In Columbus, Ohio, a General Durable Power of Attorney for Property and Finances or Financial Effective Immediately is a legal document that grants authority to an individual (referred to as the "agent" or "attorney-in-fact") to make financial and property-related decisions on behalf of another person (referred to as the "principal"). This power of attorney remains effective even if the principal becomes incapacitated or unable to make decisions. The Columbus, Ohio General Durable Power of Attorney for Property and Finances or Financial Effective Immediately allows the agent to manage various aspects of the principal's financial affairs, such as banking transactions, paying bills, buying or selling real estate, managing investments, filing tax returns, and executing contracts or legal documents. This document is especially important for individuals who want to ensure that their financial affairs are taken care of in the event of incapacitation or illness. There are different types of General Durable Power of Attorney for Property and Finances or Financial Effective Immediately in Columbus, Ohio, based on specific requirements or circumstances. Some commonly used variations include: 1. Limited Power of Attorney: This type of power of attorney grants limited authority to the agent, allowing them to handle specific financial matters, such as managing a particular property or executing certain contracts. 2. Springing Power of Attorney: This version of power of attorney becomes effective only when a specific event occurs, usually the incapacitation of the principal. It requires a written declaration from one or more physicians confirming the principal's incapacity. 3. Statutory Power of Attorney: In Columbus, Ohio, there is a standardized form created by the state that individuals can use to create a power of attorney. This form outlines the agent's powers and responsibilities, providing a clear and easily enforceable structure. To create a Columbus, Ohio General Durable Power of Attorney for Property and Finances or Financial Effective Immediately, it is advisable to consult with an attorney who specializes in estate planning or elder law. The attorney can assist in drafting the document to ensure it complies with state laws and includes all relevant details. Additionally, the document may require notarization or witnessing for validity, so it is crucial to follow the proper legal procedures during its creation.

Columbus Ohio General Durable Power of Attorney for Property and Finances or Financial Effective Immediately

Category:

State:

Ohio

City:

Columbus

Control #:

OH-P003A

Format:

Word;

Rich Text

Instant download

Description

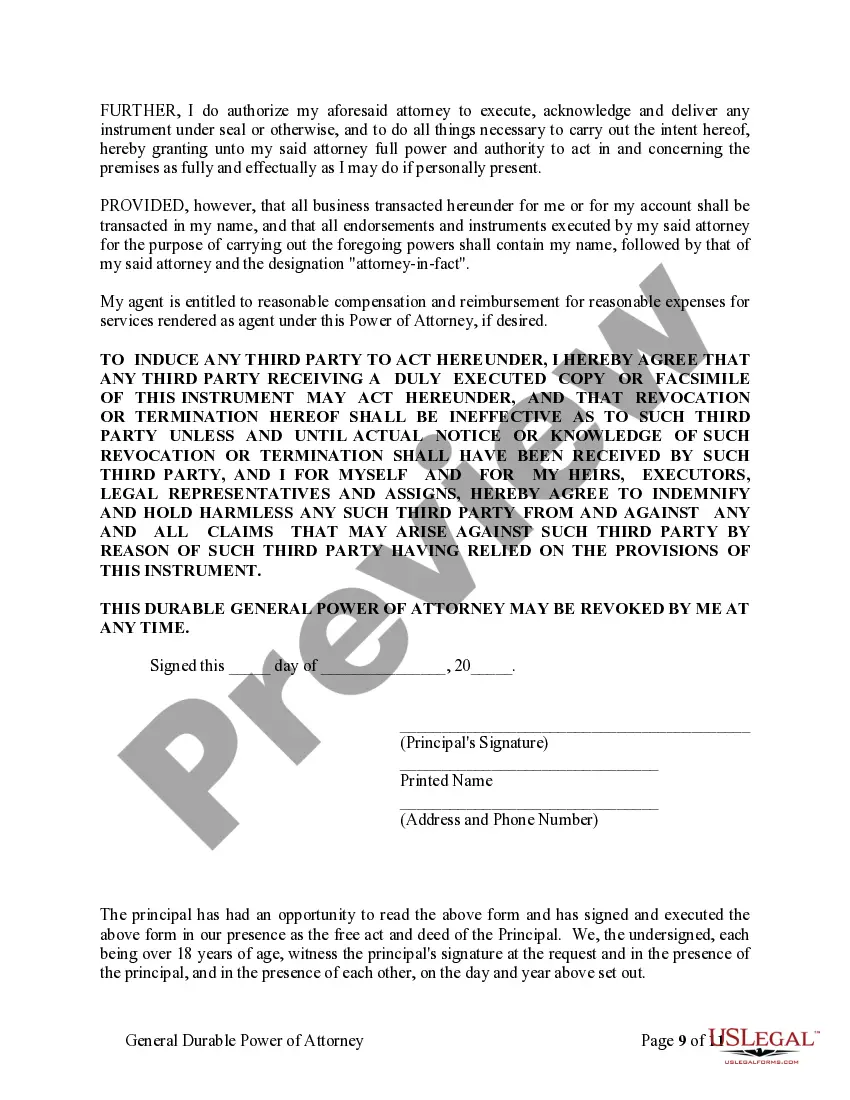

This General Durable Power of Attorney is a general, durable power of attorney which is effective IMMEDIATELY. You can use this form to appoint an attorney-in-fact (agent) to make decisions regarding property, financial, management, banking, business and other matters for you. The powers granted to an Agent in this Power of Attorney are very broad, but do NOT provide for health care services. This form complies with all applicable state statutory laws.

In Columbus, Ohio, a General Durable Power of Attorney for Property and Finances or Financial Effective Immediately is a legal document that grants authority to an individual (referred to as the "agent" or "attorney-in-fact") to make financial and property-related decisions on behalf of another person (referred to as the "principal"). This power of attorney remains effective even if the principal becomes incapacitated or unable to make decisions. The Columbus, Ohio General Durable Power of Attorney for Property and Finances or Financial Effective Immediately allows the agent to manage various aspects of the principal's financial affairs, such as banking transactions, paying bills, buying or selling real estate, managing investments, filing tax returns, and executing contracts or legal documents. This document is especially important for individuals who want to ensure that their financial affairs are taken care of in the event of incapacitation or illness. There are different types of General Durable Power of Attorney for Property and Finances or Financial Effective Immediately in Columbus, Ohio, based on specific requirements or circumstances. Some commonly used variations include: 1. Limited Power of Attorney: This type of power of attorney grants limited authority to the agent, allowing them to handle specific financial matters, such as managing a particular property or executing certain contracts. 2. Springing Power of Attorney: This version of power of attorney becomes effective only when a specific event occurs, usually the incapacitation of the principal. It requires a written declaration from one or more physicians confirming the principal's incapacity. 3. Statutory Power of Attorney: In Columbus, Ohio, there is a standardized form created by the state that individuals can use to create a power of attorney. This form outlines the agent's powers and responsibilities, providing a clear and easily enforceable structure. To create a Columbus, Ohio General Durable Power of Attorney for Property and Finances or Financial Effective Immediately, it is advisable to consult with an attorney who specializes in estate planning or elder law. The attorney can assist in drafting the document to ensure it complies with state laws and includes all relevant details. Additionally, the document may require notarization or witnessing for validity, so it is crucial to follow the proper legal procedures during its creation.

Free preview

How to fill out Columbus Ohio General Durable Power Of Attorney For Property And Finances Or Financial Effective Immediately?

If you’ve already utilized our service before, log in to your account and download the Columbus Ohio General Durable Power of Attorney for Property and Finances or Financial Effective Immediately on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Columbus Ohio General Durable Power of Attorney for Property and Finances or Financial Effective Immediately. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!