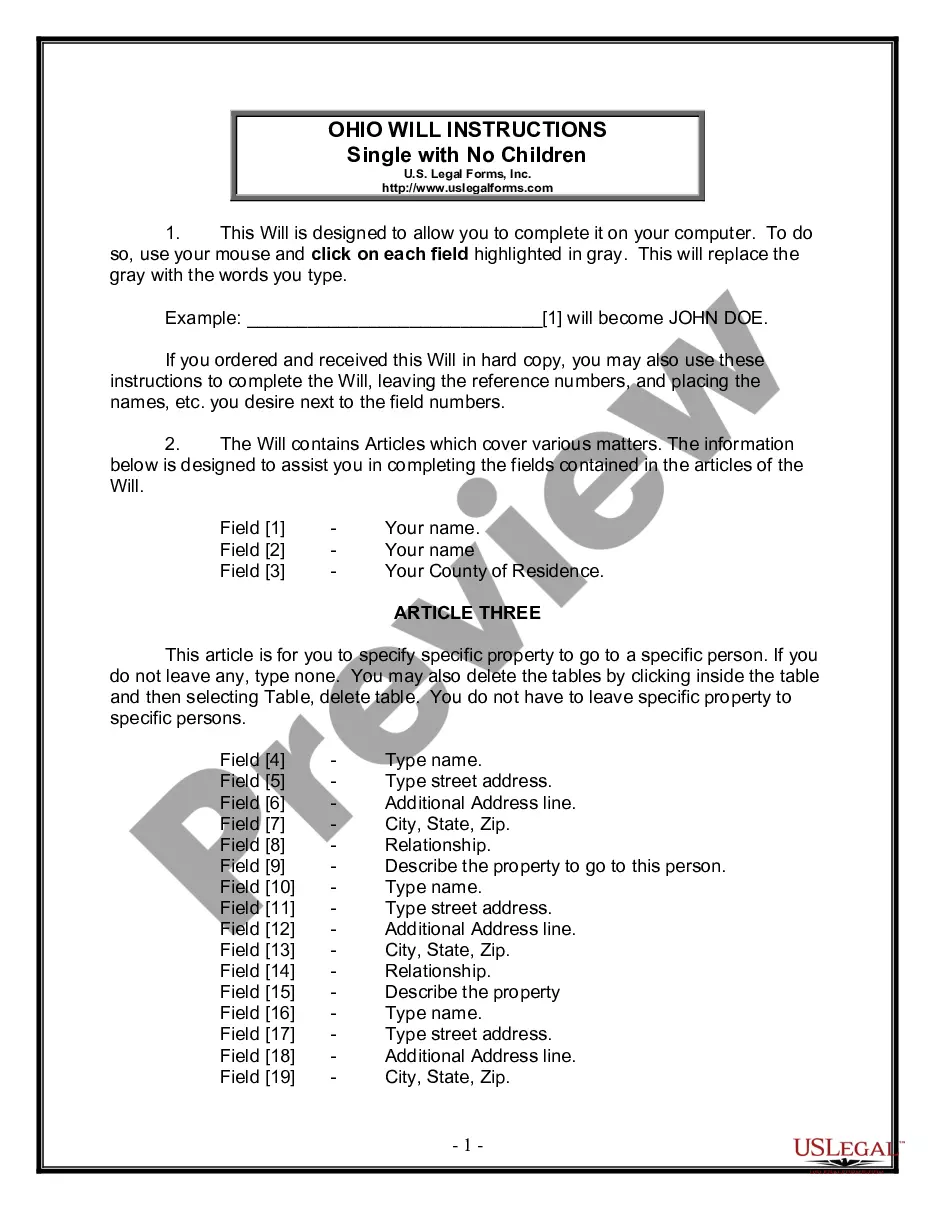

How to fill out Franklin Ohio Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Benefit from the US Legal Forms and have immediate access to any form you require. Our useful platform with a large number of document templates makes it simple to find and get virtually any document sample you require. It is possible to export, complete, and sign the Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate in just a matter of minutes instead of browsing the web for many hours searching for a proper template.

Using our library is a great way to increase the safety of your document submissions. Our experienced lawyers regularly review all the records to ensure that the templates are relevant for a particular region and compliant with new laws and polices.

How do you get the Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate? If you have a profile, just log in to the account. The Download button will appear on all the samples you look at. In addition, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Find the form you require. Ensure that it is the form you were seeking: check its title and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and choose the pricing plan you like. Then, create an account and process your order using a credit card or PayPal.

- Download the document. Choose the format to obtain the Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate and revise and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy form libraries on the web. Our company is always happy to help you in virtually any legal case, even if it is just downloading the Franklin Ohio Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!

Form popularity

FAQ

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

There is no legal requirement for promissory notes to be witnessed or notarized in Ohio. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

To enforce a promissory note, the holder must provide notice as is required per the note. If timely payment is not made by the borrower, the note holder can file an action to recover payment.

(A) Except as provided in division (E) of this section, an action to enforce the obligation of a party to pay a note payable at a definite time shall be brought within six years after the due date or dates stated in the note or, if a due date is accelerated, within six years after the accelerated due date.

Interesting Questions

More info

An insurance company may not enter into a contract for the insurance coverage, if the insured has an existing home, in a State other than Florida when the contract is issued. The Act is silent regarding the coverage of a policy or contract for the insurance of a real property loss as a result of the insured's death, which is a question that is not presented in the parties' cases. Thus, the insurance companies' policies are consistent with the Act's coverage requirements for persons with a residence located in that State if the deceased has certain financial assets at his or her death. Insurance agents' practices under the Act will likewise be consistent with the Act's requirements for insurance underwritten by them when a person who is living becomes physically or mentally incapacitated based on medical or other conditions of that person.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.